Börsipäev 1. september

Kommentaari jätmiseks loo konto või logi sisse

-

Tänase börsipäeva juhataks sisse tarkuseteraga Stock Trader's Almanac'st: "September is when leaves and stocks tend to fall".Kui ajalugu peaks mingeid vihjeid andma, siis järgmised 30 päeva on tavaliselt kujunenud investorite jaoks kõige raskemaks. Alates 1950-st kuni 2007. aastani on SP500 ja Dow keskmiseks languseks septembris olnud -0.5-(-0.9%) ning eriti eredalt peaks meeles olema eelmine aasta, mil Lehmani sündmuste tõttu lõpetas SP500 sügiskuu -9%-lise kaotusega. Tavaliselt on postiivseks osutunud esimene kauplemispäev ning kuu lõpp.

-

Reportedly, economist Andy Xie said the Shanghai Composite could fall another 25%

Shanghai tänane sulgemine +0,6%.

Tehtud. Mis edasi :) -

Makro osas langeb fookus USA tootmisaktiivsust möötvale ISM indeksile, mis avaldakse Eesti aja järgi kell 17.00 ning peaks konsensuse prognoosi kohaselt näitama tööstuse lainemist ehk jõudma üle 50 punkti taseme (ootus 50.2). Võrreldes juuniga, kerkis juulis ISM indeks 44.8-lt 48.9-le punktile, näidates paranemist seitsmendat kuud järjest.

USA kinnisvarasektor on viimasel ajal pakkunud positiivseid üllatusi ning tänane Pending Home Sales (kl 17.00) võiks pakkuda lisatõestust, et antud sektori jaoks on mustemad päevad selja taha jäänud.

-

võibolla loll küsimus aga kui Hiina nii hullult kukub siis miks GCH ei reageeri sellele?

R -

Credit Suisse langetas Nokia (NOK) varasema "outperform" soovituse "underperform" peale. Nokia 2010 EPS'i prognoosi vähendati 28% võrra, kuna riskid nutitelefonide turul suurenevad (Nokia aktsia on Helsinkis 0.2% languses). CS'i hinnagul on nutitelefonide turg väga atraktiivne pikaajaline investeering:

Credit Suisse raises their FY09 and FY10 smartphone unit estimates by 11% and 19% to 176 mln (+26% year/year) and 223 mln (+27% year/year) to reflect changes to their proprietary affordability based addressable market analysis, which factors in TCO, income distribution, and GDP. Firm's analysis suggests penetration of corporate smartphone segment is only 7%. They believe smartphones represent one of the most attractive secular trends in technology, given projected long-term compound annual growth rate of 18% (2008-2015). (briefing)

Nutitelefonide kasutusele võtust sõltub puhtalt Research in Motion (RIMM), mistõttu tõstis CS ettevõtte neutraalse soovituse "outperform" peale ja hinnasiht liigutati $76 dollarilt $95'le.

-

rainerb,

kuna GCH prospekt sätestab, et fondi varadest võidakse kuni 65% investeerida Hiina ettevõtete aktsiatesse siis on kaitset pakkunud teised investeeringud. Mai seisuga moodustasid Hiina investeeringud 34.9% -

Veel lisaks GCH fondis on eelistatud nt. kindlustajad pankadele, kinnisvarasektor, mingid tehnloogiasektorid jne, mis ei kajasta indeksit. Investeeritud on ka Hongkongi (ca 21%), Taivani (4.1%) ja Singapuri (1.9%) ning osa varadest on vaba raha all.

-

ymeramees,

eile tuldi 6.7% alla, seega tänane 0.6%line tõus midagi erilist küll ei tähenda. Kaugele sa ikka jõuad, kui lähed kuus sammu tagasi, üks samm edasi.... -

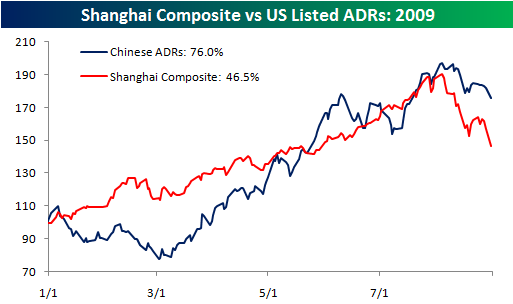

Kui jutt juba Hiina aktsiatele läks, siis Bespoke graafikult on näha, et USA turul kaubeldavad ADR-d on võtnud viimase kuu korrektsiooni veidi leebemalt vastu. Samas kui USA turult leiab 75 ettevõtte ADR-i, siis Shanghai Composite koosneb üle 850-st ettevõttest, seega pole need üks-ühele võrreldavad.

