Börsipäev 13. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

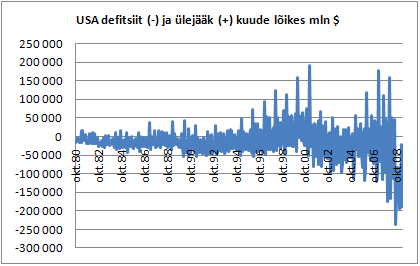

Kui tulemuste hooaja põhiline sadu saab Inteli, Goldman Sachsi ja Johnson & Johnsoniga alguse homme, siis ka juba täna peaksime saama näha Charles Schwabi (SCHW) numbreid. Majandusraportite poole pealt tuleb täna veel vaikne päev ning päeva ainuke raport tuleb Eesti aja järgi kell 21.00, mil avaldatakse USA eelarve defitsiidi suurenemise number juunikuu jaoks. Ootuseks on $77.5 miljardit, mis lükkaks 2009. kalendriaasta algusest alates 6 kuu defitsiidi juba $756 miljardi peale. Viimase 12 kuu defitsiit peaks koos juuni numbritega tulema ca $1.41 triljoni juurde ehk 10% SKPst. Seda annab ikka hiljem tagasi koguda...

-

Ja kuidas defitsiit tekib?

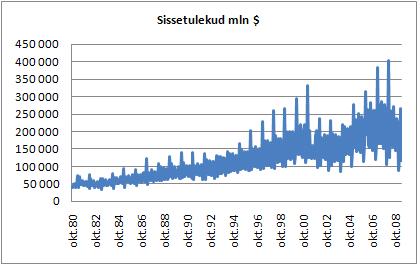

Ikka nii, et sissetulekud kukuvad...

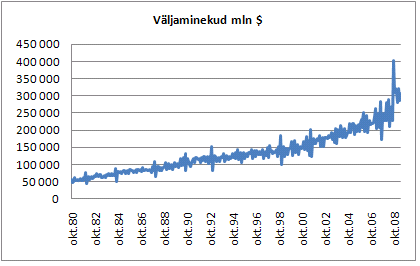

ja väljaminekud tõusevad...

-

Aasia turud on täna korralikult punases ning Jaapani, Hong Kongi, Lõuna-Korea, Indoneesia ja Vietnami börsid on kõik üle 2% punases. Sarnaselt Aasiaga on ka USA futuurid miinuses - seda ca 0.7% jagu. Nafta on hetkel kauplemas $59 juures, mis teeb -1.4%.

-

Tänasest Barronsist võib lugeda optimisminoodiga kirjutatud lugu Buffetti juhitud Berkshire Hathaway'st, mille A-osakud kauplevad sümboli BRK.A all ning väikeinvestori jaoks mõeldud madalama nominaalhinnaga B-osakud BRK.B nime all. Barrons kirjutab, et BRK.A aktsiad pakuvad tänastelt tasemetelt atraktiivset investeerimisvõimalust. Kui ajalooliselt on kaubeldud 1.6x kuni 1.7x raamatupidamisväärtust, siis praegu on see näitaja ca 1.2x.

Artikkel lõppeb lausetega: "Yet the company looks stronger than ever, due to its promising portfolio and some top-flight businesses. Investors could now buy that package for a low premium to book value and get the talents of Buffett, who continues to demonstrate his incomparable investment skills."

Buffettist, Berkshire Hathawayst ja Buffetti kehvalt ajastatud otsusest müüa $37 miljardi mahus pikaajalisi (üle 10 aasta) indeksite müügioptsioone oluliselt kõrgematelt tasemetelt ning sellest, et BRK.A/BRK.B derivatiiviraamatule pööratakse tihti liiga palju tähelepanu, kirjutasin selle aasta märtsi alguses siin.

-

http://www.bloomberg.com/apps/news?pid=20601087&sid=a7qU7lfSEq7I

Emerging Markets Priciest Since 2007 When Shares Fell

2009-07-13 06:05:07.864 GMT

By Adria Cimino and Michael Patterson

July 13 (Bloomberg) -- The last time stocks in developing countries got this expensive was in October 2007, just before the MSCI Emerging Markets Index began a 12-month tumble that erased half its value.

The MSCI gauge trades at 15.4 times reported earnings, compared with 14 for the Standard & Poor’s 500 Index, according to weekly data compiled by Bloomberg. When developing nations last commanded a premium, the 22-country benchmark sank 54 percent in the next year.

Groupama Asset Management, Palatine Asset Management and Standard Life Investments say the disparity means investors are paying too much for shares from China to India to Brazil at a time when the global economy is contracting. MSCI’s emerging- market gauge is valued at 1.7 times its companies’ net assets after a 34 percent surge last quarter, the highest on record compared with the MSCI World Index of 23 advanced economies, which trades for 1.5 times, data compiled by Bloomberg show.

