Börsipäev 2. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Kvartali lõpu ning koos uue kvartali algusega fondidesse lisanduva raha hulga mõju aktsiaturgudele oleme juba näinud. Ehk suudavad/julgevad nüüd karudki natukene oma hambaid näidata. Kuid see eeldaks, et täna avaldatavatelt makronumbritelt ei tule midagi jahmatavalt positiivset.

Tund aega enne USA turgude avanemist ehk Eesti aja järgi kell 15.30 avaldatakse turgude jaoks väga oluline juunikuu tööjõuraport, millelt oodatakse 365 000 töökoha kadumist ja töötusmäära kerkimist 9.4% pealt 9.6% peale. Tuletan meelde, et mais jäi tööta 345 000. Tunnitasu kerkis juunikuus ootuste kohaselt sarnaselt maiga 0.1%. Oodatust parem tööjõuraport annaks lootust, et palju-räägitud majanduse paranemine on tõepoolest kiiresti toimumas, kuid äsja avaldatud madalam tarbija usalduse näitaja ning ootustele alla jäänud ADP number ei taha seda palju-räägitud kiiret paranemist kuidagi toetada. Seega võimalik, et näeme üpriski nadide numbritega juunikuu tööjõuraportit. -

Eile kukkus EUR/USD 1.42 peale, kuna Reutersi andmetel soovib Hiina debateerida dollari rolli üle G8 kohtumisel. Hiina ametnikud pole aga sellisest asjast midagi kuulnud, mistõttu on EUR/USD tagasi 1.41 juures (pikemalt Bloombergis). EUR/USD on täna ilmselt volatiilne, kuna Euroopas peab Trichet kõne pärast ECB oodatavat “no-change” otsust ja USA’s avaldatakse tööjõuraport.

-

Üks Korduma Kippuv Küsimus: Kas peale OMXT aktsiaraamatute on võimalik näha ka mõningate teiste omi?

-

MSM, USA aktsiaturgudel on võimalik näha üksnes neid osanikke, kelle portfelli suurus on üle 5% aktsiakapitalist. Ja loomulikult peavad ka insiderid oma tehingutest teada andma. Kuid täielike nimekirjade ülesriputamist Eestile sarnaselt ei toimu.

-

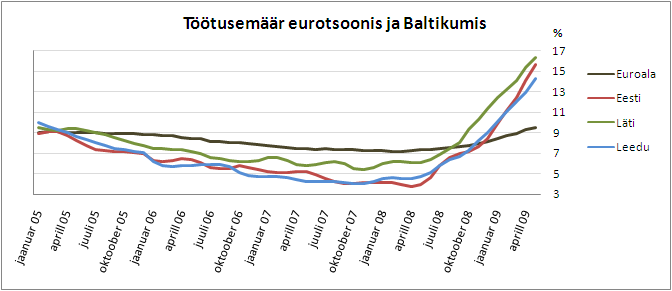

Töötusemäär kerkis euroalas kümne aasta kõrgeimale tasemele, ulatudes mais 9.5%-ni vs 9.3% aprillis. Bloombergi küsitletud analüütikud olid oodanud protsendipunkti võrra madalamat tulemust. Vaadates aga lokkavat töötust riikide lõikes, jääb see endiselt kõrgeimaks Hispaanias (18.7%), kuid kiireimaks on tempo muutunud just Baltikumis: Eesti 15.6% (aprillis 14%), Läti 16.3% (aprillis 15.3%), Leedu 14.3% (aprillis 12.9%).

-

Moody's avaldas paarkümmend minutit tagasi raporti, milles langetati Iirimaa krediidireiting Aa1 peale

"Credit-rating agency Moody's Investors Service on Thursday stripped Ireland of its Aaa government bond rating. The agency lowered the rating to Aa1 and said the outlook for Ireland remained negative. "The pronounced weakness in the economic activity has been translating into a severe deterioration of Ireland's public finances, and the country is set to emerge from the current economic crisis with a considerably higher debt burden for the foreseeable future," said Dietmar Hornung, a senior analyst in Moody's Sovereign Risk Group, in a news release" (marketwatch.com)

-

ECB jätab intressimäärad 1% peale.

