Börsipäev 8. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Austraaliast taas huvitavaid uudiseid. Kui Austraalia keskpangast sai sel nädalal esimene G20 riik, kes intresse tõstnud, siis täna avaldatud statistika näitas, et Austraalias loodi septembris juurde 40 600 töökohta - see on suurim töökohtade lisandumine viimase 2 aasta jooksul. Analüütikud ootasid keskmiselt ca 10 000 töökoha kaotamist. Töötusmäär kukkus 5.8% pealt 5.7% peale. Austraalia tarbijausaldus on viimase 2 aasta kõrgeim ning ärikliima sentiment viimase 6 aasta kõrgeim. Arenenud riikide kontekstis teeb Austraalia igaljuhul paljudele silmad ette.

-

Täna on tund aega enne USA turu avanemist tulemas esmaste töötu abiraha taotlejate arv (ootus 540 000) ning kestvate töötu abiraha taotlejate arv (ootus 6.1 miljonit). Enne turgu teatab om viimase kvartali tulemused Pepsi (PEP), kellelt oodatakse EPSi $1.03 ja tulusid $11.26 miljarid.

Alcoa (AA) eilsed ootusi ületavad tulemused viisid aktsia järelturul üle 5% kõrgemale.

USA futuurid on võrreldes eilsega hetkel juba terve protsendi võrra kõrgemal kauplemas. -

Euroopas on olulisemateks sündmuseks kahe keskpanga rahapolitiilised otsused, Euroopa keskpanga puhul pilgud pööratud taaskord pigem pressikonverentsile, kus küsimuste voorus võiks teemaks tulla Austraalia keskpanga ootamatu samm ning võimalikud vihjed Tricheti poolt, kas sarnane taktika EKP liikmete kohtumisel üldse jutuks tuli.

-

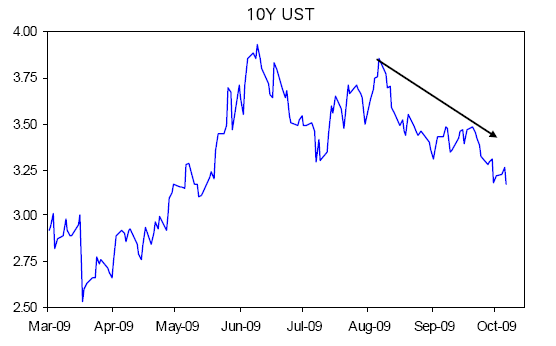

Kulla hinna uute tippude taustal on jätkuvalt huvitav USA valitsuse võlakirjade käitumine:

Eile langes USA valitsuse 10. aastase võlakirja tootlus 3.2% allapoole (viitab, et turuosalised ei oota mõnda aega intressimäärade tõstmist). Kui eeldada, et optimism sälib veel mõnda aega, siis võib lühiajaliselt treasury'de lühikeseks müük olla atraktiivne. UltraShort 7-10 Year Treasury (PST) on üks võimalus:

-

eur/usd graafiku järgi peaks ilmselgelt üle 1.48 minema.

-

"peaks ilmselgelt"?

-

Ma ei tahaks 100% kindlusega väita, sellepärast siis 'peaks ilmselgelt'.

Ise mängin täna eur/usd tõusu peale ja tegelikult pikalt üle 1.48, nagu graafik lubab. Minu jaoks 100% tõus. -

Panen graafiku ka vallutuskatsest:

-

Olen hetkel EUR/USDis short tasemelt 1.4783, ilmselge avantyyr (teadlik kusjuures), sest trend on vastupidine.

-

Ma arvan, et R2 võetakse ära. Vaatame, kes peale jääb :)

-

Olen eur.usd's lühike 1,4780 pealt, esimene 1/2 exit läks 70 pealt ja ülejäänut hoian, kuni intraday high püsib...enne ECB'd flat. Arvestades overnight tugevat oktsionit, on hea võimalus enne ECB'd 1,4790 test, kuid upside on kuni Triche sõnavõtuni limited.

See jääb ilmselt mu ainukeseks selletaoliseks kommentaariks ;) -

* Trichet

-

rehatrader

Ma arvan, et R2 võetakse ära

Kuidas said R2-e, mis tasemel?

