Börsipäev 22. mai

Kommentaari jätmiseks loo konto või logi sisse

-

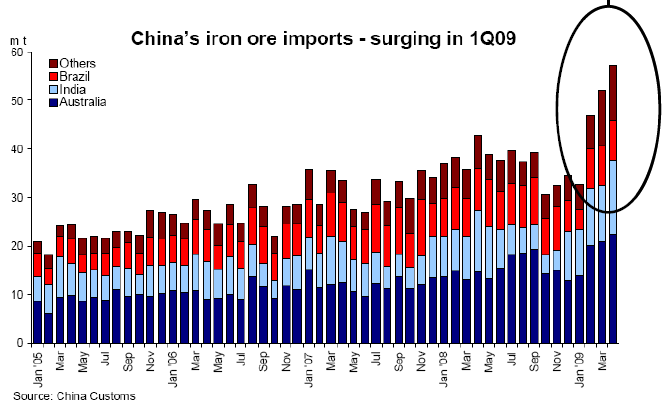

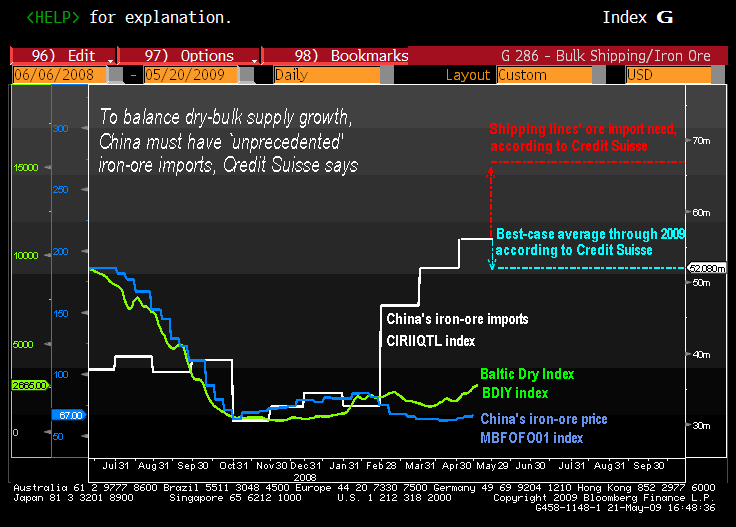

Joel on Börsipäeva teemade all korduvalt toonud välja Baltic Dry Indexi kiiret taastumist viimastel kuudel. Hiina rauamaagi import on kuivlasti vedavate laevafirmade jaoks üks olulisemaid turge, mis selgitab ka laevatamistasude tõusu paralleelselt rauamaagi impordi kasvuga Hiinasse viimastel kuudel. Allolev graafik pärineb OceanFreighti esimese kvartali aruandest.

Bloombergi Chart of the Day toob aga välja, et globaalse kuivlasti transportiva laevastiku 6.9%-line suurenemine sel aastal nõuaks juurde tellitud aluste täielikuks rakendamiseks pretsedenditut tõusu Hiina rauamaagi impordis. Täpsemalt peaks käesoleva aasta import kasvama 63% võrreldes 2008. aasta tasemega. See tähendaks, et ühes kuus veetakse riiki sisse keskmiselt 67 mln tonni rauamaaki. Credit Suisse nõnda optimistlik pole, prognoosides selle asemel hoopis rauamaagi impordi vähenemist järgmistel kuudel, kuna terasetootjad keskenduvad varude vähendamisele. Analüüsimaja kõige helgema nägemuse järgi võib keskmiseks importkoguseks tänavu kujuneda 52 mln tonni kuus.

-

USAs täna majandusraportite avalikustamisest ette ei ole nähtud ning ka ükski olulisem ettevõte ei ole oma tulemusi teatamas. Tuletan meelde, et esmaspäeval on USAs aktsiaturud Memorial Day tõttu suletud, seetõttu on ees ootamas pikk nädalavahetus ning kauplemisaktiivsus võib tulla täna seetõttu keskmisest kesisem.

-

Grossi eileõhtune sõnavõtt (video siin) USA AAA krediidireitingu võimaliku langemise teemal pärast Suurbritannia reitingu vaatluse alla võtmist S&P poolt, on ka Geithneri tagajalgadele ajanud. Artikkel Bloombergist siin.

