Börsipäev 30. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

USA turgudel lõppes eile kauplemine teist päeva miinuses, kuid indeksid likvideerisid lõpuks pea poole oma keskpäevasest kaotustest pärast beeži raamatu avaldamist. Föderaalresevi sõnul on langus USA majanduslikus aktiivsuses raugenud ning ilmnema on hakanud kerged stabiliseerumist kinnitavad märgid. Seejuures toonitati, et paljudes tegevusvaldkondades jääb jaemüük endiselt uimaseks.

Tänane USA makrostatistika piirdub esmaste töötuabiraha taotluste arvuga (kell 15.30), mille suuruseks prognoosib konsesnus 575 000. 18. juulil lõppenud nädalal kerkis näitaja 30 000 võrra 554 000-ni, mis vastas ootustele.

-

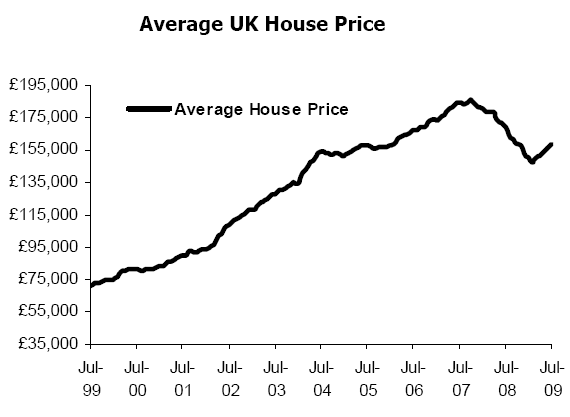

Hoolimata üsna negatiivsest taustast, jätkub Suurbritannias mõnevõrra üllatuslikult kinnisvarahindade tõus juba kolmandat kuud järjest, kerkides juulis 1.3%. Aastataguse perioodiga võrreldes jääb hind -6.2% madalamaks, kuid võrreldes juunikuu -9.3%-ga, on aset leidnud silmnähtav paranemine. Kui veel mõned kuud tagasi prognoositi käesolevaks aastaks hinnalangust siis viimased andmed annavad lootust juba näha kõrgemat tulemust.

Oma ülevaates toob aga Nationwide välja olulise nüansi, mis peaks pidurdama samasuguse trendi jätkumist. Sellise tempo juures jõuavad hinnad peagi tasemeni, mis oleks selgelt balansist väljas võrreldes sissetulekute, rendi ja muu kinnisvara valuatsiooni juurde kuuluvate näitajatega. Alahinnata ei tohiks ka kõrge töötuse määra pikaaegset mõju, mis vähendab ostja usaldust ja tekitab müügisurvet majaomaniku jaoks.

-

Juuli vast?

-

tänud...oleme taas olevikus

-

Royal Caribbean upgraded to Equal Weight from Underweight at Barclays - Target to $15 from $6.

Nice call. Kui mälu ei peta siis Barclays oli see, kes downgrades RCLi underi peale ja pani targetiks $1. Stokk sai mõnusalt peksa. Täna siis neutral ja target $15, ilus ..väga ilus. -

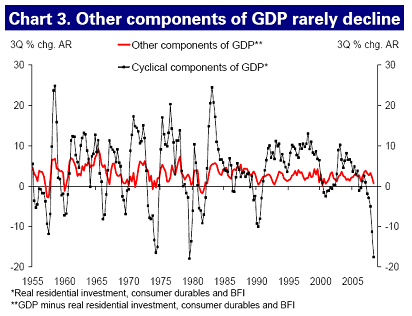

DB on välja toonud, mis komponendid on USA SKP's langust põhjustanud:

Kolme peamise languese komponendi taastumise kohta arvab DB:

1 ) investeeringud erakinnisvarasse: ... homebuilding returns gradually to the historical average rate of household formations of about 1.25 million per year over the next four years, real residential investment will have to grow at an average rate of about 25% per year from its currently very depressed level.

2) kestvuskaubad:...we can see (auto) purchases returning at least to the scrappage rate by the end of 2010. This would mean roughly a 20% annual rate of increase beginning in Q4. If we assume spending on other durable goods picks up at somewhat less than half that rate, the average growth of consumer durables will be about 12% per year.

