Börsipäev 15. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Tulemuste tabel jätkab uuenemist ning vaadata saab seda siit. Makro poole pealt tuleb täna Eesti aja järgi kell 15.30 juunikuu tarbijahinnaindeks, millelt oodatakse 0.6%list kasvu (mais oli kasv 0.1%), ilma kütuse ja toiduaineteta oodatakse kasvuks sarnaselt maikuuga 0.1%. Juunikuu tööstustoodangu muutus teatatakse 15 minutit enne USA börsi avanemist ehk siis 16.15 - ootuseks on -0.6%, mais langes tööstustoodang -1.1%.

-

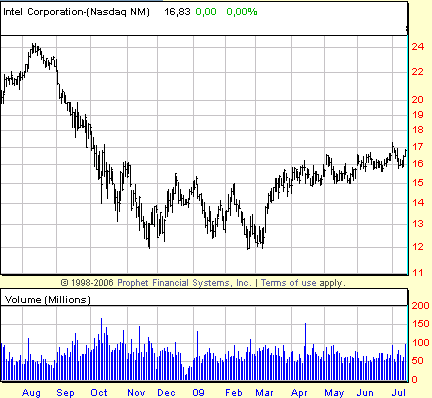

Suure positiivse üllatuse valmistas paljude jaoks eile Intel (INTC). Kui möödunud kvartalil lõi ettevõte oma tulemustega ootusi ja tõstis prognoose, väites, et PC-turg on oma põhja juba ära teinud, siis tollal ei tahtnud paljud seda uskuda. Eile õhtused tulemused võib kategoriseerida aga nime 'blowout' alla - ootusi ületati põhimõtteliselt igalpool ning taaskord tõsteti prognoose. Aktsia liikus järelturul üle 7% kõrgemale $18 juurde.

Aktsiapõhiseid kasumiootusi $0.08 ületati üle kahe korra, raporteerides $0.18sest EPSist. 2. kvartali tulud olid $8.02 miljardit vs oodatud $7.28 miljardit, brutomarginaal 50.8% oli selgelt enam kui juhtkonna poolt varem prognoositud 'neljakümnendate keskel' ja oodatud 46.4%. 3. kvartalilt ootab ettevõte tulusid $8.1 kuni $8.9 miljardit vs turu konsensusootus $7.81 miljardit ning brutomarginaalilt oodatakse kasvamist 51% ja 55% vahele vs turu 49.8%line ootus. Ja et sellest veel väheks ei jääks, on juhtkond paremat tulevikku valju häälega kuulutamas niimoodi: "Intel's second-quarter results reflect improving conditions in the PC market segment with our strongest first- to second-quarter growth since 1988 and a clear expectation for a seasonally stronger second half"

Analüüsimajade poolehoiust tehnoloogiasektori liidrite vastu kirjutasin mai keskel veel siin.

-

Kas keegi oskaks kiiresti kahe lausega öelda miks EUR/USD (ja USD/CHF ja GBP/USD) nii palju hommikul rallinud on? Mis oli katalüst?

-

BOJ???

-

Moody's downgrades state of California to Baa1 from A2; rating remains on watchlist for possible downgrade

Moody's Investors Service has downgraded the State of California's general obligation rating to Baa1 from A2. The state's lease debt and other state-backed debt have also been downgraded. The ratings remain on Watchlist for possible downgrade. The downgrade reflects the increased risk to the legally or constitutionally required payments ("priority payments") as the state deadlock continues and the controller has begun to make certain payments that are not legally or constitutionally required to be paid on time ("non-priority payments") with IOUs. -

Erilisi üllatusi THIs ei ole...

June CPI M/M +0.7% vs +0.6% consensus, prior +0.1%

June CPI Y/Y -1.4% vs -1.5% consensus, prior -1.3%

June Core CPI Y/Y +1.7% vs +1.7% consensus, prior +1.8%

June Core CPI M/M+0.2 % vs +0.1% consensus, prior +0.1%

...aga July Empire Manufacturing -0.55 vs -5.00 consensus, prior -9.41 -

Intel Surprise Raises the Stakes

By Rev Shark

RealMoney.com Contributor

7/15/2009 8:59 AM EDT

A true leader always keeps an element of surprise up his sleeve, which others cannot grasp but which keeps his public excited and breathless.

