Börsipäev 25. august

Kommentaari jätmiseks loo konto või logi sisse

-

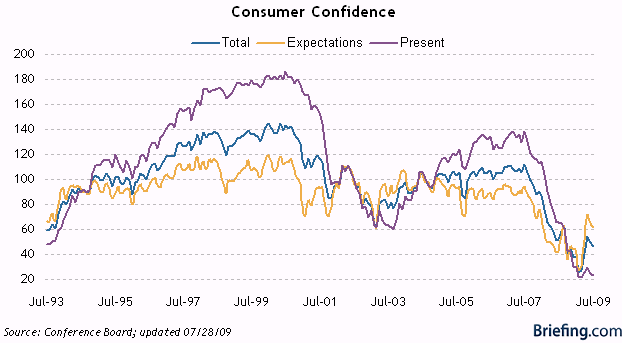

Tänase päeva tähtsaim makroraport tuleb USAs pool tundi pärast turgude avanemist ehk kell 17.00, mil avaldatakse augustikuu tarbijausalduse näitaja. Viimased kaks kuud on näitaja langenud, kuid arvestades juulikuu oodatust paremat tööjõuraportit, edukat cash for clunkers programmi ja muid positiivseid sõnumeid maailma majanduse kohta, oodatakse selle näitaja paranemist juulikuu tasemetelt. Ootuseks 47.9 punkti.

-

USA Föderaalreservi esimehe Ben Bernanke 4-aastane ametiaeg saab läbi 2010. aasta jaanuarikuu lõpuga. Obamalt on Bernanke igaljuhul teiseks nelja aastaseks ametiajaks toetuse saanud, seega tõenäoliselt jätkab Fedi eesotas Ben ka järgneval neljal aastal.

-

Hiina börsidel taas volatiilne päev - päeva keskel kukkus Shangha Compostite 5%+, kuid lõpus vähendati langust 2.6%’le. Eile pärast börside sulgemist hoiatas Hiina peaminister Wen Jiabao, et ei tohiks olla „blindly optimstic.“ Wen Jiabao:

"We must clearly see that the foundations of the recovery are not stable, not solidified and not balanced... We cannot be blindly optimistic. “ (The Standard Finance)

Weni sõnul on Hiina majandus jätkuvalt löögi all ekspordi vähenemise tõttu ja ta tunnistas, et riigil on raskusi lühiajaliselt sisetarbimise tõstmisega (Wen on seda korduvalt ka enne öelnud ja midagi uut see turgudele pole).

-

Merrill Lynch lisas oma 'kõige atraktiivsemate ostukandidaatide nimekirja' täna ravimitööstusettevõtte Mercki (MRK). Oma mõistliku valuatsiooni, ca 4.5%lise dividendimäära ja konservatiivse riskiprofiili tõttu on ka mulle Merck meeltmööda.

-

Wall Street Journal on täna väljas positiivse looga Steve Jobsi tegemistest Apple'is (AAPL), kus räägitakse, et Steve on kogu oma tähelepanu koondanud uue tootega turuletulemisele.

Väike kokkuvõte sellest läbi Briefingu: "Jobs, back at Apple, focuses on new tablet. The Wall Street Journal reports Apple (AAPL) chief executive Steve Jobs is once again managing even the smallest details of his co's products, this time focused on a new tablet device. Since his return in late June, Jobs has been pouring almost all of his attention into a new touch-screen gadget that Apple is developing, said people familiar with the situation. Those working on the project are under intense scrutiny from Mr. Jobs, particularly with regard to the product's advertising and marketing strategy, said one of these people. The people familiar with the matter declined to give details on the tablet or disclose when the device would come out. It is not clear whether the device will run the full Macintosh operating system or a version of the iPhone operating system. Apple watchers expect the tablet to debut at the end of this year or early next year. Analysts say how well an Apple tablet sells will depend on price, which most believe will be between $399, the price of a high-end iPod touch, and $999, the price of the cheapest MacBook laptop."

