Börsipäev 26. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

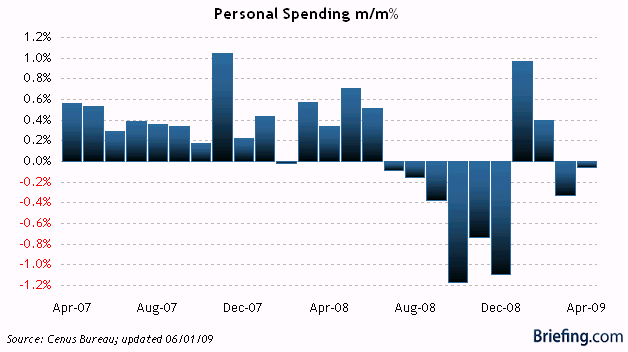

Nädala viimase kauplemispäeva eel teatatakse tund aega enne USA turgude avanemist eraisikute maikuu sissetulekute ja kulutuste muutused. Eelmise kuuga võrreldes oodatakse sissetulekute 0.3%list kasvu (aprillis oli kasv 0.5%) ning kulutuste 0.3%list kasvu (aprillis langesid kulutused 0.1%).

-

2009. aasta esimesest poolest on koos tänasega alles jäänud veel vaid kolm kauplemispäeva. Nasdaq on aasta esimesed 6 kuud lõpetamas kindlas plussis (2008. aasta lõpetati 1577 punkti peal), S&P500 on hetkel piiripeal (2008. aasta lõpetati 903.25 punkti peal) ning Dow Jones 30 indeks hetkel 3.5% jagu punases (2008. aasta lõpu tase oli 8776.4 punkti).

-

kas swedi on maas,või on mul ainukesena probleemid

-

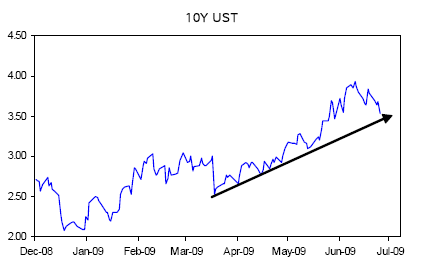

Kas 10Y UST lõpetab trendi ülespoole? 10-aastase USA valitsuse võlakirja tulusus (eilse seisuga 3.55):

Allikas: Deutsche Bank

Allikas: Deutsche Bank -

Väga pikaajaline põhjendus rallile :)

IT would take 360 years for an investor to double his/her money by investing in dollar deposits, according to Michael Hartnett, strategist at Merrill Lynch. The figures for the UK and Japan are 150 and 440 years respectively. No wonder we have seen such a rally in risky assets during the second quarter.

-

JP Morgan upgrades Industrial sector and Materials sector to Overweight from Neutral on likely continued outperformance of cyclicals. JP Morgan expects S&P 500 to see correction to 830-875 by end of summer followed by strong rally to 950-1000 by year-end - Reuters

-

“To prevent the deficiencies in the main reserve currency, there’s a need to create a new currency that’s delinked from the economies of the issuers,” the People’s Bank of China said in a review of the economy in 2008 released today.

EUR/USD liigub vaikselt 1.41 poole.

-

Miku varasemale kommentaarile lisaks ka üks artikkel Bloombergist - link siin.

“Zhou Xiaochuan sees the current international financial system is flawed, putting too much emphasis on the dollar as a reserve currency,” said Kevin Lai, an economist with Daiwa Institute of Research in Hong Kong. “The dollar should depreciate to address the global imbalance but because it’s a reserve currency it cannot.”

-

May Personal Income +1.4% vs +0.3% consensus, prior revised to +0.7% from +0.5%

May Personal Spending +0.3% vs +0.3% consensus, prior revised to +0.0% from -0.1% -

Ehk teisisõnu - lisanduv sissetulek läheb võlgade tagasimaksmiseks pankadele.

