Börsipäev 29. juuli

Log in or create an account to leave a comment

-

Aasias kisub päeva lõpp väga närviliseks- Shanghai Composite kukkus korraks -7.7% & hetkel -5.2% (Hang Seng -3.2%).

The China markets crashed because the markets are at an unattainable level because of hot money and there are fears the central government will act to cool the markets," said Francis Lun, general manager at Fulbright Securities.

Investorid on kindlad Hiina V-kujulises taastumises, kuid sellel nädalal on fookus suundunud valitsuse abiprogrammide ja lõdva monetaarpoliitika lõpetamisele, kuna mitmed ametiasutused hoiatavad uue mulli eest aktsia- ja kinnisvaraturgude.

-

Tõesti, täielik paanika :-D

Eriti kontekstis, kus Hang Seng on paari nädalaga stiilis paarkümmend protsenti kerkinud... -

baltikumis on täna PRX müügipoolel aktiivne

-

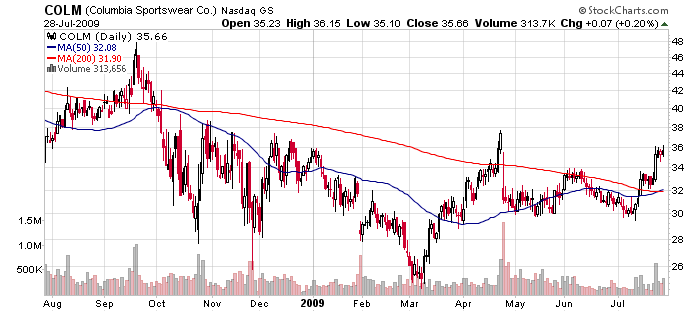

Eile pärast turu sulgemist avaldas oma Q2 tulemused Columbia Sportswear (COLM). Kuigi kvartalitulemused suutsid analüütikute konsensust nii käibe kui ka kasumi osas lüüa, jäeti 2009. aasta tagasihoidlikud prognoosid samaks:

Reports Q2 (Jun) loss of $0.29 per share, $0.13 better than the First Call consensus of ($0.42); revenues fell 15.9% year/year to $179.2 mln vs the $167 mln consensus. COLM reaffirmed its previous expectation for total 2009 net sales to decline in the low double-digits on a percentage basis compared with 2008.

Analüütikute kommentaarid ettevõtte kohta on jätkuvalt negatiivsed. Citi kinnitab müügisoovitust, kuid tõstab hinnasihi $27 tasemele:

Reiterate Sell — Though Q2 results were better than anticipated, there were no major surprises from the qtr, in our view, w/ last qtr’s disappointing FY09 guidance maintained & fundamentals still highly challenging. Mgmt alsoappears to have low visibility on timing of returns on ongoing investments in product innovation and marketing, likely indicating a prolonged turnaround. Shares are overvalued, in our view, trading at 24x our FY09 ests, a significant premium to peers as well as Columbia’s 3-year avge fwd P/E of 14.5x, despite depressed top and bottom-line growth. We reiterate our Sell rating.

Goldman Sachs on samuti väljas müügisoovitusega ja hinnasiht jääb endiselt $28 tasemele:

While still unchanged, COLM’s full year sales and margin outlook continue to speak to a number of our concerns.

(1) As a wholesaler, COLM faces later cycle risks as retailers consolidate stores and control inventory. COLM’s 2H currency neutral sales plan implies some deterioration vs. 1H.

(2) Non-US market exposure (45% of sales) adds pressure as those regions continue to deteriorate and add a currency drag that will pressure gross margin through the balance of the year.

(3) COLM’s expenses from retail store openings in late 2008 are offsetting cost reduction efforts. The 2009E gross margin is essentially flat with 2006 and the roughly 750 bp of profit erosion over the period is from deleverage. SG&A dollars were flat in 2Q vs. 16% sales decline.

Seega ootaks täna COLM aktsiahinnas korrektsiooni pärast lühikese ajaga tehtud ligi 20%-list tõusu. Samas on võimalik, et aktsia on liiga „ülerahvastatud“ – 10. juuli seisuga oli lühikeste positsioonide osakaal 26%. Lisaks ei ole Bloomberg’i andmetel 14-st ettevõtet katvast analüütikust mitte ükski (!) väljas ostusoovitusega.

