Börsipäev 12. august

Kommentaari jätmiseks loo konto või logi sisse

-

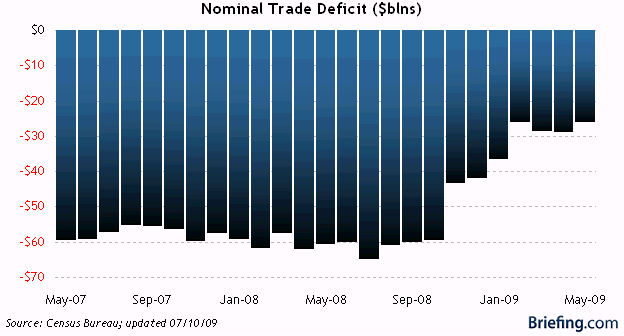

Eilne kauplemispäev näitas, et pullid hakkavad ära väsima ning suurem tõenäosus paari päeva perspektiivis on siiski allapoole liikuda. Tund aega enne USA turgude avanemist teatatakse juunikuu kaubandusbilansi numbrid, millelt oodatakse -$28.6 miljardi suurust defitsiiti, mis on sarnane veebruaris, märtsis, aprillis ja mais näidatud numbritele, kuid võrreldes aastataguse defitsiidiga on see siiski üle kahe korra väiksem ning võrreldav 2000. aasta paiku näidatud defitsiidi numbritega.

Nagu kolmapäevale ikka kohane, tuleb naftavarude raport Eesti aja järgi kell 17.30 ning õhtul kell 21.15 avaldab Föderaalreserv oma intressimäära otsuse, kus seekord on põhirõhk veel kvantitatiivse lõdvendamise programmi jätkamisel/lõpetamisel.

-

Tänane artikkel Bloombergis ilmestab hästi pullide liigset enesekindlust järjepideva tõusu jätkumises ja lühikeste positsioonide omanike turust väljapressimist. S&P500 langusele panustamine vähenes juuli lõpu seisuga 12% võrreldes kahe varasema nädalaga. Link siin.

-

Euroopa turud alustavad päeva müügisurvega ning koos Euroopaga on korralikku miinusesse kukkunud ka USA. S&P500 futuurid eelturul -0.6% @ 987 punkti, mis on viimase kuue börsipäeva madalaim tase.

-

American International Group (AIG) avaldas täna pressiteate, et Hongkongi tütarettevõte AIG Finance müüakse China Construction Bankile kogusummas $70 miljonit + $557 miljoni eest makstakse tagasi võlgu.

-

Kellele meeldivad graafikud, siis seekingalpha.com kommentaator David Fry teeb iga päev väikese graafiku kogumiku. http://seekingalpha.com/article/155263-tuesday-outlook-commodities-global-markets

-

Hiinas börsidel oli hommikul näha paanilist kasumivõttu- Hang Seng –2.8% & Shanghai Composite –4.7%. Kolmapäeval pöörati rohkem tähelepanu eile avaldatud laenuraha kasvu järsule vähenemisele juulis (+356 mld jüaani juulis vs +1.56 trln jüaani juunis), mistõttu peaks vähenema ka spekulatiivse raha vool aktsiaturgudele. Korralik kasumivõtt Hiinas ei tohiks väga suur üllatus olla, kuna turg on sellel aastal sirgjooneliselt üles sõitnud.

-

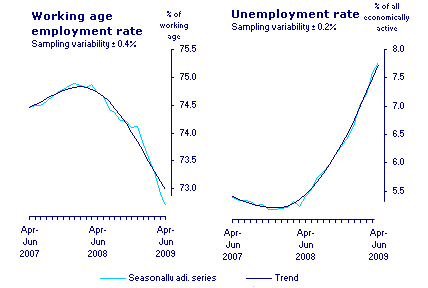

Tänase börsipäeva üks tähtsamaid majandusuudiseid kõlas Suurbritanniast, kus avaldati tööjõuraport. Teises kvartalis langes tööealiste kodanike tööhõive q-o-q baasil 0.9 protsendipunkti ehk 72.7%-le. Tööhõive langes 271,000 inimese võrra ehk 28.93-le miljonile. Töötusmäär kasvas teises kvartalis samuti 7.8%-le, mis oli kvartaalselt vaadatuna 0.7%-protsendipunktiline kasv.

