Börsipäev 16. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Pangandussektori tugevad kvartaliraportid on aidanud täna ostuhuvi tekitada nii Euroopas kui Aasias ning pakkunud toetust toornaftale ja metallidele. Eile suletuks jäänud USA indeksite futuurid kauplevad hetkel 0.5% kõrgemal.

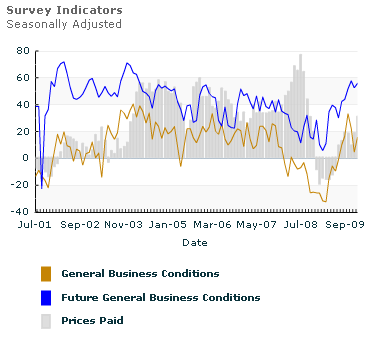

Makroandmete osas jääb päev üsna pehmeks. Euroopas langeb tähelepanu veebruarikuu ZEW indeksitele (kl 12.00) ning USA-s 15.30 avaldatavale Empire State Manufacturing indeksile, mis kajastab New Yorgi osariigi tootmisettevõtete praegust ja tulevast ärikliima hinnangut (allolev graafik peegeldab eelnevate kuude küsitlustulemusi).

-

Barclays PLC kvartalitulemused on maalikunsti tipptase:

Kasum 6.9 miljardit naela, kus Barclays Global Investori müügist laekus BlackRockilt 5.3 miljardit naela. Ilma müüki arvestamata veidi jooniastamist ja ongi kasum kirjas, kuid -> Full year profit from continuing operations fell from 3.8 billion pounds in 2008 to 2.6 billion pounds last year. Barclays Capital reported pretax profit of 2.5 billion pounds, up 89 percent from a year earlier.

Ja ei tasu unustada, et Barclays Global Investor oli ettevõtte üks peamisi tuluallikaid. -

Barclaysi positiivne üllatus tuli siit:

At the time of its third quarter trading update Barclays guided analysts toward impairments at the low end of a £9-£9.6bn range. They actually came in at £8.1bn. (loe pikemalt siit).

-

Florian Esterer Swisscanto varahaldusest on Bloombergile andnud intervjuu, kus tema sõnul on Barclay aktsiad üllatavalt odavad. Link siin.

-

Kreeka ümber toimuv ja Saksa majanduse olematu QoQ kasv neljandas kvartalis kukutasid Saksa invesorite usaldust viiendat kuud järjest 47.2 punktilt 45.1-le, ent konsensus oli oodanud oluliselt suuremat kukkumist (41 punkti). DAX tegi makro peale päeva tipu, kuid on pärast seda pisut taandunud ning kaupleb 1.1%lises plussis.

-

Suurbritannia tarbijahinnad tõusid jaanuaris yoy mõõdetuna +3.5% - keskpanga sihiks on hoida see 2% peal. Tegu selgelt liiga suure näiduga, mida võib seostada liigse rahatrüki, toetusmeetmete ja varude taastumistsükliga, kuid Bank of England ise nimetab seda lihtsalt kui 'period of inflation volatility'.

-

Deutsche Bank kiidab täna Vodafone'i (VOD ja VOD.L) ja kinnitab oma £1.90st ehk 190 pennist hinnasihti Vodafone'i aktsiatele, mis on turuhinnast ca 36% kõrgemal.

Väike kokkuvõte note'ist ka siia:

BUY ahead of further growth improvement in 2010 Vodafone's revenue growth inflected in Q3. We believe that this is the start of an improving trend. We show that the correlation between non-price voice volumes and employment is being maintained which supports this view. Further, Vodafone appears to be anticipating a surge in data volumes through to year end. An ongoing cyclical recovery of voice combined with a secular boost from data could see Vodafone return to growth in 2010. The impact on the share price would be substantial, in such a scenario. TP 190p. -

February NY Empire Manufacturing 24.91 vs 18.00 consensus, January 15.92

-

USA alustab uut nädalat igaljuhul positiivse noodiga. Tähtsamate indeksite futuurid eelturul ca +0.4%, nafta on tõusus ca +2.5%.

