Börsipäev 24. september

Kommentaari jätmiseks loo konto või logi sisse

-

Tund aega enne USA turgude avanemist teatatakse esmaste töötu abiraha taotlejate arv möödunud nädala andmete baasil. Ootusteks 550 000, mis oleks võrreldes üle-eelmise nädalaga pisut suurem. Kestvate abiraha taotlejate arvuks oodatakse 6.18 miljonit vs üle eelmise korra 6.23 miljonit. Kell 17.00 teatatakse ka USA augustikuu olemasolevate eluasemepindade müüginumbrid - kui juulis aasta baasil müügitempot 5.24 miljonit, siis augustilt oodatakse 5.35 miljonilist numbrit.

Enne USA turu avanemist teatab oma tulemustest apteegikett Rite Aid (RAD), kellelt oodatakse müügitulusid $6.39 miljardit ning EPSi -$0.16. Pärast turu sulgemist tuleb aga Research in Motion (RIMM), kust oodatakse tulusid $3.62 miljardit ning EPSi $1.00.

USA eelturul on toimunud korralikud n-ö ameerika mäed, kuid hetkel ollakse väikeses ca 0.2%lises miinuses. -

Euroopa on käimas Aasia jälgedes ning alustanud päeva ca -1% punases, kui langusesse on indeksid vedanud eelkõige finants-, tööstus- ja toorainesektori aktsiad. Oluliseks makroks saab olema Saksamaa ärikliimat peegeldava IFO indeksi avaldamine kell 11.00. Konsensus ootab tõusu jätkumist 92-le punktile, kuid arvestades eile ootusi petnud PMI-d, võib siingi olla tõenäoline, et sentiment paraneb arvatust aeglasemalt.

-

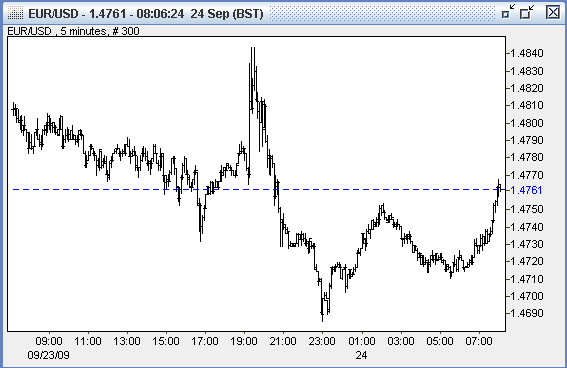

EUR/USD püsib 1.475 juures:

Eile oli näha euro kukkumist päeva teises pooles, kuid Fedi kommentaaride järel on USDi keskkond jätkuvalt väga kehv & 1.47 juurest tulid dip-buyerid turule.

Üks uudis, mis eile päeva teises pooles eurole müügisurvet avaldas, oli Pransusmaa mure euro tugevuse pärast. Täna tasub radaril hoida ka G20 kohtumine, kus valuutad võivad üheks teemaks tulla (nt dollari roll reservvaluutana, Prantsusmaa selgitused eilsetele kommentaaridele, exit-strateegiad jne). Kaks päeva kestval G20 kohtumisel on peamine agenda siiski uus maailmamajanduse kasvumudel (USA tarbija asendamine), kliimamuutus & finantsregulatsioonid.

-

Saksamaa IFO indeks paranes 91.3 punktile, mis konsensuse ootusi ei rahuldanud. EUR/USD langes esialgu väikse müügisurvega 1.474 juurde ja 1.48 testimiseks jääb täna kütust aina vähemaks.

-

Euroopa teiseks suurim rõivaste jaemüüja Hennes & Mauritz avaldas täna oma kolmanda kvartali tulemused, mis jäid ligilähedaseks ootustele. Kolme kuu müügitulud kasvasid aastaga 13% 23.5 miljardi Rootsi kroonini (prognoositi 24.2 mld SEK) ja puhaskasum 4% 3.46 mld SEK-ni (oodati 3.43 mld SEK). Majandustulemustele mõjus soodsalt euro 13%-line tugevnemine Rootsi krooni suhtes (vs aastatagusega), kuna H&M genereerib 50% oma müügituludest eurodes.