-

Ma küll lootsin, et sellega Hiina teema tänaseks piirdubki, aga võta näpust :)

-

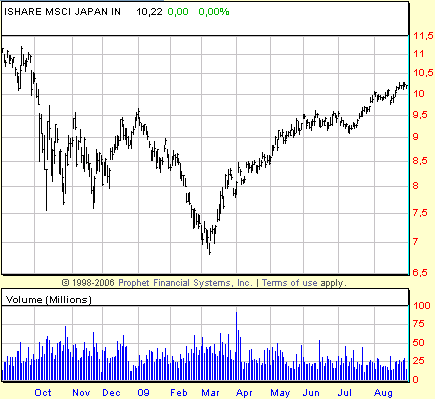

Jaapani nädalavahetuse DPJ valimisvõitu on kommenteerinud päris suur hulk investeerisimisgurusid - muuhulgas ka laialt tuntud Faber - ning enamus on sellega seoses välja toonud pikaajalise investeerimise atraktiivsuse kasvu Jaapani aktsiaturgu, kuigi leidub ka neid, kes usuvad, et 6 kuud kestnud ralli on juba suure osa tõusust lühemas perspektiivis sisse ära diskonteerinud ning et tuleb oodata paremaid ostukohti. Link 5 minutilisele videole on siin.

Läbi USA turu on Jaapani börsidele võimalik investeerida läbi Jaapani aktsiaturgu jälgiva börsilkaubeldava fondi EWJ.

-

Kas mõni ETF Shanghai composite indeksit täpsemalt kah järgib?

-

Kui Aasia turud olid eilse languspäeva järel kerges plussis, siis Euroopas on pea kõik tähtsamad börsid üle 1% miinuses. USA alustab päeva võrreldes eilse sulgumishinnaga ca 0.5% madalamalt

Euroopa turud:

Saksamaa DAX -1.49%

Prantsusmaa CAC 40 -0.87%

Inglismaa FTSE 100 -1.13%

Hispaania IBEX 35 -0.95%

Rootsi OMX 30 -1.30%

Venemaa MICEX +0.60%

Poola WIG -2.25%Aasia turud:

Jaapani Nikkei 225 +0.36%

Hong Kongi Hang Seng +0.75%

Hiina Shanghai A (kodumaine) +0.60%

Hiina Shanghai B (välismaine) -0.04%

Lõuna-Korea Kosdaq +0.31%

Tai Set 50 +0.05%

India Sensex 30 -0.74% -

Stubborn Support

By Rev Shark

RealMoney.com Contributor

9/1/2009 8:41 AM EDT

It does not matter how slowly you go so long as you do not stop.

-- Confucius

For a week now, market momentum has stalled out and the indices have gone nowhere. The bears see this as an indication that the furious uptrend since March is ready to stall out and the trend is about to turn down. That view is bolstered by the market's tepid response to recent good news.

Given how far the market has moved in such a short period of time and our continuing economic challenges, it isn't hard to make a good argument for a market pullback. The only problem is that the market has simply paused so far and has not done anything other than churn a bit. Lack of upside progress isn't necessarily negative. It may simply be healthy consolidation that sets the stage for eventual further upside.

Like many other market players, I've been rooting for the market to take a rest because there are so many extended charts that need time to set up and offer better entry points. Playing this market has been like jumping on a speeding train for a while, and some churning and consolidation would eventually help to produce some better trading.

Over the past several months, the market has been unable to rest for very long because there have been so many underinvested bulls who have been anxious to do some buying on weakness. The irony of this very persistent underlying bid is that it has kept the market from resting for very long, which creates even more anxiety among the underinvested bulls.

