Börsipäev 17. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Laiapõhjaline ralli USA turgudel on loonud täna hommikul positiivse meeleolu ka Aasias ning aidanud sealsetel indeksitel kerkida enim viimase kolme kuu jooksul (Jaapan +2.7%, Hiina +1%, Hongkong +1.5%, Austraalia +2.2%). SP500 futuur kaupleb praegusel hetkel nulli lähedal.

USA makro osas on täna päevaplaanis jaanuari housing starts (kl 15.30) ja tööstustoodang (kl 16.15). Kell üheksa õhtul avaldatakse aga FOMC eelmise kohtumise protokoll, mis hõlmab värskemaid majandusprognoose.

-

Homme õhtul kell 18.00 ootan kõiki investeerimishuvilisi osa võtma minu USA turuülevaate seminarist LHV Investeerimiskeskus. Aeg on sobivalt pärast tööd ning ei jää ka Olümpia-huvilistele takistuseks. Registreeruda saab seminarile sellel lingil - kohtume homme!

-

Portugali Keskpanga juht Vitor Constancio vahetab aprillist alates välja seni 8 aastat Euroopa Keskpanga asepresidendi toolil istunud Kreeka Lucas Papademose, kelle ametiaeg saab täis. Kes aga vahetab välja selle aasta oktoobris ametiaja lõppedes Euroopa Keskpanga presidendi toolil istuva Prantsusmaa Jean-Claude Trichet - kas Saksamaa Axel Weber või Itaalia Mario Draghi. Weber on igaljuhul hetkel selge favoriit. Weber on üldiselt tuntud kui inflatsioonivastane, mis võib tema võidu korral tähendada kõrgemaid euro-ala intresse ning tugevnevat eurot.

Link ka ühele viimasele Bloombergi loole on siin.

-

Suurbritannias tegi töötu abiraha taotlejate arv suurima tõusu alates eelmise aasta juulist (analüütikud ootasid paranemismärke). IHS Global Insighti kommentaar:

A 23,500 jump in claimant count unemployment in January is a reality check after the number of jobless had dipped late in 2009. The economy is just not strong enough at this stage to prevent further job losses and the fall in unemployment late in 2009 had masked the fact that full-time employment was still falling appreciably. Yes, the worst of the job losses are behind us; and, yes, overall job losses have been less than feared due to employer and worker flexibility, but it is unrealistic to expect the number of unemployed to have peaked when the economy is still barely growing after extended, deep recession.

-

Nõudlus USA valitsuse võlakirjade järele on välismaal vähenemas (nt jätkavad hiinlased võlakirjade müümist):

Foreign demand for US Treasury securities fell by a record amount in December as China purged some of its holdings of government debt, the US Treasury department said on Tuesday.

China sold $34.2bn in US Treasury securities during the month… leaving Japan as the biggest holder of US government debt with $768.8bn. China overtook Japan as the largest holder in September 2008. (allikas: FT).

Vaadates Fedi rahatrükki ja tohutut valitsuse eelarve puudujääki (euroalast märgatavalt suurem!), siis igati oodatav, et huvi USA valitsuse võla vastu väheneb.

-

Telegraph kirjutab, et EL liidrid on Kreeka võimes oma võlaprobleemidega hakkama saada taas pisut skeptilisemaks muutunud ning ähvardavad ise riigi poliitikat korraldama hakata, kui 16. märtsiks ei ole astutud vajalikke samme. Kõrge määramatus mängib aga euro volatiilsusega.

-

Morgan Stanley langetas Euroopa riikide maksevõimetuse riskide pärast regiooni pankade väljavaate "cautious" peale:

Morgan Stanley on Wednesday downgraded its view of the European banking sector to cautious from in-line and also cut its rating on several firms, saying elevated sovereign funding risks pose multiple threates to the sector. The broker said it sees five main risks, including materially higher funding costs; rising provisions; restrictions on loan growth; higher tax rates and a higher cost of equity.

MSi analüütikud kiidavad täna headest 4Q tulemustest raporteerinud Prantsuse panka BNP Paribast (BNP.PA):

It also upgraded BNP Paribas to overweight from equal weight, saying the decision was "a straightforward play on the French economy without major uncertainties on group balance sheet or capital base." (marketwatch)

-

LHV Maailma Pro investeerimisidee Fundtech (FNDT) on tänasel eelturul teatanud oma 4. kvartali tulemused. Numbrid on igati korralikud ning ka 2010. aasta kasumiprognoos vastab ootustele. Pikem kommentaar LHV Maailma Pro alla juba lähipäevil.