Kui aga Inditex tõi oma hiljutises poolaasta raportis välja augusti ja septembri alguse müügi tugevuse (+9%) siis H&M-i augustikuu müügi kukkumine -3% (SS -11%) valmistas tulemuste osas negatiivse üllatuse. Kokkuvõttes jäädakse tuleviku ning äriliselt avanevate võimaluste suhtes optimistlikuks, mida näitab aasta lõpuks planeeritud poodide avamiste suurendamine varasemalt 225-lt 240-le. H&M aktsia kaupleb hetkel -3% miinuses.

-

Euroopa turud -1% langusest eilsete sulgemistasemeteni tõusnud ja ka USA futuurid juba positiivsel poolel, nafta kergelt ülespoole liikunud ja USD EUR-i vastu kukkunud 0.25%. Esialgu eelturul liigub kõik tavapärases suunas. Ei tahaks siiski uskuda, et sellega kogu korrektsioon piirdub. Languspäeva tõenäosus tundub siiski suurem.

-

Krediidireitinguid hindav ettevõte RealPoint on täna avaldanud muret kogu USA hotellitööstuse ja eelkõige luksushotellide maksevõime üle. Pikem artikkel Bloombergis siin.

“What’s happening to us right now is happening, and will continue to happen, to many hotel properties given the current market,” Akhtar said in a telephone interview. The U.S. hotel loan-delinquency rate may climb to 8.2 percent by year-end, Morgan Stanley analysts led by Andy Day said in a June 23 report. That would match the peak from the last recession in 2001. Upscale hotels are suffering from “a heightened focus on prudent corporate travel expenditures,” as well as the pullback in vacation travel, Day said.

Microsoft Corp., coping with its first annual sales decline, said in July it would slash $3 billion in operating expenses, including travel spending.

The number of luxury-brand rooms in the U.S. as of the end of July rose 9.1 percent from a year earlier to 100,000, Loeb said.