We're now faced with some big questions: Are these underinvested bulls who have been trying to jump in this market for so long finally going to relent? Are the dip-buyers going to become less supportive of the market and finally let a deeper correction occur?

As the market has gone higher, many bulls capitulated and have paid up for stocks because they can't stand being left behind. That will reduce some of the underlying support for stocks, but lots of folks will be looking to jump in at some point, and if the market starts to strengthen once again, they are likely to buy on panic and squeeze the bears, who are finally becoming a bit more comfortable.

The key to this market is the underlying support. Bears who think it is suddenly going to go away and that we will collapse are likely to have difficulty. A rollover in the market is going to be a process that slowly discourages the dip-buyers. It is only when they stop worrying about underperformance that the chances of a pullback will grow.

We have some weakness this morning, but it feels like everyone is on vacation and that the market is extremely thin. The news flow is very slow, and there just isn't much going on. I'm particularly worried about a short squeeze in this sort of trading environment.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: EDAP +8.6% (light volume), CRMT +7.8%... Select biotech/swine flu vaccine related names showing strength: NVAX +14.2% (announces positive results for second Ph. II clinical trial of its trivalent seasonal influenza virus-like particle vaccine candidate), SVA +9.9% (Boryung Pharm to import Chinese-made H1N1 vaccine - Yonhap News Agency), VICL +7.4%, HEB +4.1%... Other news: YRCW +17.5% (discloses it entered into credit amendment), BEXP +10.4% (announces Figaro 29-32 #1H Bakken well produces at initial rate of ~1,895 BOEPD), OCLS +9.3% (continued strength following yesterday's 10% climb), ONCY +7.6% (light volume; has been granted its 32nd U.S. Patent entitled "Viruses for the Treatment of Cellular Proliferative Disorders"), HMPR +5.6% (continued momentum following yesterday's late jump on spike in volume), ICGN +4.2% (reports top line results of Phase IIa study of Senicapoc in allergic asthma), SPPI +3.1% (continued strength following yesterday's 10% pop), HSP +2.3% (receives FDA approval for six new presentations of Heparin), EBAY +2.1% (eBay is said to have deal to sell Skype - NY Times), PTR +1.6% (PetroChina in $1.7 bln Canadian project stake - Financial Times), BAC +1.3% (BofA seeks to repay a portion of bailout - WSJ)... Analyst comments: COH +3.4% (upgraded to Buy at BofA/Merrill), TXT +2.9% (light volume; upgraded to Overweight from Underweight at Morgan Stanley), HNT +2.5% (upgraded to Buy at Stifel Nicolaus), MEE +1.9% (upgraded to Buy at UBS), WLT +1.9% (upgraded to Buy at Merriman), RIMM +1.8% (upgraded to Outperform from Neutral at Credit Suisse), LMT +1.5% (upgraded to Buy at Citigroup), AMTD +1.2% (upgraded to Outperform from Market Perform at BMO Capital Markets ).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CMED -11.7%, GMTN -4.6% (light volume)... Select financial names trading lower: AIG -7.3% (Maurice R. Greenberg and Howard I. Smith Agree to Binding Arbitration; also downgraded to Underperform at Bernstein), IRE -5.5%, AIB -4.9%, FRE -4.8%, CIT -2.9% (discloses it is not able to execute the APM and is required to defer interest on Notes), ABB -2.5%, MBI -2.5%, CS -2.3%, RBS -2.3%, HIG -2.2%, STD -2.1%, DB -1.8%, C -1.6%, BBV -1.5%, USB -1.4%, AZ -1.2%... Select metals/mining names showing weakness: GLG -1.8%, AU -2.9% (mixed securities shelf offering), GOLD -2.3%, MT -1.8%, RTP -1.6%... Other news: ACAD -64.9% (announces results from Ph. III trial of pimavanserin in Parkinson's disease psychosis; also downgraded to Sell from Hold at Citigroup), RMBS -11.0% (anti-trust trial delayed; BWS Financial says news is certainly going to be negative for RMBS shares this morning), BEAT -10.4% (announced that Highmark Medicare Services confirmed it will implement its reduced reimbursement rate for mobile cardiovascular technology on September 1, 2009), SQNM -8.5% (pulling back from yesterday's 15%+ surge higher), BLDR -8.3% (light volume; JLL Partners Fund and Warburg Pincus Private Equity propose recapitalization), GVP -7.9% (prices 2.5 mln common shares at $6.00/share), HCN -2.6% (announces a 5 mln share common stock offering), IMMU -1.8% (issues mixed securities offering, incl up to 20 mln shares of common stock and up to 3 mln in warrants)... Analyst comments: AXL -6.1% (downgraded to Hold at Deutsche Bank), PHG -3.5% (downgraded to Underperform from Neutral at Exane BNP Paribas), NOK -2.9% (downgraded to Underperform from Outperform at Credit Suisse), AET -1.1% (downgraded to Market Perform at Leerink Swann). -

