Börsipäev 24. august

Kommentaari jätmiseks loo konto või logi sisse

-

Nii nagu juuli alguses osutus langusele panustamine enne tulemuste hooaega valeks sammuks, kuna ajalooliselt suur osakaal ettevõtetest suutis ootusi lüüa, siis samamoodi on lühikeste positsioonide omanikele turud vingerpussi mänginud augusti keskpaigas - sedapuhku on aga katalüsaatori leidmine juba oluliselt keerulisem. Pigem on asi lihtsalt selles, et tõustud on juba mitmeid ja mitmeid kuid järjest ning nii nagu langus toidab iseend languse jätkumisega, toidab ka tõus iseend tõusu jätkumisega.

Kolmapäevasest päeva põhjast 980 punkti pealt on praeguseks hetkeks eelturul jõutud täpselt 50 punkti kõrgemale ehk 1030 punktini.

-

Tänase päeva kaks suuremat uudist kohalike investorite jaoks on kindlasti TeliaSonera ülevõtupakkumised Eesti Telekomile ja Leedu Telekomile. Mõlemad ca 25% kuni 30% preemiaga tänaste turuhindade pealt.

-

Konkurentide surve on üks peamisi põhjuseid, miks Nokia analüüsimajade lemmikute hulka enam ei kuulu. Kui 13 augustil langetas Soome telefonitootja reitingut Goldman (loe Joeli kirjutatud artiklit siit) siis täna on "osta" pealt "hoia" tasemele soovituse toonud ka Deutsche Bank. Viimane heidab ette nõrka tooteuuenduste portfelli hooajaliselt tähtsas neljandas kvartalis, kui konkurentidelt peaks siis välja tulema 15-20 mudelit, mistõttu muutub küsitavaks käesoleva aasta prognoosides ettenähtud turuosa võitmise saavutamine. Lisaks nutifonide segmendile nähakse kasvavat konkurentsi ka madalama hinnaklassi segmendis. Nokia aktsia on kauplemas reedese sulgumistaseme juures (8.78 EUR)

-

Lõpetage see surnud hobuste piitsutamine. Selles foorumis ootaks ikka midagi ajakohast.

-

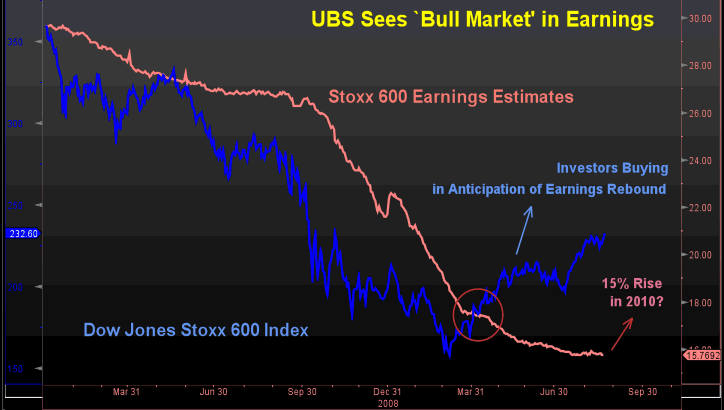

Eelmisel nädalal tõstis Morgan Stanley Euroopa ettevõtete 2010. aasta kasumikasvu prognoosi 20% peale, kui eelnevalt leiti, et bottom line 2009. aastaga võrreldes ei muutu. Reedel oli sarnast alatooni kandnud analüüsiga väljas ka UBS, prognoosides kaks aastat väldanud kasumiprognooside kärpe tsükli lõppemist ning 15%-list kasumikasvu Euroopa ettevõtetele aastal 2010. Allolevalt Bloombergi graafikult on näha, et Stoxx 600 indeks on märtsi põhjast rallinud 50% ehkki samasse indeksisse kuuluvate firmade kasumites sarnast põrget veel ei leia. Ülesostmise on tinginud investorite valmisolek näha ettevõtete kasumite paranemist tänu agressiivsele kulude kärpimisele ning müügitulude potentsiaalsele taastumisele aasta teises pooles. Viimane saab olema võtmetegur kasumitsükli pöördumises.

-

TeliaSonera pakkumine on pannud kogu balti börsi kihama. Peaaegu kõiki aktsiaid ostetakse valimatult.

-

R olid kõik Balti peaministrid CNBCs, ju siis Ansip andis ka kindlust juurde:)

-

Peaministrite optimistlikke kommentaare saab kuulata siit.