Briefing: "Fundtech reports Q4 (Dec) earnings of $0.21 per share, $0.01 better than the First Call consensus of $0.20; revenues rose 10.1% year/year to $32.8 mln vs the $32.2 mln consensus. Co issues in-line guidance for FY10, sees EPS of $0.63 to $0.73, excluding non-recurring items, vs. $0.68 consensus; sees FY10 revs of $132 mln to $135 mln vs. $131.60 mln consensus.

Fundtech CEO Reuven BenMenachem said: "I believe that we are emerging from the global financial crisis stronger than ever, and that we will resume posting double-digit organic growth in 2010." -

January Housing Starts 591K vs 580K consensus, M/M change +2.8%

January Building Permits 621K vs 620K consensus, M/M change -4.9% -

Euroopas on olnud täna tugev tõusupäev ning ka USA tõotab avaneda ca 0.5% eilsest kõrgemal.

Euroopa turud:

Saksamaa DAX +1.29%

Prantsusmaa CAC 40 +1.90%

Inglismaa FTSE 100 +0.97%

Hispaania IBEX 35 +1.41%

Rootsi OMX 30 +0.81%

Venemaa MICEX +0.60%

Poola WIG +1.26%Aasia turud:

Jaapani Nikkei 225 +2.72%

Hongkongi Hang Seng +1.31%

Hiina Shanghai A (kodumaine) N/A (börs suletud)

Hiina Shanghai B (välismaine) N/A (börs suletud)

Lõuna-Korea Kosdaq +1.22%

Tai Set 50 +0.80%

India Sensex 30 +1.25% -

Stick to the Rules

By Rev Shark

RealMoney.com Contributor

2/17/2010 8:27 AM EST

To study the abnormal is the best way of understanding the normal.

-- William James

The main focus of my posts recently have been whether the market is going to continue to act like it did last year. If it is, then the way to play it is pretty easy: We just need to buy every dip and then wait for a new high. The consistent and immediate recovery of the market favored those who were unhesitating in their bullishness.

This year we started off with strong seasonal action in the first half of January that took us to new highs. We then had a sharp selloff of an attempted bounce and then rolled over again. We have been trying to recover from the second breakdown for the last seven trading days and have nearly done so after the good move yesterday.

Since the breakdown we have had two particularly strong days that helped the bulls to believe that another "V"-shaped recovery was on the way. The first day was on Feb. 2, but there was no follow-through, which was the first significant bounce failure since June and July of 2009.

We are now undergoing the second bounce attempt and after yesterday the bulls are feeling quite positive. Although breadth was quite good and we cut through some overhead resistance, volume was quite light and it didn't qualify as a technical follow-through day as defined by Investor's Business Daily. IBD still considers the market to be undergoing a correction.

The question here is obvious. Do we struggle to trade through overhead resistance at 1100 to 1108 on the S&P 500 or do we act like we did last year and just go straight back up without any concern for the weak technical action behind this rally?

If the market had acted more normally last year, this question wouldn't be hard to answer at all. Under normal circumstances we simply can't trust the market to go straight back up on declining volume. The market violates the "rules" of technical analysis quite often, but if we stick to the odds then we just can't expect the market to move in that fashion.

Many bulls are ready to bet this market is going to do exactly what it did last year and go straight back up, leaving the skeptics and bears on the sidelines and feeling like fools again. It is very easy to see why market players want to embrace that idea. We saw it so many times in the last eight months or so that it looks like it is the standard rule and not that exception.

I'd love to trust in the idea that this market will continue to act abnormally, but it violates my trading style and my discipline. If the market does continue to go straight up to new highs on light volume, then I'm going to be on the wrong side of the trade and will have to take some stop losses and will underperform. That is the price that we pay when we try to apply rules in an environment that is often irrational. As long as we are aware that we will often be wrong and are willing to take steps to keep our losses small, we will be OK in the longer run, but it does cause a lot of frustration and anxiety in the short run.

