Börsipäev 31. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

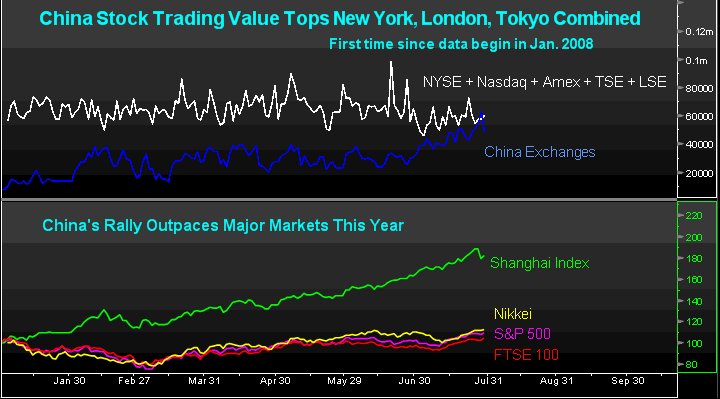

Oodatust paremad kasumiraportid Motorolalt, MasterCardilt ning toorainete võimas ralli tõstsid SP500 indeksit eile 9 kuu tippude juurde ning samas meeleolus jätkatakse ka Aasias. Hiina, kus jutt laenukraanide kinnikeeramisest kolmapäeval Shanghai indeksit -6%-ga ehmatas, on teist päeva tõusjate nimekirja eesotsas (+2.3%). Nagu allolevalt graafikult näha, on spekulatiivne maania kergitanud Hiinas kaubeldud aktsiate väärtuse esimest korda kõrgemale, kui USA, UK ja Jaapani kombineeritud väärtus kokku. 29 juulil ulatus Hiinas tehtud tehingute maht 63 miljardi dollarini, kui see samal päeval oli 58 miljardit dollarit New Yorgis, Londonis ja Tokyos.

-

Autotootjad raporteerivad oma juulikuu müüginumbrid 3. augustil ning suure töenäosusega kujuneb sellest parim kuu käesoleval aastal. Nimelt on USA valitsus juba sunnitud peatama programmi, mis subsideerib vanade autode romulasse saatmisel uute ostmist kuni 4500 dollariga ning seda lihtsal põhjusel: kuue päevaga on 1 miljardi dollari suurune eelarve juba täis. Valitsus ise lootis antud summaga hakkama saada kuni 1 novembrini, genereerides ligikaudu 250 000-list automüüki.

-

Hiina börsile voolav raha hulk muudab ettevaatlikuks ka Marc Faberi, kelle arvates Hiina majandus kasvab 7.8% asemel 2%. Lühikest arvamust võib lugeda siit

-

Millised uudised sinu arvates võivad täna USA turgu mõjutada? Kas näeme ettevatliku ja kasumivõtmise päeva või vastupidi heade tulemuste ootava rallit?

-

renessanss,

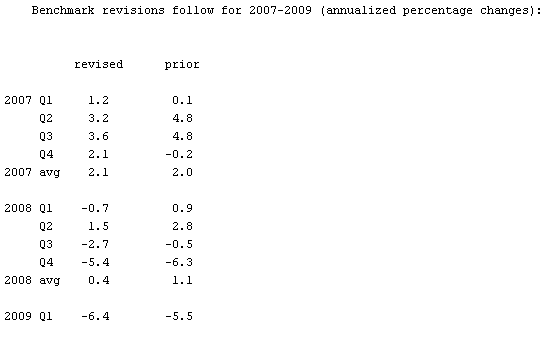

tänase päeva meeleolu paneb suuresti paika USA teise kvartali esialgse SKT näitaja avaldamine kell 15.30 Eesti aja järgi, mille languseks konsensus prognoosib -1.5% (neljandas kvartalis registreeriti kukkumiseks -6% ja esimeses -5.5%). Aruanne ei saa olema tavaline, kuna esimest korda alates 2003. aastast kavatsetakse revideerida võrdlusandmeid, eelkõige mis puudutab säästmismäära ja isiklikku sissetulekut. Seega võidakse madalamaks korrigeerida nii 2008.a Q1 ja Q2 tulemust, mis mõlemad näitasid majanduse kasvu (vastavalt +0.9% ja +2.8%) ehkki majanduslangus algas tegelikult peale 2007. aasta detsembris. Harilikult ei pälvi lähiajaloo andmete korrigeerimine palju tähelepanu aga antud kontekstis näitab see ära, kuidas inimesed on tegelikult ümber käinud oma sissetulekutega ning väga drastiline erinevus muudaks paratamatult paljude hinnangut ka praegusele olukorrale. -

