Börsipäev 8. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Alates tänasest on siis Tallinna Börsil rakendanud mõningad muudatused, millest oleme natukene kirjutanud siin (link). Muuhulgas on kadunud 15% limiidi reegel ning muudetud ka turuhinnaga edastatavate orderite täitmispõhimõtteid, mis soodustab pigem määratud hinnaga ehk limiithinnaga orderite sisestamist.

Mingeid olulisi majandusraporteid USAst täna tulemas ei ole. Varahommikused futuurid näitavad hetkel S&P500le +0.45%, Nasdaq100 futuurile +0.30% ning naftale +1.0%.

-

Superbowl ja ajaloo üks suurimaid lumetorme hoidis ameeriklasi nädalavahetusel nelja seina vahel toasoojas ja televiisori ees. Lisaks jalgpalli vaatamisele võistlevad erinevad ettevõtted jalgpallimängu reklaamipauside ajaks ostetava piiratud aja peale ning mänguks korraldatavad reklaamid on tihti ka nii-öelds ühekordsed projektid, mistõttu ootavad ameeriklased lisaks Superbowlile endale ka vaheaja reklaame. Üks näide Coca-Cola spetsiaalsest reklaamist läbi populaarse Simpsonite prisma on siin.

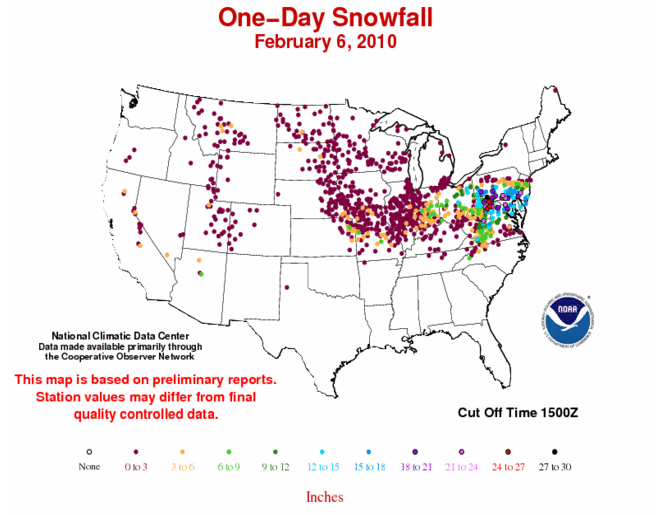

Lund sadas aga nädalavahetuse eel ja nädalavahetusel USA ida-rannikul aga väga korralikult. 6. veebruaril sadas idaosariikides maha 12 kuni 18 tolli lund (30 kuni 45 cm), mida tähistavad sinised täpid alloleval graafikul. Kohati ulatus sajuhulk ka kuni 30 tollini (tumepunased ja mustad täpid), mis tähendab üle 75 cm'list lumelisa... ja seda ühe ööpäeva jooksul.

Lume kogupaksust mõõdeti USAs 6. veebruaril järgmiselt:

-

Ei oska kommenteerida, kui palju sellest on tõtt ja kui palju vandenõuteooriat, aga ühe prantsuse blogi (google' i tõlge) allikate kohaselt on Euroopa CDS-de liikumiste ja euroalal paanika külvamise taga USA investeerimispank koos kahe suurema hedge fondiga:

According to reliable information that I received Friday from both authorities and market banks, a large U.S. investment bank (which has benefited from the bailout of U.S. banks) and two very large hedge funds would behind the attacks against Greece, Portugal and Spain. Their goal? . Earn much money by creating a panic that allows them to demand of Greece interest rates ever higher while speculating on the CDS market, a market completely unregulated and opaque.

-

Einoh, otse loomulikult - ilmselt seisid need investeerimispankurid ning hedge-fondide juhid ka kogu aeg juba aastakümneid kreeka ministrite selja taga, hoidsid revolvrit oimukohal ja sundisid täiendavat laenu võtma. Ma ei imesta, et sellise "paha kapitalismi" süüdistava vandenõuteooria taga on prantslased. :-D

-

Mis seal Riia lisanimekirjas toimub - 257% ja 40% tõusu?