-

Microsoft (MSFT) ja Yahoo! (YHOO) sõlmisid tehingu, millega:

"…Microsoft will power Yahoo's search tool while Yahoo will become the exclusive sales force for both firms' premium search advertisers. Terms are for 10 years, in which Microsoft will license Yahoo's core search technologies, and Microsoft's Bing will become the exclusive algorithmic search and paid search platform for Yahoo sites. Microsoft will pay traffic acquisition costs at an initial rate of 88% of search revenue generated on Yahoo sites for the first five years. Yahoo sees the deal lifting annual operating income by around $500 million and capital expenditure savings of $200 million. Yahoo sees an annual operating cash flow benefit of $275 million." (allikas: MarketWatch)

Selle kuu alguses teatas Google, et arendab tasuta operatsioonisüsteemi Chrome OS (otsene rünnak Windows’ile). Nüüd on Microsoft Yahoo! tehniguga teinud vastulöögi ja üritab Google’i otsingumootori domineerimist lõpetada (ilmselt saab alles aastate pärast öelda, kumb lahingust võitjana väljub).

-

USA's langesid kestvuskaupade tellimused juunis 2.5% (oodati kõigest 0.6% langust)

-

Mikk, see on headline, vaata ka sisusse

New orders excluding transportation unexpectedly rose 1.1 percent in June -

veel täpsemalt:

The June decline was due in part to 2.9% decline in manufacturing of unfilled orders, a 2.5% decline in computers and electronics and an 8.0% declinein capital goods. A key durable goods orders number seen as a barometer of health for business spending -- non-defense capital goods excluding aircraft --rose 1.4%.

Also significant was a 12.8% decline in transportation, the largest declinesince October 2008. Within transportation, orders for autos fell 1.0% while orders for non-defense aircraft and parts fell 38.5%. Both more than offset a 30.1% rise in orders for defense aircraft and parts. (allikas: thomsonreuters)

-

primary metals +8,9%

general machinery +4,4%

siit tuli oluline osa sellest ootamatust "New orders excluding transportation" kasvust -

Extended and Extended

By Rev Shark

RealMoney.com Contributor

7/29/2009 8:59 AM EDT

Rest? Rest? Shall I have not all eternity to rest?

-- Antoine Arnauld

Is this market ever going to pull back? After the run we've had following the Meredith Whitney upgrade of Goldman Sachs (GS) and the surprise earnings report from Intel (INTC) , we have not rested for more than a few hours. Earnings reports continue to solidly exceed expectations, economic reports have had a positive spin, the Obama health care initiative is becoming friendly to the free market, and the only real worry is being left on the sidelines.

It has been all good, and trying to fight the trend has been quite painful. So should we just assume that this positive action will continue indefinitely? The answer is yes. While the market is technically extended by nearly any measure, we haven't had any real signs that the momentum is slowing. On the contrary, pullbacks have been greeted with very strong buying. Many folks obviously want in, but they are waiting for prices to come back down.

That underlying strength is the key to the market. We aren't going to see a substantial pullback until it erodes, and it is not going to erode until buying weakness fails to work. The dip-buyers are going to keep on jumping in as long as the market keeps rebounding so quickly.

It is not an easy market to deal with because so many things are extended. There are big profits to protect, and the pullbacks can be very big and swift. That underlying support is there, but we still have plenty of room to fall when profit-taking kicks in. The dilemma we face is respecting the very strong momentum while also appreciating the fact that we are badly in need of some rest and consolidation.

We have a little nervousness this morning. China took a big hit overnight on concerns that banks may cut bank on lending and that liquidity could contract. The Chinese have done an economic stimulus that makes the U.S. look like an amateur, and those funds have been driving the market over there. There is now some concern that the spigot will be shut off, and that caused a big bout of profit-taking.

China is likely to have an impact on us, but we continue to have very good earnings reports. So many companies have exceeded analyst estimates that you have to wonder if it even is a surprise anymore.

Keep in mind that we are walking on the high wire, and the rewards can be great if we can stay balanced. However, the danger increases the longer we go without a rest. We have a pretty good safety net in the form of dip-buyers but they aren't always reliable -- especially if they are pressured for a while.

