Börsipäev 9. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Olulisemad sündmused täna USA turul:

14:45 - ICSC-Goldman Store Sales

15:55 - Redbook

17:00 - Wholesale Trade

18:30 - 4 nädala võlakirja oksjon

20:00 - 3 aasta võlakirja oksjon

-

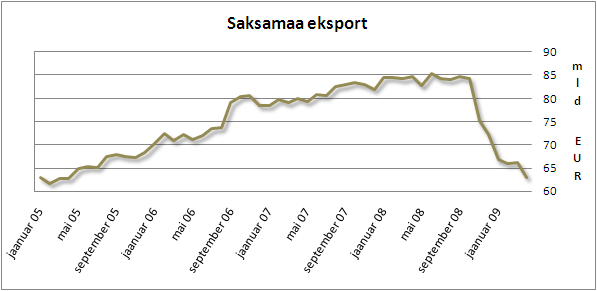

Kõik ei lähe ainult paremuse suunas, nii vähemalt näitas Saksamaa ekspordisektor, mille maht kahanes pärast märtsi 0.2%-list MoM tõusu aprillis -4.8%. Analüütikud olid häälestanud end optimislikumalt, oodates 0.1%-list langust. Aastatagusega võrreldes kukkus eksport -25.6% versus -21.4% märtsis.

-

...ja esimeses kvartalis kasvasid Saksamaa tööjõukulud 5.8% (y-o-y). Tööstussektoris kasvasid tööjõukulud koguni 11.2%.

-

TARPi teemal:

"WSJ reports the Treasury Department expects an initial payback from the nation's largest banks of at least $50 billion in bailout funds, according to people familiar with the matter, double the amount the government initially expected to recoup. In addition, Treasury officials are expected to announce Tuesday that up to nine of the biggest banks have approval to repay their Troubled Asset Relief Program funds, these people said. The $50 billion of repayments is the latest sign of improvement in the banking sector. At the same time, many of the banks repaying their TARP funds are expected to continue using other government assistance programs, such as the Federal Reserve's financing facilities. The list of large financial cos expected to get the green light on repayment includes American Express (AXP), Bank of New York Mellon (BK), Capital One Financial (COF), Goldman Sachs Group (GS) and J.P. Morgan Chase (JPM)." (Briefing.com)

-

U.S. Chain store sales increased 0.2% in June 6 week vs -0.6% in prior week, according to ICSC/Goldman Sachs

-

Susquehanna Financial kergitas täna ka Apple Inc. (AAPL) hinnasihti $155 pealt $170 peale

-

Paul Krugmani eilset kõnet peavad paljud turuosalised õhtuse rallipuhangu aluseks, tooks kokkuvõtte välja ka siia:

Summary of Economist Paul Krugman's positive comments from yesterday afternoon

Following yesterday's late day surge, some have pointed to positive comments from economist Paul Krugman. Some traders said the last-hour rally was sparked by comments from Nobel Prize-winning economist Paul Krugman, who said in a London speech that he would "not be surprised if the official end of the U.S. recession ends up being, in retrospect, dated sometime this summer." According to LA Times, Krugman has been mostly downbeat about the economy's future because he doesn't believe that the Obama administration has done enough to ensure a strong recovery. But he already has said that the recession could end this summer. He told an audience in Hong Kong on May 22 that the ending point of the downturn may be dated (after the fact) to August. Krugman's concern remains that the recovery just won't look like much. "Almost surely unemployment will keep rising for a long time and there's a lot of reason to think that the world economy is going to stay depressed for an extended period," he said, according to Bloomberg News.

-

Kergelt karusem nägemus Harvard-i proffessor Elizabeth Warren-ilt pankade stress testi kohta WSJ artiklis, mille peamisele murekohale Joel juba mõned päevad tagasi viitas ja mis ei tohiks kellegile üllatusena tulla.

Banks may need new stress tests, panel says - Washington Post

Washington Post reports the federal government should repeat its stress tests of the nation's largest banks if its assumptions about the severity of the economic downturn prove too rosy, according to a congressional oversight report to be released. The Congressional Oversight Panel, which oversees the $700 billion government bailout of the financial industry, generally praised the bank evaluations, which assessed the cos' financial health, and lauded regulators for using a reasonable model to conduct the tests. But the panel, headed by Harvard Law School professor Elizabeth Warren, noted that the stress tests assumed an average unemployment rate of 8.9% this year under the worst-case scenario. The unemployment rate for last month, however, climbed to 9.4%, meaning the assumptions by regulators might have been too optimistic. While the oversight panel praised the Fed for releasing an unprecedented amount of information about banks, the report criticized the regulators who performed the tests for not releasing enough information about how the evaluations were conducted, saying the lack of transparency raised "serious concerns" and left "unanswered questions."