-

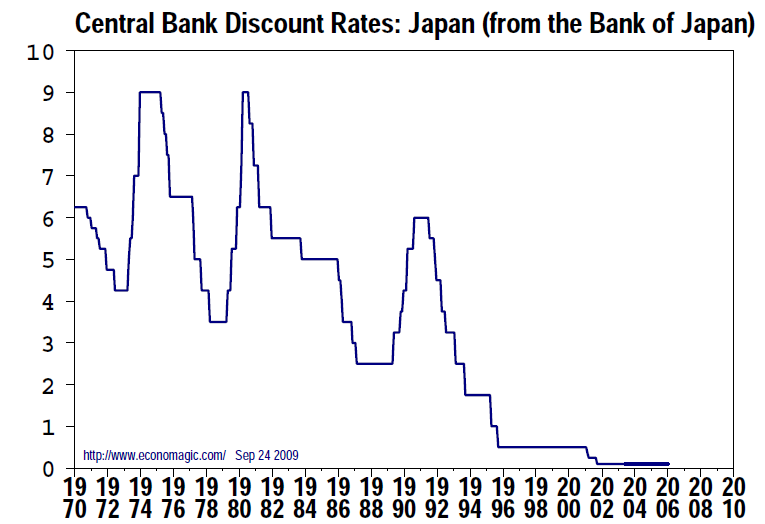

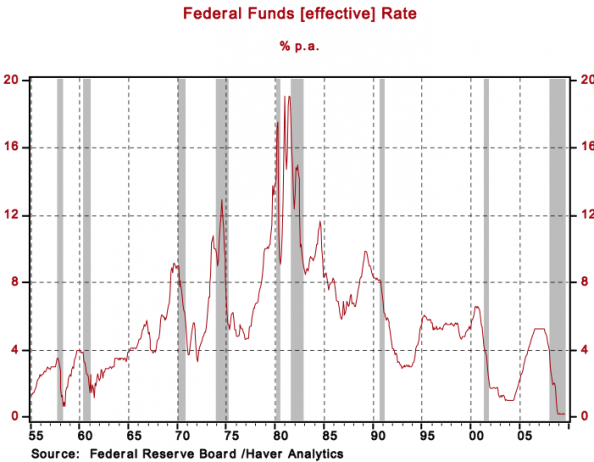

FOMC kinnitas eilses sõnavõtus, et economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period'. Kui vaadata allolevat graafikut Paul Kasrieli presentatsioonist, siis vähemalt viiekümne aasta pikkune ajalugu näitab, et igale retsessioonile on eelnenud intressimäärade tõstmine. Seega, nii kaua kui USA keskpank baasintressi nullis hoiab (eeldatavalt kuni 2010. aasta teise pooleni), viitab vähemalt ajalugu uue languse ebatõenäosusele pärast paari kvartali pikkust taastumist.

-

Ma ei saa viimase lause mõttest päris täpselt aru.

-

momentum,

nii kaua kui Bernanke raha trükib ja intressimäärasid nullis hoiab, jääb risk W-kujulise stenaariumi realiseerumise puhul väikseks. Kuid graafikult on näha, et nii pea kui määrade tõstmist alustatakse, laotakse pinnast juba järgmiseks kukkumiseks -

Varasemad W kujulised taastumised: FED oli sunnitud inflatsiooni ohjamiseks intressimäärasid tõstma (tundub uskumatuna, et 80.ndate alguses oli see 20% juures), hetkel inflatsioon veel probleemiks ei ole.

-

Jaapani Keskpanga discount rate alates 70ndatest:

-

Initial Claims 530K vs 550K consensus, prior revised to 551K from 545K; Continuing Claims falls to 6.138 mln from 6.261 mln

-

Euroopa turud:

Saksamaa DAX +0.36%

Prantsusmaa CAC 40 +0.38%

Inglismaa FTSE 100 +0.26%

Hispaania IBEX 35 +0.22%

Rootsi OMX 30 -0.84%

Venemaa MICEX +1.53%

Poola WIG +0.38%Aasia turud:

Jaapani Nikkei 225 +1.67%

Hong Kongi Hang Seng -2.52%

Hiina Shanghai A (kodumaine) +0.38%

Hiina Shanghai B (välismaine) +0.05%

Lõuna-Korea Kosdaq -1.93%

Tai Set 50 -0.29%

India Sensex 30 +0.37% -

Watch for Downside Follow-Through

By Rev Shark

RealMoney.com Contributor

9/24/2009 9:24 AM EDT

It may sound strange, but many champions are made champions by setbacks. -- Bob Richards

Yesterday, for the first time in the last 15 days of trading, we had a weak close. Since Sept. 2, the market has had a parabolic ride without any meaningful pullback at all. The bulls have been extremely confident the whole way and have benefited greatly from a legion of skeptical, underinvested bulls that provide constant support, never seeming to have an easy opportunity to load up on the long side.

On Wednesday we had one of those nasty "sell the news" reactions to rather benign news form the Fed. Nothing surprising was announced, and the initial reaction to the announcement was quite jubilant, but the selling kicked in, and the dip-buyers disappeared for once. We went straight down and closed at the lows of the day.

In the bigger scheme of things, a two-hour-long selloff after a couple of weeks of going straight up isn't anything too worrisome. In fact, it probably is a healthy thing that we have a bout of profit-taking. There are lots of recent gains, and when folks lock some in, it helps to alleviate some of the building "overbought" technical pressure. When market players rack up gains in a straight up market, you have to expect that they will periodically take some money off the table.

So overall there wasn't anything particularly unusual about a sudden bout of sell-the-news profit-taking. The issue is whether it was just a little hiccup within a very powerful uptrend or the start of something much more dramatic.

This market has been so strong for so long that it can sell off another 5% or so without really impacting the prevailing trend. It isn't until we start approaching the 50-day simple moving average around 1008 that a real change in trend commences. That doesn't mean a more minor pullback won't be quite painful. A lot of folks will be heading for the sidelines rather quickly to protect gains if we don't show signs of a quick recovery. Momentum players who have been chasing this market will sell first and ask questions later, and that can help to generate some pretty fast downside moves.

