Börsipäev 14. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Tänasel kargel hommikul, mil akna taga üle 10 kraadine pakane, kütab loodetavasti toa soojaks USA aktsiaturgude liikumine, mis eelturul on tõusnud juba 0.8% plusspoolele. Nädalavahetuse suurim uudis tuleb Lähis-Idast, kus Abu Dhabi on lubanud Dubaile $10 miljardit abi (link siin) ning kummutab sellega jutud, et Lähis-Idas võiks olla kapitalikriis.

Dubai aktsiaturg on päevaga tõusnud +10.1%, Abu Dhabi turg +7.5%.

-

USAst majandusuudiseid täna oodata ei ole. Homme avaldatakse see-eest tööstustoodangu muutus, tootjahinnaindeksi muutus ning kolmapäeval juba Föderaalreservi intressimäära otsus.

-

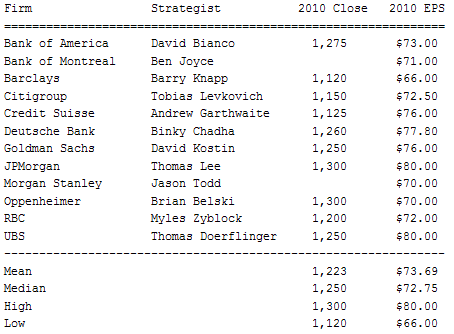

Bloombergi poolt välja toodud strateegide nimekirjas näevad kõik S&P500 indeksit järgmise aasta lõpus tänasest tasemest kõrgemal:

-

Mikk, ma teen nüüd siin Lennart Meri häält ja ütlen... "See....hmm...on....ee....ohu...märk!"

:-D -

"Olukord on sitt, aga see on meie tuleviku väetis" (Meri). Jääme ikka optimistlikuks :)

-

Kui nafta on eelturul vajunud juba protsendi jagu miinusesse, on maagaasi hind samal ajal 2.5% kerkinud. Abiks siinkohal kindlasti suvest alates maagaasisektoris valitsenud väga negatiivsed meeleolud.

-

Täna tasub gaasiettevõtted radaril hoida. Exxon Mobil on otsustanud osta XTO Energy $41 miljardi dollari eest. XTO on eelturul 21% plussis.

Exxon Mobil Corp said Monday it'll buy domestic natural gas giant XTO Energy Inc. in an all-stock deal valued at $41 billion. The agreement, which is subject to XTO stockholder approval and regulatory clearance, will "enhance ExxonMobil's position in the development of unconventional natural gas and oil resources," Exxon Mobil said. Exxon Mobil has agreed to issue 0.7098 common shares for each common share of XTO. The deal represents a 25% premium to XTO stockholders. The transaction value includes $10 billion of existing XTO debt and is based on the closing share prices of Exxon Mobil and XTO on Friday. (marketwatch)

-

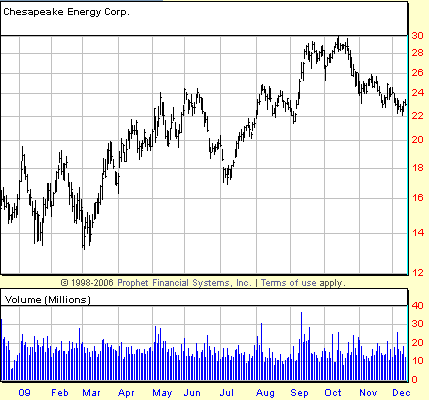

Tegu on siis LHV Maailma Pro all väljakäidud maagaasisektori investeerimisidee Chesapeake Energy (CHK) konkurendi XTO Energy (XTO) ülevõtuga. Exxon Mobili (XOM) tänane käik näitab, et maagaasisektori ettevõtetes peitub väärtust, mida suure rahakotiga nafta-ettevõtted on valmis ära kasutama. Kuigi mõne jaoks võib tulla pettumusena, et XOM ei võtnud XTO asemel üle hoopis CHK'd, ei tasu lasta end liigselt heidutada. Turul on pikka aega olnud jutud pigem BP'st kui potentsiaalsest kosilasest ja mitte XOM'ist... ning kuna CHK'l on ka kvaliteetsemad maagaasireservid kui XTO'l, on võimalik, et XOMi pakkumine CHK eest oleks jäänud lihtsalt liiga madalaks. Igaljuhul CHK aktsia on eelturul 7% kõrgemal ning tänane XOMi käik näitab vaid, millist väärtust peidab endas CHK tegelikult.

-

huvitav link ehk:

http://www.petrostrategies.org/Links/Worlds_Largest_Oil_and_Gas_Companies_Sites.htm -

Jim Crameri kommentaar Exxon Mobili-poolsele XTO Energy ülevõtule on järgmine:

Do you think Exxon (XOM - commentary - Trade Now) is going to buy XTO (XTO - commentary - Trade Now) -- the best of the best -- if it doesn't see the writing on the wall that it needs to have natural gas as part of its filling station repertoire? Do you think Exxon just wants to be in the home heating business? Do you think the most conservative company in the industry is all about just picking up some good domestic reserves when it has ignored doing so for years?

