Börsipäev 15. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Kuna viimaste päevade põnevaimad liikumised on tulnud vaieldamatult Eestist, alustame tänast börsipäeva Olympic Entertainment (OEG1T) aktsiagraafikuga. Ettevõtte aktsiahind on viie börsipäevaga kerkinud 76 sendi pealt 97 sendi peale ehk 27% tõusu. Huvi ja aktiivsus Eesti börsil on lõpuks ometi taastanud - oma roll siin paraneval globaalmajandusel, Eesti majandusel, Eesti väljavaadete üha suuremal paranemisel euro saamise osas, krooniintresside langemisel ja kodumaise raha börsile suundumisel ning välisinvestorite potentsiaalse huvi kasvamisel.

-

Meie poolt jälgitavatest aktsiatest suurima ralli on teinud jaanuari 10 kauplemispäeva jooksul hoopis Merko Ehitus (+31.5%).

-

Kui rääkida USA turust, siis Eesti aja järgi kell 15.30 ootame detsembrikuu tarbijahinnaindeksi muutuse näitu (ootus +0.2%) ning tuumikosa näidu muutust ilma toidu ja energiata (ootus +0.1%). Kell 16.15 teatatakse veel detsembrikuu tööstustoodangu muutus, kust oodatakse ca 0.6%list kasvu ning 16.55 tuleb Michigani sentimendi indeks käimasoleva jaanuarikuu kohta - sealseks ootuseks on 74 punkti vs detsembris nähtud 72.5 punkti. Seega sentiment peaks jätkuvalt paranema.

-

Euroralli kütab Eesti aktsiaturgu võimsalt. Siinkohal tabel maailmaindeksite käesoleva aasta tootluste kohta eilse sulgumisega. Seega OMXT-le tuleb juurde veel arvestada tänane +4.5%.

-

Lähme nüüd ajas täpselt 1 aasta tagasi päeva 15. jaanuar 2009. Sel päeval tegi nafta hind uusi mitme aasta põhju ja kauples alla $35 barrelist. Sellest, et niivõrd madalad hinnad saavad energiaturul olla vaid väga lühiajalised ning et palju kallimad hinnad on meid ees ootamas, kirjutasin samal päeval avaldatud artiklis 'Nafta hind teeb uusi põhju - kuid mitte kauaks!' (klõpsates artikli nimel, avaneb link).

Täna, 12 kuud hiljem maksab naftabarrel $78.7, mis on aastatagusest $35lisest hinnast 125% enam. Koos globaalmajanduse kasvu taastumisega on energiahindade jätkuv kallinemine minu arvates paratamatu. Aastataguse hinna olen alloleval graafikul tähistanud musta ringiga:

-

USA poolt Haiti maavärina ohvritele lubatud abi $100 miljonit on 0.0007% USA SKPst. Eesti poolt lubatud 1 miljon on Eesti SKPst 0.0005%. Numbrid enam-vähem võrdväärsed. Seega mõned mürgised väited, mida olen kuulnud Eesti abi vähesuse teemal, ei ole minu arvates õigustatud.

-

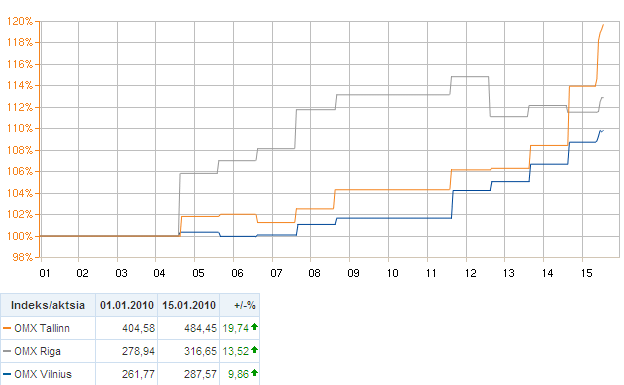

Viitsib keegi konstrueerida OMXT, OMXR ning OMXV käesoleva aasta jooned ühele graafikule?

-

Aga palun...

-

OMX1T indeks ühe päevaga tõusnud +7.36%. Muljetavaldav tõus, mis kindlustab Eesti positsiooni Erko poolt siia hommikul üleslaetud maailma parima aktsiaturuna 2010. aastal.

-

JP Morgan Chase prelim $0.74 vs $0.61 First Call consensus

JP Morgan Chase revs $25.24 bln vs $26.80 bln First Call consensus

Aktsia eelturul kerges miinuses -

Tänan. ETL lahkumisega OMXT-st väga volatiilne (mõlemas suunas) indeks saanud.