-- Charles de Gaulle

Intel (INTC) surprised the market with much-better-than-expected earnings and guidance, and we are seeing a strong sympathetic response this morning. Stocks such as Microsoft (MSFT) , Apple (AAPL) , Texas Instruments (TXN) , AMD (AMD) and Nvidia (NVDA) are indicated to open higher, and there is some genuine surprise by how strong this report really was. Of course, some say that Intel really isn't indicative of a broad improvement in technology spending, but is rather a function of exceptionally low inventories and spending in China spurred by a stimulus program.

Eventually the market will decide if Intel is representative of the broad economy or an outlier, but there is no questioning that it is being celebrated as good news this morning and will give us a strong open.

If you are heavily long, taking some gains into early strength probably isn't too difficult of a decision to make, but if you have idle cash and are looking for some opportunities, this is not an easy juncture. The major indices were running into some technical overhead and were slowing down late on Tuesday after the excitement over Goldman Sachs (GS) . Volume has been light, and while the action was positive, it wasn't particularly buoyant. Now with Intel we are seeing another push higher, but the support for much of the market is rather flimsy and it is not going to be easy to chase things higher unless the energy of the market picks up quite a bit.

Of course, with some big earnings report coming on Thursday, the chances of surprises are quite high and make it foolhardy to be too aggressive one way or the other. Even if we fade after the Intel excitement this morning, we have Google (GOOG) , IBM (IBM) and a number of financials to shake things up again.

Navigating the market during earnings season is never an easy task. Big reports like that from Intel have a way of disrupting the technical conditions in the short term and turn the market into a giant slot machine. Positioning yourself in front of a report like Intel and hoping to get lucky from a surprise report can work, but it is not a strategy that produces long-term success.

What we need to focus on now is whether the Intel news will give the market some legs. There has been a lot of talk about a head-and-shoulders top in the S&P 500, but all you really need to know is that the technical picture has been deteriorating. We found some support and are now bouncing, but we have yet to turn the tide back up. If the bulls are going to right this market, the Intel news this morning should give them the ammunition they need to squeeze the shorts and suck in some of the underinvested bulls.

Early indications are that the S&P 500 will move back over the 50-day simple moving average but will still be under the 925 level that's the main focus of technicians at this point.

