Börsipäev 13. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Täna enne turgu on oma tulemused avaldamas Johnson ja Johnson (JNJ) - turu konensusootuseks on EPSi $1.13 ning müügitulu 15.19 miljardit. Pärast turu sulgemist näitab oma kvartalinumbreid Intel (INTC), kellelt oodatakse EPSi $0.27 ning müügitulusid $9.02 miljardit. Selle nädala olulisemaid tulemuste teatajaid USA börsilt vaata siit.

Futuurid on eelturul kauplemas eilsete sulgumistasemete juures.

-

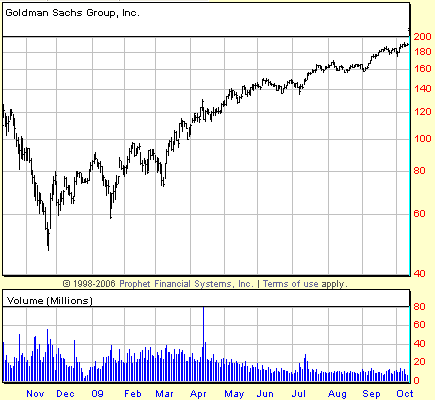

Meredith Whitney on loobunud oma viimasest ostmisväärilisest ideest pangandussektorist ning langetab täna Goldman Sachsi (GS) soovituse 'osta' pealt 'neutraalse' peale. Bloomberg on sellest ka loo teinud - link siin.

-

Kuigi ZEW indeks tuli juba mõni aeg tagasi välja, panen selle nüüd ka siia. Oktoobris kukkus see näit 56 punkti peale (septembris oli 57.7 punkti) ning jäi seega paranemist ootavale konsensusele (58.8 punkti) alla.

-

ZEW sundis EURi USD-i suhtes esimese hooga veidi taganema, ent nüüd vallutatakse juba uusi 14 kuu tippe (1.486)

-

Johnson & Johnson prelim $1.20 vs $1.13 First Call consensus; revs $15.08 bln vs $15.22 bln First Call consensus

Johnson & Johnson raises FY09 EPS to $4.54-4.59 vs $4.52 First Call consensus -

Euroopa turud:

Saksamaa DAX -0.29%

Prantsusmaa CAC 40 -0.31%

Inglismaa FTSE 100 +0.02%

Hispaania IBEX 35 -0.64%

Rootsi OMX 30 -0.38%

Venemaa MICEX -1.02%

Poola WIG -0.82%Aasia turud:

Jaapani Nikkei 225 +0.60%

Hong Kongi Hang Seng +0.79%

Hiina Shanghai A (kodumaine) +1.44%

Hiina Shanghai B (välismaine) +1.30%

Lõuna-Korea Kosdaq -0.36%

Tai Set 50 -0.65%

India Sensex 30 N/A (börs suletud) -

Forget the Mirror

By Rev Shark

RealMoney.com Contributor

10/13/2009 9:15 AM EDT

The way it actually works is the reverse. You must first be who you really are, then do what you need to do, in order to have what you want.

-- Margaret Young

Back in early July, just before earnings season was to commence, the major indices were on the brink of a technical collapse. Sentiment was poor and plenty of people were worried about how earnings season would play out. Then out of the blue Meredith Whitney upgraded Goldman Sachs (GS) the day before its earnings report. The market moved up sharply that day and kept on running when Goldman posted a very strong report. Quickly after that, Intel (INTC) posted a surprisingly strong report and the market flew higher once again.

Those two reports set the tone for earnings season, and we went straight up the rest of the month before finally resting a little in early August. Subsequently we had a couple of dips from which we immediately recovered, but ever since the Goldman/Intel combo, the market has been on a tremendous tear.

So here we are once again on the eve of major earnings report, but this time the major indices are knocking on the door of a new high, sentiment is extremely positive and Meredith Whitney is downgrading GS as we await earnings from Intel tonight.

The obvious question is whether we are now seeing the mirror image of what we had in early July. Are expectations so high now that we will be unable to gain further traction? Are we destined to trend straight down following a GS downgrade and a mediocre report from Intel?

I suspect it is a little too easy and cute to predict that we have the inverse of what we saw in July. A market with this much momentum is very unlikely to suddenly see a reverse that vigorous. What has been driving this market for so long is the supply of underinvested bulls who are anxious to buy dips. Those dip-buyers will be lurking about and they will be interested in picking up shares of stocks that sell off on decent earnings reports.

Conditions are indeed a bit frothy and there are plenty of signs of overconfidence, but we don't have any concrete technical signs that we are ready to roll over. We've paused right near the September highs and don't have a great base of support after a low-volume bounce over the past week. The market really needs to consolidate a little at this point, which is going to make navigating earnings reports quite tricky.

Typically I try not to get in front of earnings news. I view it as a gamble. Last quarter it paid off well to hold stocks for earnings, but that doesn't change my view that it tends to be nothing more than roll of the dice.