-

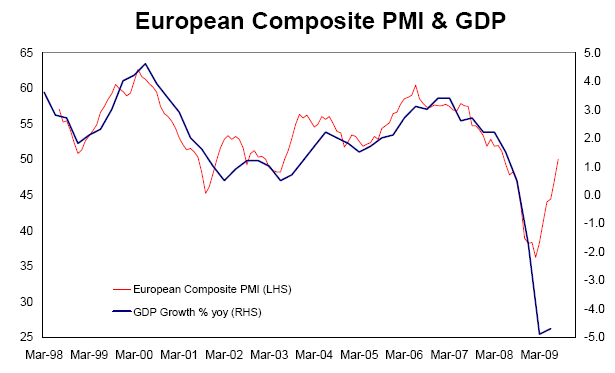

DB'l hea graafik, mis näitab, et Euroopa majandus taastub paljudele üllatuseks väga kiiresti:

ECB president J.C. Trichet oli nädalavahetusel Jackson Hole'is siiski väga tagasihoidlik:

“We see some signs confirming that the real economy is starting to get out of the period of freefall... ...does not mean at all that we do not have a very bumpy road ahead of us.” (pikemalt Bloombergis)

-

Baltikumist on CNBC-s veel eile arutatud. Läti võlaolukorrast ja kas peaks devalveerima või mitte. Isegi Credit Suisse'i peastrateeg Bob Parker võtab sõna. Link.

-

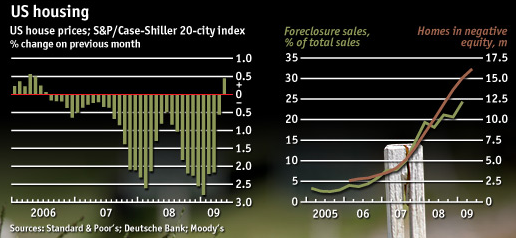

Economisti Daily Chart:

ja artiklis kirjutatakse:

Seized properties now account for almost one in four sales. Some 23% of homes with mortgages are underwater by one estimate, and others are even higher. Deutsche Bank’s securitisation team expects negative equity to peak at 48% of total homes by 2011.

Analysts at Goldman Sachs, no fools when it comes to housing, hint at several years of stagnation. They argue that the rate of home ownership, currently just over 67%, will fall back to the 64-65.5% level that prevailed before prices took off in the mid-1990s, cutting deeply into demand for properties.

-

Goldman Sachs on reedese börsipäeva järel pisut lahanud USA rekordilist eelarvedefitsiiti ning seda, et leebe fiskaalpoliitika tuleb paratamatult asendada oluliselt rangema poliitikaga järgnevatel aastatel, mis omakorda mõjub halvavalt USA pikaajalistele majanduse väljavaadetele. Sõnastatud on see osavalt - fiskaalne pohmell. Mõned huvitavamad lõigud panen ka siia:

"After several years of low taxes and an enormous fiscal package enacted early this year, policymakers will soon be confronted with a new set of challenges. The growth effect of the stimulus enacted early this year will begin to fade by early 2010 and will constitute a significant drag by 2011. The expiration of the tax cuts enacted in 2001 and 2003 will add to the drag in 2011 and again in 2012 if they are not extended. The financing of the pending health reform proposal could add to the drag. Assuming an otherwise neutral fiscal stance, this would reduce spending and/or raise taxes by 2.5% of GDP in 2011 and 1.3% in 2012. In other words, the economy faces quite a fiscal hangover.

The question confronting lawmakers now is whether to wean the economy off its large dose of fiscal stimulus with another smaller dose, or force it to go “cold turkey” in light of large deficits by letting the stimulus run off and tax rates expire.

We expect a “hair of the dog that bit you” approach—a small dose of additional measures to ease the transition over the next few years. This would include (1) extending the majority of expiring tax cuts for at least a few years and (2) enacting provisions to soften the fiscal landing, most of which would extend policies scheduled to phase out after 2009 or 2010.

/-/

Even with these actions, fiscal policy will still tighten by 1.6% of GDP in 2011 and about half that in 2012. More generally, some additional drag seems unavoidable thereafter, since the current pace of spending is clearly unsustainable and policymakers will at some point be forced to make painful choices to put fiscal policy back on a sustainable path." -

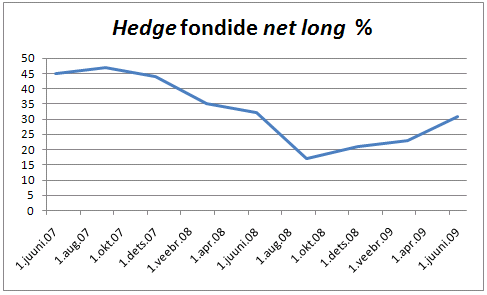

Küsimusele, kas hedge fondid on üritanud viimasel ajal panustada aktsiaturu tõusule või langusele, on osaliselt vastuse andnud GSi tänane analüüs, kus öeldakse, et hedge fondide net-long positsioonide osakaal on tõusnud juba kõrgemale tasemele, kui see oli enne Lehmanni pankrotti minemist. Järeldused põhinevad ca 680 hedge fondi allokatsioonidel, mida on viimased kolm aastat jälgitud. 2. kvartali lõpu seisuga omasid hedge fondid USA aktsiaturust 3.7% ja net long positsioonide osakaal kasvas 31%ni, mis on kõrgeim alates 2008. aasta juunist.