CAF vs Shanghai Composite

see Morgan Stanley China A Share Fund (CAF)

peaks olema vist kõige lähedasem Shanghai Composite liikumise jälgija ... erinevus võib tulla premiumi või discounti arvelt ... hetkel on CAF +5,12% preemias vs NAV -

CAFi näol on tegu esimese USAs kättesaadava instrumendiga, mis kajastab Shanghai A börsiindeksi liikumist. Tõenäoliselt on see praegu ka kõige paremini Shanghai A liikumist kajastav instrument, kuigi nagu Henno ütles, võivad seal preemiad/diskontod vahel päris suureks paisuda. 80% rahast investeeritakse A-osakutesse ja kuni 20% on õigus investeerida B osakutesse.

-

Kui eBay käis 2005. aastal Skype eest välja $3.1 mld dollarit, siis täna teatati, et Skype müüakse $2.75 mld dollari eest:

Co confirms it has signed a definitive agreement to sell its Skype communications unit in a deal valuing the business at $2.75 bln. The buyer, who will control an approximately 65% stake, is an investor group led by Silver Lake and includes Index Ventures, Andreessen Horowitz and the Canada Pension Plan Investment Board. eBay is expected to receive ~$1.9 bln in cash upon the completion of the sale and a note from the buyer in the principal amount of $125 mln. Co will retain an ~35% equity investment in Skype. The transaction, which is not subject to a financing condition, is expected to close in the fourth quarter of 2009. (briefing)

-

July Construction Spending -0.2% vs 0.0% consensus, prior revised to +0.1% from +0.3%

July Pending Home Sales M/M 3.2% vs +1.5% consensus; Y/Y 12.9% , prior +9.2%

August ISM Manufacturing 52.9 vs 50.5 consensus, prior 48.9 -

see kukumine hakkab juba vaikselt meenutama uso kukkumist 120 juurest eelmine suvi

-

kas ung long on lhv poolt ikka kehtiv? Praeguse languse juurest oleks see päris ahvatlev.

Milline oleks lhv hinnasiht ja millise ajahorisondiga? -

axl short soovitus oli päris hea 6,7 usd pealt.

-

viru1000, ung puhul oli tegu kauplemisideega, mis meie poolt määratud ajahorisondi jooksul end välja ei mänginud ning seetõttu oleme idee sulgenud. Regulatiivsed sekeldused osakute väljalaskmisega on viinud turuhinna NAVist suure hälbimiseni ja riskide olulise tõusuni.

-

Heade uudiste peale müüakse turg jätkuvalt alla. Viimasel ajal kuuma raha meelitanud aktsiad - AIG, FNM, FRE - on üle 10% miinuses. Hiina on näidanud oma 20+%lise kuu ajalise langusega, et turgudel on jätkuvalt võimalikud suured liikumised ja seda ka allapoole. Kui turg heade uudiste peale ei tõuse, siis miks peaks lühemas horisondis olema ostupoolel?

-

Pullide rünnak lõpus samuti olematu. CalculatedRisk kommenteerib tänast USA kinnisvara datat:

The increase in pending sales has been mostly from lower priced homes with demand from first time home buyers (taking advantage of the tax credit) and investors.And look at the cost of the tax credit!

If NAR is close to being correct, 2 million buyers will claim the tax credt - times $8,000 - is $16 billion. But this only resulted in "approximately 350,000 additional sales".

So this tax credit cost taxpayers about $45,000 per each additional home sold. Not very effective ... especially considering most of these are lower priced homes.