-

ja....

PCE Core M/M +0.1% vs +0.1% consensus, prior +0.3%

PCE Core Y/Y +1.8% vs +1.8% consensus, prior +1.9%

May PCE Deflator Y/Y +0.1% vs +0.1% consensus, prior revised to +0.5% from +0.4% -

MU tuli eile tulemustega ning Credit Suisse on väljas ka tulemustejärgse kommentaariga - PC'de nõudlus oli MU sõnul kvartali jooksul tugev ning see toetab Inteli poolt läinud kvartalil väljaöeldud mõtet, et nõudlus PC'de järele on oma põhja ära teinud.

Credit Suisse notes that MU indicated that PC demand continued to remain healthy in Q3 and expects a strong consumer driven Windows 7 driven product cycle in 4Q09. Firm's current global demand forecast for PC DRAM is 13% q/q in Q3 and 14% in Q4 vs. normal seasonal of 14% and 11% respectively. Co also noted channel inventories were at normal levels and that it wasn't seeing any build up investors should not be worried about incremental supply through increasing utilization.

-

More than Meets the Eye in Personal Income and Spending Report

"The Personal Income and Spending report produced some nice headlines, with income increasing 1.4%, spending rising 0.3% and core PCE increasing just 0.1%. The pleasing nature of the headlines is based on the understanding that consensus estimates for those components were set at 0.3%, 0.3%, and 0.1%, respectively. Additionally, the personal income increase for April was revised up to 0.7% (from 0.5%) while the spending number for April was revised to unchanged from an originally reported -0.1% decline... There was more to the May report, though, than meets the eye. Real disposable personal income was up 1.6% in May; however, when excluding the benefits of the American Recovery and Reinvestment Act (read: lower personal taxes and higher government transfers), real disposable income was up just 0.2%. That's OK, yet it certainly doesn't have the pleasing quality of the leading headline, especially when one also takes into account that private wage and salary disbursements fell -0.2%, marking the ninth straight monthly drop in that series. In turn, the personal savings rate increased to 6.9% from 5.6% in April, which underscores the consumer's bid to save more and spend less, which isn't the best combination when contemplating the prospects of a quick and robust recovery effort... Real PCE, on the bright side, was up 0.2% versus a -0.1% drop in April. The May number left the Q2 average roughly 0.1% below the Q1 average, so real PCE will still be accounted for as a negative factor in GDP estimates, although not nearly as extensively in recent quarters. The inflation gauge of core PCE was up just 0.1%, which left the year-over-year increase at 1.8%. That is within the Fed's comfort zone and is relatively good news." (briefing.com)

-

USA alustab nädala viimast kauplemispäeva ca poole protsendilise miinusega. Teist päeva järjest on tugevad olnud Aasia turud.

Euroopa turud:

Saksamaa DAX -0.27%

Prantsusmaa CAC 40 -0.70%

Inglismaa FTSE 100 -0.10%

Hispaania IBEX 35 -0.06%

Venemaa MICEX +0.85%

Poola WIG +0.25%Aasia turud:

Jaapani Nikkei 225 +0.83%

Hong Kongi Hang Seng +1.78%

Hiina Shanghai A (kodumaine) +0.11%

Hiina Shanghai B (välismaine) +0.76%

Lõuna-Korea Kosdaq -0.14%

Tai Set 50 +1.07%

India Sensex 30 +2.92% -

The Mighty Machines

By Rev Shark

RealMoney.com Contributor

6/26/2009 9:00 AM EDT

Machines were, it may be said, the weapon employed by the capitalists to quell the revolt of specialized labor.

-- Karl Marx

With some big gains in the second quarter of the year, money managers are under a lot of pressure to show good relative returns as things wind down. No one likes to be accused of missing out, so we usually see a strong propensity to try to add some performance before the quarter ends. Typically this is done by chasing some of the big, fast-moving stocks, but it also helps to create a generally buoyant atmosphere like we saw on Thursday.