So we are at an interesting juncture yet again. Will the market continue to act in an abnormal fashion, or will the traditional rules of technical analysis kick in? I have to stick with the TA rulebook, and that means looking for this bounce to fail.

In the early going we have some upside follow-through. Overseas markets acted well and we have some good earnings from Deere. The bulls are feeling good and are looking quite confident.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: WFMI +9.1% (also upgraded to Overweight at JPMorgan), PACR +8.9%, DE +7.8%, CSTR +7.7%, TCX +7.5%, LZB +6.9%, PLAB +6.8% (light volume), HL +4.5%, GIVN +4.5%, MIG +4.5% (light volume), TLB +4.2% (also Talbots and BPW agree to technical amendment to merger agreement to provide greater assurance to BPW shareholders regarding value of merger consideration ), UCTT +3.0%, WINN +3.0%, ING +2.8%, DVN +2.0%, HTS +1.9%, MRH +1.0%... Select financial names showing strength: LYG +2.5%, C +2.1% (Soros doubled gold ETF investment, buys Citi - Reuters), PUK +1.8%, DB +1.7%, RBS +1.7%, HBC +1.3%, BAC +1.1%... Other news: RZ +25.0% (receives approval for $32.99 million U.S. Treasury Grant), CYCC +10.4% (light volume; reports new study in clinical cancer research demonstrates potential for Cyclacel's seliciclib in treating breast cancer resistant to hormone therapy), DVAX +9.3% (receives Canadian approval to conduct Phase 3 trials), NLST +5.8% (announces that a major OEM has commenced volume consumption of NetVault-NV, a flash memory based non-volatile cache memory subsystem targeting RAID storage applications), UEC +5.7% (continued strength), DISCA +5.6% (will replace Pepsi Bottling Group in the S&P 500 index), HGRD +5.4% (still checking), AIXG +5.2% (discloses multiple system order), SAY +4.5% (still checking), NAV +4.0% (awarded $752 mln contract for MaxxPro Dash MRAP vehicles), BYI +2.8% (l replace PepsiAmericas in the S&P MidCap 400 index), CAT +2.0% (trading higher in sympathy with DE), CHK +1.8% (provides Operational Update), SNY +1.8% (still checking), POT +1.6% (Credit Suisse reviews North American January fertilizer inventory data; demand has been strong for all three nutrients), NOK +1.2% (still checking)... Analyst comments: SNDK +4.1% (upgraded to Overweight at Morgan Stanley), ANAD +3.6% (upgraded to Outperform from Market Perform at Northland Securities), JOYG +2.1% (initiated with a Buy at BB&T Capital Mkts), BUCY +1.4% (initiated with a Buy at BB&T Capital Mkts), BCS +1.3% (upgraded to Buy at RBS).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: RICK -10.8% (also the co and VCGH enter into letter of intent to merge to form largest publicly traded N. American Gentlemen's Club Owner), OC -4.3% , VCLK -4.3% , RAX -3.0% , AMMD -2.7% (also announces sale of Her Option global endometrial ablation product line), CPB -2.4% , IAG -1.5% (light volume), HWAY -1.4%... Other news: SIRO -5.6% (announced that it is filing a prospectus supplement to its existing shelf registration statement with the U.S. SEC relating to an underwritten public offering by Sirona Holdings Luxco S.C.A. of 7,000,000 shares of its common stock), DSCI -4.0% (prices a 972K share common stock offering at $5.50/share), PRAA -2.9% (announces public offering of 1 mln shares of its common stock), GSIC -2.4% (announces offering of common stock by selling stockholder), BP -2.1% (trading ex dividend)... Analyst comments: CTXS -0.8% (initiated with a Sell at Citigroup). -

Erinevalt näiteks JPMorganist, kelle arvates jääb laenukraanide kinnikeeramine Hiinas ja fiskaalprobleemid Euroopas turgusid lühiajaliselt painama, ega riku analüüsimaja pikaajalist nägemust, soovitab Morgan Stanely vastupidiselt rallit müügiks kasutada. Via Pragmatic Capitalist:

“We recommend selling risky assets into strength over the near term. The road to repair will be a long, painful journey buffeted by tremendous uncertainty—not typically a great environment for risk-taking. While the announcement details will garner the headlines, the real medium/longer term issue for the markets is not whether troubled sovereigns get the needed aid/liquidity, but rather, whether the aid and the accompanying necessary fiscal retrenchment leads to an unexpectedly soft mid-cycle economic slowdown—or, worse, a double dip—for the developed world.”