-

Loomulikult pole pangad süüdi Lõuna-Euroopa laenuhulluses, aga oleks väga imelik, kui nad ei üritaks selle arvelt nüüd raha teenida, kui võimalus avaneb. Soros tegi ju sisuliselt sama GBP vastu spekuleerides. :)

-

Karum6mm ja Street,

On täpselt samad mõtted minulgi. Ehk kuidas saab süüdistada neid, kes teiste otsuste/lolluste pealt raha püüavad teha? Kui Kreeka CDSid ei oleks juba täna nii kõrged ning võlakirjade tulusused püsiksid 3%-4% vahemikus, siis ei oleks ju valitsusel mitte mingisugust motivatsiooni end liigutama hakata ja defitsiiti piirata. Kuskile tuleb siiski piir tõmmata. -

Finantsturg on legaalne mehhanism lollide eraldamiseks nende rahast ning vastutustundetute (et mitte öelda vasakpoolsete) majanduspoliitikate ajajate karistamiseks. ;)

-

Londonis suletakse tasapisi kreeka pankade krediidiliine...

-

Sentiment lõhnab järjest halvemini...

-

DB strateegid kirjutavad täna, et EL peaks lähipäevadel tegutsema:

History is particularly unkind on Sovereigns that are running deficits of the magnitude that we see now and are likely to see over the next 2-3 years. Going forward it seems that the market won’t rest until we get what is increasingly likely to be an EU bail-out for the peripheral nations. It’s difficult to know what form such a bail-out could take but it seems that EU politicians will act at some point in the next few days or weeks.

-

16.00-16.30 Kauplemisjärgne periood

pole siiani päris hästi aru saanud mis mõte sellel asjal on? (võimalik, et kuskil on selle kohta vastus olemas - laiskus) -

Ja eks see lumetorm oli ka kindlasti mõne hedge-fondi tellitud.

-

Euroopa turud:

Saksamaa DAX +0,55%

Prantsusmaa CAC 40 +0,42%

Inglismaa FTSE 100 -0,01%

Hispaania IBEX 35 +0,24%

Rootsi OMX 30 -0,44%

Venemaa MICEX -1,72%

Poola WIG +0,07%Aasia turud:

Jaapani Nikkei 225 -1,05%

Hongkongi Hang Seng -0,58%

Hiina Shanghai A (kodumaine) -0,15%

Hiina Shanghai B (välismaine) +0,37%

Lõuna-Korea Kosdaq -2,00%

Tai Set 50 -0,59%

India Sensex 30 +0,13% -

Tricky Juncture

By Rev Shark

RealMoney.com Contributor

2/8/2010 8:45 AM EST

"The wheel of change moves on. And those who were down go up, and those who were up go down."

-- Jawaharlal Nehru

A late-afternoon rally on Friday helped to stem some of the severe losses in the major indices, but the most notable thing about the action last week was that we had a classic failed bounce. After breaking down a couple weeks ago, the bulls put together a pretty good two-day bounce last Monday and Tuesday, but just when they started to become excited about the chances of another V-shaped bounce back to recent highs, we rolled over, sold off on higher volume and made a new low. It looked like the selling was going to intensify Friday, but we bounced back strongly late in the day and ended up with some mild gains.

The failed bounce last week was the first one we've seen since early July 2009. The big question now is whether this correction gains further momentum or do the bulls now make a stand and restore this market to health.

So far, we have corrected between 9% and 10% and are 13 days from our last high. Given the magnitude of the gains since the March low, that is a fairly mild correction. Many individual stocks have corrected far more. In fact, some sectors -- such as gold, steel, China and even big-cap technology -- have slipped 20% or substantially more, so this correction has been far worse than it looks in many cases.

Unfortunately, there really isn't any good reason to be very bullish here other than trying to play some oversold bounces. There is no leadership and few attractive long setups. While the severe selling last week did stretch us a bit too far too fast to the downside, a further bounce here that plays out for a few days is going to set up some patterns that look like potential head-and-shoulders tops. It is going to take some substantial buying to return this market to health.

