Börsipäev 20. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

Uuendasin taaskord meie tulemuste tabelit - link siin.

Tänasel eelturul ootame tulemusi peamiselt USA pankadelt - Bank of America, Morgan Stanley, Wells Fargo, US Bancorp, State Street jt. Lisaks tulemustele avaldatakse Eesti aja järgi kell 15.30 detsembrikuu annualiseeritud ehituslubade arv (ootus 580 000 ehk sama, mis oli novembris) ning eluasemete ehitamiste number (ootus 575 000 ehk samuti sama, mis oli novembris). Detsembrikuu tootjahinnaindeksilt oodatakse 0.0%list liikumist ning selle tuumikosalt +0.1%.

-

Eestis on oodata täna Rahandusministeeriumilt 2009. aasta riigieelarve kassapõhise täitmise statistikat, mis peaks rohkelt selgust tooma eurole ülemineku osas

-

Eile oli üks päris huvitav artikkel/intervjuu siin, kus räägiti, et Berkshire Hathaway B-aktsiad võivad läbi teha 1:50 spliti ehk praegune B-aktsia hind kukuks ca $3000 pealt ca $60 peale. Põhjus spliti tegemiseks peitub Burlington Northern Railroadi üleostmises, kus väikeinvestorid saaksid muidu B-aktsiaid mitme komakohaga, mida ei oleks turul võimalik müüa või tuleks need kompenseerida rahas. Kui Buffett tahab, et väikeinvestorid B-aktsiaid edasi hoiaksid, tulekski minna spliti tegemise teed, mis omakorda tähendaks, et B-aktsiad võivad ühel päeval kuuluda S&P500 koosseisu (praegu on neil täitamata likviidsuse tingimus ja seda puhtalt kõrge nominaalse aktsiahinna tõttu).

-

Hiina börsid tegid täna korraliku languse - põhjuseks Hiina poliitikute kommentaarid, et sellel aastal jääb uute laenude kasv 16-18% vahemikku (vs 32% eelmisel aastal). Hiina keskpank on kohe aasta algusest üritanud laenuraha kasvu aeglustada ja tõstis eelmisel nädalal esimest korda viimase 18. kuu jooksul kommertspankadele kehtestatud kohustuslikku reservimäära. Stiimulite järkjärguline vähendamine on Hiina investorid selgelt närviliseks muutnud & suurimate börside seas on Hiina sellel aastal olnud siiani kõige kehvema tootlusega.

-

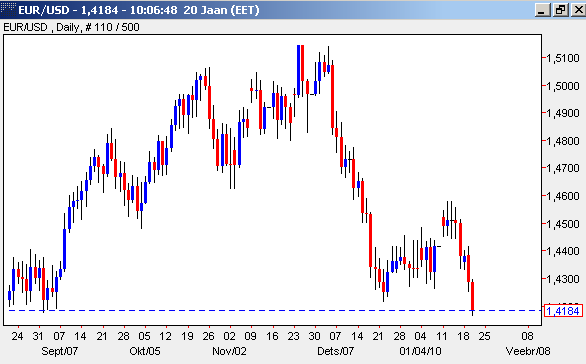

EUR/USD on viimase viie kuu põhjades (põhjuseks Kreeka, millest oleme kirjutanud pikemalt siin):

-

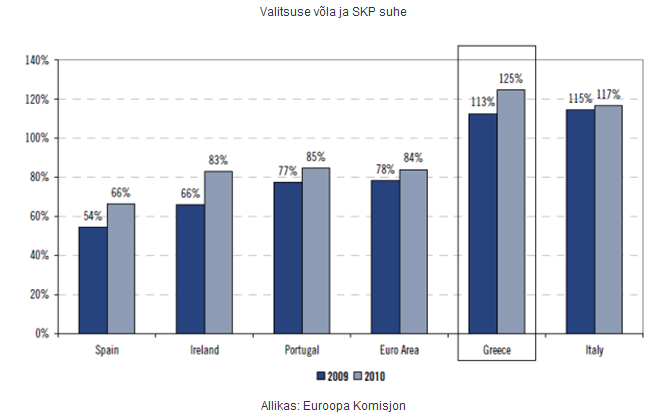

Korralik liikumine väikese Kreeka tõttu. Kui nüüd sarnaste numbritega Itaalia ka kõhu ülespoole keerab on USD selleks korraks hukust pääsenud.

-

Kui Kreekas ületavad valitsuse kulud tulusid ca 12%, siis Portugali eelmise aasta eelarve puudujääk peaks olema ca -8%, Hispaanial ca -9.6% ja Itaalial -5.6%. Valitsuse võla & SKP suhet vaadates on Kreeka & Itaalia väga sarnased.

