Börsipäev 29. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Ongi selle aasta kauplemispäevadest järele jäänud veel vaid 3. USAst jääme ootama Eesti aja järgi täna kell 16.00 avalikustatavat Case-Shilleri 20-linna indeksit, mis näitab kinnisvara hindade muutust. Neid Case-Shilleri indekseid on päris mitu erinevat ning kes soovib, siis lisa saab siit lugeda - link. Novembri näidult oodatakse ca 7.1%list langust.

Kell 17.00 avalikustatakse detsembrikuu tarbijausalduse näitaja - ootus 53 punkti. Tarbijausalduse näitajale pöörab turg reeglina suurt tähelepanu.

USA eelturg aastalõpule kohaselt väikeses plussis.

-

Baltic Dry Index, mis käis novembris selle aasta uutel tippudel ning on pärast seda sooritanud taas märkimisväärse korrektsiooni, hiilgab sellegipoolest üsna silmapaistva aastase tootlusega. Rahvusvahelistel mereteedel vedamistasusid kajastav indeks on aasta algusest tõusnud ligi 290%, mis ületab 2003. aastal püstitatud rekordit (174%). Milliseks kujuneb sõit järgmisel aastal, sõltub paljuski sellest, kuidas jätkub kaubavahetuse taastumine, kuid oluliseks jääb ka küsimus sektorit kummitava nõudluse ja pakkumise ebaühtluse osas. Bloomberg on avaldanud artikli tankerite üsna tumedast eelseistavast aastast, kui tänavu rekordilises mahus nafta hoidlatena kasutatatud laevad peaksid lepingute alt vabanema ning turul vedamistasusid 25% võrra kukutama.

-

Pühade ajal on Fed vaikselt tutvustamas meetmeid, mis peaks aitama üleliigset likviidsust majandusest kokku tõmmata. Eile teatati, et pankadele plaanitakse müüa intressi kandavaid deposiite (term deposit program). See peaks tekitama initsiatiivi panna raha keskpanka, mitte laenuturule. Kuna süsteemi on pumbatud tohutult likviidsust, siis teevad sellised lisameetmed lõdvast monetaarpoliitikast väljumise valutumaks & aitavad ühel hetkel üleliigset raha majandusest kergemini eemaldada.

-

Hetkel testib Fed ka reservide repotehinguid, millega keskpank müüb oma portfellist kommertspankadele väärtpabereid koos kokkuleppega need hiljem tagasi osta. Sellega liigutavad väärtpaberite ostjad samuti oma reserve keskpanka.

-

Vodafone (VOD) teatas, et ostab Türgi telekomioperaatori Borusan Telekomi, et parandada oma 3G teenuste kvaliteeti. Tehingu hinda küll ei avaldatud, kuid pigem on Borusan Telekom Vodafone'i jaoks üsna väike tegija. Vodafone'i (VODi) aktsia pakub meie arvates jätkuvalt soodsat võimalust panustada 3G funktsioonide laialdasemele levikule ja oleme seda pikemalt tutvustanud ka Pro all.

-

Alates novembri keskpaigast börse tabanud vaikus on sundinud analüütikuid langetama maaklerfirmade 4Q EPSi prognoose:

Bank of America Merrill Lynch analyst Guy Moszkowski cut his fourth-earnings estimates for U.S. brokerages, citing trading deceleration starting in mid-November. His estimate on Goldman Sachs EPS was cut to $5.74 from $6.57, on Morgan Stanley was cut to 40 cents from 47 cents, on J.P. Morgan Chase was cut to 68 cents from 71 cents and was left unchanged at Citi with a 36 cent loss due to its large share base (marketwatch).

-

Aktsiaturud jätkavad jõulu-/aastalõpu rallit. USA futuurid on eelturul ca 0.4%-0.5% plussis ning teinud sellega uued 15-16 kuu tipud.

-

BofA/Merrill lowers ests on GS, MS and JPM.

-

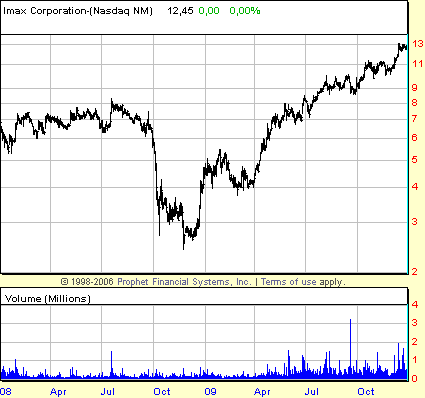

Imaxi (IMAX) investorite poolt kauaoodatud film 'Avatar', millest kirjutasime juba ideed avades veebruaris LHV Maailma Pro all, on tänaseks ca 2 nädalat nüüd kinolavadel olnud. Kuigi paljud kartsid nn 'sell the news' reaktsiooni filmi linastumise päevadel, on see siiski tulemata jäänud. Lihtsalt filmielamus, mida Imaxi 3-D kinod pakuvad, on olnud niivõrd fenomenaalne, et paneb mõtlema kinomaailma tuleviku võimaliku muutumise peale.