Euroopa turud:

Saksamaa DAX +0.69%

Prantsusmaa CAC 40 +0.38%

Inglismaa FTSE 100 +0.06%

Hispaania IBEX 35 +0.06%

Rootsi OMX 30 +0.86%

Venemaa MICEX +2.23%

Poola WIG -0.33%Aasia turud:

Jaapani Nikkei 225 +0.21%

Hongkongi Hang Seng N/A (börs suletud)

Hiina Shanghai A (kodumaine) N/A (börs suletud)

Hiina Shanghai B (välismaine) N/A (börs suletud)

Lõuna-Korea Kosdaq +1.01%

Tai Set 50 +0.41%

India Sensex 30 +1.17% -

The 'V'-Shaped Bounces Are a Memory

By Rev Shark

RealMoney.com Contributor

2/16/2010 8:34 AM EST

Life is always at some turning point.

-- Irwin Edman

We kick off a short week of trading with the market at an interesting juncture. For the last six trading days we have been attempting to bounce back from our recently technical breakdown, with only limited success. The S&P 500 has managed to tack on 11 points over those six days, but it hasn't been easy.

This action has been very different from what we saw so often in the latter half of 2009. The theme then was immediate and complete recoveries every time we had a sharp pullback. There was no hesitation by the bulls -- they trampled any bears foolish enough to stand in their way, anticipating a failed bounce.

This time this action has played out differently. We hit a high Jan. 19 and then suffered three big days of selling. The bulls tried to bounce us over the next seven or eight days, managed one particularly good day and then failed again. We had another big day of selling, and that has brought us to the most recent bounce attempt over the last six days.

I suspect that the bulls still have very fresh memories of all those impressive bounces in 2009, and that's helping to keep these bounce attempts going. The smart move was to trust the market to recover, and I'm sure no one wants to have to chase another "V"-shaped recovery once again. Even the skeptics don't want to relive the nightmare the bears went through last year, and that's keeping the bulls active enough to hold us up. They haven't had nearly the same vigor as last year, but they are holding steady right now.

I believe the bounces we had last year were the exception and not the rule. We wouldn't normally expect the market to act that way, but the flood of liquidity produced by bailouts and stimulus overrode the technical inclinations. Normally when we break down and see a trend developing, we should assume it will continue until there is some clear evidence to the contrary. The market is acting more normally now, and that means we need to be more respectful of the trend.

So far we haven't seen any solid proof that this market is about to find its footing and turn back up. We have churned for a while but in addition to the technical breakdown and downtrend over the last three weeks, the thing I find most troublesome at this point is the lack of leadership.

We just have not had any sector show us that it is ready to lead this market higher. We lost the China stocks as the Chinese government moves to cool off its overheated market, and we have seen oil, gold, steel, basic materials and other related sectors suffer as the dollar has strengthened.

Technology stocks have shown some inclination to step up and assume a leadership role, but the poor action in some of the key big-cap names such as Google (GOOG) and Amazon (AMZN) have been a problem. Small semiconductor and networking stocks have looked pretty good; we'll have to watch to see if that develops further.

Overall we have a market that has been working hard to turn back up but has had limited success so far. We haven't had a lot of positive news flow, and there aren't many signs of leadership. The bears still have the advantage, and they will likely be more aggressive if the bulls don't become more active fairly soon.