Of course, the dip-buyers have been the great strength of this market, and they will be the key in determining when this uptrend will end. They have not had any notable failures for weeks prior to yesterday afternoon, and they are very likely to stay aggressive in their pursuits. A real market turn won't come until this group of buyers loses some of its confidence and is unable to quickly and easily drive the market back up. It has been a very long time since the dip-buyers have shied away, and they are going to keep on trying until they suffer a few nasty losses. At some point, the trend will shift, and we will get a propensity to sell strength. There are no signs of that yet, but that is what we have to watch for.

So we have one weak day after a very powerful run. It is premature to make too much about it, but it certainly is something to keep in mind. What we look for now is some downside follow-through. If the bulls can manage another weak day, then maybe we start questioning the health of this uptrend more. At this point, the negatives are still too minor to worry too much about, although some increased defensiveness is not a bad idea at all.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: COMS +7.3%, RHT +6.9% (upgraded to Buy at BofA/Merrill), CTAS +2.6% ... Select financial names showing strength: AIG +2.7%, FRE +2.5%, SNV +2.1%, GNW +1.9%, ING +1.4%, MS +1.3%, STT +1.0%... Select gold related names trading higher: NG +3.4%, AUY +2.3%, HMY +2.2%, KGC +2.1%, AEM +2.0%, AU +1.9%, GOLD +1.8%, IAG +1.8%, GG+1.6%, ABX +1.4%... Select casino related names showing strength: LVS +1.4%, MGM +1.3%... Other news: GNVC +18.4% (receives fourth-year funding from NIAID For HIV vaccine contract; will receive up to $2.3 mln for the fourth year), VICL +14.2% (presents positive preclinical results with Vaxfectin-formulated, peptide-based cancer vaccine), ONCY +13.9% (announces start of enrolment in U.S. Phase 2 melanoma cancer clinical trial), HLCS +13.2% (announces publication of first-ever direct sequencing of single molecules of RNA), CRXX +12.7% (FDA Advisory Committee hears presentations and public comment on EXALGO extended-release tablets), YRCW +3.4% (continued strength from yesterday's 30%+jump), C +1.8% (Citigroup will pare back to six major metro areas - WSJ), EQT +1.1% (Cramer makes positive comments on MadMoney)... Analyst comments: ARIA +4.9% (Leerink Swann sees increasing excitement surrounding ARIA's multi-kinase inhibitor), CTXS +4.4% (added to Conviction Buy list at Goldman- Reuters), MTH +4.2% (Goldman Sachs raises U.S. homebuilders sector to Attractive - Reuters), NSM +3.4% (upgraded to Buy at Citigroup), CPN +2.3% (upgraded to Buy at Citigroup), KLAC +1.5% (upgraded to Perform at Oppenheimer), APA +1.3% (upgraded to Overweight at Morgan Stanley).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CPRT -7.1%, WR -6.8% (also downgraded to Neutral at JPMorgan), RAD -5.1%, PAYX -3.0%, BBBY -2.4% (also downgraded to Neutral from Outperform at Credit Suisse)... M&A news: ERTS -1.6% (MSFT spokesperson says co has no plans to buy ERTS)... Select China related names ticking lower: CHL -1.6%, LFC -1.5%... Other news: CNXT -11.5% (announces that it intends to sell 7 mln shares of common stock), HERO -9.5% (announces 17.5 mln common share offering), PSEC -9.5% (to issue and sell ~2.81 mln shares of common stock at an aggregate offering price of $9.00 per share), PPS -6.1% (commenced a public offering of 3 mln shares of common stock), ARE -4.8% (is commencing an underwritten public offering of 3,000,000 shares of common stock), NMR -3.4% (Nomura Holdings plans $5.6 billion share sale - WSJ), BSDM -2.9% (filed for a $50 mln mixed shelf offering), ATPG -1.9% (prices 5.3 mln common share offering at $18.50/share), FFCH -1.8% (announces it has priced offering of 4,193,550 shares of common stock at price of $15.50/share), AZN -1.8% (still checking)... Analyst comments: ANN -3.6% (cut to Neutral from Buy at Goldman- DJ), UFS -2.6% (downgraded to Hold at Deutsche), MDRX -1.2% (downgraded to Market Perform from Outperform at Raymond James), CAH -1.2% (downgraded to Hold at Deutsche), HTS -1.0% ( downgraded to Market Perform from Outperform at JMP Securities). -

