Börsipäev 10. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

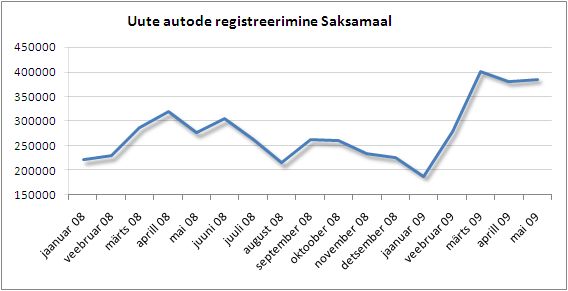

Euroopa mitmetes riikides juba aasta algusest käivitatud programmid, mille raames valitsused jagavad vana auto lammutusse andnud ja kütusesäästlikuma mudeli asemele ostunud tarbijale rahalist toetust, on lõpuks jõudmas ka Ühendriikidesse. Esindajatekoda kiitis eile heaks seaduse, mille raames antakse autoomanikule 3500 USD, kui uus masin sõidab vanaga võrreldes 4 miili rohkem ühe galloni kohta ja 4500 USD, kui 10 miili rohkem ühe galloni kohta. Programm kestab aasta ning läheb maksma hinnanguliselt 4 miljardit dollarit, asendates kokku miljon tänaval liiklevat kütuseõgijat ökonoomsemate neljarattaliste vastu. Saksamaal näiteks on programm andnud automüügile uue hingamise ning tõenäoliselt lükkab käigu siisse ka USA-s, kuid nii nagu Euroopaski, võivad põhilised kasusaajad olla odavamate ning loodusesõbralikemate autode valmistajad Aasiast.

-

Kui Eesti Pangal ka trükkal keldris 24h ööpäevas tuld annaks, siis oleks praegune kriis ka kõigest vormistamise küsimus.

-

...naera puruks selle riikliku sekkumise peale. Alles see oli, kui soodustati pick-up truck'e ja SUV-sid, eriti kodumaiseid? Ühe käega soodustame Toyota ja Honda müüki ning teise käega päästame-restruktureerime GMi? Absurd kisub juba naljakaks...

-

Et kodumaised tootjaid täielikult oma turuosast ilma ei jääks, kehtivad SUV-de, pickupide ja minivanide osas leebemad reeglid. 3500 dollari saamiseks peab kütusekulu olema vähemalt 18 mpg. Või teise variandi järgi 2 mpg-d parem vanast mudelist ja 4500 USD saamiseks 5 mpg-d kõrgem.

-

Seega täidaks kriteeriumid ka 2009. aasta Hummer H3T, mis sõidab linnas ühe galloniga 14 miili ja maanteel 18 aga sellegi poolest oleksid võitjad hoopis hiinlased.

-

Nagu juba traditsiooniks on saanud, siis USA börsikalender on täna selline:

15:30 - The Commence Department avaldab aprillikuu kaubandusbilansi. Märsis oli defitsiidiks $27.6 miljardit ning konsensus prognoosib defitsiidi tõusu $29.0 miljardile. Raporti mõju on turgudele suur.

17:30 - Toornafta varude raport (5. juuniga lõppenud nädala kohta). Mõju turgudele samuti suur.

21:00 - Rahandusministeeriumi eelarve ehk "Treasury Budget" raport. Konsensus prognoosib, et maikuus kasvas valitsuse eelarvedefitsiit $181.0 miljardile (varasemalt $165.9 miljardilt). Raport ei peaks suurt mõju turgudele avaldama.

21:00 - Föderaalreservi Beige Book ehk börsipäeva üks suuremaid sündmuseid. Mõju turgudele suur.

-

1 MPG = 1,2 l/100 km?

Fordi kastikas jääb endiselt enimmüüdud sõidukiks usas. -

Toorainesektor staaritsemas täna nii Aasias kui Euroopas, kui nafta barrel armutult taas uusi tippe teeb. Euroopa indeksid ca 1.5% kõrgemal, Micex 2.5%.

Nafta hinnaliikumine alates 2008. novembrist

-

üks MPG peaks siiski tähendama kütusekulu 2.35 L saja kilomeetri kohta

-

1 mile per gallon = 0.425143707 kilometers per liter

-

1 MPG (US) ≈ 100 * 3.785 L / 1.609 km ≈ 235 L/100 km

-

oh, põnev, mõned (erinevad?) gallonid ja näiliselt lihtsad arvutused

-

Kui vana SUV läbis 15 miles per gallon (US) equals 15.68 liters/100 km.

ja uus läbib 20 miles per gallon (US) equals 11.76 liters/100 km., siis ameeriklane saab voucheri 4500$, nice! -

jah, minu aps. 235 l 100 kilomeetri kohta. Ehk 18 mpg puhul peaks SUV keskmiseks kütusekuluks saavutama 13.7 l/100 km, et valitsuselt hüvitist saada.

-

LHV lehel "Turud & Hinnad" oleks vist juba ammu aeg Olimpic Eesti Telekomi vastu välja vahetada. Põhjuseid pole vist mõtet nimetada.