Minu abivahendid on ületanud kõik tasemed, hetkel pusib R3 all. -

Mul näitab R2 1.4780

-

Tundub, et teistel ka, miks muidu nad sealt põrget ootavad.

-

Multiple R ja p-value ei toeta eriti seda järeldust, mu meelest. ANOVA ka täitsa sassis.

-

-

TRX, panustad ka tõusu peale?

-

Täna ei tee mingit tehingut, liiga palju tegureid mõjutamas turgu : Olulisemad uudised

-

jim võiks uudiste mõju kommenteerida.

-

Veel üks ostusoovitus enne tulemusi finantssektoris:

Deutsche Bank analysts initiated coverage of Goldman Sachs (GS) with a buy rating and a price target of $220. The broker said Goldman's strong risk management and innovative culture, along with improving capital market trends, should enable it to generate superior earnings and a "healthy" return on equity in the near term. Deutsche Bank added that in the mid-to-longer term it expects Goldman to be able to put some of its excess capital and liquidity to use and/or pursue share buybacks. (marketwatch)

-

Saksamaa tööstustoodang kasvas augustis 1.7% MoM, mis vastas suuresti turu ootustele (+1.6%). IP on jätkuvalt 16.8% YoY madalamal ja peaks ka edaspidi madala baasi pealt kasvama.

-

Panin oma pika kinni. Õpetuseks, et Pivot joonelt tuleb siiski alati põrgatada.

-

exit short @ 1.4763

-

ECB jätab siis intressi 1% peale

-

Tõesti? Tõde selgub pressikal!

-

momentum

PRESSITEADE

8. oktoober 2009 - Rahapoliitilised otsused

Tänasel Veneetsias toimunud istungil otsustas EKP nõukogu säilitada põhiliste refinantseerimisoperatsioonide pakkumisintressi alammäärana 1,00%, laenamise püsivõimaluse intressimäärana 1,75% ning hoiustamise püsivõimaluse intressimäärana 0,25%.

EKP president põhjendab neid otsuseid täna kell 14.30 Kesk-Euroopa aja järgi algaval pressikonverentsil.

http://www.ecb.int/press/pr/date/2009/html/pr091008.et.html -

Siit saab kuulata EKP pressikonverentsi: Link

-

Otsust ma tean, pressikas võib tuua uusi tuuli, nii et ECB *jätab* intressi 1% peale pole mõtet enne presika lõppu öelda.

-

Initial Claims 521K vs 540K consensus, prior revised to 554K from 551K; Continuing Claims fall to 6.04 mln from 6.11 mln

-

Nii Target, Kohl kui ka JC Penney on tõstmas oma 3. kvartali kasumiprognoose:

1) Kohl's raises Q3 EPS to $0.52-0.54 vs $0.49 First Call consensus; reports Sep same store sales +5.5% vs +0.2% Briefing.com consensus

2) JC Penney reports Sept same store sales of -1.4% vs -3.3% Briefing.com consensus; raises its Q3 EPS guidance to a range of $0.03-$0.10 (vs $0.05 consensus), up from the previous range of ($0.05)-$0.05 (34.91)

3) Target expects Q3 EPS performance to exceed the current median FirstCall estimate of 43 cent

Samas Target hoiatab, et nende väljavaated 4. kvartali arengute osas on ettevaatlikud. -

Coca-Cola (KO) aktsia on peaaegu täitnud Credit Suisse'i poolt seatud $57lise hinnasihi ning nüüd tõstetakse see $62 peale.

Ühe põhjusena, nagu viimasel ajal on üha tihedamini kombeks saanud, on hinnasihi tõstmisena võrdlusgrupi kallinemine - Briefing: They have raised their tgt to reflect the increased valuations for the sector. -

Trichet pajatab pikalt distsipliini vajalikkusest riikide fiskaalpoliitikas... USA puhul on distsipliinist raske rääkida. Lisaks räägib Trichet, et kui hinnastabiilsuse tagamiseks on vaja reageerida, siis seda on ECB valmis ka tegema. Igaljuhul kõige selle peale kokku on euro dollari vastu veelgi tugevnenud ning jõudnud tasemele €1=$1.48.

-

EUR/USD on pärast Tricheti kommentaari tugeva dollari kohta tõusmas (Trichet toetas seda, kuid ei maininud midagi konkreetset). Aga 1.48 on huvitav reaktsioon.