At this point, my game plan is to give the bulls some room to bounce us some more but to look for strength to be a good selling and/or shorting opportunity. After all the V-shaped bounces we had last year, I suspect the bulls are going to be arguing very loudly about how wonderful fundamentals are and how we should be taking advantage of all those wonderful "buying opportunities" that have arisen in the past few weeks. Be skeptical of those arguments.

This time, I don't think the action is going to play out like it did so often in the last part of 2009. A recovery is unlikely to be quick and easy. This time, the character of the market has changed as bailouts and stimulus are mostly over and the focus now turns to efforts by the Fed to drain the liquidity that drove this market and efforts by the government to reign in the deficit by raising taxes.

We are going to hear from a lot of bulls about how great the fundamentals are, but they seem to forget that we have been pricing in a better economy since last March. We have to stay focused on the price action. There were a lot of great earnings reports recently, but the market just hasn't cared. Some will say that the market is wrong not to care, but the market is simply telling us that it has already considered and discounted the news.

This is a tricky juncture here because there are going to be lots of hopeful bulls telling us that we have already corrected enough and are now ready to resume the rally. Maybe -- but there just isn't any evidence to support that belief at this time. We have a technically broken market, lots of poor charts and no leadership. The late-Friday reversal was nice, and we have some of that standard Monday-morning strength, but there is nothing happening yet to indicate that the trend is shifting back up.

Quite a few market players were excited about the late-Friday bounce, but I believe that was just some shorts locking in gains and short-term money positioning for the very consistent strength we have seen on Mondays over the past year. I'll be flipping long positions into strength and will be looking for shorts to set up again.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CFSG +14.6% (also announces contract win of $92 mln ), CAGC +9.3% (stock split in effect today), HAS +8.3%, LFUS +6.2% (light volume), HS +3.9% (light volume), CVS +2.7%... Select potash names showing strength: POT +1.5%, MOS +1.4%... Other news: SNSS +8.8% (granted Carmot Therapeutics an exclusive license to its proprietary Fragment-Based Lead Discovery technology), AVNW +5.3% (Cramer makes positive comments on MadMoney), AMAG +3.3% (provides Feraheme safety update), CNK +2.6% (Cramer makes positive comments on MadMoney), AAN +2.4% (mentioned positively in Barron's), AMR +2.1% (JAL to stay with American, end Delta talks, report says - Reuters.com), MOT +2.0% (mentioned positively in Barron's ), SNY +1.4% (still checking for anything specific)... Analyst comments: HD +1.5% (upgraded to Overweight from Equal Weight at Morgan Stanley), PCU +1.1% (upgraded to Outperform from Underperform at Credit Suisse),AMZN +0.7% (Amazon.com, Macmillan settle price dispute - WSJ; also upgraded to Buy from Hold at Collins Stewart).

Allapoole avanevad:

Select financial related names showing weakness: NBG -7.9% (Greece sticks to austerity plan: Finance minister - Reuters), AIB -7.9%, LYG -4.8%, IRE -3.8%, PUK -3.7%, ING -3.7%, BCS -3.0%, CS -3.0%, RBS -2.5%, BBVA -1.9%, HBC -1.9%, UBS -1.8%, STD -1.1%... Select metals/mining names trading lower: GFI -2.8%, RTP -2.7%, HMY -2.2%, AU -2.0%, GOLD 1.9% (announces 4Q09 results and update), MT -1.5%, BBL -1.4%... Other news: WTU -20.4% (provides update and termination date for the trust), NVAX -9.3% (terminates negotiations with ROVI Pharmaceuticals for influenza vaccine collaboration), SAP -2.5% (appoints Bill McDermott and Jim Hagemann Snabe Co-Chief Executive Officers)... Analyst comments: HK -1.0% (downgraded to Mkt Perform from Outperform at Bernstein). -

Fed's Bullard says Fed could begin to sell some assets in the second half of 2010 - Reuters

-

Fed's Yellen says US monetary policy likely "excessively stimulatory" for Hong Kong, China - Reuters

-

NY Fed-sponsored group considering FDIC-style emergency fund for tri-party repo market-documents - Reuters

-

CIT Group To Prepay $750 Million of Debt

-

Electronic Arts sees Q4 $0.02-0.06 vs $0.13 First Call consensus; sees revs $800-850 mln vs $850.97 mln First Call consensus