-

Fed's Fisher says don't want to have banks too big to fail; still have banks too big to fail, according to FBN

-

Redbook (y-o-y) -4.4% (0.1% previous)

-

The Uptrend Is Alive and Well

By Rev Shark

RealMoney.com Contributor

6/9/2009 8:25 AM EDT

The art of living is more like wrestling than dancing.

-- Marcus Aurelius

Substantial swings in the final hour of trading Monday turned a quiet day of gentle correction into something that looked emotional and/or manipulated. Over the last several months, the wild volatility in the final 60 minutes of trading has rendered the rest of the day mostly irrelevant. The moves have tended to have a positive bias, so they are embraced by investors who are happy to see an uptrending market, but they're so big and so fast there is an air of artificiality about them.

As long as we are going up, we won't hear too many complaints about this action, but in the market if a pattern works to the upside it often works to the downside at some point as well. I suspect there would be a substantial outcry about manipulation if the market consistently had these substantial swings to the downside in the last hour.

I've heard a number of theories to explain these moves. Some say it is due to the daily rebalancing of the leveraged index ETFs that generated so much volume now. Others say that Goldman Sachs (GS) has been doing massive program trading with great success, which is driving some of this.

Some bulls say there isn't any manipulation. It is just a combination of easily squeezed shorts and underinvested bulls who consistently find themselves on the wrong side of the market as the day winds down.

As traders, we simply need to be aware of this late-day tendency. Often these patterns become self-fulfilling because they are so widely anticipated, but when traders become too confident about a pattern, they keep trying to jump in front of other traders, and that eventually causes the pattern to stop working.

Whatever the reason might be for this late action, the end result is that the market is staying in a very strong uptrend. The pullbacks are staying extremely shallow as dip-buyers are rewarded over and over again. The indices remain technically healthy although a bit extended.

I've been staying focused on the speculative action in smaller stocks as my main indicator of market health. As long as traders are actively chasing pockets of momentum, that action helps to provide an underlying bid to the broader market. It is when the aggressive traders become more reticent that we'll have to start looking for downside to accelerate a bit. When momentum dries up, the drops come very quickly.

There has been some narrowing in the momentum, but yesterday we continued to have very strong action in many low-priced biotechs and continued interest in select China stocks; until the final hour, though, it was more sedate action.

This morning Texas Instruments (TXN) is helping the tone with increased guidance but, overseas markets were mixed. Steels have an upgrade, Apple (AAPL) got a target increase and banks are being granted permission to repay some TARP funds. The news flow is good, and it will be instructive to see if the bulls can run with it. It is their game to lose at this point.

---------------------------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: SAY +17.3% (Oct-Dec consolidated net profit INR1.60 bln - DJ), MW +11.4%, TC +6.4% (also announces changes to 2009 operating plans), PBY +5.7%, TXN +5.1%... Select semi/tech related names ticking higher following TXN guidance: NSM +3.2%, WFR +3.1%, STM +3.0%, ONNN +2.6%, ADI +1.1%... Select solar names showing strength: CSUN +6.4%, LDK +3.9%, JASO +3.5%, CSIQ +3.5%, STP +2.2% (signs 500 MW agreement with Qinghai province's Haixi autonomous region-- JLM Pacific Epoch), SOLF +1.9%... Select shipping names ticking higher in early trade: FRO +5.8%, DRYS +2.8%, GNK +2.6%... Other news: MRNA +143.5% (receives full FDA approval of generic calcitonin-salmon nasal spray for osteoporosis), GNBT +26.7% (presented 'positive' study data at the American Diabetes Association Scientific Sessions), NTWK +22.9% (signs new licensing agreement with "major Chinese captive finance company"), ADCT +9.7% (Cramer makes positive comments on MadMoney), ARNA +7.9% (continued momentum following yesterday's 25% climb higher), VVUS +7.8% (VIVUS' Qnexa shows significantly improved blood sugar control through weight loss in patients with type 2 diabetes), LYG +2.8% (Lloyds TSB to cut more than 1,500 jobs, according to Sky News - DJ), BXP +2.5% (Cramer makes positive comments on MadMoney), NOK +2.1% (still checking for anything specific), AXP +2.0% (Sources tell CNBC that American Express is on the list to repay TARP funds), AMLN +1.4% (Meta-analysis of clinical data showed no increased risk of cardiovascular events associated with exenatide use), JPM +1.0% (to repay TARP money - WSJ)... Analyst comments: CSX +3.7% (ticking higher premarket; hearing upgraded to Buy at tier 1 firm), MRVL +3.5% (upgraded to Outperform at JMP), X +3.0% (upgraded to Overweight at Morgan Stanley), AKS +2.9% (upgraded to Equal Weight at Morgan Stanley), KEG +2.7% (added to Top Picks list at FBR Capital), SLB +1.5% and DO +1.3% (upgraded to Market Perform from Underperform at FBR Capital).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CRDN -16.8% , ZQK -15.7% (also announces financial restructuring plans, Private Equity to provide $150 mln 5-yr term and loan Bank of America and GE Capital to provide new $200 mln line of credit), BTH -4.1% (light volume), GIGM -3.4% , PLL -1.7%... Other news: ELY -14.4% (announces proposed private offering of $110 million of convertible preferred stock; also reduces dividend to $0.01/quarter vs. $0.07/quarter previously; reaffirms "confident" with annual guidance), HNBC -13.0% (announces strategic initiatives; working with its advisors and consultants to raise additional capital, execute on potential asset sales, reposition the balance sheet, and restructure funding sources), CBL -10.6% (announces 50 mln common share stock offering), FNB -6.9% (announces $115 mln common stock offering), EPB -6.4% (announces 11 mln common unit offering), GNA -4.0% (light volume; announces suspension of production and mill closure), KMP -3.2% (discloses that it is commencing an underwritten public offering of 5 mln common units), CMS -3.1% (announces offerings of convertible senior notes and senior notes), AOC -1.0% (filed for a mixed shelf offering for an indeterminate amount)... Analyst comments: MAS -6.6% (downgraded to Sell at UBS), OFG -4.5% (downgraded to Sell at Sterne Agee), MR -2.4% (ticking lower; hearing downgraded to Neutral at tier 1 firm), HIG -1.5% (downgraded to Hold at Citigroup). -