Meenub ütlus - on väiksed valed, suured valed ja siis veel statistika...

-

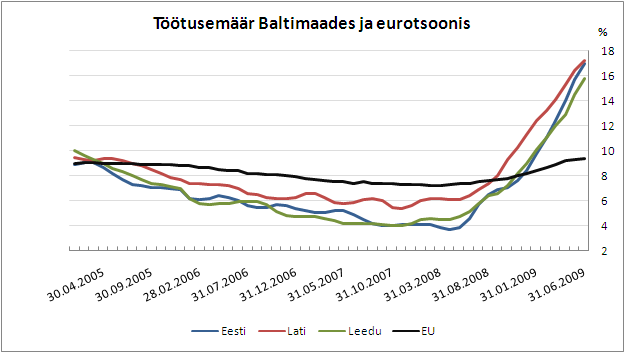

Täna avaldatud eurotsooni juunikuu töötusemäär osutus oodatust paremaks, millele lisaks korrigeeriti 30 baaspunkti võrra madalamaks ka maikuu näitajat (9,6%-lt 9.3%-le). Prognoositud 9.7% asemel ulatus töötus 9.4%-ni, mis sellegi poolest on kõrgeim tase alates 1999. aastast ning jätnud euroalal töötuks 14.9 miljonit inimest. Kõige kiirem töötuse kasv oli Eurostati andmetel Baltimaades, kus juuni näitaja kerkis võrreldes maiga Eestis 15.7%-lt 17.0%-ni, Lätis 16.4%-lt 17.2%-ni ning Leedus 14.5%-lt 15.8%-ni. Kõigis kolmes Balti riigis korrigeeriti maikuu näitajat ülespoole.

-

Naftahind lõpetas esimese kvartali 50 dollarist natuke allpool ja teise kvartali lõpus maksis toornafta barrel natuke alla 70 dollari (+40%). Naftaettevõtted on aga üks vähestest sektoritest, kus kasumite langus on analüütikute ootusi selgelt ületanud (nt Shell –67%, ExxonMobil –66% & täna avaldatud Totali ja ENI'i Q2 kasumid kukkusid -54% & -76%).

Stephen Schorki (Schork Report’ist) hinnangul ei pööra konsensus piisavalt tähelepanu naftaettevõtete tulemustele, mis kinnitavad jätkuvalt rekordmadalat nõudlust (madalad rafineerimise marginaalid viitavad juba mitu kuud nafta väga kehvale nõudlusele). Schork kommenteerib irooniliselt eilset naftahinna rallit (+5.7%):

...demand for oil and therefore profits for oil companies are down, NYMEX rallied yesterday because Motorola (mobile phone maker) had a smaller than projected loss and Calphalon (cookware) and Paper Mate (writing instruments) had better than expected profits.

FT kinnitab pointi väljavõttega Bloombergist:

Hetkel on naftahind 50 senti miinuspoolele vajunud & septembri futuurid maksavad 66.44 dollarit.

-

Paar huvitavamat call'i täna Citigroupi analüütikutelt:

-) Kontoritarvete keti OfficeMax (OMX) reiting tõstetakse "Osta" peale hinnasihiga $12. (varasemalt "Hoia" ja $8) Makromured jätkuvad, kuid suur osa sellest võib aktsiasse juba sisse arvestatud olla:

Upgrading to Buy— We are upgrading OMX to Buy from Hold rating based on: 1) stabilizing sales trends which will likely continue to improve into 2H09; 2) accelerating share gains in the co’s Delivery business; 3) the co’s lean cost structure and ongoing cost control efforts which should result in stronger margins in FY10 and 4) an attractive valuation.