Aga ega USAs midagi väga roosilist ka pole. Näiteks Kalifonia eelarve puudujääk on 2009/10 ca 6.6% ja Kalifornia majandus on Kreekast 3x suurem.

-

Haitil on inimesed taas tänaval: Magnitude 6.1 earthquake hits Haiti

-

Bank of America prelim ($0.60) includes items vs ($0.53) First Call consensus; revs $25.4 bln vs $26.84 bln First Call consensus.

Coach prelim $0.75 vs $0.72 First Call consensus; revs $1.07 bln vs $1.02 bln First Call consensus.

US Bancorp prelim $0.30 vs $0.29 First Call consensus; revs $4.4 bln vs $4.28 bln First Call consensus. -

Bank of NY reports Q4 EPS of $0.55, ex- $0.04 in a tax benefit offset by restructuring.

(The provision for credit losses decreased to $65 mln in the fourth quarter of 2009 compared with $147 mln in the third quarter of 2009)

-

Kaufman tõstab Google'i hinnasihi enne homme õhtul avaldatavaid tulemusi $740 dollari peale:

Kaufman is raising their tgt to $740 from $645 based on 22x their new FY11 est. For 4Q, they expect approximately 2% upside to Street revs and ~4% upside to Street EPS. They believe strength in the quarter was driven primarily by eCommerce strength. While they believe that investors are expecting solid results, they note that shares are down 6% from recent highs and they believe 2010 Street ests remain conservative (their 2010 revenue est is 3% above Street). For 2010, they move to $21.2 billion and $28.39 from $20.35 billion and $28.00 pro forma EPS (consensus is at $20.525 billion and $26.46).

-

Big News Makes for Tough Trading

By Rev Shark

RealMoney.com Contributor

1/20/2010 8:09 AM EST

Elections are won by men and women chiefly because most people vote against somebody rather than for somebody.

-- Franklin Pierce Adams

The market did a good job yesterday of anticipating a win by the Republican in the Massachusetts senatorial election. Drugs and health care stocks led to the upside as the health care issue suddenly faced some major obstacles.

The market doesn't usually have a strong preference for one candidate over the other, but in this case the promise of some gridlock that would slow down higher taxes and more spending had obvious appeal.

The market is a discounting mechanism that is always looking ahead, which is why we had the "Brown rally" yesterday and are on to new business today. Health-related stocks have already had a big move into the news and now are ripe for some profit-taking.

The market is focusing this morning on efforts by Chinese authorities to slow bank lending and to prevent the economy from overheating. Banks were to increase their reserve requirements by half a percent, and that weighted on oil and overseas accounts.

The Chinese market has been extremely hot for months, but a little over a week ago the momentum started to cool on increased talk about tightening by the China central bank. China has been the economic engine that has propelled oil, commodity, shipping and a host of other sectors, and any slowing there is going to be felt.

Of course, earnings are the other focus of this market -- today we'll hear from a large number of banks. So far Bank of America (BAC) is a bit soft, but there isn't much movement. Last night IBM (IBM) posted good numbers and has an upgrade but the stock is seeing a "sell the news" reaction and is trading down.

Yesterday I discussed how I was not inclined to bet on big news events. Even if you are right about the event, it is still extremely difficult to anticipate the reaction. We are seeing a good case of that this morning as many folks were looking for strong follow-through on a Brown victory, but instead the market is now focused on China and earnings reports rather than the health care debate.

After a big drop on Friday, a big bounce yesterday and a sharp drop this morning, the market is providing a very good example of how tricky it can be to navigate a series of major news events. The charts don't give us a lot of good short-term guidance when the main focus is on news, so my tendency is to stay out of the way and focus on how the reaction develops. This morning it looks like the reaction is catching quite a few folks by surprise.

----------------------------

Ülespoole avanesid:

In reaction to strong earnings/guidance: CREE +10.0% (also target raised to $70 from $48 at Piper Jaffray), LAB +8.9%, EAT +6.5%, COV +5.5% (light volume), NTRS +3.1%, WFC +2.5%, BK +2.3%, ASML +1.9%, USB +1.3% (light volume)... Select managed healthcare names ticking higher: HNT +7.8%, WCG +3.4%, AET +2.6%, WLP +1.1%, UNH +1.0%... Select solar stocks showing modest strength: JASO +2.0%, TSL +1.8%... Other news: LXRX +23.9% (announces phase 2 Trial of LX4211 demonstrates significant and rapid improvements in multiple parameters in type 2 diabetic patients), RMBS +13.7% (Rambus and Samsung sign comprehensive agreement; Samsung to invest $200 mln), DEER +12.1% (announces 3 year national sales agreement with Chinese electronic retailer; sees 2010 revs above consensus ests), IOC +11.9% (confirms indications of oil at Antelope-2), SIRI +10.6% (adds 257,000 net subscribers in the fourth quarter), PPO +5.4% (Polypore signs new evergreen supply agreement with Exide), TLVT +2.7% (Cramer makes positive comments on MadMoney), CBE +1.5% (Cramer makes positive comments on MadMoney)... Analyst comments: SHPGY +3.2% (upgraded to Overweight at JPMorgan), ADM +1.5% (upgraded to Buy from Hold at Citigroup), DOW +1.0% (initiated with an Overweight at Morgan Stanley).