I'm looking for the sellers to hit this open a bit, but there should be some underlying support. The dip-buyers should be active, but the problem the market has faced recently is that it doesn't have a lot of life. There has not been the very strong momentum like we saw back in May and June, and that is what we need if this market is really going to make a run back up to challenge those June highs.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: GCI +25.2%, INTC +7.1%, ALTR +4.2% (also raised to Neutral from Sell at Goldman- Reuters), ASML +4.1%... Select semi/tech related names showing strength following INTC results: STM +8.1%, AMD +7.6%, LSI +5.4%, NVDA +4.1%, MU +3.8%, SMH +3.7%, FCS +3.4%, TXN +3.3%, MRVL +3.0%, MSFT +2.6%, NSM +2.5%, LLTC +2.3%, BRCM +2.2%, ATML +2.0%, HPQ +1.9%, DELL +1.9%, AAPL +1.5%, AMZN +1.3%, GOOG +1.3%... Select financials trading higher: AIB +8.1%, AEG +6.5%, ING +5.3%, AXA +5.1%, BCS +5.0%, HBC +4.6%, RBS +4.1%, DB +4.0% (initiated with Outperform at FBR Capital), UBS +3.9%, LYG +3.5%, C +3.1%, MS +1.9%, CS +3.1%, DFS +2.2% (initiated with a Buy at Sterne Agee), GS +1.1% (upgraded to Outperform from Market Perform at Keefe Bruyette)... Select metals/mining names showing strength: SLW +6.6% and GG +2.4% (construction of the first sulphide process line at Goldcorp's world-class gold-silver-lead-zinc Penasquito mine in Zacatecas, Mexico is now complete), MT +5.6%, RTP +4.2% (iron ore output up 8% - Reuters), BBL +3.8%, VALE +3.8% (upgraded to Buy at BofA/Merrill), ABX +3.1%, KGC +2.7%, AAUK +1.5%, GLD +1.5%... Select oil/gas names trading higher: E +3.0%, CHK 2.8% (upgraded to Buy from Outperform at Caylon), BP +2.6%, RDS.A +2.2%, TOT +2.2%, PBR +2.2%... Select shipping names showing continued strength: FRO +5.5%, EXM +5.1%, DRYS +4.9%, DSX +3.4%... Other news: TRGT +52.6% (Targacept TC-5214 achieves all primary and secondary outcome measures in Phase 2b Trial as augmentation treatment for major depressive disorder), GY +13.4% (Aerojet receives $40 mln U.S. Army HAWK contract), BEXP +12.4% (announces 2,021 Boepd Three Forks well and provides Williston Basin update; also upgraded to Strong Buy from Underperform at Raymond James), CADX +10.2% (announces priority review and acceptance of NDA submission for Acetavance for treatment of acute pain and fever), NYT +9.2 (up in sympathy with GCI), YRCW +9.2% (makes significant progress on comprehensive plan; modifications would create an ~$45 mln per month savings), CPBY +5.5% (Announces $26.28 mln in Newly Signed Contracts in 2Q09), VIA.B +2.2% (Cramer makes positive comments on MadMoney), NXG +1.8% (announces positive Young-Davidson pre-feasibility study)... Analyst comments: ALU +11.6% (upgraded to Buy at BofA/Merrill), ICE +4.4% (upgraded to Overweight at Barclays), CEO +3.5% (upgraded to Overweight from Equal Weight at Morgan Stanley), IGT +3.3% (upgraded to Buy from Neutral at Janney Montgomery), CSCO +2.5% (initiated with Buy at Citigroup), PALM +1.3% (initiated with a Market Perform at BMO Capital).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PAR -21.0% (also downgraded to Neutral at Merriman and tgt cut to $8 from $10 at Credit Suisse), JNS -10.5% (also announces $150 mln offering of common stock and $150 mln in convertible senior notes), SMIT -10.2% (light volume), JBHT -6.9% (downgraded to Market Perform from Outperform at Raymond James), YUM -3.9%, WOR -2.7% (light volume), ABT -2.2%... Other news: TKG -6.5% (trading ex dividend), COBZ -4.1% (continued weakness from yesterday's 15%+ drop), COBZ -2.9% (prices 12.67 mln common share offering at $4.50/share)... Analyst comments: PPDI -3.7% (seeing early weakness; hearing downgraded at tier 1 firm). -

AMRilt oodatust kehvemad majandustulemused:

AMR Corp prelim ($1.14) vs ($1.28) First Call consensus; revs $4.89 bln vs $4.90 bln First Call consensus -

EPS on ju 0,14 dollarit parem?

-

Pessimism USA turgudel on kiiresti asendunud eufooriaga. Futuurid indikeerivad S&P500 indeksi avanemist eilsest sulgumishinnast ca 1.4% kõrgemal, Nasdaq100 puhul 1.8% kõrgemal. Nafta on +2.5% @ $61.9 barrelist ning maagaas on plusspoolel 1% jagu.

Euroopa turud:

Saksamaa DAX +1.83%

Prantsusmaa CAC 40 +1.80%

Inglismaa FTSE 100 +1.73%

Hispaania IBEX 35 +1.46%

Venemaa MICEX +3.77%

Poola WIG +0.79%Aasia turud:

Jaapani Nikkei 225 +0.08%

Hong Kongi Hang Seng +2.09%

Hiina Shanghai A (kodumaine) +1.38%

Hiina Shanghai B (välismaine) +1.08%

Lõuna-Korea Kosdaq +2.19%

Tai Set 50 +1.96%

India Sensex 30 +2.88% -

SideKick, minu viga :) Mul olid lihtsalt peas kõrgemad ootused valmis mõeldud :P

EPS tõepoolest $0.14 võrra konsensuse ootustest parem. -

June Industrial Production -0.4% vs -0.6% consensus, prior revised to -1.2% from -1.1%;

Capacity Utilization 68.0% vs 67.9% consensus, prior 68.2% -

Imaxi (IMAX) hoog ei näi raugevat, hetkel kaubeldakse ligi kolme aasta tippudel. Kohe on esilinastumas Harry Potteri uus film ja kuigi isiklikult taoliste filmide suur sõber ei ole, siis fantaasiat natuke jagub. Kui kujutada sellist merestseeni ülisuurele ja tavakinodest oluliselt parema resolutsiooni ja heliga Imaxi 3D (mis ulatub ka vaataja kõrvale ehk 3D tipp on ca 30% vaatajale "lähemal") ekraanile, võib Imaxi kinode märgatavalt paremast täituvusest ja korralikust hype'st aru saada. Aktsia hind seda ka väljendab, samuti on konsensus jõudnud juunikvartali osas kasumi prognoosimiseni.