Allikas: Office for National Statistics

-

Juuni eurotsooni tööstustoodang jäi selgelt ootustele alla:

Eurozone IP fell by 0.6% in June compared to an expectation for a 0.3% gain (thomsonreuters).

Nõrk tööstustoodang peaks mõju avaldama ka neljapäeval avaldatavale eurotsooni SKP numbrile. Reutersi andmetel oodatakse hetkel languseks 0.5%.

-

Mervyn Kingi pressikonverentsist ei ole samuti midagi positiivset kuulda. Bank of England esimehe sõnul võib majanduse ning tööturu stabiliseerumine kujuneda oodatust pikemaks. Samuti anti vihje selle kohta, et inflatsioonimäär jääb käesoleval aastal kõikide eelduste kohaselt allapoole varasemaid sihte. Tõepoolest, probleemidest anti märku ka nädala esimeses pooles, kui BoE otsustas suurendada nii-öelda "kvantitatiivse lõdvestamise" eelarvet. Tänane FEDi otsus kujuneb kahtlemata põnevaks!

-

Meisler RealMoney alt toob välja just selle, millest viimastel päevadel oleme rääkinud (pullide liigne usk tõusu jätkumisse, kõrge pettumuse võimalus jne):

"The Investors Intelligence readings for this past week show the most bulls since December 2007 and the fewest bears since October 17, 2007, which if you don't have a chart handy was exactly when the S&P made its high."

49.4% bulls, most since December 2007

21.3% bears, least since October 2007 -

Eesti majandusuudised on maailma mastaabis niivõrd olulise koha hõivanud, et Bloombergi reporterid on meist lausa eraldi loo kirjutanud. Artikli leiad siit. Oma versiooni on olukorrast teinud ka WSJ. Artikli leiad siit.

-

See Balti majanduste teema on välismaailmale justkui freakshow. Saab mõne raputava ning kollakahõngulise suure SKP langusnumbri leheveerele. Küllap siis loetakse, ikka põnevam kui tehnilisest analüüsist kirjutada.

Motiivid vast samad kui artiklis, kus kirjutatakse mitme nulliga seekord Zimbabwe inflatsioon tuli. Keskmise Bloombergi-lugeja seisukoht mõlemas küsimuses on aga ilmselt who da fuck cares? -

The International Energy Agency Wednesday raised its forecast for this and next year's global oil demand, citing strong consumption from Asia especially China, the world's second-biggest oil consumer. In a monthly report, the energy adviser to 28 developed countries revised up this and next year's demand forecast by 190,000 barrels a day and 70,000 barrels a day, respectively. Despite the revision, this year's demand is still expected to be 2.7% lower than last year's, the IEA said. (marketwatch.com)

-

Äsja avaldati siis USA kaubandusbilanss, milles kajastus kaubandusdefitsiidi suurenemine $27.0 miljardile dollarile vs konsensuse oodatud -$28.7 miljardit. Toodete ja teenuste import kasvas $3.5 miljardi võrra ehk $152.8 miljardile. Eksport kerkis $2.4 miljardi võrra ehk $125.8 miljardile - märkides teist tõusukuud järjest.

-

USA eelturgudel on olnud tõsine Ameerika mägede sõit - 0.7%lisest langusest on turu alguseks taas tõustud nulli.

Euroopa turud:

Saksamaa DAX +0.62%

Prantsusmaa CAC 40 +0.42%

Inglismaa FTSE 100 +0.24%

Hispaania IBEX 35 +0.13%

Rootsi OMX 30 +0.73%

Venemaa MICEX -0.01%

Poola WIG -0.76%Aasia turud:

Jaapani Nikkei 225 -1.42%

Hong Kongi Hang Seng -3.03%

Hiina Shanghai A (kodumaine) -4.67%

Hiina Shanghai B (välismaine) -2.40%

Lõuna-Korea Kosdaq +0.60%

Tai Set 50 N/A (börs suletud)

India Sensex 30 -0.36% -

Good Character

By Rev Shark

RealMoney.com Contributor

8/12/2009 8:55 AM EDT

Good character is more to be praised than outstanding talent. Most talents are, to some extent, a gift. Good character, by contrast, is not given to us. We have to build it, piece by piece -- by thought, choice, courage, and determination.