-) Vagunelamuid tootva Thor Industries'e (THO) "Osta" reitingut kinnitakse, kuid hinnasihti tõstetakse $2 võrra $30-ni ning aktsia lisatakse Top Picks Live nimekirja. Citi hinnasiht on jätkuvalt kaheksa analüütiku hulgas kõrgeim:

Well Positioned Within L-T Growth Industry — We believe that underlying RV demand is intact (sweet spot from demographic perspective), despite near-tern cyclical pressures. We also believe THO is very well positioned. Dealers view Thor as a vendor of choice, given turmoil w/ other major competitors. Fleetwood and Monaco are under new ownership after having gone bankrupt,

and dealers we speak with are still reluctant to reorder products from them. -

(p)bulli saaks, kui USA GDP tuleks positiivne :)

-

tuleb kah, + 0,2% :)

-

Q2 GDP- advanced -1.0% vs -1.5% consensus, prior -5.5%

Q2 GDP Price Index +0.2% vs +1.0% consensus, prior +2.8%

Q2 Core PCE +2.0% vs +2.3% consensus; prior revised to +1.1% from +1.6%

Q2 Employment Cost Index +0.4% vs +0.3% consensus, prior +0.3%

Q2 Personal Consumption -1.2% vs. -0.5% consensus; prior revised to +0.6% from +1.4% -

parem, kui oodatud, kuid mitte piisavalt. ma arvan, et täna tuleb selloff.

-

Millised veel arvamused?

-

Täna on reede ja kuu viimane päev. Seega saab kuidagimoodi neid numbreid kindlasti überpositiivsena tõlgendada :)

-

Ehk siis suur hulk dipbuyereid on kõik jaole tulemas täna. Aga kas ka täna ostetakse kõik langused üles või saavad nad seekord tünga, saab näha. Viimasel ajal on kombeks üles osta.. aga see strateegia töötab täpselt niikaua kuni ükskord enam ei tööta.

-

Kuigi USA SKP -1% langust oli oodatust parem, läheb esilagu tähelepanu Q1 SKP korrigeerimisele (allikas: ThomsonReuters):

-

Deal With Frustration

By Rev Shark

RealMoney.com Contributor

7/31/2009 8:59 AM EDT

Frustration, although quite painful at times, is a very positive and essential part of success.

-- Bo Bennett

The great irony of extremely strong markets is that they aren't that easy to trade. We see a lot of celebration in the media and big blaring headlines in the newspapers about the fantastic gains, but under the surface there is a tremendous amount of anxiety.

The market would be very easy if everyone were fully invested and just riding things straight up, but that isn't the case. In fact, one of the major tailwinds for this market is the horde of folks who are very underinvested and anxiously trying to make some buys. They keep waiting for things to pull back, and when it doesn't happen, they jump in anyway and keep the uptrend going.

If you are feeling frustrated because you have been lagging the market recently, it is important to realize that you are not in an unusual position. The folks who do best in this sort of market are those who tend to stay fully invested at all times. They likely rode the market down and are now enjoying the ride back up. Of course they are going to be feeling much better about things, and that is the celebration we see reflected in the media.

So what do you do if you have been lagging this market and are feeling a bit frustrated? First, you need to appreciate that the nature of trading is that you will underperform in certain types of markets. You will make excellent gains in the right stocks in a runaway market, but if you are trading, the likelihood is that you have taken some profits prematurely and have had too much cash in a market as strong as this one. That is just the nature of the beast: If you have a trading discipline that requires taking gains on a regular basis, you will be underinvested in a market like this.

Once you accept the fact that not all markets will reward all trading styles, the next thing is to realize that the character of the market will change at some point. The big danger of being frustrated is that you will start to trade differently and find yourself with a whole new approach just at the point that the market starts to shift.

Markets always evolve, and big moves always give way to something else eventually. Even if it is a new bull market, we will have periods of basing and pullbacks after the big trend move.