-

Euroopa turud:

Saksamaa DAX +1.33%

Prantsusmaa CAC 40 +1.31%

Inglismaa FTSE 100 +0.63%

Hispaania IBEX 35 +1.17%

Rootsi OMX 30 +0.91%

Venemaa MICEX +3.57%

Poola WIG +0.74%Aasia turud:

Jaapani Nikkei 225 +0.34%

Hong Kongi Hang Seng +1.18%

Hiina Shanghai A (kodumaine) N/A (börs suletud)

Hiina Shanghai B (välismaine) N/A (börs suletud)

Lõuna-Korea Kosdaq +1.14%

Tai Set 50 +0.29%

India Sensex 30 +0.22% -

Short gbp.usd 1,6075, risk 15 points.

-

Fighting the Pattern Is Frankly Exhausting

By Rev Shark

RealMoney.com Contributor

10/8/2009 8:38 AM EDT

It's the repetition of affirmations that leads to belief. And once that belief becomes a deep conviction, things begin to happen.

-- Claude M. Bristol

We have to pay attention to patterns in the markets because there is a strong tendency for them to repeat. If they are repeated enough they become beliefs, and beliefs become trends ... and trends persist.

The emotions and psychology that cause market players to act in a certain way don't just suddenly disappear. They persist and become self-reinforcing as they lead to positive results on successive occasions. If you are rewarded every time you buy a dip, then you keep on doing it, and you become even more inclined to continue the more frequently you are rewarded.

The action the last few days is a particularly good illustration of how a pattern tends to repeat. Look back at early July just before earnings season. We had topped out the prior month, started to downtrend a little and were just on the verge of a major change of trend. We then stabilized had some positive action on lower volume, but then momentum caught fire and we went straight up. Bears who had just started to gain some confidence were caught by surprise, and the underinvested bulls turned into extremely aggressive dip-buyers in the hopes of gaining some long exposure.

The pattern this past week was almost an exact copy of the July action. We were just about to see a major change in trend last Friday on the very ugly unemployment picture, but we stabilized and then rallied on lower volume. We are now set to gap up strongly for the fourth day in a row. The catalyst this morning is good earnings from Alcoa (AA) , continued weakness in the dollar and some good economic news overseas.

A lot of folks have tried to fight this pattern of complete and immediate recovery from the brink of a breakdown because it doesn't fit their fundamental arguments of the market. They keep thinking the market deserves to break down, and they are continually frustrated when we roar back yet again as if we are in the best economic environment ever.

We have to remember that the driving force in this market isn't fundamentals -- it is primarily liquidity. Due to the stimulus, the bailouts and various governmental programs, there is cash looking for some place to go. Bonds provide no return, real estate is still questionable and too illiquid, so what choice is there but to buy stocks?