Even with the Meredith Whitney downgrade this morning, the early indications are steady. Johnson & Johnson (JNJ) is trading down on slightly-better-than-expected earnings, but it is Intel tonight that will be the star -- we'll likely stay in a tight range until that number is out.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ININ +15.4%, PIR +12.0%, BZ +11.5%, JCI +1.4%... M&A news: TCHC +58% (light volume; Homeowners Choice submits proposal to merge with 21st Century Holding; proposed offer values 21st Century shares at $5.30 per share)... Select metals/mining names showing strength with continued decline in dollar: AU +3.7%, AUY +3.3%, GFI +3.0%, MT +2.7%, HMY +2.6%, GDX +1.7%, ABX +1.6%, GG +1.5%, RTP +1.5%, GLD +1.1%... Select oil/gas related names trading higher: CHK +1.8%, E +1.7%, TOT +1.4%, SU +1.3%, RDS.A +1.1%... Other news: VASC +24.2% (Vascular Solutions and Zerusa Limited announce FDA market clearance for the next generation Guardian II Hemostasis Valve), CGEN +19.8% (light volume; Compugen and Bayer Schering Pharma to collaborate on Compugen discovered oncology target and splice variants), NSPH +17.9% (light volume; announces FDA 510(k) Clearance of the Verigene SP and Respiratory Virus Nucleic Acid Test), VNDA +17.5% (enters into exclusive license agreement for commercialization and development of Fanapt in the U.S. and Canada for treatment of schizophrenia) CPBY +10.9% (announces a record $30.05 mln in newly signed contracts in Q3; also initiated with a Mkt Outperform at Rodman & Renshaw), AUDC +9.4% (still checking), SVA +5.6% (receives Certificate of Approval to distribute Panflu (H5N1) vaccine in Hong Kong), ARST +4.4% (Cramer makes positive comments on MadMoney), ALKS +3.6% (announces 'positive' results from two clinical trials of ALKS 33), SI +1.4% (confirms it wins six new wind turbine orders of more than 565 megawatts rated capacity in North America; worth more than $900 mln), YONG +1.2% (announces that the number of independently-owned, branded stores selling Yongye's Shengmingsu products increased 40% to approx 7,000, during 3Q09), ASEI +1.0% (Cramer makes positive comments on MadMoney)... Analyst comments: DRYS +4.7% (upgraded to Buy from Hold at Lazard Capital), NTES +3.0% (Hearing JP Morgan upgrading NTES to Overweight; tgt $53), PHG +2.9% (upgraded to Neutral at Exane BNP Paribas and upgraded to Buy at RBS), AMD +2.6% (upgraded to Mkt Perform from Underperform at JMP Securities), KEY +2.4% (resumed with Buy at BofA/Merrill), C +1.5% (initiated with Buy at Deutsche), PKX +1.4% (upgraded to Buy and added to Conviction Buy list at Goldman- Reuters), YHOO +1.3% (upgraded to Buy at Benchmark), ONNN +1.1% (initiated with Buy at Deutsche).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: TLVT -8.5% (light volume), JNJ -2.1%... Select European financial names showing weakness: BCS -2.8%, AIB -2.7%, LYG -2.2% (faces "significant" fee to exit APS, according to source - DJ), RBS -1.4%, HBC -1.3%... Other news: CIT -21.2% (debt swap struggles, bankruptcy looms - Reuters; also initiates CEO transition), DINE -13.6% (trading ex dividend), BKE -5.4% (trading ex dividend), CATY -2.2% (announces $70.5 mln common stock offering)... Analyst comments: SYNA -5.1% (downgraded to Underperform at Jefferies), GAP -4.2% (downgraded to Sell from Neutral at Pali Capital), PPO -3.0% (downgraded to Neutral at Baird), MAC -2.0% (light volume; downgraded to Neutral from Buy at BofA/Merrill), MET -1.9% (downgraded to Neutral from Outperform at Credit Suisse), GS -1.8% (downgraded to Neutral at Meredith Whitney Advisors), JOYG -1.3% (downgraded to Hold at Keybanc). -

Tulemuste tabel täna hommikuste teatajatega nüüd uuendatud - link siin.

-

Tulemuste eel kerkinud ootuste latti ilmestab hästi tänane Johnson & Johnson (JNJ) aktsia liikumine. Hoolimata EPSi ootuste löömisest on aktsia juba praegu kauplemas ca 2.7% miinuses.

-

Fed's Kohn says sees no conflict between preserving financial stability and preserving economic stability - Reuters

-

CSX Corp prelim $0.74 vs $0.71 First Call consensus; revs $2.3 bln vs $2.32 bln First Call consensus

-

Intel prelim $0.33 vs $0.28 First Call consensus; revs $9.4 bln vs $9.04 bln First Call consensus

-

Intel sees Q4 revs $9.7-10.6 bln vs $9.51 bln First Call consensus

-

Intel FY cap spending expected to be ~$4.5 bln, down from prior expectation

-

Krt ei uurinud enne põhjalikumalt ja Inteli peale lendas asi üles ära, aga:

JP Morgani väitel Comscore data unique visitors AMZN'l 2 esimest kvartali kuud +16%, kvartal kokku +18%.. seega siis september +22%??

Oli väljas mingi 15 min enne turu sulgemist, aga homme ilmselt suur hulk positiivseid kommentaare. Kui õnnestuks veel AMZN close juurest saada, siis võiks täitsa mõistlik ost olla. Üle $90.25 ei tahaks maksta. -

95.25 ikka?

-

:D $90.25 -ga vist ei saa jah hästi, nii et $95.25 siis jah.Võibolla isegi mõned sendid rohkem.

-

Oh tra, oleks pidanud agressiivsem olema AMZN -ga.