3) ettevõtete kapitaliinvesteeringud: The current level of real business fixed investment is roughly in line with the depreciation of the business capital stock, indicating that the growth of that capital stock has dropped to about zero. This is by far thelowest rate of increase recorded in the past five decades.

& kokkuvõtvalt:

...even under very conservative assumptions we think there is significant potential for a sizable bounce in spending from the very low levels in these categories—enough, we estimate, to push GDP growth up to at least 3 per cent in 2010.

-

Initial Claims 584K vs 575K consensus, prior revised to 559K from 554K; Continuing Claims falls to 6.197 mln from 6.251 mln

-

headline kergelt negatiivse varjundiga, kuid muidu OK numbrid, turg teeb kerge põlvenõksu ja siis üles

WASHINGTON, July 30 (Reuters) -The number of U.S. workers filing new claims for jobless benefits rose slightly more than expected last week, but a gauge of underlying labor trends fell for a fifth straight week, government data showed on Thursday.

Initial claims for state unemployment insurance benefits rose 25,000 to a seasonally adjusted 584,000 in the week ended July 25. The four-week moving average for new claims, considered to be a better gauge of underlying trends as it smoothes out week-to-week volatility, fell by 8,250 to 559,000.

This was the lowest level since late January. The weekly moving average has declined for five straight weeks.

A Labor Department official said the trend in claims was now back to where it would have been without July distortions caused by the timing of auto plant shutdowns.

Analysts polled by Reuters had forecast new claims rising to 570,000 from a previously reported 554,000.

The number of people staying on the benefit rolls after collecting an initial week of aid fell by 54,000 to 6.20 million in the week ended July 18, the latest week for which the data is available. This was the lowest since early April and marked the third straight week that this measure had declined. -

USA futuurid viitavad tugevale päeva algusele & ootused majanduskasvu kiire taastumise suhtes kasvavad. Turud on kindlal seisukohal, et majanduskasv on taastumas, kuid veel ei olda kindlad, mis kujuga. BusinessInsideris on pealkiri "You Fools Don't Get It: This Is A V-Shaped Recovery!" (loe siit), mis näitab, kuidas üha enam über-pullid julgevad võtta sõna. Samas argumendid (nt One reason unemployment is so high is that employers over-reacted...) ei veena eriti.

-

Don't Argue With the Market

By Rev Shark

RealMoney.com Contributor

7/30/2009 8:33 AM EDT

The next mile is the only one a person really has to make.

-- Danish fur trapper's expression

One of the easiest ways to find yourself out of step with the market is to look too far down the road. We can always make a good argument for why things are bound to eventually change, but it seldom pays to argue with what is presently happening in front of us.

The market has a tendency to trend, and those trends don't end easily or logically. Most often, they will persist far longer than we think are reasonable and they will reverse only when few are prepared for it.

The present rally, which kicked off a couple weeks ago on earnings from Goldman Sachs (GS) and Intel (INTC) is a particularly good example of a trend. It has already gone much further than most would have predicted and has been astonishing in its persistence and lack of pullbacks.

For many, including me, the breathless excitement in the market seems out of step with the much more sober views on Main Street. While Wall Street is celebrating the deceleration or our economic meltdown, many ordinary folks are still very concerned about unemployment, real estate prices and the pace of any recovery.

Bur our job as traders isn't to worry too much about how realistic the market might be but rather to embrace what is happening now and try to profit form it. What is happening now is a tremendously strong rally that has many folks scrambling to find a way to enter this market. They aren't seeing any meaningful pullbacks, so they are paying up and chasing stocks that, in many cases, are already extended.

How much further will this extended market run before we have a meaningful correction? I have no idea, and I'm not going to try to anticipate it. I'll simply accept the fact that we have a strong market and try not to question it.

One of the easiest ways to improve your investment results is to simply not argue with the market. It is not a rational beast, and no matter how logical or insightful you might be, you are never going to win an argument with the market. It may eventually come around to your viewpoint, but you can become broke pretty fast if your timing is off.