-- H. Jackson Brown

I like to view the market in terms of character. Good character can take a while to develop, but once it is developed isn't quickly or immediately lost. A market with good character can be expected to have a few stumbles here and there, but it will overcome obstacles and will regroup and continue to act in a positive and promising matter. A market with good character deserves the benefit of the doubt.

If you stick with and trust a market with good character, it will treat you well, but the most dangerous time for a market player is when character starts to deteriorate. When bad habits start to develop, when the action become lazy and sloppy and when we become distrustful, it is important to take action.

While we always want to give some benefit of the doubt to a market that has been exhibiting good and strong character, we have to be prepared to draw a line at some point. No matter how well the market has acted, a point will come when behavior starts to shift and we need to be more careful.

Character is king in the market, and when it changes, we need to adjust.

So far this market continues to show superior positive character. We have slipped a little bit the last few days, but it hasn't been anything that we can't forgive, especially in view of how good the action has been for many weeks. Even the best markets are entitled to a few slips. In fact, they are better for them -- especially if they can recover with some gusto.

A lot of folks are watching for this market to start falling apart with some vigor, but we still have too much positive character at work. We have to watch for it to be chipped away, but this is a market that has done little wrong so far, and it is going to stand up much better than some folks think. That doesn't mean we shouldn't be ready to be more cautious, and we certainly need to make sure we are taking gains and keeping stops fairly tight, but this market still hasn't not done much wrong, and that is the sort of character that deserves respect.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: EJ +18.0%, JAZZ +16.6%, CAAS +13.9% (light volume), WX +13.4%, ADCT +11.6%, MFB +11.6% (light volume), CREE +8.5% (also upgraded to Neutral at BofA/Merrill), TOL +7.2%, TGB +5.8%, PRGN +4.1%, AMAT +2.1%, CCJ +1.6%... Select homebuilders ticking higher following TOL results: HOV +7.9%, SPF +4.6%, DHI +4.2%, BZH +4.1%, XHB +3.2%, LEN +2.7%... Select oil/gas related names showing strength: TOT +1.9%, RDS.A +1.5%, STO +1.2%, E +1.0%... Other news: DVAX +8.6% (plans for continued clinical development of HEPLISAVTM Phase 3 investigational adult hepatitis B vaccine in Europe), ADY +8.0% (still checking), RBS +4.6% (still checking for anything specific), CLNE +4.3% (Cramer makes positive comments on MadMoney), SGEN +2.5% (announces pricing of public offering of common stock at $10.75; also initiated with Buy and $14 tgt at Deutsche), ASML +2.2% (still checking), FMC +1.6% (will replace Centex in the S&P 500)... Analyst comments: CVGI +11.1% (upgraded to Overweight at JPMorgan), BPI +3.9% (upgraded to Overweight from Neutral at Piper Jaffray), LINTA +3.6% (upgraded to Buy at BofA/Merrill), ALL +2.5% (upgraded to Buy at BofA/Merrill), BUCY +2.0% (added to Conviction Buy list at Goldman- Reuters), VRSN +2.0% (upgraded to Outperform at Credit Suisse), IP +1.7% (added to Conviction Buy list at Goldman- Reuters).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: GU -14.3%, CLWR -10.9%, LIZ -9.0%, BOBE -7.9%, VISN -7.5%, JASO -6.7%, SYMM -5.1%, SLE -2.8% (light volume), ING -2.0%, M -1.7%, SQM -1.5%... Select ag/chem related names ticking lower: MOS -1.7%, POT -1.6%, DOW -1.2%, DD -1.2% (trading ex dividend)... Other news: VNR -12.9% (announces public offering of 3.5 mln common units), IMAX -6.1% (prices public offering of 5,882,353 of its common shares at $8.50 per share), PETD -6.1% (priced its 3.75 mln share common stock offering at $12/share), AWK -6.0% (announces a 30 mln share common stock offering; all of the shares will be sold by the selling stockholder), BPO -5.5% (to raise $900 mln in common share offering), AINV -5.0% (announces public offering of 2.25 mln shares), MPEL -4.9% (announces commencement of follow on 37.5 mln ADR public offering), SSRI -3.9% (announces $46 mln public offering of common shares), RNWK -3.8% (RealNetworks loses ruling on DVD copying - WSJ), RTP -3.2% (Rio Tinto workers face formal charges in China - WSJ)... Analyst comments: YRCW -8.7% (downgraded to Sell from Hold at Stifel Nicolaus), GRMN -4.8% (added to Americas Conviction Sell List at Goldman- Reuters), TXRH -4.5% (downgraded to Neutral from Outperform at Cowen), LPX -3.3% (ticking lower; hearing weakness attributed to downgrade at tier 1 firm), SPWRA -2.9% (downgraded to Underperform at BofA/Merrill). -