Täna on Piper Jaffray kinnitanud Imaxi ostusoovitust ja oma $16list hinnasihti.

-

Amazon.com tgt upped to $172 from $163 at Piper Jaffray - CNBC

Amazon.com target raised to $155 at Kaufman Bros as data points, checks indicate solid Q4 upside; firm also raises FY10 ests -

Kes ei ole veel lugenud, siis täna on Bloomberg teinud ühe artikli Faberi ja Biggsi mõtetest. Mõlemad mehed usuvad dollari tugevnemisse ja ütlevad, et dollar võib euro vastu tugevneda 10% jagu ning vastupidiselt senistele trendidele võib kaduda seos nõrga dollari ja kõrgema aktsiaturu vahel ning koos dollari tugevnemisega tõusta ka S&P500 5% kuni 10%. Link siin.

-

Potash fertilizer names should correct following POT's U.S. granular potash price cut of 14% out yesterday afternoon - Soleil

Soleil notes that in the wake of the China settlement at $350 per tonne cfr, yesterday afternoon just before the close POT slashed its U.S. granular potash list price by 14%, $65 per ton. Since equity valuations tend to follow the commodity price in basic materials, they believe potash-fertilizer names should correct following this announcement; e.g. their work suggests that a $400 per ton Midwest potash price implies a $90 POT share price.

Kas siit võik saada trade? Eelturul kauplemas 0.5% madalamal $111.20 tasemel. Samas mitmed analüüsimajad juba viimase nädala jooksul väetise hindasid kärpimas, kuid aktsia hind rühib ikka ülespoole. -

Goldman Sachs (GS) target raised to $240 at JMP Securities.

-

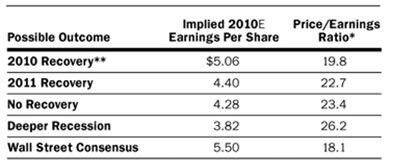

USAs transporditakse ca 40% kaubast raudteed mööda, mistõttu annavad sektori ettevõtted päris hea ülevaate majandustegevusest. Siin on toodud USA suurima raudteefirma Burlington Northerni prognoosid, mis tehti, kui arvestati W. Buffetti ostupakkumist:

Siit hästi näha, kuidas Wall Streeti konsensus on ettevõtte enda optimistlikust stsenaariumist märgatavalt optimistlikum. Järgmine aasta peavad paljud ettevõtted analoogselt enda ootusi ületama, et Wall Streeti rahuldada. Saab näha, kas ootused 2010. osas liiga kõrgele krutitud või mitte.

-

Külmad ilmad USAs on tõstnud maagaasi hinna $6 mcf'ist. Tugev kontrast võrreldes suviste alla $3liste hindadega... ja meenutagem, et siis leidus igasuguseid artikleid, mis põhjendasid, miks maagaasi õiglane hind peaks olema alla $3. Näiteks Lynchi mõtted augustis: "Lynch said the price for gas is likely to stay down. "People believe natural gas will remain relatively cheap for the foreseeable future, say in the $4 to $5 range instead of the $10 range, which some people were thinking would become the norm," he said."

-

Imax highlighted as Piper's top small-cap pick for 2010; firm believes growing theatre footprint, strong 2010 film slate, and improving brand awareness will drive EBITDA growth of 30%+ over the next several years

IMAX ka LHV Pro investeerimisidee. -

October CaseShiller Composite -7.28% YoY vs. -7.20% consensus; prior revised to -9.27% from -9.36%

-

Euroopa turud:

Saksamaa DAX +0,24%

Prantsusmaa CAC 40 +0,51%

Inglismaa FTSE 100 +0,58%

Hispaania IBEX 35 +0,01%

Rootsi OMX 30 +0,28%

Venemaa MICEX +0,12%

Poola WIG +0,38%Aasia turud:

Jaapani Nikkei 225 +0,04%

Hongkongi Hang Seng +0,09%

Hiina Shanghai A (kodumaine) +0,72%

Hiina Shanghai B (välismaine) +0,14%

Lõuna-Korea Kosdaq -0,09%

Tai Set 50 +1,40%

India Sensex 30 +0,24% -

Play the Trend

By Rev Shark

RealMoney.com Contributor

12/29/2009 8:38 AM EST

"If we were logical, the future would be bleak, indeed. But we are more than logical. We are human beings, and we have faith, and we have hope, and we can work."