This morning the market is seeing strength once again as Asian markets recovered from a one-day thumping and a flow of good earnings reports continued. It isn't easy to find new buys in this market, but it is far more dangerous to not respect this great strength.

----------------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ITP +17.6%, SONS +17.4%, NAVR +15.5%, TRMA +15.1%, BIOS +13.6%, PTI +13.2% (light volume), BT +11.6%, AMSC +11.4%, NWL +8.6%, MOT +8.1%, AMKR +7.1%, MA +7.1%, CVC +7.0%, DAVE +6.7%, ALU +6.7%, CPF +6.6%, CI +6.3%, SNE +6.0%, BSY +5.8%, LSI +5.7% (upgraded to Buy form Neutral at Goldman - Reuters), SMMX +5.3% (light volume), HIG +5.3%, FLS +5.3%, WYNN +4.8%, IP +3.3%, MYL +3.0%, ESRX +2.8%, AZN +2.6%, AHL +2.4%, AGNC +2.3%, AEM +1.5% (also Cramer makes positive comments on MadMoney), TYC +1.0%... M&A news: OSP +12.7% (Overseas Shipholding proposes to acquire remaining public stake for $8.00/unit in cash)... Select metals/mining names showing strength: RTP +5.8%, AAUK +4.0%, BHP +3.9%, MT +3.7%... Select oil/gas related names trading higher: STO +2.1%, SLB +1.9%, RIG +1.8%, PBR +1.7%, OXY +1.3%... Select financials showing strength: IRE +7.0%, AIB +5.3%, IBN +5.2%, MET +3.6%, PRU +3.0%, HBC +2.9%, FITB +2.8%, BAC +1.6%, UBS +1.4%, ABB +1.2%... Select drug related names trading higher: PFE +1.5% (Pfizer and Medivation initiate phase 3 trial of dimebon in patients with Huntington Disease), GSK +1.0%... Other news: VRNM +55.4% (Verenium and BP announce partnership to advance the commercialization of cellulosic ethanol), AXL +15.0% (continued strength), ARIA +10.6% (still checking), AIS +10.5% (receives payment from Teva for commercial development of Vibex Auto-Injector product), WXCO +9.1% (still checking), LVS +3.9% (up in sympathy with WYNN), POT +2.0% (Cramer makes positive comments on MadMoney)... Analyst comments: RCL +4.8% (upgraded to Equal Weight at Barclays), GE +4.6% (upgraded to Buy from Neutral at Goldman- DJ), RF +2.8% (upgraded to Neutral at BofA/Merrill), BDN +2.5% (upgraded to Buy at Argus), YUM +2.2% (upgraded to OVerweight at Morgan Stanley), SAP +1.9% (upgraded to Hold at SocGen), AMZN +1.3% (initiated with a Buy at UBS).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: LVLT -13.6%, AKAM -11.3% (also multiple analyst downgrades), FBP -10.1% (light volume), GMR -9.3%, SYMC -8.4%, OCR -7.3%, CTV -6.0%, DRIV -5.4%, GMCR -5.2%, FLEX -4.5% (downgraded to Hold at Needham), FISV -3.8%, CERN -3.8%, ASIA -2.9%, WMI -2.8%, VAR -2.8%, PH -2.7%, XOM -2.1%, (CML -1.5% (light volume), CL -2.0%... Other news: RUK -14.2% (Reed Elsevier shares plunge in Europe on share placement - DJ), ENL -14.2% (still checking), INO -12.9% (announces $30 mln registered direct offering), ENL -11.0% (still checking), TOO -8.9% (announces it has priced its public offering of 6.5 mln shares of common stock at $14.32/share), MITI -8.8% (announced that it intends to offer shares of its common stock in a public offering), CSFL -8.2% (light volume, prices 11.54 mln common shares at $6.50/share), RCRC -5.6% (announced that it priced a public offering of 3,500,000 shares of common stock; expects to receive net proceeds from the offering of approximately $49.6 mln), GHL -5.1% (announces 3,000,000 share common stock offering), HRBN -2.2% (prices a public offering of 6,250,000 shares at $16.00 per share)... Analyst comments: CATY -6.5% (downgraded to Neutral at B. Riley), CML -6.3% (downgraded to Accumulate at ThinkEquity), THOR -4.1% (downgraded to Hold from Buy at Lazard Capital Mkts). -

Turg

http://www.youtube.com/watch?v=dx9kksyjjbU -

Abesiki, milleks toppida mingit jura linki börsipäeva teemasse. Võiks siis vähemalt lisada, et musa või mp3. See on kasvav trend kus lingid riputatakse ebapiisava sissejuhatusega. Ei midagi isiklikku!