-

Oleks äge kui Apple tablet pakuks samas mahus e-raamatuid kui Amazoni Kindle raamatupood. Ma lihtsalt loodan, et Apple suudab levida kiiremini väljaspoole USAt. Amazon nimelt ei paku mujal kui USAs (ja vist Kanadas) oma Kindlet põhjendusega, et "Whispernet mille abil raamatuid vidinasse tõmmatakse ei levi mujal maailmas". Mis on täielik tobedus. Sest see on lihtsalt mingi suvaline leping suvalise mobiilifirmaga kes lubab enda võrgus seadmel pervotada. Seega kui Amazon oleks üks ja ainus, siis mugavat e-raamatute lugemist muu maailm vist ei näekski. Amazon võiks vähemalt raamatute tirimiseks ka lihtsalt downloadimise võimaluse pakkuda, ei pea ju kõik läbi õhu tulema.

-

n6us - ootan ka huviga millal lisaks igasugustele bling bling applikatsioonidele ka m6nele praktilisele t2helepanu p66rataks

-

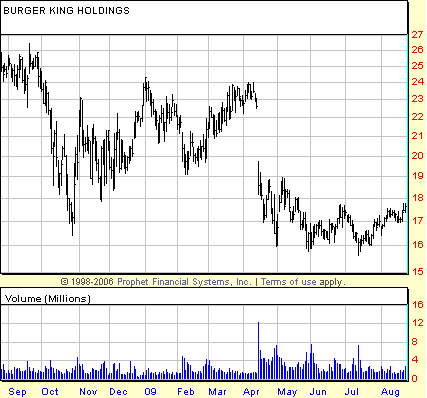

Burger King (BKC) on äsja teatanud oma fiskaalaasta 4. kvartali tulemused, kus näidati EPSi $0.43 vs oodatud $0.33, ületades EPSi osas ka kõige optimistlikumate analüüsimajade ootused. Müügitulu teeniti $629.9 miljonit, mida on 2.4% jagu vähem võrreldes aasta taguse ajaga ning 0.4% vähem võrreldes oodatuga. Kuigi järgmiseks fiskaalaastaks prognoose ei tehta, on pikaajaliste sihtidena ettevõttel silme ees võrreldevate restoranide tulude kasvatamine 2% kuni 3%, restoranide arvu kasvatamine 3% kuni 4%, EBITDA kasvatamine 10% kuni 12% ning EPSi kasvatamine 15% võrra.

Täna kauplevad $18 peal aktsiad ca 12.3x äsja lõppenud fiskaalaasta kasumit, mis on pikaajalise investori jaoks aktsiate soetamiseks igati mõistlik hind. Pikem kommentaar läheb juba Pro alla.

-

Long-term bull, very short-term bear mõtteavaldus Kniessilt siin.

-

Vaatan, et Kalev Jaiki teema on nüüd teisele lehele jäänud. Kes vaidluse võitis?

-

The prices of single-family homes in 20 major cities rose a seasonally adjusted 1.4% in June and were down 15.4% in the past year. (marketwatch)

-

USA eelturgudel jätkub optimismilaine. S&P500 indeksi futuurid on eilse sulgumisega võrreldes tõusnud 0.6%, Nasdaq100 omad 0.5% jagu.

Euroopa turud:

Saksamaa DAX +0.42%

Prantsusmaa CAC 40 +0.23%

Inglismaa FTSE 100 +0.13%

Hispaania IBEX 35 +0.37%

Rootsi OMX 30 -0.59%

Venemaa MICEX +0.57%

Poola WIG +0.17%Aasia turud:

Jaapani Nikkei 225 -0.79%

Hong Kongi Hang Seng -0.49%

Hiina Shanghai A (kodumaine) -2.60%

Hiina Shanghai B (välismaine) -1.45%

Lõuna-Korea Kosdaq -0.13%

Tai Set 50 +0.09%

India Sensex 30 +0.38%June S&P Case-Shiller Composite-20 Y/Y -15.44% vs -16.40% consensus, prior -17.02%

-

MSM, tssss :)

-

Leave Your Feelings Out of It

By Rev Shark

RealMoney.com Contributor

8/25/2009 8:59 AM EDT

One might as well try to perform brain surgery with a sledgehammer.