-

2008. aasta 15. septembril kirjutasin võimalikust ohust USA 'AAA' krediidireitingule ka ühe aritkli - link siin.

-

Credit Suisse avaldas täna raporti, milles kajastati pikemalt USA regionaalpankade seisukorda. Šveitsi pangandushiiglase prognoosi kohaselt võib oodata, et teatud regionaalpankade aktsiad teevad lähiajal uusi põhju. Valitsuse osaluste ning uute aktsiate emiteerimisega seotud riskid on siinkohal reitingu langetamise peamisteks põhjusteks. Credit Suisse analüüsimaja hinnangul on ka fundamentaalselt vaadatuna regionaalpankade bilansilehed endiselt korrast ära. Samuti usutakse, et konsensuse EPS prognoosid on liialt optimistlikud, eriti aastaks 2010.

"Outperform" reitingu said: Bank of Hawaii (BOH), Comerica (CMA) ja First Horizon (FHN).

"Neutral" reitingu said: Fulton Financial (FULT), KeyCorp (KEY), M&T Banks (MTB), Regions Financial (RF), SunTrust Banks (STI), TCF Financial (TCB) ning Valley National (VLY).

"Underperform" reitingu said: BB&T Corp (BBT), Synovus (SNV) ja Zions Bancorp (ZION).

Morgan Stanley langetas täna SunTrust Banks (STI) reitingu aga "equal weight" pealt "underweight" peale.

-

Turgudel on hakatud USA krediidireitingu võimalikku langetamisse üha ärevamalt suhtuma, mis tähedab seda et dollaripotsioonide asemel eelistatakse parema meelega kindlamaid valuutasid nagu euro ja jeen. See on aidanud mõlemal valuutal mitme kuu tippe vallutada.

EUR/USD

JPY/USD

-

Lisaks Kristjani poolt kirjutatud soovituste muutmisest finantssektoris, on Morgan Stanley juba niigi oma 120% kõrgemal olevat Bank of America (BAC) hinnasihti $25 peal veelgi kõrgemale liigutamas. Uueks sihiks $32, mis pakub tänase $11.5lise hinna juures 180%list tõusupotentsiaali!

-

Saksamaa DAX +0.97%

Prantsusmaa CAC 40 +1.02%

Inglismaa FTSE 100 +0.86%

Hispaania IBEX 35 +1.27%

Venemaa MICEX +2.43%

Poola WIG -0.69%

Aasia turud:

Jaapani Nikkei 225 -0.41%

Hong Kongi Hang Seng -0.80%

Hiina Shanghai A (kodumaine) -0.50%

Hiina Shanghai B (välismaine) +0.34%

Lõuna-Korea Kosdaq -0.90%

Tai Set 50 +0.96%

India Sensex 30 +1.10%

-

Will the Bears Take an Early Holiday?

By Rev Shark

RealMoney.com Contributor

5/22/2009 9:01 AM EDT

Although no sculptured marble should rise to their memory, nor engraved stone bear record of their deeds, yet will their remembrance be as lasting as the land they honored.

-- Daniel Webster, on Memorial Day

The market has been showing some signs of tiring lately, but bears looking for downside follow-through aren't seeing much. In the last two weeks we have had a couple of poor days and few weak closes, but the bulls continue to show up just in the nick of time.

The action yesterday was looking particularly poor, and we were even starting to crack 880 on the S&P 500, which would have created a little double top formation. However, a last-hour surge turned the tide, and what might have been a really ugly day turned into just some mild losses on lighter volume.

Although the market has been losing momentum lately, it still hasn't suffered any major technical damage. We have been working off some periodic bouts of frothiness and have had a number of quick reverses, but the uptrend off the March low is still intact and the dip-buyers continue to pop up and keep the overall picture leaning toward the positive.

The big issue going forward is whether the catalysts that have been working will continue to do so. The bank bailouts, economic stimulus, TARP plans, etc. are old news at this point and have been priced in to some degree. They have worked in shoring up sentiment, but actual economic performance is going to be much more important going forward. We have gotten a lot of mileage out of the perception that the pace of decline is slowing, but that won't work indefinitely.

I'm looking for things to be much choppier over the next week or so, but for now we have holiday trading, which tends to be positive, and the end of the month coming up, which also helps to prop things up. Even though we are bouncing back, we are suffering some damage lately and we can't be blithely bullish. We will have to think more about selling into strength and not being so trusting in sustained upside momentum.

