Börsipäev 11. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Tänase päeva olulisimaks makroraportiks on veebruari esimese nädala töötuabiraha taotlejate arv USA-s, mille suurusjärguks prognoosib konsensus 465 000 (eelneval nädalal 480 000) ja kestvate töötu abiraha taotlejate arvuks 4.59 mln (eelneval nädalal 4.6 mln). Raport avaldatakse Eesti aja järgi kell 15.30.

-

Marc Faberi seisukoht, et pikemas perspektiivis muutuvad nii USA kui Euroopa maksevõimetuks, võtab CNBC saatejuhid sõnatuks. Link videole.

-

Eesti neljanda kvartali majanduslanguseks tuli 9,4%. Positiivse poole pealt näidati edenemist võrreldes kolmanda kvartaliga - SKP kasv +2,6%.

Pikemalt siit: http://www.stat.ee/37885

-

Faber on täna figureerimas mitmes erinevas intervjuus. Siin veel link ühele intervjuule, kes pikemalt arutatakse Hiina majanduse, laenukasvu, aktsiaturgude teemal. Suureks ohuks toormaterjalide hinnatõusu jätkumisele peab Faber eelkõige Hiina majanduskasvu aeglustumise võimalust.

-

Washingtoni ametnikud on lumetorimi tõttu jätkuvalt aheldatud kodudesse. WaPo vahendusel:

Federal agencies across the nation's capital will close Thursday for a fourth straight day -- taking the week-long shutdown of the government into uncharted territory. The cost to taxpayers, in lost productivity by government workers, from this week's closings and last Friday's early dismissal is up to an estimated $450 million -- not huge when compared to the government's overall expenditures, but certainly notable considering the current economic climate and the growing debt and deficit.

Bloomberg näitab hetkel, et reedese päeva peale lükatud jaemüügi ja laovarude raporteid loodetakse ikkagi avaldada.

-

Iseenesest pole idees, et arenenud riigid default'ivad midagi imelikku. Arvestades seda pidu, mis peetud on, oleks see loogiline jätk. Kummalisel kombel ei taha aga Faber näiteks USA puhul arvestada seda, et kelle käes on trükipress... USA maksab alati oma võlad ilusti ära. Iseasi, mis selle surnud presidentide piltidega raha ostujõuga vahepeal juhtunud on...

-

Standing next to European Commission President Jose Manuel Barrosso, European Council President Herman Van Rompuy read out a statement saying that no direct aid will be delivered to Greece but that European governments stand ready to assist the country if needed.

The European Commission and the European Central Bank will monitor Greece's budget cutting efforts -- a first assessment will come in March -- and the International Monetary Fund will provide technical assistance. (marketwatch)

-

EUR/USD jätkuvalt päeva põhjade juures. Paljud ootavad, et mingid garantiid tuleks ka Portugalile ja Hispaaniale.

-

"if needed"

:-D

Hallooo....it very clerly IS needed! :-D -

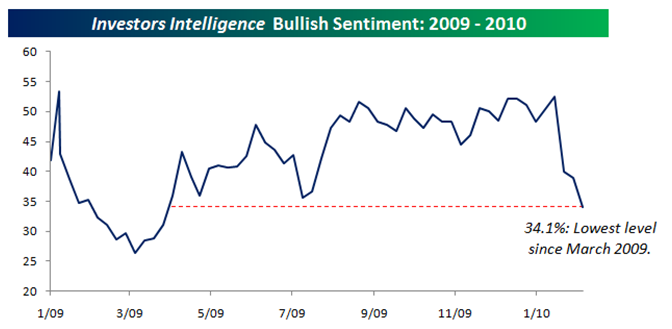

Pulle jääb iga nädalaga vähemaks (link):

Enamus räägivad lühiajalisest korrektsioonist (ca 10%) ja uut karuturgu ootavad jätkuval üsna vähesed.

-

MERKEL SAYS GUYS FROM GREECE ARE REALLY HANDSOME

GUYS FROM GREECE SAY MERKEL LOOKS UGLY, BUT MAYBE MANANA AFTER THE SIESTA SHE GETS SOME

GUYS FROM GREECE: BRING THE BAILOUT THEN WE DANCE -

Pepsi (PEP) tulemused üsna ootuspärased:

PepsiCo prelim $0.90 vs $0.91 First Call consensus; revs $13.3 bln vs $13.26 bln First Call consensus; reaffirms FY10 outlook

Pepsi potentsiaalist kirjutasime pikemalt siin.

-

USA tööturult head uudised - töötu abiraha taotlused, mis hakkasid jaanuaris tõusma, tegid veebruari alguses suurima kukkumise alates juulist:

Initial Claims 440K vs 465K consensus, prior revised to 483K from 480K

Continuing Claims falls to 4.538 mln from 4.617 mln

-

siseinfo, ma kukkusin naerust toolilt maha praegu! :-D

-

Euroopa turud:

Saksamaa DAX -0.27%

Prantsusmaa CAC 40 -0.24%

Inglismaa FTSE 100 +0.56%

Hispaania IBEX 35 -1.29%

Rootsi OMX 30 +0.40%

Venemaa MICEX +0.12%

Poola WIG -0.61%Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hongkongi Hang Seng +1.73%

Hiina Shanghai A (kodumaine) +0.10%

Hiina Shanghai B (välismaine) +0.80%

Lõuna-Korea Kosdaq +1.37%

Tai Set 50 +1.07%

India Sensex 30 +1.45% -

Where's the Leadership?