-- Jacques-Yves Cousteau

For the sixth straight day in a row, the major indices are set to gap up at the open. According to SentimenTrader.com, this is only the fourth time in the history of the S&P 500 that this has occurred. What makes this even more remarkable is that it has been happening on steadily declining volume.

That would seem to indicate that we need to be increasingly cautious as the market becomes extended, but with only three days of trading left in 2009, market conditions are highly manipulated, and it's impossible have confidence that we won't continue to be pushed higher as market players make tax-related moves and try to add some performance to their results.

If the situation wasn't already tricky enough, we have the added factor of some of the lightest volume in years. It is always slow during the holidays, but this year volume is even more abysmal than usual.

It is fitting that we are ending this year with another one of these remarkable runs where we go up multiple days in a row on thin volume. It has occurred numerous times this year, most notably in July following bullish comments by Meredith Whitney and some strong earnings reports. There were other big runs in March and in early September, October and November.

I don't know how many times this year I have written how these low volume V-shaped moves were hard to trust technically but how it was even more difficult to fight the trend. If you have tried to catch tops in the market this year, the chances are very good that you were early and ended up serving as short-squeeze fodder.

So here we are once again with a market that is technically extended on light volume but with conditions in place that make it extremely dangerous to anticipate a top. End-of-the-year window dressing, positive seasonality and the performance-anxiety of money managers all give the bulls an advantage in keeping this market running to the upside.

My advice continues to be that we should play the trend but not be overly confident or complacent. That means taking some gains when we have them, keeping stops fairly tight and maybe even hedging a little. On the other hand, the bulls have consistently shown us this year that they can take this market up much higher than seems reasonable, and there isn't much to stop them from doing it again.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CKSW +3.9%... Select metals/mining names trading higher: RTP +2.6% (Bemis provides update on status of pending Alcan Packaging Food Americas acquisition; expectation that regulatory approval will be received in early 2010), BBL +2.5%, MT +2.4%, BHP +2.1%... Select mortgage/insurer related names showing continued strength: FNM +7.9%, FRE +6.0%, PMI +3.1%, RDN +2.5%, MBI +1.5%, AIG +1.6%... Other news: BNVI +25.0% (announces publication describing first novel dual mTOR Inhibitor, BN107, for the treatment of breast cancer), IPSU +5.7% (Settles $345 Million Insurance Claim), VVUS +5.5% (submits Qnexa new drug application to the FDA for the treatment of obesity), PAR +4.8% (continued strength from yesterday's 10% climb), CZZ +4.4% (boosted by climbing sugar prices; also upgraded to Overweight at JPMorgan), VICL +4.2% (announces the publication of data documenting the successful pilot lot production and initiation of animal immunogenicity testing of a Vaxfectin-adjuvanted DNA vaccine), ING +1.3% (still checking)... Analyst comments: AMZN +1.0% (tgt upped to $172 from $163 at Piper Jaffray).

Allapoole avanevad:

M&A news: TRMS -18.2% (Arigene announces termination of tender offer to purchase and return of validly tendered shares of common stock of Trimeris)... Select potash related names seeing modest weakness: IPI-1.3%, POT -1.2%, MOS -1.1%... Other news: CAF -10.4% (trading ex dividend), UCBI -10.0% (to temporarily suspend stock dividend), ALSK -5.5% (trading ex dividend), AGNC -5.2% (trading ex dividend), SBIB -4.8% (Sterling Banc and First Banks announced the termination of the purchase and assumption agreement)... Analyst comments: UNH -1.0% (downgraded to Hold at Standpoint). -

Tarbijausaldus vastavalt ootustele:

December Consumer Confidence 52.9 vs. 53.0 consensus; prior revised to 50.6 from 49.5 -

Five-year notes auction yields 2.665% with bid-to-cover of 2.59The results of the previous 5-year auction and the averages for the previous 11 sales this year were: Bid-to-Cover: prior 2.81, average 2.33... Indirect Bidding: prior 60.9%, average 45.9%.

-

"Awards nn% of bids at high" reale ka ajaloolist võrdlust on anda või?

indirect seekord 18,44 / 42-st = 43,9% -

millega seda süüakse?

-

2009 aasta keskmine: bid-to -cover 2.31 and indirect bidder 45.8%.

The market is looking for a higher, wide range of 2.655% to 2.685% yield as they lower the bar a touch in the face of yesterday's 2-yr auction and ahead of the 7-yrs dropping tomorrow in thinned, erratic action. The market will almost certainly react poorly on the results unless they are somehow off the charts in a positive way.

Viimane lause ilmestab hästi hetkel valitsevaid meeleolusid. -

U.S. 5-year treasury auction table

PS: LHV võiks selle graafiku oma serverisse võtta.

PS: LHV võiks selle graafiku oma serverisse võtta. -

Tehtud!