Overseas markets inched up during our holiday and we have a positive open brewing. Keep in mind that this market has had its best gains on the first day of the week for quite some time, so I'd give the bulls some room at this point.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CPSL +13.4%, AEIS +12.3%, BCS +11.0%, DGIT +6.5%, TNDM +5.4%, PAAS +3.6%, MRK +2.7%, Q +2.3%, ANF +1.3%... M&A news: TRA +22.1% (Terra Industries to be acquired by Yara International for $41.10/share in cash)... Select financial names showing strength: RBS +5.0% (JP Morgan will buy energy business from RBS, Sempra - WSJ), UBS +4.5%, HBC +2.5%, CS +1.5%, C +1.3%, WFC +1.2%, BAC +1.2%, BBVA +1.2%... Select metals/miing names showing strength: CDE +10.6%, ABX +3.0%, RTP +2.9%, GG+2.8%, GOLD +2.6%, GDX +2.4%, EGO +2.4%, GLD +2.2%, BHP +1.6%, MT +1.4%, VALE +1.1%... Other news: ENMD +36.6% (receives orphan drug designation for ENMD-2076 in Leukemia), DSCO +27.5% (receives FDA guidance regarding pathway to Potential SURFAXIN approval), NIHD +11.2% (NII Holdings and Televisa agree to Televisa investment in Nextel Mexico), RIGL +10.3% (Rigel Pharma and AstraZeneca sign license agreement for late-stage development product - fostamitinib disodium - for treatment of rheumatoid arthritis), ENTG +9.1% (Cramer makes positive comments on MadMoney), OSK +7.7% (U.S. Army affirms FMTV contract award to Oshkosh), APWR +6.0% (receives NDRC approval and makes cash contribution to Texas wind farm project co), IOC +2.2% (announces year-end 2009 gross best case resource estimate of 1.52 billion barrels of oil equivalent)... Analyst comments: SNV +4.6% (upgraded to Outperform at Morgan Keegan), ARTG +4.3% (initiated with Buy at Deutsche), ADSK +3.2% (upgraded to Buy at Goldman), DB +2.4% (upgraded to Outperform at Credit Suisse), MRO +2.2% (upgraded to Outperform at Bernstein), STO +2.1% (upgraded to Hold from Sell at Deutsche Bank).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PMI -8.3%, IHG -2.8% (light volume), CTAS -2.4%, KFT -1.9%... Other news: NBG -8.9% (Euro zone gives Greece 30 days to show good on deficit - Reuters), OTE -7.5% (pulling back from Friday's late day surge), AIB -4.4% (still checking), BT -3.5% (still checking), RDN -1.3% (ticking lower in sympathy with PMI)... Analyst comments: STEC -4.8% (downgraded to Hold at Needham), MWA -4.4% (downgraded to Sell from Neutral at Goldman), PHM -2.4% (downgraded to Sell from Neutral at Goldman), GPS -2.3% (downgraded to Underweight from Equal Weight at Morgan Stanley), JCP -1.0% (downgraded to Equal Weight from Overweight at Morgan Stanley), -

yahoo andmetel saab STEC kõvasti peksa täna. -100%

-

Sellest, kuidas mured Kreeka, Hispaania, Portugali ja Iirimaa eelarve defitsiidi ja võlakoormuse osas on minu arvates liigselt varjutamas USA pikaajalisi kroonilisi defitsiite, paisuvaid kohustusi ja hapnevaid osariike, kirjutasin täna e24's järgmise pealkirja all (link lisatud):

"Eurotsooni probleemide taustal on USA ära unustatud"

Teemast huvitatutel soovitan kindlasti lugeda.

-

German conservative leader Seehofer says okay to support Greece politically but not with euros, according to paper - Reuters

-

February NAHB Housing Market Index 17 vs 16 consensus, January 15

-

Medifast: Fidelity discloses 7.7% stake in 13G filing

-

Fidelity discloses new positions in 13G filings

Notable positions include new stakes in HMIN 8.6%, NADVF 6.2%, PNRA 6.6%, GAME 10%, and PLX 5.4%. -

Fidelity discloses new positions in 13G filings

Notable positions include new stakes in SINA 10.0%, TTWO 10.0%, SIVB 9.8%, THO 5.6%, UNT 9.7%, VMW 7.2%, WL 9.4%, XL +7.3%, and ZION +6.1%. -

YRC Worldwide: Credit Suisse discloses 5.3% stake in SC 13G filing

-

JP Morgan Chase: Bomb explodes at JPMorgan branch in Greece, no injuries - AP

Ateenas toimunud plahvatus ei ole aktsia hinnale mõju avaldanud! Plahvatusele oli eelnenud ähvardav telefonikõne. -

JP Morgan Chase follow up: CNBC reports bomb exploded in street outside of JP Morgan office, and JPM does not know if it was the target

-

T. Boone Pickens' BP Capital discloses 12/31 portfolio positions

In a SEC 13F filing, BP Capital reports new 119K share position in FLR, 166K shares in FWLT, 197K shares in SII and 345K shares in RIG. BP also discloses 524K share increase in GST, 530K share increase in SD, 300K share increase in WFT and 1.645 mln share increase in TAT. -

Citigroup (C) releases January credit card trust data

Co reports January Credit Loss Component of 9.80% vs 9.56% in December; January delinquincies of 5.75% vs 5.62% in December. Co also reports that January delinquincies of 5-34 days of 3.09% vs 3.11% in December. -

Tänane käive turgudel ikka jube madal, ~ kuu pole vist nii madalat käivet olnud.

Kuid ei maksa unustada, et viimati tehti nii madala käibega selle aasta tipud:) -

Origin Agritech (SEED): Citadel Advisors discloses 0.8% stake in amended 13G filing, down from 9.0% previously reported on 2/13/09

-

Myriad Pharma (MYRX): Fidelity discloses 11.7% stake in amended 13G filing, down from 13.0% on 8/10/09