Don't get discouraged if you aren't keeping pace in this market. The most important determinant of success in the market is persistence. You have to keep plugging away at it through good times and bad.

The main point I'm trying to make here is that the market isn't a black and white thing. It isn't as simple as "'up' is good and 'down' is bad." The media distorts this greatly, and it affects the way we feel about our trading. Don't get discouraged if you're feeling left out of the big celebration. There is far more frustration out there than you may think.

We have the GDP numbers hitting this morning and are getting a slight negative reaction so far, probably due to the lower-than-expected personal consumption. Overseas markets in Asia were strong, which probably helped to hold us up this morning after some late selling yesterday, but profit-taking is on the minds of many, and I'm looking for much more skittish action.

----------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ANDS +46.1% (also receives FDA clearance of phase II protocol to study ANA598 in combination with interferonaAlpha and ribavirin in HCV patients), ISLN +21.4% (light volume), NVTL +19.2%, GXDX +10.2%, ABAX +9.9%, SGY +9.3%, CSV +8.6% (light volume), RPRX +6.4%, RST +6.2%, DRYS +5.7%, CEG +5.1%, GHM +4.5% (light volume), ITT +4.0%, VSEA +4.0% (also upgraded to Buy at UBS), MHK +3.7%, AMCC +2.2% (light volume), DLB +2.2%, PDLI +2.2%, D +2.0%... Select European financials trading higher: IRE +7.3%, AIB +5.6%, ING +4.4%, CS +3.1%, PUK +2.0%, BCS +1.6%, HBC +2.1%... Select shippers showing strength following DRYS results: FRO +4.9%, EXM +2.2%... Select metals/mining names showing strength: GFI +2.2%, AU +1.8%, AUY +1.6%, AEM +1.4%... Other news: SSRX +10.4% (still checking), CHK +1.7% (provides operational update; increases proved reserves by 0.7 Tcfe to 12.5 Tcfe), AZN +1.4% (still checking), KMP +1.1% (Cramer makes positive comments on MadMoney), ... Analyst comments: CFX +5.6% (upgraded to Outperform at Baird), ODSY +3.6% ( upgraded to Outperform from Market Perform at JMP Securities), IRBT +3.1% (upgraded to Buy from Hold at Kaufman Bros), OMX +1.9% (upgraded to Buy from Hold at Citigroup), CCL +1.1% (initiated with a Buy at Citigroup).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: SYNA -16.3% (also downgraded to Average at Caris ), ARIA -14.2%, GPRO -12.0% (also downgraded by multiple analysts), YRCW -11.8%, PWAV -11.2%, FSLR -10.7% (also downgraded to Accumulate from Buy at ThinkEquity), LVS -10.3% (also downgraded to Underperform at Wedbush Morgan based on valuation), TSYS -8.9%, ESLR -8.4%, PKI -8.3%, DXPE -7.7%, MPWR -7.5%, REXX -7.3%, SFI -7.0%, PBI -6.8%, EXEL -6.8%, BOOM -6.8%, VPRT -6.6%, GNW -6.5%, E -5.9%, AGP -5.8% (light volume), , BEZ -5.8%, UQM -5.0% (files registration for 15 mln share common stock offering), SWIR -4.9%, CPN -4.7%, GERN -4.5%, SWN -3.5%, DIS -3.1%, ARRS -2.8%, TOT -2.2%, ADPT -2.2% (light volume), AN -1.1%... Select solar stocks pulling back: SOLF -4.5%, JASO -4.4%, CSUN -4.3%, SPWRA -4.3%... Other news: AGEN -11.8% (to raise $10 mln in private placement), SKS -5.7% (filed for a $400 mln mixed shelf offering), GGC -5.7% (modestly pulling back), FUQI -1.3% (prices offering of common stock at $21.50)... Analyst comments: LVLT -7.0% (cut to Sell from Neutral at Goldman- Reuters), CRR -3.3% (downgraded to Equal Weight from Overweight at Morgan Stanley). -