The important thing is to not overthink what is going on. We have a positive pattern that keeps repeating and it isn't because fundamentals are so fantastic. The bearish arguments just don't matter much in the face of this positive price action. At some point, like last Friday on the jobs news, the fundamentals will be an excuse for selling, but that isn't the case this morning.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance/SSS: HOTT +10.3%, CPKI +7.3% (also upgraded to Buy at KeyBanc Capital Mkts), SCSC +7.3%, AA +6.5%, ZUMZ +6.0% (also upgraded to Buy at Roth), PLCE +5.3%, AEO +3.8%, GPS +3.7%, ANF +3.6%, SKS +3.2%, ARO +3.0%, TJX +2.9%, JWN +2.9%, M +2.7%, RT +2.0%, KSS +1.6%, PEP +1.2%, JCP +1.1%, TGT +1.0%... Select aluminum related names showing strength following AA results: CENX +10.4%, AWC +7.0%, ACH +4.1%, KALU +2.1%... Select financial names trading higher: ING +5.6%, BBV +3.4%, AIG +1.7%, STD +1.6%, MS +1.3% (initiated with a Buy at Deutsche Bank), AZ +1.3%, C +1.3%, AXA +1.2%, GS +1.0% (initiated with a Buy at Deutsche Bank)... Select oil/gas names seeing early strength: PTR +1.4%, SU +1.3%, PBR +1.3%, SLB +1.2%, APC +1.1%... Select metals mining names showing continued strength with weakness in the dollar: VGZ +9.3%, MT +4.9%, GOLD +4.5%, AUY +3.7%, RTP +3.3%, BHP +2.3%, HMY +2.2%, GG +2.1%, GFI +2.1%, ABX +2.0%, HL +2.0%, AU +2.0%, BBL +2.0%, VALE +1.9%, GLD +1.0%... Select iron/steel names showing strength: X +3.3%, AKS +2.9%, STLD +2.6%... Select shipping names trading higher: EGLE +4.2%, DRYS +4.0%, GNK +2.1%, PRGN +2.0%, DSX +1.3%... Other news: DDSS +21.3% (completes distribution and supply agreement with Grunenthal for twice-daily tramadol-acetaminophen for a number of European countries), LIZ +14.6% (unveils new distribution strategy for the Liz Claiborne Brand franchise; JCPenny to become exclusive department store destination), MVIS +9.9% (secured an initial purchase order for a global consumer electronics OEM to private-label its PicoP display engine-based accessory laser pico projector), TGIC +9.8% (to sell mortgage insurance operating platform to Essent Guaranty), NCT +9.6% (still checking), LOCM +8.3% (awarded patent which covers a system and method for Enhanced Directory Assistance Services), HEB +6.9% (announces Ampligen/Intranasal Flu vaccine program to be presented at International Vaccine Workshop in Osaka), SQNM +6.7% (continued momentum from yesterday's 15%+pop), TYPE +4.8% (Monotype Imaging licenses fonts to Yahoo! for the design of Yahoo! TV Widgets ), COV +1.3% (Cramer makes positive comments on MadMoney)... Analyst comments: ABB +3.6% (upgraded to Buy at UBS), SYT +3.4% (upgraded to Overweight at JPMorgan), EBAY +2.1% (upgraded to Buy at Kaufman), ANSS +2.0% (upgraded to Buy at Deutsche), MOS +1.6% (initiated with a Outperform at RBC Capital Mkts), CLX +1.4% (upgraded to Buy at Deutsche).

Allapoole avanevad:

In reaction to disappointing earnings/guidance/SSS: CATY -2.2%... Select European financials showing modest weakness: IRE -3.3%, AIB -1.6%, RBS -1.1%... Other news: FNSR -7.6% (currently trades under symbol FNSRD; announces its intention to offer $75 million aggregate principal amount of convertible senior notes due 2029), TRGT -6.7% (files S-3 to register an additional $8.8 mln in shares to prior registration statement ), SVNT -5.4% (announces a 4 mln share common stock offering pursuant to an effective shelf), RINO -3.2% (files for $150 mln mixed securities shelf offering), MFA -2.4% (trading ex dividend), VOD -1.5% (still checking)... Analyst comments: LLL -2.5% (downgraded to Sell at Goldman- Reuters), BRCM -1.5% (downgraded to Neutral at Baird), PNC -0.9% (initiated with a Sell at UBS). -

exit 1/2 at 1,6060, +15 points

-

shortisin veel korra EUR/USD, 14785, exit 14748, +37 pips.

-

Ma võtsin eur/usd 1.4765 pealt ja müüsin 1.4791 peal ja olin pahane, et nii vara välja läksin. Praegu ei saa üldse aru, mis toimub. Väike paus vaja teha.

-

* See oli siis pikk positsioon.

-

exit 2/2 at break-even, turg 1,6060 juures balanced.

-

Üritan rahvaga solidaarne olla ja siit lühike positsioon eur/usd 1.4758

Fib 50 ja FullS tipus. -

Solidaarsus ei maksa midagi. 83 kinni ja 25 miinust.

-

rehtrader

otsustavus see-eest maksab. :-)

olen taaskord short, 1.4785. -

Ma olin vahepeal 84 pealt lühike, aga lükati välja. Seekord ei lasknud ennast miinusesse ja võtsin 2 pipsi :)

Praegu on üks võimalik stsenaarium, et kukume ca 68-ni ja siis üles. -

Kui 1.48 ületatakse, siis peaks vast R3-ni sees olema.

-

Cable_guy, mis tasemeni € positsiooni hoiad ja millist riski/tulu suhet üldiselt sihid?

-

Tulin 1.4813 välja. Polnud närvi. Vahel pööratakse enne joont alla.

-

Rumors: BP may make a bid for Chesapeake Energy (CHK) in the $40 price range.