USA eelturgudel on indeksfutuurid kergelt plussis. Mujal maailmas lõppes börsipäev nii:

Saksamaa DAX -0.08%

Prantsusmaa CAC 40 +0.13%

Inglismaa FTSE 100 +0.15%

Hispaania IBEX 35 +0.90%

Venemaa MICEX -0.46%

Poola WIG +0.93%

Aasia turud:

Jaapani Nikkei 225 -0.80%

Hong Kongi Hang Seng -1.07%

Hiina Shanghai A (kodumaine) +0.71%

Hiina Shanghai B (välismaine) +0.17%

Lõuna-Korea Kosdaq -2.11%

Tai Set 50 +1.42%

India Sensex 30 +3.14%

-

Huvitavat lugemist USA hüpoteeklaenudest:

"FT reports defaults on US commercial mortgages could hit 4.1% by the end of the second quarter, their highest level since the 1992 recession, according to Real Estate Econometrics, a property research co. Default rates have accelerated as recession-hit businesses struggle to keep up with their mortgage payments and find it harder to refinance maturing loans. Next month, defaults are expected to hit 4.1%, compared with 2.25% at the end of March. Conditions in the troubled market for commercial real estate loans could deteriorate further still if the government's controversial toxic asset clean-up plan is shelved, say investors and analysts."

-

US Treasury says 10 of 19 largest U.S. banks approved to repay combined $68 bln in bailout funds - Reuters

Doesn't name banks approved to make repayments. Says firms that repay bailout funds can repurchase warrants treasury holds at market value. Says has received about $4.5 bln in dividend payments from financial firms in bailout. Combined with repayments from other firms, Treasury says has gotten $70 bln from bailout participants. -

Morgan Stanley says it will repay $10 bln in TARP funds - Bloomberg

-

American Express spokeswoman confirms that the co is eligible to repay entire $3.4 BLN TARP infusion - Reuters

-

Capital One approved to repay TARP money, expects to repurchase $3.55 billion in preferreds in coming weeks, according to spokeswoman - Reuters

-

April Wholesale Inventories -1.4% vs -1.2% consensus, prior revised to -1.8% from -1.6%

-

US Bancorp confirms Approval to Redeem $6.6 Billion of Preferred Stock from the U.S. Treasury Department

-

GIGM saab küll pihta

-

Muidugi iPhones laiutab TomTom

-

Küll veidi aegunud uudis, aga TARPi käigus saadud kapitali võivad tagastada järgmised ettevõtted: J.P. Morgan Chase (JPM), American Express (AXP), U.S. Bancorp (USB), Capital One Financial (COF), Bank of New York Mellon (BK), State Street (STT) ja BB&T (BBT). Morgan Stanley (MS) valitsuse testi ei läbinud, kuid ettevõte oli tänaseks tõstnud piisavalt kapitali, mistõttu anti luba ka TARPi tagasi maksmiseks. Northern Trust (NTRS) ei kuulud küll 19 nii-öelda stressi testi läbinud ettevõtte hulka, kuid finantsettevõttel on samuti võimalus tagastada valitsusele saadud kapital.

-

Must kuld $70 barrelist... Täna +2.8%.