By Rev Shark

RealMoney.com Contributor

2/11/2010 8:57 AM EST

Details create the big picture.

-- Sanford I. Weill

The headline this morning is that eurozone leaders have reached a deal to help Greece. No details have been released, and the market's initial response is a yawn. It probably isn't a big surprise that some rescue is being put together, but with the market still oversold I'd normally expect a more positive response even if it was just momentary.

That's the most worrisome thing about this market right now -- we have not been able to put together a bounce similar to what we saw so often in the latter part of last year. There hasn't been any rush by underinvested bulls to jump in, and no one seems too worried this time that the market is going to run away and leave them behind.

The big picture can be summed up fairly easily: We broke down about three weeks ago, had one failed bounce attempt and now we have been struggling for the last four days to bounce again. So far the buyers have looked weak, sentiment is still negative and we are in danger of rolling over again.

My position here is that the market is trending lower and we should assume that we will sell off further at some point in the near future. We may see a better bounce develop first, but there is lots of technical overhead and no leadership. The bears deserve the benefit of doubt until the bulls can deliver better action.

My view is determined not only by the technical patterns of the major indices but also by the hundreds of individual charts that I look at each day. Quite often there can be some pockets of strong action even though the major indices don't look so healthy. In the present market, there just is no upside leadership at all. We have had some dead-cat bounces in weak-dollar plays as the greenback pulls back a little within its recent uptrend, and we have some brief relative strength in groups like airlines and homebuilders, but there just isn't any group stepping up to take a leadership role.

Leadership is important because it helps strength broaden out to other sectors of the market. If semiconductors start to lead the market, then traders will start looking to jump into other sectors that they believe will see some sympathy buying. The buying slowly expands out, and before you know it we have a numbers of sectors leading the market and acting better as investors look to jump in quickly.

Unfortunately, we don't have any of that leadership in the market right now; until we do, it is going to be very hard to trust a bounce to last for long. Ultimately it is always a market of individual stocks and the major indices can mislead, but at this point there is nothing in the action of individual stocks to indicate hidden strength that we can build on to turn the market up.

I always expect the current trend to continue until there is solid proof to the contrary. We will have some good, tradable countertrend moves within any major trend, and they can easily fool you. Watch individual stocks and see if any clear leadership is developing. When we start seeing those pockets of momentum, then we can become more optimistic about the overall trend.

We have a very mild response so far to the Greek bailout news this morning. I believe we have a decent chance for some more upside in the short term, but the bulls really need better energy pretty quickly. The dip-buying has been very unimpressive lately, and that makes it very easy for us to roll over and suffer another leg down.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: LF +23.6%, CHBT +12.5%, XIN +7.8%, ATRM +6.8%, EDMC +6.5%, ATVI +5.8%, HGR +5.4%, CPII +5.2%, CHBT +4.9%, SCOR +2.5%, BSX +2.3%, RTP +1.3%... M&A News: AYE +18.9% (co to be acquired by FE for $27.65 per share)... Other news: AZC +18.1% (SLW to acquire 100% of the life of mine silver and gold production from AZC's Rosemont Copper Project), SOL +7.6% (announces that it has signed an OEM agreement to provide 600 megawatts of solar modules to a major global solar company over a period of three years)... Analyst Comments: PALM +3.1% (upgraded to Hold from Sell at Citigroup; with a $10 tgt; ABB upgraded to Buy at Deutsche Bank).

Allapoole avanevad:

In reaction to weak earnings/guidance: ELON -7.3%, SWIR -15.8%, HOS -13.5%, GLUU -12.0%, ALU -8.2%, BT -8.1%, BSX -7.6%, AMKR -5.4%, TRAK -4.4%, FLIR -4.0%, WATG -3.3%, PRU -2.8%, EQIX -2.1%, ARRS -0.4%... European financials showing modest weakness despite Greece bailout reports: STD -3.5%, BCS -2.6%, DB -1.7%, LYG -1.6%, ING -1.6%, AIB -1.2%, RBS -1.2%... Other news: CADX -10.5% (FDA issued a Complete Response letter to its NDA for intravenous acetaminophen; indicated that deficiencies were observed during the FDA's facility inspection), FE -4.1% (co is buying AYE in $8.5 bln stock deal). -

Senate Banking Chairman Dodd says Republican Senator Corker agrees to work on his financial reform bill - Reuters

-

$16 bln 30-year Bond Auction Results: Yield 4.720% (expected 4.687%); Bid/Cover 2.36x (prior 2.26x); Indirect Bidders 28.5% (prior 44%)

-

AMZN sai 120 st üle, päris palju calle on seal all