-

TAL1T moodustab pea pool Tallinna börsi tutukapitalisatsioonist. Seega Tallinki aktsia liikumine mõjutab OMXT indeksit kõvasti.

-

December CPI M/M +0.1% vs +0.2% consensus, prior +0.4%

December Core CPI M/M +0.1% vs +0.1% consensus, prior 0.0% -

USA alustab tänast päeva punases. Suuremad indeksid ca 0.3% kuni 0.5% miinuses.

Saksamaa DAX -0.79%

Prantsusmaa CAC 40 -0.39%

Inglismaa FTSE 100 +0.11%

Hispaania IBEX 35 -0.08%

Rootsi OMX 30 -0.30%

Venemaa MICEX +0.22%

Poola WIG -0.05%Aasia turud:

Jaapani Nikkei 225 +0.68%

Hongkongi Hang Seng -0.29%

Hiina Shanghai A (kodumaine) +0.27%

Hiina Shanghai B (välismaine) +0.51%

Lõuna-Korea Kosdaq +1.41%

Tai Set 50 -0.51%

India Sensex 30 -0.17% -

Will the Good Earnings Be Sold?

By Rev Shark

RealMoney.com Contributor

1/15/2010 8:35 AM EST

I am a firm believer that if you score one goal, the other team have to score two to win.

-- Howard Wlkinson

One of the most interesting and difficult things about earnings reports is that the actual numbers are far less important than the market's expectations. What may look good in isolation may turn out to be a huge disappointment if the market was expecting something even better. Adding to the trickiness is that the published earnings estimates of analysts don't necessarily reflect what the market is really expecting. There usually is a vague "whisper number" that is a better measure of true expectations.

With that in mind, we shouldn't be too surprised that Intel (INTC) is trading flat and JPMorgan (JPM) is trading down this morning after releasing what looks to be some pretty solid numbers. This market has been trending up for quite a while, and that means we have already priced in some pretty positive news. Many folks have good profits, and earnings reports often offer a good excuse to lock in some gains -- especially when there is a tepid response to solid numbers.

Last quarter Intel had a rather dramatic "sell the news" response to its report; the stock sank for weeks following a very strong report. A number of other stocks also sold off on good news but the overall market continued to trend upward. The profit-taking reaction was isolated and the market just kept chugging along.

The early indication from Intel and JPMorgan is that there is a predisposition to do some selling. Once a theme like that starts, it often has a tendency to persist as more companies report. It is still quite early and we don't want to be too quick to assume that the buyers won't still jump in after some initial hesitation, but so far it doesn't look like the very good earnings numbers are going to be sufficient to keep some extended stocks moving ever higher.

It's a mistake think that the market is wrong when it doesn't react positively to what seems to be good news. The market is never wrong. It may feel like it's acting irrationally, but that is simply our inability to understand the emotions that are at work. The market may quickly shift, but that isn't because it made a mistake, but rather because it changed its mind. Don't argue with the beast -- there is no way you will ever win that debate.

In addition to earnings reports, we have a lot of talk this morning about the weak euro vs. the dollar. There are obviously some major problems in Greece and concerns that it may spill over to other countries in the eurozone. If the dollar strengthens, we will likely see pressure on oil and commodity stocks that have been some of the best leaders in this market.

Overall it looks like the bulls are going to be challenged a bit today. For quite some time it has been a mistake to bet against them, but if good earnings reports don't generate a better response it is going to cause more folks to think harder about locking in gains. The market is a bit extended, but it still hasn't done anything wrong on a technical basis.

