Börsipäev 9. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Aasia on täna hommikul jätkamas kauplemist punases, eesotsas Jaapaniga, kus kolmanda kvartali majanduskasvu korrigeeriti 0.7%-lt 0.3%-le. Sellises mahus revideerimise tingisid peamiselt ettevõtete kapitalikulutuste, valitsuse kulutuste ja varude ümberhindamine. SKT deflaator revideeriti 0.2%-lt -0.5%-le, mis tähendab, et deflatsiooni mure pole veel kusagile kadunud ning kombineerituna tugeva jeeniga rõhub Tõusva Päikese Maa kasvuväljavaated.

Goldman Sachsi kommentaar:

We think GDP growth from the Oct.- Dec. quarter through mid-2010 is likely to slow to nearly zero due to a fallback in consumption, which government stimulus revved up through the Jul.-Sep. quarter, and the partial suspension of the FY2009 supplementary budget. If the yen stays at the current level of strength over this span, that would squeeze profits at exporters in manufacturing industries and create further substantial downside risks to the economy in terms of employment and wage reductions.

USA makro osas on tänane päev taas võrdlemisi vaene ning pingsamalt jälgitakse seetõttu olukorda Kreekas ja Dubais. Oktoobrikuu kaubandusbilansi avaldavad Prantsusmaa ja Saksamaa, mis jagavad vihjeid eksporditööstuse kohta.

-

Jaapani uus valitsus tahab hirmasti majandust toetada, kuid selleks on raske vahendeid leida (sellel nädalal tutvustati uut stiimuli, mis moodustab 1.5% SKPst ja jääb ilmselt liiga väikseks). Valitsus peab hetkel saavutama eelarve ülejäägi 3% SKPst, et ainuüksi intressimakseid tasuda (eeldusel, et 10. a valitsuse võlakirja intress püsib 1.5% juures). Jaapani võlaprobleemid on viimasel ajal tekitanud suurt huvi JGB shortimise vastu:

Either the economy is shot, in which case Japan will have to issue more debt and yields will rise, or it is going to recover, in which case current low yields make little sense. (Although with deflation of 2 per cent, the real yield on Japanese bonds is rather high.)

-

Eile lubas Obama kulutada osaliselt TARPist ülejäänud raha töökohtada loomisele & osa raha pidavat minema defitsiidi vähendamiseks:

Mr Obama’s proposals, which officials cautioned did not amount to a “silver bullet”, would represent a more targeted effort to stimulate hiring. His plans include help for small businesses, up to $50bn in new spending on infrastructure and tax incentives for people who make their homes more energy-efficient. Mr Obama also backed Congress plans to extend unemployment insurance and cut the cost of health insurance for people who have lost their jobs.

Mr Obama stressed that an unspecified portion of the $200bn fiscal windfall would go towards deficit reduction... (pikemalt siin)

-

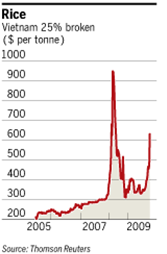

Sellel aastal riisisaak väga kehv olnud & selline graafik tekitab 2008. aasta alguse tunnet toiduainete inflatsiooni suhtes (eriti Aasias):

-

Pärast väikest puhkust nüüd tagasi sadulas.

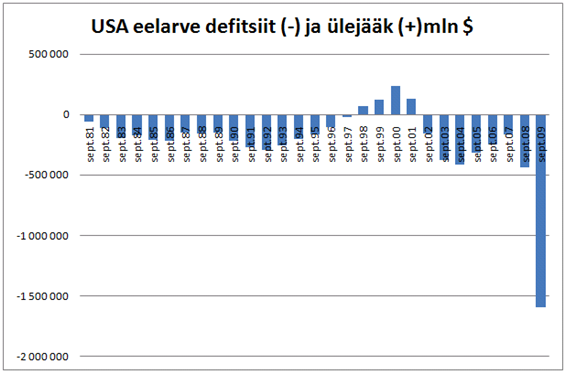

Tuletame veel kord meelde, kui suur USA defitsiit siis ikkagi on. Unspecified amount $200 miljardist on ikka kole-vähe.