Morgan Stanley strateeg J. Todd on täna väljas analüüsiga „Taking the Bait“. Todd tõstis S&P500 aastalõpu õiglase väärtuse sihi 1050 punkti peale. 2009 aasta S&P EPSi prognoos tõsteti $51 pealt $55 dollarile ja 2010. aasta EPS kergitati $62 pealt $70. Seega kaupleks S&P500 1050 punkti juures 15x järgmise aasta kasumi juures. MS tunnistab aga turu tugevust ja arvab, et S&P võib aasta lõpuks tõusta 1200 punkti juurde:

With risk assets in a sweet spot (growth momentum improving, rates are on hold, and liquidity measures plentiful) for at least the next 2 quarters, we think the market will trade away from our fundamental valuation before growth and earnings concerns resurface and potentially disappoint expectations built in equities. At 1200, however, we would turn cautious unless there has been a material change in the fundamentals.

Kirjutasin eelmine nädal ka siin, et turgudel on hea keskkond veel mitu kuud tõus jätkamiseks & eile kinnitas Fed, et antud keskkond jääb mõneks ajaks püsima. Valitsuse poolt tekitatud nõudluse ja madalate intressimäärade näol on aga tegu minimulli tekitamisega, mis võib lõhkeda, kui ilmuvad esimesed nõrkuse märgid majanduses (MSi hinnangul võib esimene pettumus tulla ISM indeksist).

-

Morgan Stanley oli minu teada veel üks viimaseid karusid S&P500 aastalõpu hinnasihi osas, olles väljas 900 punktilise sihiga. All bulls now?

-

August Existing Home Sales 5.10 mln vs 5.35 mln consensus; M/M change -2.7%

-

Turgu rõhunud riskisuse taasjõdumine fookusesse: negatiivsem existing home sales + keskpankade toetusprogrammide osaline lõpetamine.

* The U.S. Federal Reserve on Thursday said it will offer banks

access to emergency short-term funds through its Term Auction

Facility at least through January while trimming the sizes and

maturity lengths of the auctions in light of healing financial

markets.

* The European Central Bank will scale back its provision of

U.S. dollar liquidity to just one-week funds, after a joint

announcement by global central banks Thursday.

* The Bank of England said on Thursday it will suspend its

three-month dollar repo operations after the last one on

October 6, but will continue to offer 7-day dollar funds until

January 2010.

* The Swiss National Bank will continue to offer 7-day dollar

liquidity as well as Swiss francs through 7-day euro-franc

foreign exchange swaps through January 2010. -

Russell 2000 indeks sai 600.16 pidama, RUT vajumine läbi 600 punkti peaks turule närvilisust kergelt lisama.

-

EUR jällegi nõrgenemas USD vastu ja nafta ei suuda samuti kuidagi kosuda. S&P 500 piisavalt kaua püsinud 1050 ümber, et siit õhtuks kergelt verd lasta.

-

Briefing: Palm drops 50 cents on spike in volume; hearing Verizon (VZ) has decided not to support the Pre

-

Research In Motion sees Q3 $1.00-1.08 vs $1.05 First Call consensus; sees revs $3.6-3.85 mln vs $3.92 bln First Call consensus

Research In Motion prelim $1.03 vs $1.00 First Call consensus; revs $3.53 bln vs $3.62 bln First Call consensus -

Ootused on viimaste kuude aktsiaturgude rallide ja V-kujuliste majanduse taastumise juttudega kõrgele viidud. RIMMi numbrid ja prognoosid on selgelt liiga tagasihoidlikud, et elevust jätkuvalt üleval hoida. RIMM on järelturul kauplemas -13% ca $75 peal.