Börsipäev 21. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Esiteks tänan kõiki, kes mind ja Erkit eile õhtul Radissonis seminaril kuulamas käisid. Mul oli väga hea meel näha niivõrd suurt inimeste arvu ja huvi!

Aga minnes nüüd tänase juurde - sarnaselt eilsele on tulemas ka täna väga tihe tulemuste päev. Nüüdseks olen meie tulemuste tabeli ka taaskord ära uuendada jõudnud ning esimesest tulbast on näha, et sellel nädalal oma märgi tabelisse kirja saanud 32 ettevõttest pole veel ükski EPSi ootustele alla jäänud. Ometi liiguvad järelturul ülespoole vaid need ettevõtted, kes on suutnud näidata ka tugevat müügitulu või annavad tuleviku osas optimistlikke prognoose. Seega ainult headest numbritest ei piisa - aktsiate edasiseks tõusuks peavad täna olema näidud lausa suurepärased.

Olulisi makroandmeid täna peale 17.30 avalikustatava naftaraporti tulemas ei ole.

-

Teiste seas tulevad oma 3. kvartali tulemustega eelturul Altria (MO), Boeing (BA), Morgan Stanley (MS), Wells Fargo (WFC) ning järelturul Amgen (AMGN), eBay (EBAY) ja Noble Corp (NE).

-

Euroopa turud:

Saksamaa DAX -0.72%

Prantsusmaa CAC 40 -1.07%

Inglismaa FTSE 100 -0.73%

Hispaania IBEX 35 -0.64%

Rootsi OMX 30 -1.38%

Venemaa MICEX -1.36%

Poola WIG -0.26%Aasia turud:

Jaapani Nikkei 225 -0.03%

Hong Kongi Hang Seng -0.30%

Hiina Shanghai A (kodumaine) -0.45%

Hiina Shanghai B (välismaine) +0.23%

Lõuna-Korea Kosdaq -0.22%

Tai Set 50 -1.43%

India Sensex 30 -1.24% -

Tänased tulemused ka enne kauplemise algust:

Wells Fargo prelim $0.56 vs $0.37 First Call consensus; revs $22.5 bln vs $21.63 bln First Call consensus

Morgan Stanley prelim $0.38 vs $0.27 First Call consensus; revs $8.7 bln vs $7.00 bln First Call consensus

Boeing misses Q3 EPS by $0.11, misses on revs; lowers FY09 EPS guidance as expected and reaffirms FY09 revs guidance

Altria beats by $0.01, misses on revs; guides FY09 EPS in-line

-

Where's the Fear?

By Rev Shark

RealMoney.com Contributor

10/21/2009 8:06 AM EDT

"I am not worried about the deficit. It is big enough to take care of itself."

-- Ronald Reagan

Although there have been plenty of very strong earnings reports so far this quarter, the market has had a mix of reactions. Initially, the stocks with strong reports, like Intel (INTC) , IBM (IBM) , Alcoa (AA) and Johnson & Johnson (JNJ) , sold off while the market indices held up. Yesterday, we saw stocks with strong reports, like Apple (AAPL) and Caterpillar (CAT) , act well while the market indices sold off.

The distinction may not be all that important, because both reactions are indications that the market is finding it more difficult to make progress. Expectations have been high and the news generally good, but we aren't ripping higher like we did in the second quarter, because we have already priced in much of the positive news.

This is a slight change in character, and it is too early and not yet sufficiently significant to make a big deal over. In fact, it would be more surprising if the market didn't rest a bit rather than continue to move straight up with no profit taking. Earnings are always a convenient excuse to look at some gains, and the fact that it happened on some good reports isn't very surprising.

The biggest negative this market has going for it is that it is hard not to be a bit complacent about it. We still have a strong uptrend in place, there is plenty of underlying support, the earnings news is good and folks are less pessimistic about the economic situation. As there is nothing much else to do with cash other than stick it in the stock market, why should we be worried about anything?

An overbought, complacent market is usually cause for a little worry, but in this market, the biggest mistake you could make is looking for a change of trend. Instead of looking for reasons why we are on the verge of falling apart, it has been far more productive to focus on why nothing is likely to change.