Allapoole avanesid:

In reaction to disappointing earnings/guidance: COH -6.5%, PPDI -6.5%, SPW -3.9% (light volume), CSX -3.8%, SCHW -2.5%, IBM -1.8%, MS -1.2%... Select financial names showing weakness: NBG -6.0% (Greece has no plans to leave the euro zone, Finance Minister says - DJ), ING -4.0%, LYG -3.4%, STD -3.2%, CS -3.2%, UBS -2.8%, BCS -2.6%, HBC -1.5%, PUK -1.5%... Select metals/mining names trading lower: RTP -4.9%, MT -4.6%, BBL -4.1%, BHP -3.7% (BHP Billiton lifts iron ore output - Reuters.com), GFI -3.4%, AU -3.0%, AUY -2.7%, HMY -2.6%, GOLD -2.4%, SLW -2.3%, VALE -2.2%, ABX -2.2%, AEM -2.1%, KGC -2.0%, IAG -1.9%, GG -1.7%, SLV -1.7%, GDX -1.7%, GLD -1.1%... Select oil/gas related names showing weakness: STO -2.8%, SNP -2.7%, E -2.5%, SU -2.4%, TOT -2.3%, PBR -2.1%, RDS.A -2.0%, COP -1.3%, XOM -0.8%... Select rail/transportation names ticking lower following CSX results: UNP -2.3%, NSC -1.3%, CNI -1.3%... Other news: AXU -5.3% (announces equity financing), ITMN -4.9% (proposed public offering of 5 mln shares of stock), ANW -4.5% (announces proposed ~3.9 mln share public offering of common stock), ATRO -4.3% (to record 4Q09 non-cash goodwill and intangible asset impairment charge), NRGY -3.5% (announces public offering of 4,500,000 common units), DAI -2.9% (still checking), AMTD -2.8% (down in sympathy with SCHW), AMAG -2.6% (filed for a mixed shelf offering for an indeterminate amount and announces proposed offering of 3 mln shares of common stock), CNK -2.5% (announces the sale of shares by Madison Dearborn Capital Partners and Syufy Enterprises)... Analyst comments: ECA -1.8% (downgraded to Equal Weight at Barclays), AAP -1.8% (downgraded to Neutral from Buy at BofA/Merrill). -

Oleme veel 15.30sed makroandmed võlgu:

December Building Permits 653K vs 580K consensus, prior revised to 589K from 584K.

December Housing Starts 557K vs 572K consensus, prior revised to 580K from 574K.

December PPI M/M +0.2% vs 0.0% consensus, prior +1.8%.

December Core PPI M/M 0.0% vs +0.1% consensus, prior +0.5%. -

Saksamaa DAX -0.70%

Prantsusmaa CAC 40 -0.93%

Inglismaa FTSE 100 -0.85%

Hispaania IBEX 35 -1,52%

Rootsi OMX 30 -0.60%

Venemaa MICEX -0,91%

Poola WIG +0.03%Aasia turud:

Jaapani Nikkei 225 -0.25%

Hongkongi Hang Seng -1,81%

Hiina Shanghai A (kodumaine) -2,94%

Hiina Shanghai B (välismaine) -1,03%

Lõuna-Korea Kosdaq -0.91%

Tai Set 50 -0,64%

India Sensex 30 -0.07% -

LONDON, Jan 20 (Reuters) - European shares hit a three-week closing low on Wednesday as banks came under pressure after worse-than-expected earnings from Bank of America (BAC.N) and Morgan Stanley (MS.N) and commodity shares slipped.

Selle taustal on OMXT lausa imedemaa. :) -

FDIC's Bair says expect higher commercial real-estate charge-offs - DJ

-

Thoratec (THOR)- Heartmate II approved as permanant implant by U.S.-- Bloomberg

-

White House reiterates commitment to Consumer Financial Protection Agency - DJ

-

SLM originated $4.5 billion in federal student loans in Q4, up 14% y/y

SLM Corp Q4 EPS of $0.41, may not compare to $0.44 First Call consensus -

Starbucks prelim $0.33 vs $0.28 First Call consensus; revs $2.72 bln vs $2.60 bln First Call consensus