Norra keskpank jättis intressimäärad samale tasemele ehk 1.25% peale, kuid nentis, et on võib-olla sunnitud intressimäärasid kergitama oodatust varem. Keskpankurid tunnevad, et on aeg tasapisi intressimäärade kotisuud taas koomale tõmbama hakata. Praegu küll päris sidumiseks veel ei lähe, kuid piltlikult öeldes on mees juba poodi nööri järele saadetud...

-

Alates tänasest on NYSE'l ka üks uus aktsia juures - Emdeon (EM) viis läbi eduka IPO, kus turule tulemise hinnaks oli prognoositud vahemiku $13.5-$15.5 ülemine äär ehk $15.5. Järelturul on aktsia kauplemas ca $18 juures. Emdeon pakub tervishoiusektorile erinevat tarkvara ja teenuseid.

Emdeon (EM), which provides billing software to the healthcare industry, prices its IPO at $15.50, at the high end of its expected range of $13.50-15.50. The total offering of 23.7 mln shares includes about 10.7 mln from Emdeon and just under 13 mln from current stockholders. The company offers products and services designed to simplify and streamline healthcare billing for insurance companies, healthcare systems, and doctors. Emdeon's software links health care providers with private and public insurers, such as Medicare and Medicaid. It also automates administrative functions for payer and provider customers throughout the patient encounter, including benefits verification, claims management, payment distribution, payment posting and patient billing/collection.

Emdeon reaches the largest number of payers, providers and pharmacies in the US. In 2008, the co processed 4 bln transactions, including one out of every two commercial healthcare claims delivered electronically. Its ubiquitous platform facilitates alignment with customers, thereby creating a significant opportunity to increase penetration and drive the adoption of new services. The co is profitable and posted 1H09 revenue of $444.4 mln, up 5% yr/yr, with 12% operating margin.

-

Toornafta varud +2.52 mln barrelit vs oodatud +1.0 mln barrelit

Mootorkütuse varud -0.93 mln barrelit vs oodatud -1.2 mln barrelit.

Distillaatide varud +0.79 mln barrelit vs oodatud +0.2 mln barrelit. -

Vaadates turgu, mis esimese poole tunniga ilma kordagi tagasi vaatamata püstloodis üles sööstis ja vaadates dollari olulist nõrgenemist euro vastu, tekib vägisi küsimus, et ega keegi ei tea juba õhtul avaldatavaid Föderaalreservi edasisi samme ette... Poleks esimene kord, kui need andmed lekiksid. Ilma lekkimiseta oleks aktsiate hoidmine üle teadaande selgelt liiga riskantne.

-

kui keegi midagi teab, siis ilmselt vaid goldman

-

Sector ETF strength & weakness @ midday

Leading Sector ETFs:

Insurers- KIE +3.5%, SPDRS homebuilders- XHB +3%, Base metals- DBB +2.5%, US airlines- FAA +2.5%, iShares broker/dealers- IAI +2%, Finance- XLF +2%, IYF +2%, RUT 2000- IWM +2%, Oil HLDRS- OIH +2%, Semis- IGW +2%, SPDRS tech- XLK +2%, Crude/WTI oil- USO +1.5%, OIL +1.5%, NDX 100- QQQQ +1.5%, SPDRS industrials- XLI +1.5%, iShares transports- IYT +1.5%

Lagging Sector ETFs:

Nat gas- UNG -1.5%, US dollar- UUP -.5%, US bonds- TLT -.5% -

10-Year Auction Results: Yield 3.73% (3.70% expected); Bid/cover 2.49x (4 auction avg 2.71x); Indirect Bidders 46% (4 auction avg 33%)

-

S&P 500 sai ka 1008 punktist kõrgemale ja hetkel püsib pealpool. Liikumine siiski ilma käibeta ja võlakirjaoksjoni tulemusi ignoreeriti täielikult.