-

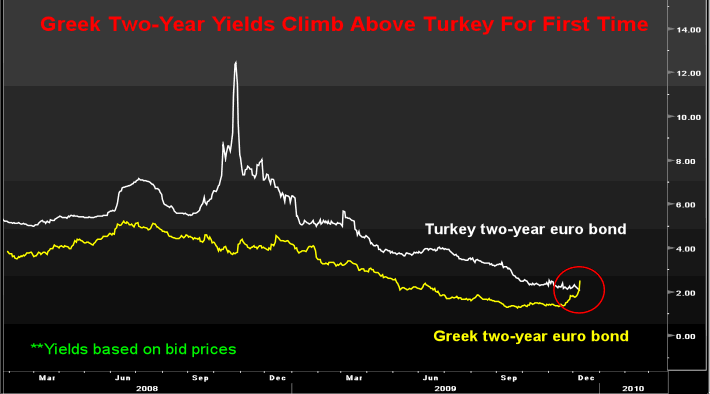

Ükskõik kui julgustavaid kommentaare Kreeka finantsminister riigi pangandussektori ning riigi kredibiilsuse kaitseks ka ei anna, on hirmul suured silmad. Kreeka 10a võlakirja yield on täna kerkinud veel 25 baaspunkti võrra 5.59%-ni ning erinevus Saksa 10a võlakirja tulususe vahel nüüd 245 baaspunkti versus 209 eile sulgudes.

-

Kurioosne on mõelda, et investoritel jagub vähem usaldust Kreeka kui Türgi vastu, kes on üritanud nüüd juba üle neljakümne aasta Euroopa lõimumisprotsessist osa saada. Bloombergi allolevalt graafikult on näha, et esimest korda ajaloos ületab Kreeka valitsuse 2a võlakirja yield Türgi ekvivalentset võlakirja. Ning alles eelmisel nädalal tõstis Fitch Türgi riigireitingut kahe pügala võrra BB+ peale, tuues välja majanduse vastupidavuse globaalses kriisis.

-

fun, see on päris hea viide.

Äkki on prognoosi aluseks midagi Taylori-reegli laadset, mille kohaselt intressimäärad peaksid täna olema -2,25% juures (ehk spread reaalsete määrade ja mudeli vahel on mitme aastakümne suurim)... Kuna aga nominaalset määra ei saa nullist madalamaks langetada, siis on üle mindud otsese rahapakkumise reguleerimisele. Loogika võib siis olla selles, et kui Fed hakkab raha süsteemist uuesti kokku korjama, läheneb negatiivne Taylori-reegli järgi hinnatav intressimäär nullini ning jõuab siis vastavalt 2012. aastaks sinna, kus seda tõstma hakataks. Aga see on selline oleks-schmoleks, lõdva rahapoliitika jätkumisele viitaks see endiselt. -

Huvitav, kas nad ka ise julgevad sellele mängida? Kuna võrreldes konsensusega ollakse väga erineval arvamusel, on võimalus ju derivatiiviturul sellele ka väga tugevalt mängida. Kui see nii on, siis tasub meeles pidada, et kui intressimäärad jäävad madalaks ebanormaalselt pikaks ajaks, võidab sellest eelkõige Goldman ja et kui Föderaalreserv peaks millalgi siiski määrade kergitamisega üllatama, võib Goldmanil kapis luukeresid peidus olla.

-

Briti rahandusminister A. Darling lubab majandust toetada, kuni kasvus ollakse kindlad & seejärel järgneva nelja aasta jooksul eelarve puudujäägi poole väiksemaks teha (üsna ambitsioonikas). Rahandusministeeriumi hinnangul jääb järgmise aastal majanduskasv 1-1.5% vahemikku.

Darling: No windfall tax on banks

Darling: 50% tax on banker bonuses over $40,700

-

Härrased, konsensus on teatavasti sea ja käo aritmeetiline keskmine :-D

-

USA kinnisvaraturul paranemismärgid:

Demand for U.S. home loans rose to the highest level in about two months, mainly from borrowers locking in low mortgage rates by refinancing, the Mortgage Bankers Association said on Wednesday.

Nearly three of every four loan requests last week was for a refinancing, the industry group said.

Total mortgage applications, based on the group's seasonally adjusted market index, rose 8.5 percent to 665.6 last week to the highest since early October.