-

Vaatame korraks volatiilsusindeksit VIX ka. Nagu näha, siis on investorid turul muutunud väga 'uniseks' - vähemasti viimase 9 kuu lõikes. Complacency, however, is dangerous.

-

June Nonfarm Payrolls -467K vs -367K consensus, prior revised to -322K from -345K.

initial Claims 614K vs 615K consensus, prior revised to 630K from 627K; Continuing Claims falls to 6.702 mln from 6.738 mln.

June Average Weekly Hours 33.0 vs 33.1 consensus

June Unemployment Rate 9.5% vs 9.6% consensus -

Tõusva töötusega saab ka nii võidelda:

The U.S. Census Bureau has said it will hire more than 1.4 million people over the next year to conduct the population count that happens once every 10 years.

Üldiselt võiks kõik Eesti elanikud saata USAsse jänkisid loendama, oleks meie probleemid ka lahendatud.

-

Oppenheimer on täna pangandus ja investeerimispangandus sektoreid analüüsimas:

"Oppenheimer discusses the banking sector, saying they continue to believe investors should skew their financial holdings toward investment banks for the time being, as they are trading at similar valuations on a price/TBV basis and are likely to reach "normalized" ROEs much sooner than most commercial banks. The firm believes Q2 earnings reports will be marred by all manner of special charges, in particular a special FDIC assessment, charges related to TARP repayment, and non-cash accounting charges known as "DVA" or "CVA" that relate to improving credit spreads on the companies' own debt. They think all these charges are well known and should not impact stock performance. Excluding the charges they expect the two big investment banks (GS, MS) to have underlying returns on tangible equity in the mid- to upper teens while they expect most commercial banking companies to be in single digits. They believe core operating trends in 2Q09 are likely to be highlighted by strong trading and underwriting income, fairly stable net interest margins and pre-provision earnings at banks, and continued deterioration of asset quality. (Stocks mentioned include BAC, C, JPM, USB, WFC, GS, MS, JEF, LAZ)" (briefing.com)

-

USA turud on oodatust oluliselt nõrgema juunikuu tööjõuraporti peale päeva alustamas korralikus miinuses. S&P500 on -1.4% @ 907 punkti, Nasdaq100 -0.8% ning nafta -3.2% @ $67 barrelist.

Euroopa turud:

Saksamaa DAX -2.81%

Prantsusmaa CAC 40 -2.32%

Inglismaa FTSE 100 -1.89%

Hispaania IBEX 35 -1.58%

Venemaa MICEX -3.00%

Poola WIG -0.33%Aasia turud:

Jaapani Nikkei 225 -0.64%

Hong Kongi Hang Seng -1.09%

Hiina Shanghai A (kodumaine) +1.74%

Hiina Shanghai B (välismaine) +0.73%

Lõuna-Korea Kosdaq +0.98%

Tai Set 50 -2.11%

India Sensex 30 +0.09% -

Such a Skittish Market

By Rev Shark

RealMoney.com Contributor

7/2/2009 8:29 AM EDT

Those who won our independence believed liberty to be the secret of happiness and courage to be the secret of liberty.

-- Louis D. Brandeis

The market will likely offer few fireworks today as market players take a break for the Independence Day holiday following one of the wildest six-month periods ever for the stock market. After hitting lows in March not seen in more than 10 years, we had one of biggest gains ever over the next few months. The mood shifted from a feeling that the world is coming to an end to celebration that the worst is over and that steady improvement lies ahead.

We haven't made much additional progress over the last couple of months, but the stock market has been enjoying a steady diet of optimism even though many on Main Street don't believe that things are really getting that much better.

I continue to be surprised by how the attitude of people I talk to about the economy is much less upbeat than what the stock market seems to be reflecting. The business media is full of stories about "green shoots" and how things aren't quite as bad as they were. The market has embraced that feeling and has plugged away nicely for a number of months, but the folks I tend to encounter feel much more worried and less positive.

Part of the explanation is that the market is supposed to look forward and discount developments down the road. The way the market is acting, the recovery is right around the corner and should be relatively smooth.