Q2 GDP Less than Meets the Eye

The advance Q2 GDP report showed the economy contracted at an annualized rate of -1.0%. That was much improved from a downwardly revised -6.4% (from -5.5%) in the first quarter and it was also better than the expected -1.5% decline. The initial reaction by the market, however, was one of disappointment. Looking further into the report, it is easy to understand why... Personal consumption expenditures, which are the main driver of the economy, fell at an annualized rate of -1.2% and subtracted 0.88 percentage points from the change in real GDP. In the first quarter, PCE added 0.44 percentage points to real GDP. This disappointment was a reminder that the economic recovery will be an uneven affair, quite simply because the U.S. consumer isn't what he/she used to be in the face of rising unemployment and falling home values. Real final sales, which exclude the change in private inventories, decreased -0.2% in the period versus a -4.1% decrease in Q1... Looking elsewhere, government consumption expenditures added 1.12 percentage points to Q2 GDP after subtracting -0.52 percentage points in Q1. The government spending has been necessary, but it, too, provides a reminder that activity in the private sector continues to be lackluster. Even with the positive contribution from government spending, real GDP was still down -1.0%. The biggest drag was gross private domestic investment. It subtracted 2.64 percentage points from real GDP... Separately, the change in private inventories subtracted 0.83 percentage points. That was the sixth time in the last seven quarters that the change in inventories has been negative, so the market will presume this component should shape up in the near future with inventory restocking... The bright spot so to speak was net exports. They added 1.38 percentage points to the change in real GDP as global trade rebounded from the extremely depressed base of the first quarter. Imports were the swing factor there, adding 2.14 percentage points while exports subtracted 0.76 percentage points (which wasn't as bad as the minus 3.95 percentage point contribution in Q1).

-

July Chicago PMI 43.4 vs 43.0 consensus, prior 39.9

-

White House says expects more job losses to be reported next week - Reuters

Ja turg tuleb alla -

Sector ETF strength & weakness through the first hour of trading

Leading Sector ETFs:

Wind energy- FAN +3%, Dry-bulk shippers- SEA +2%, Base metals- DBB +2%, SPDRS homebuilers- XHB +2%, SPDRS metals/mining- XME +1.5%, Steel- SLX +1.5%, Gold miners- GDX +1%, Basic mat- XLB +1%, IYM +1%, Semis- SMH +1%, IGW +1%, Livestock commods- COW +1%, Gold- GLD +1%, Reg banks- KRE +1%, Comm banks- KBE +.5%Lagging Sector ETFs:

Solar- KWT -4%, TAN -3.5%, Nat gas- UNG -2%, Clean energy- PBW -1.5%, US Dollar- UUP -.5%, Oil HLDRS- OIH -.5%, Energy- XLE -.5%, IYE -.5%, iShares broekr/dealers- IAI -.5%, SPDRS utilities- XLU -.5% -

EUR USD vastu juba +1.45% tõusus, $1.4263 tasemel, mis omakorda annab turgudele tuge.

-

Toon siia välja nädala insiderite tehingud, millest jäävad silma AAPL ja AXP tehingud. Mõlemad on olnud viimase tõusu staarid.

Weekly Insider Trading Summary:

Notable Purchases -- IBKR, VRX, SNV, SCSS, STBA, FWRD, CNS, SNBC;

Notable Sales -- RS, LEAP, BXP, SYK, JDAS, APOL, JNPR, AAPL, HCSG, AXP

Over the past week we've seen notable insider buying in the following stocks: Interactive Brokers (IBKR) 10% owner TCM VI Members bought 285,098 shares at $17.78-18.60 on 7/29-7/30... Valeant Pharmaceuticals (VRX) 10% owner ValueAct Holdings bought 39,400 shares at $24.88-24.97 on 7/24-7/28... Synovus (SNV) 3 Directors bought 206,000 shares at $2.94-3.31 on 7/27-7/30... Select Comfort (SCSS) 10% owner Adage Capital Partners bought 200,000 shares at $1.81-1.95 on 7/28-7/29... S&T Bancorp (STBA) 3 Directors bought 23,900 shares at $10.69-11.98 on 7/22-7/24... Forward Air (FWRD) Director bought 10,000 shares at $21.44-21.60 on 7/28... Cohen & Steers (CNS) Director bought 10,000 shares at $17.59 on 7/27... RAE Systems (RAE) 10% owner LeRoy Kopp bought 100,000 shares at $1.57-1.87 on 7/27-7/28... Sun Bancorp (SNBC) Chairman of the Board and Vice Chairman bought 34,363 shares at $4.29-4.49 on 7/27-7/28...