After some unenthusiastic action following the Fed on Wednesday, the buyers were off and running on Thursday. Breadth was extremely strong all day and buyers even jumped in on a minor late-day bounce. There were some very big moves back up in momentum stocks that had broken down recently as the bears just stood aside and let things run.

Today we add another factor that should have a major impact on trading -- today's the day the Russell indices are rebalanced. This rebalancing has caused some very unusual action in the past. It isn't just a matter of buying and selling the affected stocks at the close. We will see a bunch of big blocks cross the tape at the close, but the shares that are being added to and subtracted from the Russell indices will have already been bought and sold to a great degree using various hedging and other strategies. The machines will be at work, and we'll be at their mercy to a great degree.

In the past I recall seeing some huge program trades kick in intraday that suddenly jerked around many of the small-cap stocks being added to the Russell 2000. You will see some unusual volume patterns in these stocks throughout the day, and they can be quite misleading as you review charts and look for trades.

A lot of folks try to game the rebalancing, so add to the volatility as well. For the Russell 2000, about 500 stocks will have lots of shares bought or sold; for the Russell 1000, about 100 stocks will be very active. You are going to see a lot of these names pop up on your screens due to the unusual action.

Keep in mind that when you combine the Russell rebalancing with the end-of-quarter window dressing, you end up with some very crazy action. Don't try to read anything significant into it -- it has nothing to do with big-picture fundamentals. There will be a lot of computer-driven action, and a lot of it will be very random. I would be surprised if we didn't have a major swing in the indices late in the day today.

We have a quiet start setting up, but it shouldn't stay that way. Be ready for some volatility, especially in the smaller-caps, and just remember it is the machines that are in control.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PALM +12.3%, SMSC +6.3%, TIBX +5.9%, ACN +4.9%... Other news: VIT +8.8% (still checking), BORL +7.8% (discloses that strategic buyer has offered a new nonbiding proposal to acquire BORL for $1.25/share in cash), SPPI +7.6% (still checking), VRNM +7.1% (Verenium and BP invited to begin negotiations for next phase of U.S. Department of Energy Loan Guarantee Program), SYT +1.7% (announced that it has entered into an exclusive worldwide research and commercial license agreement for Chromatin's proprietary gene stacking technology in sugar cane), GE +1.2% (General Electric's Immelt says GE Capital "worth $10 billion or $20 billion" - DJ)... Analyst comments: CQB +6.4% (upgraded to Buy at Janney), SVU +1.2% (upgraded to Speculative Buy from Hold at Canaccord), DB +1.2% (upgraded to Buy at UBS).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: POT -4.4%, FINL -4.3%, MU -4.2%, UBS -4.0% (also unveils $3.5 bln equity placement - FT), RBN -2.8% ... Select ag/chemical related names showing weakness following POT results: IPI -6.7% , MOS -5.2% , CF -4.6% , AGU -4.6% , MON -2.2%... Select metals/mining names showing weakness: RTP -3.9%, BBL -2.4%, MT -2.4%, BHP -1.7% (downgraded to Equal Weight at Barclays)... Other news: CEP -12.5% (completes borrowing base redetermination and suspends distribution), BPZ -7.7% (announces $88 mln registered direct offering of common stock), SNY -3.3% (still checking)... Analyst comments: JAZZ -5.1% (downgraded to Underweight at Barclays), GTS -4.0% (downgraded to Hold at Stifel Nicolaus). -

Roth Capital kommenteerimas positiivselt täna veel Imaxit:

Roth Capital notes Transformers: Revenge of the Fallen was released in IMAX theaters Wednesday to strong results, ~$4 mln in its first day, approx 6.6% of the movie's total $60 mln domestic take. The film is on pace to generate IMAX's biggest opening weekend ever, topping the total, per-day and per-screen records set by Dark Knight and Star Trek.