This is the biggest game-changing transaction in the nat gas patch that I can recall, because Exxon just endorsed both its reliability and its cleanliness. Remember, you do not see Exxon bidding on the Iraq fields. While it is doing some exploration across the globe, you bring in XTO because you want to dominate in natural gas at home.

We know that the whole "nat gas as bridge fuel" concept has been scuttled by the president's bizarre insistence that we can use coal and oil until we bridge to clean coal, even though we just gave $3 billion to foreign firms to try to do it.

I think that this move is the move that Andrew Littlefair, the bold CEO of CleanFuel Energy (CLNE - commentary - Trade Now), would have predicted and no one else would have.

It also, as my friend Dan Dicker points out, shows you that there is so much more value in natural gas at $5 than there is oil at $70.

Game-changer! -

Barron'sis intervjuu Doug Kassiga ("I do not believe we have embarked on anything close to a new bull market").

Kassi lemmik lühikeseks müügi idee on hetkel Franklin Resources (BEN):

The market cap is large, around $25 billion. The forward P/E [price/earnings ratio] is at around 18 times, at the upper end of its historic range, which has peaked consistently at about 21 times in every cycle. The shares have nearly tripled from their March low of 37 to around 109.

The problem is that about $70 billion, or 13% of their $523 billion of total assets under management, was in global fixed income as of Oct. 31. And that percentage is much higher if you include the portion of their hybrid total-return funds and their domestic bond funds. So Franklin Resources can be seen as a good short against the emerging bubble in the world's fixed-income market -- as well as a play on the possibility of a recovery in the U.S. dollar. We view it as an absolute short, but we also view it as an attractive pair trade against State Street [STT].

-

Euroopa turud:

Saksamaa DAX +0,77%

Prantsusmaa CAC 40 +0,51%

Inglismaa FTSE 100 +0,98%

Hispaania IBEX 35 +0,63%

Rootsi OMX 30 +0,96%

Venemaa MICEX +0,63%

Poola WIG +0,45%Aasia turud:

Jaapani Nikkei 225 -0,02%

Hongkongi Hang Seng +0,84%

Hiina Shanghai A (kodumaine) +1,72%

Hiina Shanghai B (välismaine) +0,04%

Lõuna-Korea Kosdaq +1,34%

Tai Set 50 +0,89%

India Sensex 30 -0,13% -

The Bulls Need to Show Their Mettle

By Rev Shark

RealMoney.com Contributor

12/14/2009 8:32 AM EST

Happiness is the ability to recognize it.

-- Carolyn Wells

A very slow week of trading has left the market with an interesting setup as we count down the last few days of 2009. Last week wasn't a bad week at all for the indices, as the bulls put some points on the board. However, volume was light, the stronger dollar weighed on some sectors and we had little clear leadership.

The good news is that this churning and consolidating action make for a bullish setup as we enter one of the most seasonally positive times of the year. Not only does the calendar favor the bulls, but we also have the FOMC interest-rate announcement on Wednesday, which also consistently attracts buyers. We have sold off following the FOMC announcement a couple times recently, but we have tended to rally before the report all year.

Overall, it looks quite promising for the bulls and, at a minimum, there isn't any compelling reason to be negative on the market at this point. There are just too many positive factors in play for the next 12.5 days of trading.

The more intriguing question is what sectors the market will favor for the next couple of weeks. Last week, the dollar strengthened quite a bit, which sent gold down sharply. Other 'weak' dollar groups -- oil, agriculture and commodities -- also struggled, but were more mixed.

I hypothesized that a strengthening of the dollar might hasten a rotation into technology stocks, particularly the big-cap names, like Google (GOOG) , Apple (AAPL) , Research in Motion (RIMM) , Priceline (PCLN) , Amazon (AMZN) , etc. But while small-cap semiconductors showed some good relative strength, the big-cap tech names struggled and did not exhibit much leadership.

Banks were also a mixed bag, as they failed to rally much on TARP repayment news. There was a brief burst of optimism a week ago on news that Bank of America (BAC) was repaying the funds and undertaking a secondary offering, but the stock went nowhere. This morning, Citigroup (C) is making a similar announcement and nothing much is happening there.

My main focus is usually on what I call a "hot pocket" of momentum action. One of the best groups recently has been small-cap China names, but the action there started to narrow and slow down last week. When we dig deeper, we see that some of the best performance is coming in odd groups, like utilities and textiles.

While the major indices do look good, it is a narrow market without any powerful leadership. There are a few areas of interest and some good positive action to be found, but no real coherent theme.

We have plenty of positives driving the overall market, so we need to keep digging and looking for emerging opportunities. The bulls are in pretty good shape, but they need better energy. This week should be a good opportunity to show their conviction.