The question is whether we can trust the market's judgment. The market was horribly wrong in April and May of 2008 and did a terrible job of predicting what lay ahead for both the economy and the stock market. If you took action as we began to falter after that time you were OK, but if you blindly stuck to the argument that the market was making positive predictions back in May 2008, you were in big trouble six months later.

The market is not a good predictor of where things are going to be months from now, but it does give us warning of how trends may be shifting. We need to stay highly responsive to that and adapt as things change. Good action last month may be negated very quickly by poor action this month. The idea isn't to embrace just the things we like, but to look at the big picture and to react as developments emerge.

The market has not giving us any major warnings yet, but it has been struggling a little more. We have had some upside over the past week or so with the end of the quarter, index rebalancing and the inflow of new money for the second half of the year, but we haven't been able to gain any strong traction. On the other hand, we are still holding support levels and the bears can't gain much ground either.

Today we have the jobs report and what will be very thin trading, so it's going to be tough to draw any major conclusions. Still, the reversal yesterday and the end of some artificial factors that have held us up should make us increase our caution levels. We'll see how we react to the jobs data, but right now the market is a bit nervous.

-----------------------------

Ülespoole avanevad:

M&A news: IPCR +6.8% (Flagstone Reinsurance offers to acquire all of IPC's outstanding shares for total consideration of ~$33.62/share; also Validus reaffirms commitment to outstanding IPC offer), NRG +1.0% (Exelon increases offer to acquire NRG Energy by 12.4%)... Other news: ELN +27.1% (Johnson & Johnson announce definitive agreement for Alzheimer's immunotherapy program and equity investment), DAC +10.7% (announces it has reached agreement on waiver terms on all its credit facilities), JMBA +8.1% (announces multi-unit restaurant sale as part of broader refranchising strategy), QSFT +7.0% (will replace Wind River Systems in the S&P MidCap 400), PACR +6.3% (enters first amendment and waiver to its credit agreement), AIG +2.9% (in agreement to sell its consumer finance operations in Colombia),REP +2.2% (confirms it has received offers for YPF - DJ), DEO +2.2% (issues statement regarding the new Captain Morgan rum facility in the US Virgin Islands)... Analyst comments: ESLR +9.3% (upgraded to Overweight from Underweight at JP Morgan), DAL +7.7% (initiated with Overweight at Morgan Stanley), ENER +4.7% (initiated with Overweight at JPMorgan), CAL +3.9% (upgraded to Overweight at Morgan Stanley).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ILMN -13.4%, MANH -9.1%, XLNX -5.2%, DMAN -2.5% (light volume)... Select metals/mining names showing weakness: HMY -5.3%, GFI -4.3%, AAUK -3.7%, KGC -3.3%, AU -3.3%, AUY -3.2%, GG -3.0%, AEM -2.7%, GOLD -2.3%, MT -2.0%, SLV -1.8%, VALE -1.6%, BBL -1.5%, GLD -1.4%... Select oil/gas names trading lower: RDS.A -3.0%, SLB -2.0%, TOT -1.9%, COP -1.7%, PTR -1.6%, E -1.4%... Select drug related names ticking lower: GSK -2.7%, WYE -2.1%, AZN -1.8%, SHPGY -1.5%, NVS -1.1%... Select financials showing weakness: AXA -4.4%, IRE -3.3% (Moody's downgrades Ireland to Aa1; outlook negative), CS -2.6%, ING -2.3%, ABB -2.3%, UBS -2.1%, MS -1.9%, BAC -1.7%, WFC -1.5%, DB -1.3%... Select telecom related names trading lower: CHU -3.8%, CHL -3.4%, VOD -2.5%... Other news: DSCO -51.4% (learned that the FDA will now apply a newly-defined standard to determine whether Discovery Labs has adequately demonstrated comparability of Surfaxin clinical to commercial drug product; also downgraded to Sell at Wedbush Morgan) LEA -20.8% (Reaches agreement in principle on consensual debt restructuring; plans to commence proposed restructuring under Chapter 11), TIVO -16.0% (announces that U.S. Court of Appeals for the Federal Circuit granted the request of EchoStar and its related companies to stay the contempt order), SEPR -15.6% (determined that SEP-225289 did not meet the primary efficacy endpoint; the positive control in the study did achieve separation from placebo that was statistically significant on the primary endpoint), LIFE -5.3% (trading down in sympathy with ILMN), ACUR -4.9% and KG -3.1% (Acura Pharma and King Receive FDA Complete Response Letter Regarding Acurox)... Analyst comments: DYN -5.7% (downgraded to Sell at UBS), LUV -4.4% (downgraded to Underweight at Morgan Stanley), JCI -2.7% (downgraded to Hold at Deutsche), FSLR -2.4% (downgraded to Neutral at JPMorgan). -