“Emerging-market stocks are at risk,” said Matthieu Giuliani, a Paris-based fund manager at Palatine, which oversees $5.56 billion. “You should only pay so much for growth.”

Investors are already starting to show a lack of confidence in a continued rally. MSCI’s developing-nation index has dropped 9.7 percent from its 2009 high on June 1, while the MSCI World fell 7.7 percent and the S&P 500 retreated 6.8 percent.

Emerging-market funds had $540 million of net outflows in the week ended July 8, the second time in three weeks investors withdrew money, according to Cambridge, Massachusetts-based EPFR Global, which tracks funds with $10 trillion worldwide. -

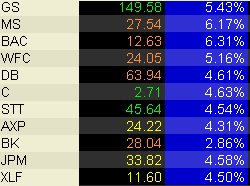

Finantssektorist ja seal (loodetavasti) peituvatest võimalustest sai pikemalt kirjutatud Pro all reedel. Täna hommikul on Meredith Whitney tõstmas Bloombergi andmeil oma soovituse Goldman Sachsil (GS) hoia pealt osta peale - hinnasihiks $186.

-

Cramer'i arvates oli Meredith Whitney GS'i suhtes liiga karune liiga kaua. Jimbo kommentaarist õhkub natuke kibestumust, sest tegelikult oli Whitney ju eelnevalt väljas neutraalse, mitte müügisoovitusega.

Meredith Whitney upgrades Goldman Sachs (GS). She stayed bearish too long. Is Roubini next? Sheesh. -

"For the second time since it was launched, Microsoft's Bing search engine overtook Yahoo! Thursday (9th July) in US usage according to analysis conducted by web analytics co StatCounter. Bing took 12.9% of the US market ahead of Yahoo!'s 10.15%(YHOO) but still well behind market leader Google (GOOG) at 74.99% according to the company's research arm StatCounter Global Stats. The last time Bing overtook Yahoo! on one day was shortly after launch on June 4th according to StatCounter. "The jump in Bing's share may reflect a positive review of the search engine compared to Google which appeared online in the New York Times on the 8th and in the print version on the 9th July," commented Aodhan Cullen, CEO, StatCounter. "While its lead over Yahoo! may not last into next week our data suggests that it is slowly but surely closing the gap." StatCounter earlier this month announced June figures which showed that Microsoft had 8.23% market share in the US behind Yahoo! at 11.04% with Google at 78.48%. This research was based on an analysis of 1.316 billion search engine referring clicks (336 million from the US) which were collected from the StatCounter network of over three million websites." (briefing.com)

-

Whitney kiidab CNBC peal veel ka Bank of America (BAC) aktsiat, öeldes, et pank võib kasvatada oma tangible raamatupidamisväärtust teises kvartalis kogunisti kuni ca $1.5 võrra aktsia kohta. Kvartalitulemused peaks BAC avaldama reedel. Whitney'lt saabuv optimismisüst on saatnud kogu USA pangandussektori 3% kuni 5%lisse plussi. BAC kaupleb +5.2% @ $12.5.

-

Aasia ja Euroopa on nagu öö ja päev...

Euroopa turud:

Saksamaa DAX +1.69%

Prantsusmaa CAC 40 +1.26%

Inglismaa FTSE 100 +1.19%

Hispaania IBEX 35 +1.08%

Venemaa MICEX +2.06%

Poola WIG +0.14%Aasia turud:

Jaapani Nikkei 225 -2.55%

Hong Kongi Hang Seng -2.56%

Hiina Shanghai A (kodumaine) -1.07%

Hiina Shanghai B (välismaine) -0.44%

Lõuna-Korea Kosdaq -3.88%

Tai Set 50 -0.65%

India Sensex 30 -0.77% -

Will Earnings Lift Us Back Up?

By Rev Shark

RealMoney.com Contributor

7/13/2009 8:12 AM EDT

"What we see depends mainly on what we look for."

--John Lubbock

After a couple weeks of slow and dreary trading, the action should pick up this week as major earnings reports start to hit. Financial stocks Goldman Sachs (GS) , JPMorgan Chase (JPM) , Bank of America (BAC) , Citigroup (C) and General Electric (GE) will be the primary focus this week, but we also have technology names Novellus (NVLS) , Intel (INTC) , Google (GOOG) and International Business Machines (IBM) that will help to set the tone.

As always, the key to earnings is expectations. Lousy reports when expectations are low will often generate positive responses and good reports when expectations are high will tend to generate negative responses.

In the first quarter of this year, expectations were pretty low, and reports came in fairly well, which gave the market a boost that kept us running through June. Earnings helped to produce the psychology that kept the bounce going from the March low. Things just didn't seem that bad despite all the economic news out there, which wasn't nearly as pleasant.

Since mid-June the market has started to roll over, and the psychology has become more negative. The big question is whether earnings can shift the tide and help repair the technical damage that has been done.