-- Ben Bernanke

While some may argue that our monetary policy has been used like a sledgehammer over the past year, the market is reacting favorably this morning to news that Ben Bernanke will be reappointed chairman of the Federal Reserve. Continuity in leadership is certainly to be greeted as a positive in this market, which has consistently applauded every governmental move that has been made in the last six months. No news lately has been bad, and that is sure to continue be the case today in regard to Bernanke.

Recent months have seen the rise of much skepticism and doubt about the governmental efforts to rescue the economy, yet the stock market continues to act not only like the worst is over, but as if there are no lingering problems or fallout from the deluge of governmental bailouts.

Seldom has a market rally been as hated as this one. The bears obviously have had absolutely no success, and the market just shrugs off their worries and concerns. While bulls have been rewarded very nicely the last few months, many never fully embraced the move and have been given little chance to jump in the market in a prudent manner. Since the bottom in March, we've had very limited pullbacks and little basing action -- if you wanted to be long, you have had to chase stocks higher, and that is the not the preferred methodology. So while many have been bullish, they have not been able to buy ... and the market refuses to make it easier.

Bulls continue to be presented with this problem of trying to put money to work in a market that is not offering easy entry. Even if you totally disregard the many bearish fundamental arguments and are extremely positive about where things are headed, it still is not a simple job to put capital to work in this market. If you have any concerns about the fundamental situation and the pace of our economic recovery, it is even harder to not take gains and keep capital at work.

I keep coming back to the same old trading rule -- the trend is your friend. Technically the market has done nothing wrong. It may be somewhat extended, and it reversed in an ugly manner yesterday, but it has done little to make us more cautious.

The hardest thing for me in this market is to try to reconcile my personal view of the economic situation with the very buoyant market action, and I shouldn't even try. Imposing personal views on the market simply doesn't work. The market will always win the argument, but even if you are very aware of that it isn't that easy to disregard personal biases. I suspect I'm not alone in my feelings. In fact, I talk to many folks who just can't reconcile the market action with their view of the overall economic situation. That makes them hesitant to buy stocks, but they are frustrated by being left out and end up providing a persistent underlying bid.

The bulls continue to plug away this morning with a positive response to Ben Bernanke's reappointment, but this is one bull market without a lot of fans and that is likely to keep it going.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: COCO +14.2%, BGP +8.1%, VIMC +8.0% (light volume), SAFM +6.8% (light volume), BIG +5.1%, BKC +3.6%, WINN +2.5%... Select financial names showing early strength: FNA +6.6%, FNM +5.9%, RBS +4.3%, IRE +4.2%, FRE +3.4%, HIG +3.1%, ING +2.8%, BCS +2.7%, RF +2.5%, BBV +2.4%, FITB +1.7%, ABB +1.6%, BAC +1.4%, C +1.2%, MS +1.2%... Select education related names ticking higher following COCO Q4 results and guidance: ESI +3.2%, APOL +2.2%... Select metals/mining names showing strength: AU +4.4%, IVN +3.9%, HMY +3.2%, GFI +2.4%, NEM +1.9%, ABX +1.8%, VALE +1.8% (raised to Overweight from Equal Weight at Morgan Stanley), MT +1.7%, GG +1.6%, GLD +1.1%... Select casino related names trading higher premarket: LVS +2.6% and WYNN +1.8%... Other news: APCV +288.1% (currently trading under ticker APCVZ; announced early this morning that it has received FDA approval to market penicillin G potassium for Injection), PLX +17.1% (receives FDA Fast Track designation for prGCD), WLDN +15.6% (light volume; awarded a $67 mln contract with Consolidated Edison Co of New York, a subsidiary of Consolidated Edison), WPTE +14.3% (sells operating assets to a subsidiary of PartyGaming, Peerless Media), GNVC +10.4% (receives an approximate $2.5 mln grant to support novel cell line development), HGSI +7.2% (still checking), AMD +4.0% (continued strength following yesterday's analyst upgrade), SPPI +3.5% (still checking), BCRX +3.2% (continued strength from yesterday's 20%+jump), VOD +2.3% (still checking for anything specific)... Analyst comments: SI +4.7% (upgraded to Buy at BofA/Merrill), WCRX +4.1% (upgraded to Buy from Hold at Jefferies), FRO +2.9% (JP Morgan believes their could be a short squeeze ahead of Friday's earnings), TSL +2.6% (initiated with an Outperform at Credit Suisse), LOW +2.5% (upgraded to Overweight at Morgan Stanley), COST +1.4% (upgraded to Market Perform at William Blair), V +1.3% (initiated with Buy at Jefferies), ARD +1.0% (initiated with Buy at UBS).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: AIR -10.4% (also tgt lowered to $14 at Jesup and Lamont following last night's preannouncement below consensus), ARAY -8.9%, SPLS -3.8%, AMWD -3.1%... Other news: MTW -3.5% (Carefusion will replace Manitowoc in the S&P 500)... Analyst comments: CEDC -2.8% (downgraded to Underweight at Morgan Stanley), NPD -2.8% (downgraded to Sell from Hold at Roth Capital), KIM -1.6% (downgraded to Hold from Buy at Benchmark), ENER -1.4% (downgraded to Underperform from Neutral at Macquarie), SPWRA -1.4% (downgraded to Underperform from Neutral at Macquarie), PCU -1.1% (downgraded to Underweight at HSBC). -