LHV, mõelge selle peale. -

Nafta +1.8% @ $71.25. S&P500 futuur eelturul +1.4% @ 953 punkti. Lühikestest tehakse jaanigrilli...

-

Yahoo! (YHOO) upgraded to Buy at Soleil; target raised to $20

Soleil upgrades YHOO to Buy from Hold and raises their tgt to $20 from $12 as they believe all the bad economic news is already priced into the stock and the ad driven stocks should follow retails stocks in outperforming the broader market. -

The Guessing Game

By Rev Shark

RealMoney.com Contributor

6/10/2009 8:28 AM EDT

'Tis not the eating, nor 'tis not the drinking that is to be blamed, but the excess.

-- John Selden

Flat action in the senior indices on Tuesday covered up some very strong action under the surface. Semiconductors led and energy and commodities were strong on a weaker dollar, but the momentum in a variety of small-caps was most impressive.

The benign market environment is giving traders increased confidence to aggressively pursue trades. The dips have been so shallow and the underlying support so strong that traders are no longer being shaken out like they were so often prior to the March low. Technical patterns are being embraced and not just treated as an opportunity for a quick flip.

Yes, some of the moves in some of these stocks smack of overzealous speculation, but that is a natural function of a market that is acting pretty well. The more important issue is when does complacency and confidence move to the point where buying power is depleted and the danger of a reversal increases? That is the guessing game that Wall Street loves to play, and it isn't an easy one.

As I've written very often, markets tend to trend in one direction much longer than you think is reasonable. That tendency is what can keep a market like this going. The folks who think the market should reverse soon are greeted with another strong day, and rather than become more convinced that a reversal is coming soon, they grow frustrated and worry about being left behind. So they chase something higher or jump in a minor pullback, and that keeps the trend going, causing more angst for those who think it's gone on too long ... and the cycle continues.

That is where we are right now, and with the quarter coming to an end in a few weeks, money managers are under tremendous pressure to perform. The stronger the market stays, the greater the pressure on the premature bears and underinvested bulls.

This morning indications are for a strong open. There isn't any major news driving things, just a continuation of the rather sanguine attitude about the economy and the belief that the worst is behind us.

Technically the S&P 500 is set up quite well, with a rather tight trading range over the past week or so. We've been hovering right below the next breakout level of 950, and current indications are we should break above that level at the open.

The sentiment surveys show that we have about twice as many bulls as bears right now, the most since December 2007. Confidence levels are high, momentum strong and technical action positive. The only negative is that it may be too much of a good thing. -

Turg eelturul taas plussis ning nafta 2009. aasta tippudel. Mida rohkem nafta tõuseb, seda enam on juttu lähiajal saabuvast $80 hinnast ning keskpikas perspektiivis täituvast $100 sihist. All over again.

Turule on täna positiivselt mõjunud finantssektori uudised TARP osas ning Home-Depot' (HD) majandusaasta prognoosi tõstmine. Alles mõne nädala eest kergitas prognoose ka HD konkurent Lowe's (LOW). -

April Trade Balance -$29.2 bln vs -$29.0 bln consensus, prior revised to -$28.5 bln from -$27.6 bln

-

USA eelturgudel indeksfutuurid plussis. Ka mujal maailmas olid

indeksid ilusad rohelised.

Saksamaa DAX +2.06%

Prantsusmaa CAC 40 +1.61%

Inglismaa FTSE 100 +1.69%

Hispaania IBEX 35 +1.85%

Venemaa MICEX +1.94%

Poola WIG +1.96%

Aasia turud:

Jaapani Nikkei 225 +2.09%

Hong Kongi Hang Seng +4.03%

Hiina Shanghai A (kodumaine) +1.02%

Hiina Shanghai B (välismaine) +1.22%

Lõuna-Korea Kosdaq +0.46%

Tai Set 50 +3.25%

India Sensex 30 +2.25%

-

Kas tänase päeva kohta keegi julgeb prognoosi teha? Huvitav mis GOOG-li optsioonidega on.... Artikel manipuleermisest ja nüüd www.optionpain.com hind päris erineb turuhinnast...........

-

Geithner says not capping executive pay but need standards to ensure risk-taking is prudent - Reuters

Ja enne võlakirjaoksjoni:

Bonds Cracking to New Lows into Auction, 10-yr eyeing 4% yield -

Turu tervise idikaatorid Briefingust:

Market Internals

The NASDAQ is down 0.82% to 1845, the S&P 500 is down 0.48% to 938 and the Dow is down 0.36% to 8732. ETF sector strength: Global Solar Energy-TAN +5.5%, U.S. Oil-USO +2.2%, U.S. Gasoline-UGA +2.0%, Utilities-XLU +1.6% and Metals and Mining-XME +1.4%. ETF sector weakness: Realty Majors-ICF -2.2%, U.S. Broker-Dealers-IAI -2.1%, U.S. Real Estate-IYR -2.0%, 20+ yr Treasury Bonds-TLT -1.5% and Regional Banks-RKH -1.2%. The morning's action has come on below average NYSE volume and average NASDAQ volume (NYSE 487 mln vs midday avg of 594 mln; NASDAQ 1,100 mln vs midday avg of 1087 mln), with decliners outpacing advancers (NYSE advancers/decliners 1397/1508, NASDAQ advancers/decliners 998/1562), and with new highs outpacing new lows (NYSE new highs/new lows 15/2 NASDAQ new highs/new lows 39/8).