Analysts have been saying that expectations are too low. This morning Meredith Whitney is upgrading Goldman Sachs in front of its report this week, and Jeffries and Merriman are saying that consensus estimates appear too low for Google.

The problem is that when analysts raise the very expectations that they claim are too low, they undermine their argument and set up the dynamic for a sell-on-the-news reaction. The key will be how much stocks run up in front of the reports.

Earnings are a very tricky game to play, but a lot of folks like to bet on them. Many investors like to think they have some special insight into how a stock will react to earnings, but it is almost always just a gamble. Not only do you have to guess how earnings will be reported and the tone of the report but you have to gauge expectations and the psychology of the market. There are thousands of investors trying to game each important earnings report, and none of them have any edge unless they have some special inside information.

There always is plenty of volatile action after a report is out, so there is no need to bet on a report unless you enjoy the adrenaline rush of gambling. A lot of gambling takes place during earnings season, which makes for more interesting action and creates good opportunities for those who like to play the reactions as the news hits.

I'm a bit concerned that, while expectations may not be too high, the overall mood is rather sanguine. We will have a good test this week from the likes of Goldman Sachs, which everyone expects to issue a blow out report.

Technical conditions suggest that earnings will not shift the trend back up, but, at a minimum, we certainly can expect a hiccup or two that will catch both bulls and bears by surprise.

This morning the early action is flat. Asian markets were under pressure while Europe is around flat. Oil and gold are flat, and the big news so far is the upgrade of Goldman Sachs by Meredith Whitney.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PHG +4.3%... Select financial names showing strength boosted by Meredith Whitney GS upgrade and comments about the sector: HBAN +7.0%, AIG +6.8%, BAC +5.2% (Meredith Whitney appears on CNBC; says BAC is cheapest of banks relative to tangible book; also BofA balking at paying fees for guarantees: Report - Reuters), DFS +5.1%, FITB +3.7%, GS +3.5% (raised to buy from Neutral by Meredith Whitney - DJ), C +3.5%, MS +3.1%, JPM +2.4% ... Other news: SNSS +35.3% (light volume; receives $1.5 mln milestone payment from Biogen), HOV +14.1% (still checking), RINO +8.9% (approved for Nasdaq Listing), OSIP +7.9% (New data from Ph. 3 SATURN study showed Tarceva improved overall survival when used immediately after initial chemotherapy in patients with NSCLC; upgraded to Outperform at RBC Capital Mkts), STP +5.8% (signs strategic agreement to develop an aggregate 1.8GW of projects in China; ALSO Hoku Scientific and Suntech amend supply agreement to adjust milestone and shipping schedule), OCLS +5.5% (entered into an agreement with OroScience), BSX +4.4% (announces European approval for Its LATITUDE Patient Management System ), ARST +3.9% (Cramer makes positive comments on MadMoney), ELN +2.1% (announce phase 1 data showing ELND005 achieves desired concentrations in brain tissue and cerebrospinal fluid), SCHW +1.2% (mentioned positively in Barron's)... Analyst comments: JASO +4.5% (initiated with a Buy at Needham), KFT +1.6% (upgraded to Outperform at BMO Capital Markets; tgt raised to $31), SNDK +1.5% (upgraded to Overweight at Thomas Weisel).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ADY -19.1%, EXPD -11.6% (light volume), FAST -7.8%, CELL -5.8% (also announces an offering of 15 mln common shares by selling shareholder) ... Select oil/gas names ticking lower: STO -1.3%, PTR -1.3%... Other news: BEAT -37.1% (announces Highmark Medicare Services reimbursement reduction regarding CPT Code 93229; co withdraws previously stated FY09 guidance; ests and tgt lowered to $5 at Jefferies and downgraded to Mkt Perform at Leerink Swann), HOKU -12.3% (provides update to polysilicon production strategy; also Hoku Scientific and Suntech amend supply agreement to adjust milestone and shipping schedules), TSM -3.9% (still checking), CINF -2.0% (announces Q2 catastrophe losses), ISLE -1.2% (light volume; filed for a $300 mln mixed shelf offering)... Analyst comments: IPI -3.2% (downgraded to Underperform at Oppenheimer; firm cuts their '09E EPS by 50%). -

Järeldus. Eesti asub aasias:)

-

Whitney tänane GSi ostusoovitus päev enne ettevõtte tulemuste avaldamist ja positiivsed kommentaarid ka teiste pankade suunas on saatnud finantssektori sõna otseses mõttes lendu.

-

Novellus prelim ($0.41) vs ($0.38) First Call consensus; revs $119.2 mln vs $119.22 mln First Call consensus

-

04:40 hakkab Kanal 2s saade "Üks päev Imre Kosega" muideks.

-

NVLS Guides Q3 -$0.15 to $0.00 v -$0.24e, R $150-180M v $137Me.