It should be a most interesting battle today, so buckle up and adjust your trading goggles -- we have work to do.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: GNV +6.1%, CRI +3.4% (light volume)... M&A news: BARE +18.1% (Shiseido announces tender offer to acquire Bare Escentuals for $18.20/share), CF +6.6% (CF Industries Withdraws Offer to Acquire Terra Industries and is No Longer Pursuing Acquisition), IDC +4.4% (Data group IDC sounds out likely buyers - Financial Times)... Select semi/tech related names ticking higher following INTC results: TSM +4.0%, AMD +2.0% (upgraded to Outperform at FBR), MRVL +1.0%... Other news: TSFG +11.8% (unit approved as a preferred lender under the U.S. Small Business Administration Preferred Lender Program), TGB +7.8% (project approved by provincial government - BC Local News), MTW +5.0% (seeks amendment to its senior credit facility), RBS +3.4% (still checking), S +2.4% (rebounding from yesterday's 10% decline), UPL +1.8% (Cramer makes positive comments on MadMoney), BRY +0.9% (prices 8.0 mln common shares at $29.25/share)... Analyst comments: RTK +9.8% (initiated with a Buy at Brean Murray), CSE +3.2% (upgraded to Overweight at Barclays), AIB +2.7% (initiated with Overweight and Morgan Stanley), OMX +2.3% (upgraded to Overweight from Neutral at JP Morgan ),IRE +1.1% (initiated with Equal Weight and Morgan Stanley).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: COOL -23.7%, FALC -13.1%, AZZ -10.9%, JPM -1.1%... M&A news: CHRD -5.4% (CDC Software withdraws offer to acquire Chordiant Software and sells entire holdings in company), TRA -3.1% (CF Industries Withdraws Offer to Acquire Terra Industries and is No Longer Pursuing Acquisition), AGU -0.9% (to nominate two directors for election to CF's Board of Directors and calls for removal of poison pill)... Select financial names showing weakness: ING -2.8%, DB -2.8%, UBS -2.5%, CS -2.3%, FITB -2.3%, NBG -2.2%, BCS -1.8%, COF -1.6% (reports December Charge-off and Delinquency Statistics), C -1.4% (Citigroup plans to cap cash bonuses - FT), WFC -1.4%, BAC -1.3% (reports December trust data), MS -1.0%, GS -1.0%... Select metals/mining names showing weakness: MT -2.3%, NG -2.2%, HMY -2.1%, GSS -2.0%, GG -1.2?X -1.0%... Select European drug names trading lower: GSK -1.9%, SHPGY -1.6%, NVS -1.4%... Other news: BTM -9.3% (Brasil Telecom, Tele Norte Leste and Coari decided to postpone the process of the share exchange), ATHX -9.2% (files for a 20 mln share common stock and or warrants offering), GERN -8.0% (announces warrant exchange), HT -6.9% (prices offering of 45,000,000 common shares of beneficial interest at a price of $3.00 per share), BWEN -5.8% (Hearing weakness attributed to pricing of offering), CNXT -5.0% (files $100 mln universal shelf registration statement), SY -2.0% (Vertica announces it prevailed in Sybase patent lawsuit), CHU -2.3% and VOD -1.8% (still checking), GOV -1.0% (prices public offering of 8,500,000 common shares of beneficial interest at a price of $21.50 per share)... Analyst comments: CAAS -6.4% (downgraded to Neutral at Merriman), NVO -2.9% (downgraded to Hold at Jefferies), INCY -2.6% (downgraded to Neutral at UBS), CNW -2.5% (downgraded to Neutral at JPMorgan), PAYX -2.4% (downgraded to Sell from Neutral at Janney Montgomery), TOT -1.9% (downgraded to Hold at ING Group), TOL -1.8% (downgraded to Neutral from Buy at Goldman), DUK -1.6% (downgraded to Underweight at Morgan Stanley), AYR -1.2% (downgraded to Hold at Citigroup), SO -1.0% (downgraded to Underweight at Morgan Stanley), EXC -1.0% (downgraded to Neutral at Goldman), STO -0.9% (downgraded to Sell from Hold at ING Group). -

December Industrial Production +0.6% vs +0.6% consensus, prior revised to +0.6% from +0.8%; Capacity Utilization 72.0% vs 71.8% consensus, prior 71.5%

-

Tuletan taaskord meelde, et kuni esmaspäevani (k.a.) on aega oma 2010. aasta majandus- ja aktsiaturu prognoosid 2010. aasta ennustusfoorumis kirja panna - link siin. Soovitan kõigil julgelt osa võtta.

-

Küsin igaks juhuks targematelt üle. Kas ma saan õigesti aru, et XDE optsioonide lõplik väärtus pannakse paika viimasel kauplemispäeval kell 12.00 (jaan optsioonide puhul siis täna). Kui sel hetkel olen rahast väljas on optsioon aegunud, kui rahas, siis toimub vastalt selle hetke hinnale tasaarveldus?

Settlement Value for Expiring Contracts: The spot price at 12:00:00 Eastern Time (noon) on the last trading day prior to expiration will be the closing settlement. -

KFT Feb 27 puts are active with 4740 contracts trading vs. open int of 4430, pushing implied vol down around 2 points to ~24% -- co is expected to report earnings early Feb

CSIQ Jan 27 calls are active with 2050 contracts trading vs. open int of 960, pushing implied vol down around 64 points to ~64%

CF Jan 100 calls are seeing interest with strength in the underlying stock after co dropped its bid for TRA and AGU subsequently reaffirmed its interest in acquiring CF with 10.2K contracts trading vs. open int of 22.8K, pushing implied vol up around 3 points to ~54% -

Meeldetuletuseks kõikidele, et esmaspäeval 18. jaanuar on USA börsid pühade tõttu suletud.

US Holiday: Martin Luther King Jr. Day