Tänane tööjõuraport toetab turgude double tip teesi, mille võtab suht hästi kokku Duncan Balsbaugh arvamus:

...the green shoots have been all about inventory rebuilding. And with the consumer still deleveraging and mortgage applications slipping to the lowest level in over eight months, GDP, even if it moves to positive will likely remain sickly. Sure China PMI has been positive for four plus months, but that is part of the inventory build - globally the problem is that there is no replacement in sight for the U.S. consumer, the economic locomotive engine of the world.

Nagu Joel hommikul hoiatas, siis on hetkel hea võimalus karudel rünnaku alustamiseks. Rünnakut võib võimendada suvine käive...

-

ja turgudele natuke tuge:

New factory orders rose by 1.2% in May, the largest increase since June 2008 and well above the 0.8% gain economists were expecting, the Commerce Department reported today. April orders were revised down to a 0.5% gain from 0.7% (thomsonreuters).

-

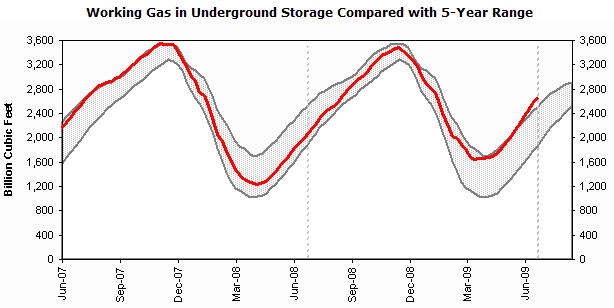

Sellega ei ole tänane uudiste sadu aga veel lõppenud. Kell 17:30 avaldab EIA (Energy Information Administration) iganädalase maagaasi varude raporti. Bloombergi andmetel prognoosivad analüütikud varude 74 bcf-ilst kasvu (26. juunil lõppenud nädalal). 30. juunil avaldas sellekohase analüüsi ka UBS, milles prognoosisid analüütikud, et varud kasvasid möödunud nädalal 65-75 bcf. Möödunud aasta samal nädalal kasvasid varud 85 bcfi. Põhjuseks tõid UBS analüütikud soojeneva ilma kogu Ameerikas. Nimelt oli y-o-y baasil vaadatuna ilm 26% soem ning koguni 37% soem, kui 5-aasta keskmine.

Allikas: EIA.com

-

Leidub arvamuse avaldajaid nagu Nassim Taleb, kelle arvates üksikud green shootid on vaid ajutiseks leevenduseks kokkukukkuvas majanduses ning leidub arvajaid nagu Dennis Kneale, kes reporterina CNBC otseetris majanduslangusele paar päeva tagasi lõpu kuulutas ning rahvale kahe käega lootust jagab. See väike videolõik on päris mitmed blogijad vihale ajanud.

-

ja üks face-off ka: http://zerohedge.blogspot.com/2009/06/dennis-lets-zero-hedge-have-it.html

-

Natural gas inventory showed a build of 70 bcf, analysts were expecting a build of 75 bcf, ranging from a build of 69 bcf to a build of 85 bcf.

-

Jõle unamerican on, kui nii all sulgume täna. Ootaks hiljemalt sulgemise eel mingit rallikatset.

-

Väike graafik ka sellest, mis täna turgudel toimub. Graafiku ajaperiood 6 kuud ning viimane punane küünal on tänane päev. Läbisime 200 SMA taseme.

Allikas: LHV Trader

-

New York Stock Exchange to close at 4:15 to 'execute customer orders impacted by system irregularities.'

Tundub et närvilisust jätkub.Isegi kinni ei saa pandud.