Fedi eesotsas jätkab B. Bernanke, kes pärast Obama otsust ütles:

"We have been bold or deliberate as circumstances demanded, but our objective remains constant: to restore a more stable economic and financial environment in which opportunity can again flourish"

-

Panen ühe video lingi siia veel. Sedapuhku Goldman Sachsi Hatzius, kes puudutab nii majanduslanguse/-kasvu teeemat, inflatsiooni, intressimääri jpm. Link siin.

-

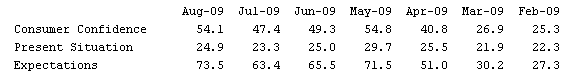

Augusti tarbijausaldus ületas ka kõige optimistlikumad ootused & S&P500 hüppas rohkem kui protsendi võrra plusspoolele.

August Consumer Confidence 54.1 vs 47.9 consensus, prior 46.6

-

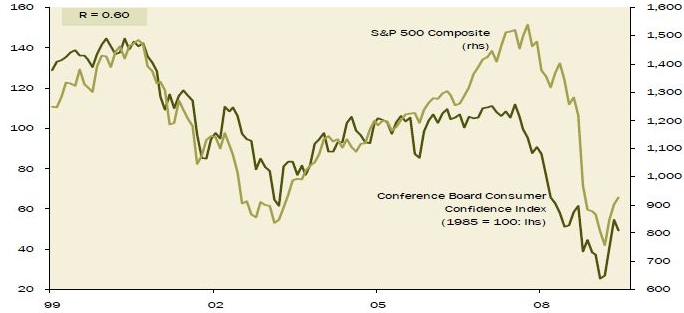

Tarbijausaldus oli veel juuli seisuga karude üks nurgakivisid & võimas hüpe augustis tugevdab ralli alustalasid:

Tarbijausalduse ja S&P seos

Allikas: Gluskin Sheff

Siiski on ameeriklased jätkuvalt arvamusel, et preagu pole hea aeg tarbimiseks, kuid tuleviku suhtes on ootused tõusnud kõrgeimale tasemele alates 2007. a detsembrist:

Allikas: ThomsonReuters

-

Huvitav, kui palju aitas $4500line tühi tšekk uue auto ostuks tänaseks lõppenud C4C programmi raames augustikuu tarbijausalduse numbreid tõsta...?

-

Vägisi tundub, et praegustelt tasemetelt on müügihuvi ostuhuvi ületamas... Headele uudistele on reageeritud jahedalt. Ootaks siit miinuspäeva, kuigi tuleb tunnistada, et olen varemgi eksinud.

-

Ei Joel, täna ei eksi:) SP juba testis päeva põhju, selge märk "väsimusest".