We have a little softness this morning, as the dollar is showing some signs of rallying again, which is probably the most obvious negative for this market right now. Otherwise, it is looking like nothing more than just a little healthy consolidation. The fact that there isn't more fear is the only thing that is troubling about this mild action so far.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CASB +35.7%, IDSA +17.8%, SLM +9.6%, DSCM +9.4% (light volume), SNDK +6.5%, YHOO +4.8%, SYK +4.4% (also upgraded to Neutral at BofA/Merrill), CKSW +4.0%, CREE +3.6% (also upgraded to Buy at Morgan Joseph), LLY +2.2%, WLT +1.7%, INFN +1.6%, CBY +1.4%... Other news: SATC +9.0% (their PowerGate Plus 500 kW solar PV inverters were selected for and are now fully operational at First Light), SHPGY +2.0% (targets fourth quarter filing of BLA for REPLAGAL for fabry disease with U.S. FDA), RX +2.0% (confirms that it is exploring a variety of strategic alternatives), DSW +1.9% (DSW CEO bought 10K shares at $21.00-21.50 on 10/19), NVAX +1.8% (announce collaboration to develop large-scale manufacturing process for 2009 H1N1 influenza VLP vaccine), DT +1.7% (still checking), CRXL +1.1% (announces that preliminary results of the Phase I study of its HIV vaccine were presented), OXPS +1.1% (Cramer makes positive comments on MadMoney), MU +1.1% (trading up in sympathy with SNDK)... Analyst comments: CYOU +2.1% (light volume; upgraded to Buy at Roth).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CONN -16.9%, GAP -14.3%, MI -8.1%, BSX -6.5%, SWI -6.4%, PKG -5.8%, VLTR -5.7%, RF -5.3%, EDU -4.1% (light volume), JDAS -2.8%, SVU -2.5% (light volume), STT -2.1%, KO -2.1%, BIIB -1.8%, BMI -1.7%, ZION -1.1%... Other news: ANPI -6.1% (announces the FDA has said its 510(k) submission for Bio-Seal, stating that Bio-Seal is a class III device that requires Pre-Market Approval for FDA marketing clearance), BCS -4.3% (Qatar to sell Barclays), AIXG -2.2% (still checking), EWZ -2.1% (Brazil's finance Minister confirms govt will levy financial transactions tax on capital inflows)... Analyst comments: TNP -3.6% (downgraded to Underweight at JPMorgan), GME -3.1% (downgraded to Neutral at Janney), BA -2.7% (downgraded to Underweight at Morgan Stanley), PCS -2.4% (cut to Neutral from Buy by Goldman Sachs - DJ), PTV -1.8% (downgraded to Equal Weight at Barclays). -

GENZ jäi tulemuste osas alla ja tõmbas ka prognoose madalamale. Aktsia sai enne tulemusi juba kerget müüki, kuid täna avanemisest juba +$1 visanud, kas õigustatud liikumine?

-

SQNM osaleb nädalavahetusel American Society for Human Genetics teaduskonverentsil mitme ettekandega. Teaduskonverentsil ettekannetes negatiivseid tulemusi ei esitleta. Midagi peab siiski olema millest rääkida. Võib oodata järgmisel nädalal tõusu.

-

Figures released on Monday show that, in the 12 months ending September, federal personal income tax receipts were down more than 20%, while corporate tax receipts dropped a remarkable 54.6%. These are the biggest declines since World War Two, and explain why the deficit has risen so sharply. A large part of the current stimulus is unplanned rather than deliberate (buttonwoods).

Valitsusele väga kehv, kui võlakirjade intressimäärad peaks tõusma hakkama (võlakirjad täna ka miinuspoolel).

Aktsiaturgudel tugev algus - SPY 110

Valuutaturul rabeleb EUR/USD olulise 1.5 tasemega.

-

to joel; teil oli tõesti hea seminar mille tulemusena ma olen otsapidi nüüd siin foorumis!

-

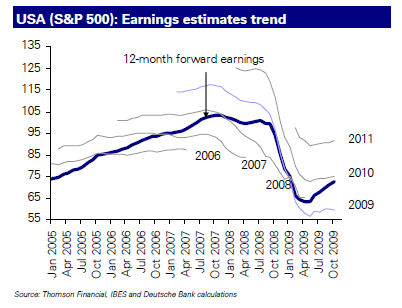

Deutsche Banki graafik konsensuse ootustest:

-

max_power, rõõm kuulda.