-

see uudis on jäänud maailma meedias Eesti Telekomi ja TEO ülevõtmispakkumise varjus märkamata :)

BRUSSELS, Aug 24 (Reuters) - Euro zone industrial new orders rebounded more than expected in June against the previous month, adding to signs of economic recovery as a strengthening global economy created demand for euro zone goods.

Orders rose 3.1 percent month-on-month for a 25.1 percent annual drop, European Union statistics office Eurostat said.

Economists polled by Reuters had expected a 1.5 percent monthly rise and a 28.9 percent annual fall. -

USA turud avanevad reedesest sulgumistasemest poole protsendi jagu kõrgemalt ning jätkavad sarnaselt muu maailma börsidega oma ralliseeriat.

Euroopa turud:

Saksamaa DAX +0.60%

Prantsusmaa CAC 40 +0.59%

Inglismaa FTSE 100 +0.45%

Hispaania IBEX 35 +0.84%

Rootsi OMX 30 +0.32%

Venemaa MICEX +0.75%

Poola WIG +1.47%Aasia turud:

Jaapani Nikkei 225 +3.35%

Hong Kongi Hang Seng +1.67%

Hiina Shanghai A (kodumaine) +1.10%

Hiina Shanghai B (välismaine) +1.00%

Lõuna-Korea Kosdaq -0.15%

Tai Set 50 +1.38%

India Sensex 30 +2.55% -

Pessimism Depletes Pocketbooks

By Rev Shark

RealMoney.com Contributor

8/24/2009 8:44 AM EDT

"Every now and then, go away, and have a little relaxation. To remain constantly at work will diminish your judgment. Go some distance away, because work will be in perspective, and a lack of harmony is more readily seen."

-- Leonardo da Vinci

It is good to be back in the saddle after taking a little break. My last note on Monday as the market was pulling back sharply was that I expected that the market would continue to hold up fairly well and was unlikely to suddenly collapse. I did not expect that it would hold up as well as it did and go straight up four days in a row and make a very strong push to a new high on Friday.

There is no question about the extremely strong price action. There are very persistent bids under this market as the players continue to look for ways to add some long exposure on any weakness.

What is supporting this market more than anything is the skepticism that still exists about the overall economy in many quarters. Few folks are as optimistic about the pace of an optimistic recovery as the market seems to be. However the market is staying stubbornly strong, and pessimism isn't making anyone any money these days. If you haven't been extremely positive about the market for months, you have been on the wrong side of the trade.

So now what? My approach is that we have to continue to respect the price action above all else. It is extremely easy to argue against this strong market on a fundamental basis, but the market isn't listening. It doesn't matter how logical and insightful and brilliant your analysis might be. The market is acting well, and that needs to be respected above all else.

Even though this market has been extremely strong, the irony is that it has not been easy for many bulls, and that is what is keeping it so strong. We simply have not had pullbacks or basing activity to set up easy entry points. If you want to be in, you've had to chase momentum, and that is not the preferred approach of many.

We have some minor follow-through this morning and not much news on the wires. After the strength of the last four days, it would be reasonable to expect some consolidation at this point, but what has made this market so tricky is how quickly buyers are to jump in on the slightest pause.