Demand for loans to buy a home increased by 4.0 percent, while refinancing applications jumped 11.1 percent to 3,185.9 last week. This was the highest refinance index level in about two months. (cnbc)

-

S&P kinnitas Hispaania pikaajalist AA+ ja lühiajalist A-1+ lühiajalist krediidireitingut, kuid langetas stabiilse väljavaate „negatiivse“ peale.

-

Euroopa turud:

Saksamaa DAX -0,06%

Prantsusmaa CAC 40 -0,06%

Inglismaa FTSE 100 +0,20%

Hispaania IBEX 35 -0,11%

Rootsi OMX 30 -0,42%

Venemaa MICEX -0,26%

Poola WIG -0,64%Aasia turud:

Jaapani Nikkei 225 -1,34%

Hongkongi Hang Seng -1,44%

Hiina Shanghai A (kodumaine) -1,74%

Hiina Shanghai B (välismaine) -1,01%

Lõuna-Korea Kosdaq +0,17%

Tai Set 50 -0,61%

India Sensex 30 -0,59% -

Stay Disciplined and Stay Defensive

By Rev Shark

RealMoney.com Contributor

12/9/2009 8:53 AM EST

The first and best victory is to conquer self.

-- Plato

What has been so remarkable about the market since March is how quickly and completely we have recovered every time we've been on the brink of a breakdown. We might not quite be on the brink of a breakdown now, but yesterday we had some poor action and suddenly there is a lot more caution and worry. All the folks on CNBC were suddenly quite negative and there are proclamations once again that we have seen the highs for the year.

We have had a lot of top calls this year, but the market just keeps rolling along. One of these days we are going to have a breakdown that we won't recovery from so easily, and it is going to be painful because the sanguine bulls who have been bailed out over and over again will suddenly be trapped.

From a trading standpoint, the proper methodology is to be disciplined and turn defensive when stocks start to act poorly. You honor your stops and decrease your market exposure. But in this market, being disciplined has been a very poor strategy. The minute you are on the sidelines or putting on some shorts, the market reverses up -- and not only does it reverse, but it goes straight back up without a pause, making entry points very difficult.

So here we are once again, with the market looking shaky and discipline demanding that we be more defensive and raise some cash. We really have no choice but to be more defensive. We might end up feeling foolish once again when the market comes roaring back, but the fact that the market has had a long series of "V"-shaped bounces doesn't mean we can count on it happening again. We can't become undisciplined simply because the market has not acted in typical fashion this year.

I don't want to sound too bearish here. We've only had a mild pullback and the major indices are only a few points off this year's closing highs. But the action felt much worse than it looked yesterday, and that was probably due to the fact that the weak-dollar plays that have led for so long were being hit the hardest. Oil, gold and commodities fell sharply as the dollar rallied.

The big concern now is that the dollar will continue to strengthen, which will cause some serious repercussions while the massive carry trade is unwound. Market players have been borrowing cheap dollars and using the funds to invest in a variety of assets. If the dollar starts to rise, that strategy won't work as well and assets will be sold to pay back the borrowed dollars.

We'll see how the dollar acts. If it does continue to strengthen, I'll be looking for rotation out of the weak-dollar plays and into other groups like technology, biotechs, medical and maybe retail.

However, the important thing now is to stay disciplined and to not count on the market to keep on bailing us out every time we are in trouble. Protecting capital is always our most important job.