-

January Industrial Production +0.9% vs +0.7% consensus, prior revised to +0.7% from +0.6%; Capacity Utilization 72.6% vs 72.6% consensus

-

DELL Feb 14 puts are seeing interest ahead of earnings tomorrow Feb 18 after the close with 7690 contracts trading vs. open int of 20.2K, pushing implied vol up around 3 points to ~67%

-

Moody's downgrades Greek banks' hybrid securities ratings, following revisions to its hybrids methodology

-

Fed's Plosser advises selling some agency MBS from portfolio sooner rather later as recovery gains - Reuters

-

Bill Fleckenstein CNBC-s sõna võtmas ning nägemus üsna negatiivne, kuid QE tõttu ei julge turul short olla. Nagu enamusele viimasel ajal, on ka tema lemmik investeering kuld.

-

Täna turgudel käive keskmise lähedal. Kui päeva alguses oli näha ka kerget müüki, siis bid on väga tugev all ja nüüd liigutakse pea ilma käibeta, kergete spikidega üha kõrgemale.

-

Amazon.com: Loop Rumors discusses today's Credit Suisse note on AMZN; says firm expects Amazon e-book share to fall from 90% to 35%

-

ADI Feb 30 calls are seeing interest ahead of earnings today after the close (volume: 5350, open int: 1820, implied vol: ~76%, prev day implied vol: 68%)

-

CBOE Put/Call ratio hetkeseisuga 1.02 punkti, VIX -2.02% ja VXN -1.23%. Üsna muretu elu.

-

Fed officials raise 2010 GDP forecast to 3.2% from 3% in November, according to Fed minutes - DJ

Fed officials raise 2010 core inflation forecast to 1.4% from 1.3%, according to minutes - DJ

Fed officials mull 25 basis points discount rate rise, according to minutes - DJ

January Treasury Budget -$42.6 bln vs -$46.0 bln consensus -

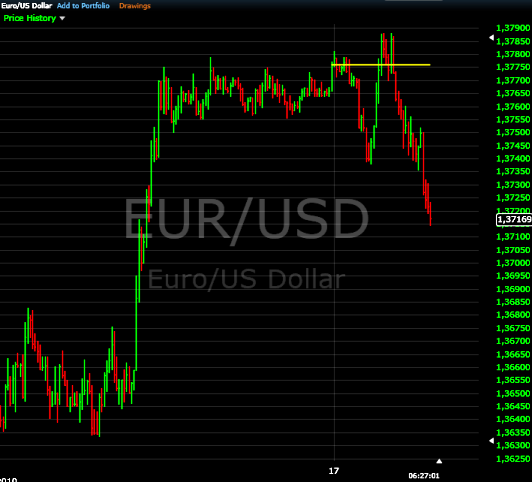

Kuld -0.55% ja EUR -1.20% languses. Mõlemad tublisti tagasi andnud, kuid turg pressib ülespoole. Kas suudetakse 1100 peale ronida?

-

Treasury says housing rescue plan now has 116,297 active permanent modifications vs 66,465 through Dec - Reuters

-

2009 aastal kukkus kulla nõudlus 11%, kuid kulla hind tõusis 35%.

-

Täne pelae turge avaldavad kvartalitulemused: ADI, AMAT, CECO, HPQ, LVS, NTAP, NVDA, PCLN ja homme enne turgude avanemist: APA, ABX, DAI, DTV, GT, MGM, PLA, WMT ja WCG.

-

Viimasel ajal ülipopis kasiinosektoris saab homme huvitav päev olema. Kas MGM ja LVS suudavad oma hinnatasemeid õigustada?

-

Blockbuster (BBI): S&P lowers Corporate Credit Rating to 'CCC'; Outlook Negative

-

Hewlett-Packard prelim $1.10 vs $1.06 First Call consensus; revs $31.2 bln vs $30.01 bln First Call consensus

Hewlett-Packard sees Q2 $1.03-1.05 vs $1.03 First Call consensus; sees revs $29.4-29.7 bln vs $29.03 bln First Call consensus

Esialgu paistavad väga tugevad numbrid, aktsia samuti +3% tõusus ja kauplemas $51 tasemel.