-

Turg püsib kenasti 990 punktist ülevalpool, kuid mõned sektorid on juba kerget müüki saamas. SMH on täitnud gap-i ära ja kaupleb 0.5% tõusus. Kella 20 avaldatakse võlakirjaoksjoni tulemused, mis annavad turule suuna. Nafta futuurid püsivad tugevana ~+5%, kuigi käive on üsna väikseks kuivanud.

-

Sector ETF strength & weakness at midday

Leading Sector ETFs:

Crude/WTI oil- USO +6%, OIL +6%, Heating oil futures- UHN +5.5%, RBOB gas futures- UGA +5%, Coal- KOL +4.5%, Steel- SLX +4.5%, iShares REITS- ICF +4%, Commods- GSG +4%, DBC +3%, SPDRS metals/mining- XME +3.5%, iShares real estate- IYR +3.5%, Basic mat- XLB +3.5%, IYM +3.5%, Clean energy- PBW +3%, Base metals- DBB +3%, Comm banks- KBE +3%, Nat gas- UNG +3%, Ag futures- DBA +3%Lagging Sector ETFs:

Airlines- FAA -.5%, Livestock commods- COW -.5%, US bonds- TLT -.5% -

Kallis Danel,

Ma saan Su murest täiesti aru. Mulle ka ei meeldi kui Bloomberg repordib suuremas osas hommikust õhtuni mingit jura ning samamoodi Briefing. Niisugune trend on ka juurdunud analüütikitesse, kes nagu annavad välja note aga kui vaatad sisse siis nagu polegi note`i kuskil. Milleks kirjutada 20 lehekülge jura kui sellest pole kellegile kasu?

Sellest tulenevalt on saanud muusika tähtsaks osaks päevast, sest muud midagi pole teha. Võimalik oleks Delfis tetrist mängida või motikaga mõnes mängus kurjameid taga ajada. Aga mulle ei meeldi mootorrattad ja tetris on liialt vägivaldne, sest seal tümitab üks blokk teist.

Teiseks, mida peaksid inimesed tegema kui ei saaks muusikat kuulata? Muud poleks teha kui jooma hakata ...no mida sa muud teed? Kas sa tõesti oled nii paha inimene, et tahad, et ma keset päeva hakkaks jooma? ai-ai -

7-year Auction Results:

High Yield 3.369% (3.39% expected); Bid/Cover 2.63x; Indirect Bidders 62.3%

Ja turg astub sammu üles -

millised sinu ennustused tänase homse päeva suhtes. Kas tulekul ka mõned uudised mis võivad trendi muuta? Mida arvad neti aktsiatest nt täna GOOG tugevalt plussis ja YHOO täiesti vastupidi?

-

Google initiated with a Buy at UBS; tgt $525

Üleüldise turu tugevuse taustaks ka UBS google hinda toetamas. -

Homme kell 15:30 avaldatakse USA Q2 QoQ GDP ja Personal Consumption , mis annavad kindlasti turule suuna. Hetkel juba kõikidel pullidel näpud sügelemas a la S&P 500 1000 punkti tasemest kohe üle sõitmas ja paljud vist ei jõua ära oodata, millega lisavad õli tulle. Hommikune kiire tõus valdavalt shortide katmine.

-

Relative Strength in Housing -XHB- in recent trade

The XHB has pushed to a new session high in recent action to test its 8 month high from May at 14.28 -- LEN +1.5%, MTH +1.4%, PHM +4.3%, SPF +3.3%, TOL +0.8%, DHI +2.7%, KBH +1.2%, RCII +1.9%, LEG +2.3%, AAN +2.1%. -

abesiki, palun postita muusikaga seotud siia Disko pole oluline, punk on põhiline.