Ja ka sektorite lõikes:

Sector ETF strength & weakness at midday

Midday Sector ETF Leading % Gainers:

Solar power- TAN +5%, KWT +4%, Crude/WTI oil- USO +2%, OIL +2%, RBOB gas futures- UGA +1.5%, SPDRS utilities- XLU +1.5%, Clean energy- PBW +1%, Coal- KOL +1%, Steel- SLX +1%Midday Sector ETF Leading % Decliners:

iShares real estate/REITS- IYR -2.5%, ICF -2.5%, iShares broker/dealers- IAI -2.5%, SPDRS retailers- XRT -1.5%, US bonds- TLT -1.5%, SPDRS homebuilders- XHB -1.5%, Reg banks- RKH -1.5%, KRE -1%, Finance- XLF -1.5%, IYF -1%, Biotech- IBB -1%, XBI -1%, SPDRS cons disct- XLY -1%, SPDRS industrials- XLI -1% -

Täna pilt natuke teine ja müügihuvi üsna tuntav: finants, tehnoloogia nõrk. Täna ei pruugi enam tavapäraseks saanud õhtust ülesostu tulla.

-

Ja veel selline uudis:

WHO calls emergency committee meeting on swine flu Thursday -

renessanss, ehk on abi kui ma näitan, mis erinevad analüüsimajad Googleist arvavad:

31. märts - analüüsimaja Merriman from "neutral" to "buy"

13. aprill - analüüsimaja Oppenheimer "outperform" hinnasihiks $390-410

14. aprill - analüüsimaja Benchmark "buy" hinnasihiks $430

15. aprill - JMP Securities "market perform" hinnasiht $400-425

17. aprill - Jefferies & Co "buy" ja hinnasihiks $450-442

17. aprill - JMP Securities "market perform" hinnasihiks $425-450

8. juuni - Benchmark "hold" -

10-year Note Auction results: Bid/Cover 2.62x (5 auction avg 2.88x); High Yield 3.99% (avg 2.88%, expectations were 3.97%); Indirect Bidders 34.2%; (avg 25%)

Ja turg astus korraliku sammu alla. -

Müsteerium jätkub, nafta tugevalt tõusus ja jällegi koos USD-ga?

-

Fed Beige Book says economy weak but signs decline is slowing

Fed's Beige Book: 5 of 12 districts see economic decline moderating

Fed says contacts from several Districts said that their expectations have improved, though they do not see a substantial increase in economic activity through the end of the year

Fed's Beige Book: Prices mostly flat, falling

May Treasury Budget -$189.7 bln vs -$181.0 bln, prior -$28.6 bln -

Ja kes tahab kommentaare lugeda siis siin veidi pikem tekst:

Summary of Fed's Beige Book

Reports from the twelve Federal Reserve District Banks indicate that economic conditions remained weak or deteriorated further during the period from mid-April through May. However, five of the Districts noted that the downward trend is showing signs of moderating. Further, contacts from several Districts said that their expectations have improved, though they do not see a substantial increase in economic activity through the end of the year. Manufacturing activity declined or remained at a low level across most Districts. However, several Districts also reported that the outlook by manufacturers has improved somewhat. Labor market conditions continued to be weak across the country, with wages generally remaining flat or falling. Consumer spending remained soft as households focused on purchasing less expensive necessities... A number of Districts reported an uptick in home sales, and many said that new home construction appeared to have stabilized at very low levels. Vacancy rates for commercial properties were rising in many parts of the country, while developers are finding financing for new commercial projects increasingly difficult to obtain. Commercial real estate markets continued to weaken across all Districts. Most Districts reported that overall lending activity was stable or weak, but with mixed results across loan categories. Most Districts said that credit conditions remained stringent or tightened further. Labor market conditions continued to be weak across the country, with wages generally remaining flat or falling. With few exceptions, the District Banks reported that prices at all stages of production were generally flat or falling. However, prices for other energy commodities, like coal and natural gas, remained relatively low. Other exceptions to the prevailing price trend included agricultural items. -

Ja taas kella 21.00 ostuhuvi peale, kuid siiski peaks tõenäoliseks, et päeva lõpuks turg madalamal.

-

Tunnistan oma viga ja pean tõdema, et jällegi toimis vana skeem, kus õhtu ostetakse turg üles, kuid närvilisus on juba õhus.

-

Futuurid jällegi päevalõpus mega käibega üles, kuid turg nagu viimased 5-10 minutit enam eriti kaasa ei läinudki.