Miku kommentaarile ütleks veel täienduseks, et põhimõtteliselt kulub täna ca 6% kuni 7% USA eelarve tuludest võlakoorma pealt intresside tasumise peale. Intresside kergitamine/kerkimine on seetõttu ameeriklaste jaoks hell teema. -

USD nõrkuse tõttu naftabarreli hind üha kõrgemale liikumas ja need kaks omakorda turgu ülespoole vedamas.

-

Millegipärast tundub, et turg müüakse siit õhtuks madalamale ja USD jääb ikkagi EUR vastu alla 1.50 taseme.

-

Stiglitz says US growth won't be sustainable; says US will remain in "deep recession" - Bloomberg

-

Kellaaeg juba selline, kus eur/usd turul tavaliselt suuremaid liikumisi ei tehta. Arvan ka, et kõrgemale ilmselt ei lähe.

-

GENZ tuligi ilusti alla $53 tasemele.

-

Kuigi EUR/USD ja nafta püsivad tippude läheduses, on turg kergelt vajumas. Paistab, et keegi näpuotsast vaikselt positsioone maha laadimas.

-

Fed's Fisher says "I don't see" a double dip recession - Bloomberg

-

Fisher ei tea midagi, küsige parem Lepiku käest...

-

Nafta ja EUR/USD käsikäes edai tõusmas, huvitav mis tasemest nad turgu rõhuma hakkavad?

-

Fed's Tarullo says skeptical of idea of breaking up big banks as a solution for too-big-to-fail - Reuters

-

USD-l põhi alt täiesti kadunud.

-

Fed's Beige Book andmed tulevad 15 min pärast kell 21:00. Turg hetkel üsna rahulikult ühe koha peal tiksumas, kas sealt ka suund?

-

Fed says housing market, manufacturing kept improving

Fed Beige Book: Stabilizing Or Modest Improvement In Most Sectors

Beige Book: Consumer Spending Remains Weak In Most Areas

Fed says labor markets typically characterized as weak or mixed, but with 'pockets of improvement' -

Ja turg ei liigu grammigi:D

-

Vaatan, et kui ES on mitmeks päevaks tipus samale tasemele seisma jäänud, siis on alati korrektsioon tulnud. Hetkel ka tipp ja mitu päeva samal tasemel.

-

TA indikaatorid kalduvad hetkel küll korrektsiooni indikeerima aga kui turg tahab üles minna, siis ei peata teda miski:D

Aga nagu juba eelpool mainitud, siis tundub, et täna näeme õhtuks kergelt punast. -

U.S. to order steep pay cuts at cos that got most aid - NY Times

NY Times reports responding to the growing furor over the paychecks of executives at companies that received billions of dollars in the government's financial rescue, the Obama administration will order the companies that received the most aid to deeply slash the compensation to their highest paid executives, an official involved in the decision said on. Under the plan, which will be announced in the next few days by the Treasury Department, the seven companies that received the most assistance will have to cut the annual salaries of their 25 best-paid executives by an average of about 90% from last year. Their total compensation — including bonuses and retirement contributions — will drop, on average, by about 50%. The companies are Citigroup (C), Bank of America (BAC), American International Group (AIG), General Motors, Chrysler and the financing arms of the two automakers. At the financial products division of AIG, no top executive will receive more than $200,000 in total compensation, a stunning decline from previous years in which the unit produced many wealthy executives and traders. In contrast to previous years, an official said, executives in the financial products division will receive no other compensation, such as stocks or stock options. And at all of the companies, any executive seeking more than $25,000 in special perks — such as country club memberships, private planes, limousines or company issued cars — will have to apply to the government for permission. The administration will also warn AIG that it must fulfill a commitment it made to significantly reduce the $198 million in bonuses promised to employees in the financial products division. -

Ja keeratigi müügikraanid lahti, kas huvi jätkub 23:00 või suudavad dipbuyerid üles osta?

-

Bloomberg reports that Rochdale's Bove cuts WFC to Sell from Neutral... ja WFC juba -3.7%

-

Short natuke CTXS @ $39.60.

Licence revenue hädine ja guidance pole ka päris see, mida näha tahetakse praegu minu arvates. Vt PLCM käitumine täna. -

CTXS kaetud @ $38.7 avg.

Ilmselt läheb veel, aga ei maksa ahneks ka minna.