Expecting this market to keep on trending up may be tough in theory, but until conditions change, that is what we need to do.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: NPD +16.1% (also announces resignation of Co-Chief Executive Officer, effective August 20, 2009), SNP +4.8% (light volume)... Select financial stocks showing continued strength: AIG +5.3%, RBS +4.5%, C +4.3%, AIB +4.0%, ING +4.0%, MBI +3.3%, RF +3.2%, FITB +2.4%, BBV +2.4% (BBVA Compass acquires banking operations of Guaranty Bank), ABB +2.1%, BAC +1.8%, AZ +1.7%, CS +1.3%, STI +1.3%... Select metals/mining names trading higher: RTP +3.0% (Chinalco open to talks with Rio Tinto - WSJ), MT +2.3%, BHP +2.2%, GOLD +1.8%, SLV +1.4%, AUY +1.3%... Select solar names seeing early strength: YGE +3.6%, FSLR +2.8%, STP +2.6%, CSIQ +2.1%... Select coal related names ticking higher with FT reporting that coal prices have jumped as a drop in Chinese domestic output forces the country to import: ACI +3.1%, BTU +1.1%... Other news: ARIA +9.4% (announces that the Court of Appeals granted their petition for rehearing En Banc in the Lilly NF-kB patent lawsuit), MELA +7.3% (mentioned positively in Barron's), CTIC +6.5% (FDA has accepted and has filed for review the co's New Drug Application for pixantrone as treatment for relapsed or refractory aggressive non-Hodgkin's lymphoma), BCRX +6.4% (still checking), CRESY +5.6% (still checking), LVS +3.0% (checking for anything specific)... Analyst comments: DFS +10.6% (upgraded to Overweight at Barclays), SBGI +8.4% (upgraded to Buy at Benchmark), AMD +5.4% (upgraded to Buy at Citigroup), HIBB +2.7% (upgraded to Overweight at JPMorgan), AXP +2.3% (upgraded to Overweight at Barclays), COF +2.0% (upgraded to Overweight at Barclays), CAKE +1.9% (upgraded to Neutral at Piper Jaffray), BRCD +1.8% (upgraded to Buy at Argus based on valuation).

Allapoole avanevad:

General news: RRR -11.8% (reports distribution of Ripplewood Holdings' share ownership to its limited partners), VRX -7.6% (announces that Phase IIa Retigabine study for PHN does not meet pre-specified primary efficacy endpoint), SHPGY -1.3% (still checking)... Analyst comments: SWHC -2.7% (downgraded to Neutral at Wedbush Morgan), CREE -2.5% (downgraded to Hold at Kaufman), KSU -2.1% (light volume, downgraded to Neutral at UBS), TOL -1.6% (downgraded to Hold at Citigroup), OFC -1.1% (downgraded to Underperform from Market Perform at Wells Fargo). -

Citigroupi-poolne AMD soovituse tänane tõstmine 'hoia' pealt 'osta' peale ning hinnasihi liigutamine $4.25 pealt agressiivse $5.50 peale võiks täna omajagu tähelepanu saada. Tõsi, midagi väga head ei öelda ning argument, et sektori teiste ettevõtete rallimise tõttu on võrdlusgrupiga diskonto suurenenud, ei ole just kuigi suurt veendumust sisendav... Aga nagu öeldakse - tõusva turu ajal on igasugune aktsiakaup kuum.

-

Kuigi kogu turg tervikuna on plussis, ei tohiks Nokia 2%line pluss selle taustal olla müstiline. Samas, võttes arvesse seda, et DB alandas täna ettevõtte soovituse 'osta' pealt 'hoia' peale ning oma hinnasihi €13 pealt $9.5 peale, näitab tänane tõus ilmekalt, et aktsia on investeerimismaailmas 'underowned' ning ettevõtte nõrkused smartphone portfelliga ning tugevnev konkurents muudes segmentides on ammuilma kõigile teada...

-

Sector ETF strength & weakness @ midday

Leading Sector ETFs:

Commods- GSG +3.5%, DBC +.5%, US ailines0 FAA +3.5%, Nat gas- UNG +3%, Coal- KOL +3%, Steel- SLX +2.5%, SPDRS metals/mining- XME +2%, Oil HLDRS- OIH +2%, Insurers- KIE +2%, Energy- XLE +2%, IYE +2%, RBOB gas futures- UGA +1.5%, Ag/chem- MOO +1.5%, Silver- SLV +1.5%, Comm banks- KBE +1.5%, Financials- XLF +1.5%, IYF +1%, Ag commods- DBA +1.5%, Dry-bulk shippers- SEA +1.5%Lagging Sector ETFs:

Livestock commods- COW -.5%, SPDRS retailers- XRT -.5%, Gold -GLD -.5% -

Rääkides intressimääradest... Täna tõstis Iisraeli keskpank oma intressimäärad 0.5% pealt 0.75% peale. Intresside kergitamist keegi ei oodanud ning esimest lüket oodati alles 2010. aasta teises kvartalis. Nagu näha, siis teisedki keskpangad võivad meid veel üllatada.

-

Finants on hakanud samuti vajuma, kas näeme ka kerget paanikat?

-

Kes sellest võidavad?

White House Advisers ask FDA to speed up decision on intravenous formulas of flu drugs - Reuters -

Keegi võttis vist kergelt kasumit. Müük oli üsna korraliku käibega, kuid nüüd tiksutakse jällegi ilma käibeta ülespoole. Dip-buyerid jälle hoos. Õhtu saab kahtlemata väga huvitav olema ja tavapärase tõusupäeva asemel võib ka kergelt punetust näha:)

-

US DOT extends deadline for dealers to submit "clunkers" applications - DJ

New "clunkers" deadline for applications is noon Tuesday