We have a bit of a bounce this morning as the dollar is weakening once again. Gold is up and traders are already eyeing the weak-dollar sectors.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: HITK +9.9%, CMTL +4.1%, COO +3.9% (also upgraded to Outperform from Market Perform at Wells Fargo), AVAV +3.7%... Select oil/gas names showing strength: SU +1.7%, CHK +1.3%, PBR +1.2%, RIG +1.2%, RDS.A +1.0%... Select metals/mining names trading higher: RTP +2.2%, EGO +1.9%, SLW +1.7%, GG +1.5%, ABX +1.4%... Other news: RNWK +13.0% (discloses the Arbitrator disposes all claims pending in the arbitration with VRSN; upgraded to Neutral from Underweight at JP Morgan), EFJI +12.0% (named on contract from U.S. Internal Revenue Service; the maximum total value of the five-year contract is $750 mln; however), NLST +11.5% (still checking), PAL +8.7% (to restart Lac des Iles Palladium Mine and Commence Development of the Offset Zone), DPS +5.8% (PEP reaches agreement to distribute certain Dr Pepper Snapple group brands), RMBS +5.8% (European Commission accepts Rambus commitments in final settlement), RBS +3.4% (HSBC set to buy RBS Asia assets, Indian paper says - Reuters.com), SLE +1.0% (P&G near deal to buy Sara Lee air-care unit for up to $700 mln - WSJ)... Analyst comments: SQNM +6.0% (upgraded to Hold at Auriga), S +5.9% (upgraded to Buy at Citigroup), VNDA +5.2% (initiated with a Buy at Jefferies), JAZZ +4.7% (initiated with a Buy at Jefferies), SWM +4.2% (initiated with a Buy at Goldman; added to Americas Conviction Buy list- Reuters), CA +3.4% (upgraded to Buy from Hold at Deutsche Bank), MMM +1.9% (upgraded to Buy at Citigroup).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: MOV -19.0%, MW -16.2%, NCS -5.9%, MDAS -4.7% (also downgraded to Neutral at Robert W. Baird), CKR -3.5%, TXN -2.2%, SAI -1.9%, PEP -1.5% (also reaches agreement to distribute certain Dr Pepper Snapple group brands)... Other news: NBG -6.1% (Former BOE official Buiter says Greece may be first EU default - Bloomberg.com), WPRT -4.4% (offering to sell its common shares), DNDN -1.8% (announces proposed public offering of common stock of 15 mln shares), MDSO -1.5% (announces the pricing of 5.5 mln shares of its common stock at $15.00/share in a public offering by a number of its stockholders), JOSB -1.1% (ticking lower in sympathy with MW)... Analyst comments: MITI -8.4% (downgraded to Hold at Roth), ACN -2.0% (downgraded to Hold at Kaufman). -

Aga tulles mu eelpool ülesse pandud eelarve defitsiidi graafiku juurde tagasi, siis üks võimalik vastus kulude koomale tõmbamiseks oleks sõjakulutuste vähendamine. Iraak ja Afghanistan kokku lähevad iga aasta USAle maksma ca $0.8-$1 triljon (link siin).

-

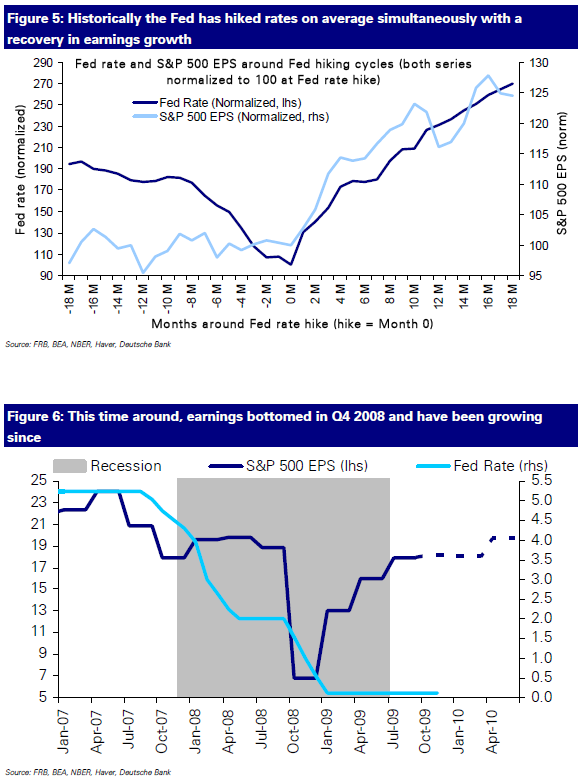

Hea võrdlus, kuidas varem intressimäärasid on tõstetud & kuidas need seekord madalal püsivad (aastani 2012 sellised intressimäärad oleks ajalugu vaadates küll korralik mullistumine):

Allikas: Deutsche Bank

-

Prognoosid järgmise aasta orkaanihooajaks (mõju energia hindadele):

Colorado State University expects 2010 Atlantic storm season to produce 6 to 8 hurricanes, to produce total of 11 to 16 tropical storms; season to produce 3 to 5 major hurricanes - Reuters -

October Wholesale Inventories +0.3% vs -0.5% consensus, prior revised to -0.8% from -0.9%

-

CLY päris ilusti liikunud täna

-

CLY liikus kõigest 48.58 üles ( seega 2093.97%)