-

Cash for Clunkers programm, mis USAs on kõvasti laineid löönud ja võimaldab vana romu eest taotleda riigilt kuni $4500 suurust toetust. Niivõrd huvitav kui see ka ei ole, jõudis sellesisuline reklaam just praegu ka minu postkasti. Vot sellist kampaaniat tehakse : )

-

July Monthly Budget Statement -$180.7 bln vs -$180.0 bln consensus, prior year -$102 bln

-

FOMC leaves target fed funds rate at 0.0-0.25%.

FOMC: Rates To Stay 'Exceptionally Low' For Extended Period.

Fed says extends purchases of long-term U.S. Treasury debt to end of October, keeps amount $300 bln.

Fed says econ 'leveling out' but to remain weak for a time. -

Täispikk pressiteade:

Release Date: August 12, 2009

For immediate release

Information received since the Federal Open Market Committee met in June suggests that economic activity is leveling out. Conditions in financial markets have improved further in recent weeks. Household spending has continued to show signs of stabilizing but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment and staffing but are making progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

The prices of energy and other commodities have risen of late. However, substantial resource slack is likely to dampen cost pressures, and the Committee expects that inflation will remain subdued for some time.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve is in the process of buying $300 billion of Treasury securities. To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions and anticipates that the full amount will be purchased by the end of October. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is monitoring the size and composition of its balance sheet and will make adjustments to its credit and liquidity programs as warranted.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen. -

Seega võlakirjade ostmise mahtu ei pikendatud - lihtsalt $300 miljardilise programmi tähtaega lükati kuu aja võrra edasi. Aga kui päeval tõin illustreeriva näitena välja, et Norra keskpankurid on justkui oma mehe saatnud intressimäära kotisuu kinnipoole siduma hakkamiseks poodi nööri järele, siis tundub, et omamoodi valmistusi on tegemas ka Fed. Lihtsalt Föderaalreservi mees teeb veel kohapeal soojendust, et nööri järgi minema hakata...

-

Turg sama koha peal, kus enne FOMC otsust, põhimõtteliselt kerge üles alla saagimine ja siis samale kohale. Mis toimub?????

-

Olulisema liikumise on läbi teinud EUR.USD, mis eelneva +0.5% pealt -0.1% peale jõundud ja jällegi alla 1.415 taseme kukkunud. Kas turg tuleb lõpuks järgi?

-

Panen ka EUR-USD tänase graafiku siia:

-

Föderaalreserv tundub oma tegudes tõepoolest liiga tuim ning pole siis ime, et õhku kerkivad sapised küsimused. Robert Marcin on RealMoney all selle väga hästi ja tabavalt kokku võtnud:

Marcin: "As a free market capitalist, it's hard to watch investors, Bill Gross included, bully the Fed into keeping the intervention going to support securities prices. But that's the world we live in.

Assets drop, Fed intervenes, assets recover, Fed does nothing.

Greenspan first, now Bernanke. Asymmetrical intervention. It's what caused the debt/risk bubble in the first place. The Fed is giving banks/brokers/investors a license to speculate with leverage. That's what caused the crisis in the first place.

The Fed can't do anything to rile the financial markets is the refrain. Decent recovery, world record junk rally. Employment lagging indicator. No matter. Can't remove QE til we get back to 15,000 on Dow, 6% junk, and home prices up double digits.

This "stupid Fed tricks" mentality created the mother of all leverage problems. It got us the bubble, it will cause the meltdown in the dollar and T bonds." -

1:0

-

Kirjutasin päeval portaali loo, mis selgitas, miks dollar Fedi otsuse peale kallines & aktsiad sellele ei järgnenud (viimase kuu ajaga on EUR/USD’i korrelatsioon suurem intressimäärade ootustega võrreldes VIX’iga). EUR/USD tegi küll V-kujulise liikumise, kuid dollarile on Fedi kommentaarid pigem bullish.