------------------------------------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CNO +23.7%, WCG +23.0%, VPHM +22.3%, SMTL +13.1% (light volume), KLIC +10.0%, JNY +9.2%, MCK +8.9%, USNA +8.8% (light volume), UHS +8.2%, CRI +6.6%, LIFE +6.5%, FTI +5.8%, BDN +5.5%, PLT +5.2%, HGR +4.6%, TASR +4.5% (light volume), , MEE +4.4%, FIS +4.4%, IDCC +4.2% (light volume), WDC +3.9%, NICE +3.1%, NMR +2.9% (light volume), DWA +2.9%, WYN +2.6%, GD +2.3%, Q +2.0%, HES +1.7%, HL +1.7%, SAP +1.4%, PNRA +1.2%... Select health insurer related names ticking higher following WCG results: CAH +2.6%, UHS +2.3%, HNT +1.7%... Other news: INO +168% (universal influenza vaccines demonstrate 100% protection against current pandemic A/H1N1 influenza viruses in animal studies), ELRN +38.2% (receives formal FDA clearance to market Its Insulin Micropump in the United States), LCRD +8.5% (continued strength from yesterday's 40% surge higher), ICAD +7.3% (still checking), BPHX +7.3% (still checking), PCAR +5.8% (continued strength following earnings)... Analyst comments: CGEN +10.6% (initiated with a Buy at Cantor Fitzgerald), MRNA +10.1% (initiated with a Buy at Cantor Fitzgerald), CY +2.8% (initiated with a Buy at ThinkEquity), TXT +1.6% (upgraded to Outperform from Neutral at Cowen), COH +1.1% (upgraded to Overweight from Neutral at Piper Jaffray).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: JAKK -10.3%, PENN -10.2%, THQI -9.6%, ALVR -9.1%, IXYS -8.6% (light volume), NYB -8.3%, CBI -7.2% (light volume), ANAD -6.9%, MT -5.9%, PX -5.4%, SPN -5.2%, SLT -5.0%, S -3.7%, STD -3.0%, TRMB -2.7%, HTZ -2.0%, SNY -1.0%... Select financials trading lower: UBS -2.4%, AZ -2.3%, MS -1.9% (cut to Neutral from Buy at Goldman - Reuters), USB -1.4%, MET -1.4%... Select metals/mining names showing weakness: BBL -2.3%, GG -1.9%, RTP -1.8%, VALE -1.8%, ABX -1.5%, BHP -1.0%... Select oil/gas related stocks trading lower: WFT -3.0%, CHK -2.8%, PTR -2.5%, RIG -2.2%, SLB -2.4%, OXY -2.0%, STO -1.9%, PBR -1.7%, CVX -1.4%, XOM -1.0%... Other news: YHOO -7.1% (Yahoo!, Microsoft confirm search deal; no upfront payment to YHOO), MFA -5.4% (announces a 30 mln share common stock offering), CCL -5.0% (trading down in sympathy with RCL), KG -3.0% (FDA Panel says more study needed for heart imaging drug Corvue - DJ), SY -2.7% (announces proposed private placement of $250 million convertible senior notes)... Analyst comments: CAVM -5.9% (downgraded to Buy from Strong at Needham), MGM -3.3% (downgraded to Neutral at BofA/Merrill), NSC -3.3% (downgraded to Neutral at BofA/Merrill), JEC -3.1% (cut to Neutral from Buy at Goldman- Reuters), ARMH -3.1% (downgraded to Neutral at UBS), AFL -2.8% (downgraded to Hold at Citigroup), EPD -2.2% ( removed from Focus List at Morgan Keegan). -

Euroopa turud:

Saksamaa DAX +1.7%

Prantsusmaa CAC 40 +1.4%

Inglismaa FTSE 100 +0.8%

Hispaania IBEX 35 -0.4%

Rootsi OMX 30 +0.2%

Venemaa MICEX -1.6%

Poola WIG +0.2%Aasia turud:

Jaapani Nikkei 225 +0.3%

Hong Kongi Hang Seng -2.4%

Hiina Shanghai A (kodumaine) -5.0%

Hiina Shanghai B (välismaine) -3.7%

Lõuna-Korea Kosdaq -0.5%

Tai Set 50 -1.4%

India Sensex 30 -1.0% -

Sector ETF strength & weakness through the first hour of trading

Leading Sector ETFs:

Comm banks- KBE +1.5%, US bonds- TLT +1%, Heathcare- IHF +1%, IYH +.5%, Reg banks- KRE +1%Lagging Sector ETFs:

Steel- SLX -4.5%, Coal- KOL -4.5%, SPDRS metals/mining- XME -4.5%, Crude/WTI oil- USO -4%, OIL -4%, Oil HLDRS- OIH -4%, Solar- KWT -3%, TAN -3.5%, Energy- XLE -3%, IYE -3%, Base metals- DBB -3%, Gold miners- GDX -3%, Basic mat- IYM -3%, XLB -2.5%, RBOB gas futures- UGA -2.5% -

Struggling US home owners cite job loss, wage cuts

In June, about 72 percent of homeowners who got foreclosure prevention counseling from the Consumer Credit Counseling Service of Greater Atlanta, which serves all 50 states, said they had lost a job or had a recent income cut, the agency said. "As unemployment rises, we are seeing a change in the financial profile of the people seeking our help," Suzanne Boas, president of CCCS of Greater Atlanta, said in a statement. "We are serving an increasing number of people who work in professional services and skilled trades. These people have maintained solid incomes their entire lives, but are now in financial trouble and are reaching out for counseling to help avoid foreclosure." -

Sector ETF strength & weakness @ midday

Leading Sector ETFs:

Comm bansk- KBE +1.5%, Reg banks- KRE +1%, SPDRS homebuilders- XHB +1%, US bonds- TLT +1%, US Dollar- UUP +1%, Healthcare IHF +.5%, IYH +.5%Lagging Sector ETFs:

Crude/WTI oil- USO -6%, OIL -6%, Coal- KOL -5%, Heating oil futures- UHN -4.5%, RBOB gas futures0 UGA -1.5%, Commods- GSG -4%, DBC -2.5%, Steel- SLX -4%, SPDRS metals/mining0 XME -4%, Nat gas- UNG -4%, Oil HLDRS- OIH -3.5%, Dry-bulk shippers- SEA -3%, Gold miners- GDX -3% -

5-year Note Auction Results:

High Yield 2.689% (2.635% expected); Bid/Cover 1.92x (2009 Avg 2.22x); Indirect Bidders 36.7% (2009 Avg 41.9%)

Previous offering saw $37B, 2.7% yield, with a bid-to-cover of 2.58x and an indirect bidder participation rate of 62.8%.

Turg astus korraliku sammu alla, kas katalüsaator müümiseks olemas? -

Fed says commercial real estate mkts weakened further

Fed's Beige Book sees Most Districts See Recession Easing

Fed's Beige Book sees Econ Activity Still Weak; Most Districts Report Sluggish Retail Activity

Ja turg teeb kerge hüppe ülespoole -

Summary of Fed's Beige Book

Reports suggest that economic activity continued to be weak going into the summer, but most Districts indicated that the pace of decline has moderated since the last report or that activity has begun to stabilize, albeit at a low level. Manufacturing activity showed some improvement in the Richmond, Chicago, and Kansas City Districts; while St. Louis and Dallas reported some moderation of declines; Philadelphia and Minneapolis saw activity decrease; and most other Districts indicated that manufacturing activity continued at low levels. Boston, Richmond, St. Louis, Minneapolis, and San Francisco reported contractions in services industries. Banking sectors in the New York, Cleveland, Richmond, St. Louis, Kansas City, and San Francisco Districts experienced weaker demand for some categories of loans. Residential real estate markets stayed soft in most Districts, although many noted some signs of improvement. By contrast, commercial real estate markets weakened further in recent months in two-thirds of the Districts and remained slow in the others. Districts reported varied—but generally modest—price changes across sectors and products, with competitive pressures damping increases; however, Boston, Cleveland, Chicago, Minneapolis, and Dallas noted that some metals prices have increased in recent months. Most Districts indicated that labor markets were extremely soft, with minimal wage pressures, and cited the use of various methods of reducing compensation in addition to, or instead of, freezing or cutting wages.