We've seen notable insider selling in the following stocks:

Reliance Steel (RS) Director sold 3,500,000 shares at $35.30 on 7/28... Leap Wireless (LEAP) 10% owner Harbinger Capital Partners sold 3,041,000 shares at $25.44-27.05 on 7/24-7/28... Boston Properties (BXP) CEO and Chairman of the Board sold 893,518 shares at $52.50-53.47 on 7/27-7/28... Stryker (SYK) Director sold 949,000 shares at $38.89-39.47 on 7/24-7/28... JDA Software (JDAS) 10% owner Thoma Cressey Equity Partners sold 1,286,900 shares at $20.24-21.36 on 7/23-7/30... Apollo Group (APOL) Executive Chairman of the Board sold 250,000 shares at $66.45-70.08 on 7/28-7/29... Juniper Networks (JNPR) CEO (pursuant to 10b5-1 plan) sold 500,000 shares at $26.05-26.28 on 7/28-7/30... Apple (AAPL) Director sold 40,000 shares at $158.53 on 7/27... Healthcare Services Group (HCSG) CEO sold 200,000 shares at $18.78-18.85 on 7/29-7/30... Vical (VICL) 10% owner Special Situations Fund sold 801,200 shares at $3.16-3.61 on 7/24-7/27... Watts Water Technologies (WTS) Director sold 100,000 shares at $26.20 on 7/29... Illinois Tool Works (ITW) Director sold 62,100 shares at $40.51 on 7/27... American Express (AXP) EVP sold 60,000 shares at $29.19 on 7/27... All sales exclude option sell offs...

-

Window-dressing täies hoos, nii kui turg puudutab punast tuleb kerge ostupower peale.

-

Sector ETF strength & weakness @ midday

Leading Sector ETFs:

Gold miners- GDX +3.5%, Silver- SLV +3.5%, Wind energy- FAN +3.5%, SPDRS metals/mining- XME +3%, Dry-bulk shippers- SEA +2.5%, Steel- SLX +2.5%, Crude/WTI oil- USO +2%, OIL +2%, Gold- GLD +2%, Commods- GSG +2%, DBC +1.5%, SPDRS homebuilders- XHB +2%, US Bonds- TLT +1%, RBOB gas futures- UGA +1.5%, Semis- SMH +1%, IGW +1%Lagging Sector ETFs:

Solar- KWT -4%, TAN -3%, Nat gas- UNG -2.5%, US Dolalr- UUP -1.5%, Biotech- BBH -1%, IBB -1%, XBI -.5%, Clean energy- PBW -1%, SPDRS utilities- XLU -1%, SPDRS healthcare- XLV -.5% -

Mida arvad Alari - Kas langeb edasi ja miks?

-

Hetkel päeva lõpuks nägemus puudub, pigem hoitakse turgu kinni ehk siis sulgutakse eilsete tasemete juures.

-

Arvad et eilsed tasemed on tähtsad turuosaliste jaoks ja nad jälgivad neid?

-

Tänane päev on näidanud, et S&P 500 alla 987 taset ei lasta, kui sealt läbi vajub siis võib ka kerge liu saada.

-

Soory aga sa arvad et Dow ja Nas sõltub S&P-st vä?

-

S&P 500 on kõige laiapõhjalisem indeks.

-

Jällegi kerge ostupower 987 pealt, kuigi Tick püsis üsna kaua üle -700 taseme ja Trin üle 1.3 taseme. Hoitakse viimase hingetõmbeni kinni:)

-

vabamüürlased?

-

Eks ikka window-dressing:)

-

"Stock prices have reached what looks like a permanently high plateau."