-

Esimese pooleteist tunni jooksul pole turg veel nõrkust näidanud, tehnoloogia ja finants on suuremad vedurid.

-

Intel (INTC) on nüüd oma suurepärased numbrid teatavaks teinud ja lühemas perspektiivis sellega ootuste latti tublisti kergitanud. Nüüd aga küsimus - kui kõrgel on riskid praegu aktsiate hoidmisel pärast kolmandat tõusupäeva enne HOG, NOK, GOOG ja IBM tulemusi. Who can beat INTC? Risk-reward getting lousy...

-

Võimsa tõusupäeva kohta jätab käive küll soovida...

-

Fed Raises GDP Outlook

The minutes from the FOMC meeting are dated by their very nature since they are released three weeks after the end of the FOMC meeting. Still, the market keeps a close eye on the minutes because it is cognizant that they capture the forward-looking views of Fed officials.

With the latter thought in mind, the minutes from the June 23-24 meeting have been digested in a favorable manner. The focal point for participants was the Fed's raised forecast for real GDP in 2009, 2010 and 2011. To be sure, that will be the headline that is trumpeted around the world.

The improved outlook was predicated on the understanding that a variety of data points are indicating that things are less bad than when the Fed provided its central tendency projections in April. Recall then that the Fed lowered its growth views for all three years versus the projections it offered in January.

Notably, the market cheered the raised outlook for 2009 in the June minutes that indicate central tendencies anticipate a -1.0% to -1.5% decline in real GDP versus the April view that called for a decline between -1.3% and -2.0%. The latest forecast isn't all that different from the January projection of -0.5% to -1.3%, yet the market is certainly acting as if it is.

Timing is everything when it comes to releases like this. The market was already in a cheery mood following a better-than-expected earnings report and guidance from Intel, so the added indication that growth projections were picking up was just the icing on the cake for traders.

A forecasting point that was lost in the trading equation was that the Fed increased its projections for the unemployment rate for 2009, 2010 and 2011 as well. Although the market is predisposed to look at the unemployment rate as a lagging indicator, it is becoming a leading political indicator.

Specifically, a rising unemployment rate isn't the best platform for an incumbent to run on. Moreover, a rising unemployment rate is going to expose the White House's deficit projections as being too low.

The White House is projecting an annual average unemployment rate of 8.1% for calendar year 2009, 7.9% for calendar 2010, and 7.1% for calendar 2011. The midpoint of the Fed's latest projections for the unemployment rate for those years is 9.95%, 9.65%, and 8.60%, respectively.

The Fed could be wrong, but at this point we'll give it the nod of having more credible numbers when it comes to forecasts for the unemployment rate.

The minutes, by and large, reinforced the overall view that the outlook is still uncertain, but that the economy is no longer in the freefall we all witnessed through the fourth quarter of 2008 and the first quarter of 2009. As such, the Fed remains content to wait for more incoming data before it makes any rash moves at this juncture.

The Fed can afford this wait-and-see attitude because inflation pressures remain subdued while lending conditions remain tight.

These minutes were considered uplifting in the market's initial take on things because the forecasts for growth were at least headed in the right direction.

Now, it's about waiting on the data to see if the Fed has it right.

-

VIX 3.5% tõus koos S&P 500 indeksi 3% tõusuga indikeerib suurema üllatuse tulekut, mida seostaks CIT Group-iga. Homme enne turge peaks juba selge olema, milliseks ettevõtte tulevik kujuneb. Bloombergi statistika kohaselt on 2007 aasta augustist selline erakordne liikumine ilmnenud 25-l korral, millest 18 korda on järgmine päev keskmiselt 1.6% käest antud.