-----------------------------

Ülespoole avanevad:

M&A news: CAMD +48.8% (California Micro to be acquired by ON Semiconductor for $4.70/share in all cash tender offer), XTO +20.5% (to be acquired by Exxon Mobil in all stock deal valued at roughly $51.69/share), JAVA +9.9% (EU regulators welcome Oracle proposal on Sun bid - WSJ)... Select financial names showing strength: BCS +2.1%, CIT +1.8%, CS +1.4%, DB +1.2%, HBC +1.1%... Select metals/mining related names showing strength: ABX +1.7%, RTP +1.5%, GOLD +1.4%, BBL +1.4%... Select oil/gas names trading higher boosted by XTO news: RRC +6.7%, CHK +6.5%, SNP +5.9%, EOG +5.5%, SWN +4.4%, APC +4.2%, DVN +4.1%, KWK +3.7%, SU +2.7%, COG +2.6%, APA +2.5%, E +1.7%, OXY +1.7%, STO +1.5% (upgraded to Equal Weight at Barclays), RDS.A +1.2%, HAL +1.1%... Select airlines ticking higher: AMR +4.0%, LCC +3.5%, UAUA +2.9%... Other news: LUNA +44.2% and HNSN +12.4% (Hansen settles litigation against Luna Innovations), GERN +6.4% (announces the U.S. Patent Office grants request for an interference with U.S. Patent No. 7,510,876 to Novocell), V +3.3% (will replace Ciena in the S&P 500; also upgraded to Outperform from Neutral at RW Baird), CYD +3.0% (announces joint venture in China with Caterpillar to remanufacture diesel engines), ENER +2.7% (announces 3 Megawatt rooftop solar project in Spain), SAI +2.2% (will be add to S&P500), SNH +2.1% (will be add to S&P400), CLF +2.1% and ROST +2.0% (will be add to S&P500), MJN +1.8% (will replace MBI in the S&P 500; also upgraded to Outperform at Credit Suisse), LDK +1.6% (signs contract to supply solar modules to Belgium-based Enfinity; co will deliver approx 50 MW of solar modules to Enfinity in 2010), SAP +1.5% (still checking), COH +1.2% (mentioned positively in Barron's), AXA +1.2% (AXA, AMP raise bid for AXA Asia Pacific to $11.7 bln - Reuters.com; mentioned positively in Barron's), ONXX +1.2% (Nexavar in combination with chemotherapy demonstrates activity in patients with advanced breast cancer in two phase 2 studies; Patients receiving capecitabine plus Nexavar had a 74% improvement in progression-free survival), GMCR +1.1% (will be add to S&P400)... Analyst comments: TKC +4.2% (upgraded to Buy from Neutral at Goldman; added to Pan-Europe Buy list- Reuters), RSH +3.7% (upgraded to Overweight at Barclays), NFX +3.6% (upgraded to Overweight at Barclays), ARMH +3.2% (initiated with a Buy at Deutsche Bank), NYB +2.7% (upgraded to Buy at Stifel Nicolaus), VIP +2.4% (upgraded to Buy from Neutral at Goldman; added to Pan-Europe Buy list- Reuters), ITW +2.1% (upgraded to Outperform at FBR), PM +2.0% (added to Conviction Buy list at Goldman- Reuters), TCB +1.1% (upgraded to Neutral from Underweight at JP Morgan).

Allapoole avanevad:

M&A news: TRA -18.4% (Terra Industries rejects CF Industries' latest proposal to be acquired for $29.25 in cash plus 0.1034 of a share of CF common stock per Terra share; trading ex dividend), XOM -1.7% (XTO Energy to be acquired by Exxon Mobil in all stock deal valued at roughly $51.69/share)... Other news: LYG -27.3% (welcomes 95% share take-up - BBC; trading ex dividend), CVG -4.9% (removed from S&P500), MBI -4.1% (MJN will replace MBI in the S&P 500), C -3.0% (Citigroup, U.S. government and regulators agree to TARP repayment), SCHW -2.5% (reports monthly activity highlights; total client assets up 26% from Nov. '08, up 4% from Oct. '09), MTU -2.1% (sets share price 428 yen, to raise $11.6 billion - Reuters.com), AMZN -1.0% (mentioned negatively in Barron's)... Analyst comments: KIM -1.4% (downgraded to Sell at Citigroup). -

Jefferies on tõstnud Amazoni (AMZN) hinnasihi $120 dollari pealt $150 dollarile & ootab väga head neljandat kvartalit (AMZN alustab kauplemist -2% langusega):

The firm notes that overall ecommerce is doing much better than a year ago, up 3% Y/Y Nov 1-Dec 6, vs. a 3% decline last year. The firm finds AMZN well positioned to be very well positioned to benefit from the robust e-commerce activity in 4Q and further macro improvement in 2010, which should help support the company's valuation overtime.

-

Citi puhul ei tõlgenda investorid TARPi tagasimaksmist tugevuse märgina (tingimused ka teistest tagasimaksmistest teised) & aktsia on -4.5% miinusesse vajunud.

-

Kui mu mälu ei peta, siis Kass nimetas BENi oma lemmikshordiks juba siis kui aktsia oli $70ish...

-

Müüsin GE maha ja ostsin GSi asemele.