-

Miks turg kukkus?

-

Mingit otsest põhjust ei olegi, eks ilmselt natuke kardetakse selle ralli lõppu. Siiani on kõik päevad lõpus üles ostetud, täna siis vastupidi. VIXi viskas ka kõrgemale. Teisalt vaadates, kus turg lõpetab, siis seda väga märkimisväärse liikumisena võtta ei maksa.

-

Kas homme kell 15.30 on selge turu liikumine viimasel nädal päeval?

-

California?

-

renessanss, turg on viimasel ajal näidanud, et selge pole siin midagi, aga kahtlemata on teise kvartali SKP päeva üks olulisemaid sündmusi. Praegu on olnud selge panus kiirele paranemisele, periood kuni juuni lõpuni on paljude jaoks kauge minevik. Eks ole näha, kas see muutub või mitte.

-

First Solar beats by $0.49, beats on revs

Reports Q2 (Jun) earnings of $2.11 per share, $0.49 better than the First Call consensus of $1.62; revenues rose 25.8% year/year to $525.9 mln vs the $459.1 mln consensus -

FSLR käis üle 190 peale tulemusi, pärast hakati kasumit võtma ja langes alla sulgemis hinna aga hea hea koht sisenemiseks, sest tulemused on väga head käive ja kasum rohkem kahekordsed võrreldes eelmise aasta sama perioodiga.

http://investor.firstsolar.com/phoenix.zhtml?c=201491&p=irol-newsArticle&ID=1314526&highlight= -

ja mina vaatasin eile õhtul, et guidance tõi müügi... nii et kasummivõtt. igatahes oli see siis väga jõuline võtmine :)

-

lisaks veel First Solari kohta: ületas ootusi aga eile oli väga volatiilne -- kuid mõned ütlevad, cash on vähenenud oluliselt. Jah nii see on -285M kuid vaadates bilanssi on eelimise perioodiga aksiad +85M, sularaha investeeringud +50M, arved saada +290M !!!, varud +40M , nii et ei näe ka seal probleemi. Aasia täna tugev seega FSLRga võib täna korralikku rallit näha, samuti on väga tõenäoline target upgrades.

-

seller, oskad sa öelda?

- täna müüdavate FSLR paneelide kasutegur?

- eluiga/garantii?

-kui suureks ohuks pead hiina si-pv tootjaid, kelle ASP ja processing cost juba konkureerib FSLR´iga

Ette tänades! -

Seller

Kirjutasid välja bilansilise jaotuse: +290M arved saada mis on pool Revenuest siis kas see tõesti ei ole probleem ? -

jah seda on palju ja ses mõttes võib probleem olla et kuna on palju krediiti müüdud siis oleneb nüüd sellest, mis selle 290M taga on. Kas on värsked arved/lepingud või juba hapuks minemas. Aga igal juhul pole cash lihtsalt ära haihtunud lihtsalt varad on suurenenud ja likviidsus kehvemaks läinud ja õnneks see number pole varudes. Igatahes oleks muidugi parem kyll kui see oleks 290 revenues olnud aga loodetavasti 3 kvartali müük näitab tõusu selle arvelt. Kui see 290 oleks lootusetu siis oleks ka sellest juttu olnud.

-

Lihtsalt hoiatuseks: Write-offidest saad sa teada tagant järgi !

Mulle tundub see 50 % krediiti müük hoiatusena, vb on see sealsete firmade eripära. -

DanelK le kommentaariks, et First Solari eelilseks on hea paneelide materjali hinna ja toodetava energia suhe. kuigi see on veidi vananenud ja metallid, mida kasutatakse on ohtlikud on neil recycling programm, millega materjalid on võimalik uuesti taaskasutusse anda. Rohkem saab Solarite kohta kohta lugeda näiteks siit: http://www.scribd.com/doc/16417638/Csfb-December-Solar

-

seller, hoia stop väga lähedal.

-

seller, väga huvitav link!