Today's trading is going to be thin, but you can already see the sentiment as generally positive as folks look forward to the Memorial Day weekend. The bears aren't likely to be too busy, but that doesn't mean we won't see some swings in this light-volume atmosphere.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: SHLD +23.3%, ARUN +21.4% (also upgraded to Overweight from Neutral at JP Morgan), EXM +18.8%, ADSK +14.4% (also upgraded to Hold from Underweight at KeyBanc), SB +13.0%, BBOX +12.9%, VRGY +7.2%, ESEA +5.4%, FL +4.8% (light volume), DBRN +4.6%, ARO +4.5%, CPB +3.0%, GPS +1.4%... M&A news: CGRB +15.2% (Johnson & Johnson announces definitive agreement to acquire Cougar Biotechnology for $43/share in cash)... Select financial names showing strength: AIB +12.5%, ING +5.8%, BCS +4.7%, RBS +3.7%, STD +3.5%, AXA +3.4%, UBS +3.2%, BAC +3.2%, DB +2.9%, CS +2.6%, WFC +1.4%, GS +1.3%, C +1.3% (Citigroup looks to slash tech costs - Financial Times), BK +1.1%, JPM +1.0%... Select shippers trading higher boosted by SB and EXM earnings results: EGLE +6.9%, SBLK +6.6%, DRYS +5.3% (announces completion of the "ATM" equity offering), NM +4.5%, OCNF +4.0% (announces the termination of the standby equity purchase agreement program), FRO +2.8%... Select oil/gas names showing strength: PBR +2.3%, E +2.2%, SLB +2.0%, TOT +1.6%, BP +1.4%, RDS.A +1.3%... Select metals/mining names trading higher: RTP +4.3% (raised to Neutral from Sell by Goldman- DJ), AAUK +4.0% (upgraded to Buy from Neutral at Goldman- DJ), GOLD +2.9%, BBL +2.2%, GG +2.1%, ABX +1.7%... Other news: AMSWA +26.4% (announced that it is commencing a cash tender offer for all of the outstanding publicly held minority interest in Logility for $7.02 per share), XIN +18.8% (still checking), OGXI +13.5% (continued momentum from this week's 80%+surge higher), QGEN +10.0% (Qiagen up amid talk Sanofi-Aventis may bid for co- DJ), SAY +9.4% (discloses that four nominee directors of Venturbay have been appointed to the board of directors of Satyam), WDC +3.9% (will replace Embarq Corp. in the S&P 500), +1.6% (Cramer makes positive comments on MadMoney), T +1.0% (considering lower-cost, capped data for iPhone, others - AppleInsider)... Analyst comments: NE +3.5% (upgraded to Buy from Hold at Deutsche Bank), MOS +3.5% (upgraded to Buy at Citigroup), MDAS +3.2% (upgraded to Outperform at Baird), POT +2.1% (upgraded to Buy at Citigroup), ALGT +1.8% (upgraded to Buy at Jesup & Lamont), AGU +1.7% (upgraded to Hold at Citigroup).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ZUMZ -13.8% (also downgraded to Neutral at Baird), RRGB -13.2% (also downgraded to Neutral at JPMorgan), CRM -8.2%, LDK -6.6%, MPR -6.2%, YGE -4.3%... Other news: ATAX -14.3% (prices 3.5 mln share offering at $5.00 per share), BKUNA -8.2% (Bankunited FSB was closed by the Office of Thrift Supervision and the Federal Deposit Insurance Corporation was named Receiver - FDIC), PURE -5.7% (to raise up to $3 mln in registered direct financing), RT -5.5% (files $300 mln mixed securities offering), SHO -4.0% (prices public offering of 18 mln common shares at $5.00), MA -2.2% (drops ~5 pts in pre-mkt following Bloomberg story regarding loss of card users due to shift of JPM's business to Visa)... Analyst comments: MON -1.2% (downgraded to Hold at Citigroup). -

Dollar saab täna korralikult peksa, olles päevaga nõrgenenud üle 1% - juba oleme tasemel €1=$1.405.

-

huvitav, miks enam käime ei saa seda rida eur,usd, cash, idealpro

-

leid

Proovi sümbolit E7.