Börsipäev 25. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Vabariigi aastapäev nüüd möödas ja rõhk taas väärtpaberiturgudel. USAst on igaljuhul täna tulemas omajagu makroandmeid. Esiteks tööjõuturu kohta - kell 15.30 avaldatakse esmaste töötu abiraha taotlejate number, kust oodatakse ca 460 000list numbrit. Mäletatavasti eelmine nädal ehmatas just see number turgu väga kõrge 473 000lise näiduga, seega on nüüd oluline näha, kas tegu oli ühekordse hüppega või mitte. Mida madalam number, seda parem aktsiaturgudele. Kestvaid töötu abiraha taotlejaid oodatakse ca 4.57 miljonit.

Samuti näeme kell 15.30 jaanuarikuu kestvuskaupade tellimuste muutust, kust oodatakse ca 1.5%list kasvu (ja ilma volatiilse transpordisektorita +1.0%).

Varastel hommikutundidel on USA tähtsamad indeksid ca 0.6% kuni 0.7% miinuses ning euro on dollari vastu kaotanud 0.5% ja kaupleb tasemel €1=$1.346. -

Abiraha taotlejate madalam number (suur miinus) on ikka kehvem aktsiaturgudele?

-

Ma vaidleks vastu, peaks ikka vähem punane olema.

-

Euro taas müügisurve all, kuna Moody's ja S&P hoiatavad Kreekat lähikuudel uue reitingu langetamisega:

Standard & Poor’s said late yesterday it may lower its BBB+ rating by the end of March and Moody’s Investors Service said today it may reduce its A2 grade in a few months. The warnings further complicate the government’s effort to persuade investors that it can slash its fiscal shortfall from last year’s 12.7 percent of gross domestic product. (bloomberg)

-

punane, sa ajad praegu initial claimsi (esmaste töötu abiraha taotlejate numbri) ja non-farm payrollsi (tööjõuraporti muutuse) segi. Mida vähem esmaste töötu abiraha taotlejaid, seda parem. Mida väiksem miinus kuises tööjõuraportis/mida suurem pluss kuises tööjõuraportis, seda parem.

-

Enesetappude poolest kuulus France Telekom (kaupleb USAs sümboliga FTE) raporteeris täna korralikest tulemustest – eelmise aasta kohandatud puhaskasum oli 4.85 milj. eurot vs oodatud 4.6 milj. eurot (rahavood ka korralikud). Neljandas kvartalis tõusid tulud +3.3%. Samuti teatas ettevõte, et soovib maksta 1.4 eurot aktsia kohta dividende (yield ca 8%). Euroopa telekomide dividendi yield tundub jätkuvalt väga korralik ja mõni neist oleks mõistlik portfelli lisada (Pro all soovitame Vodafone’i, mis kaupleb Nasdaqil sümboliga VOD).

-

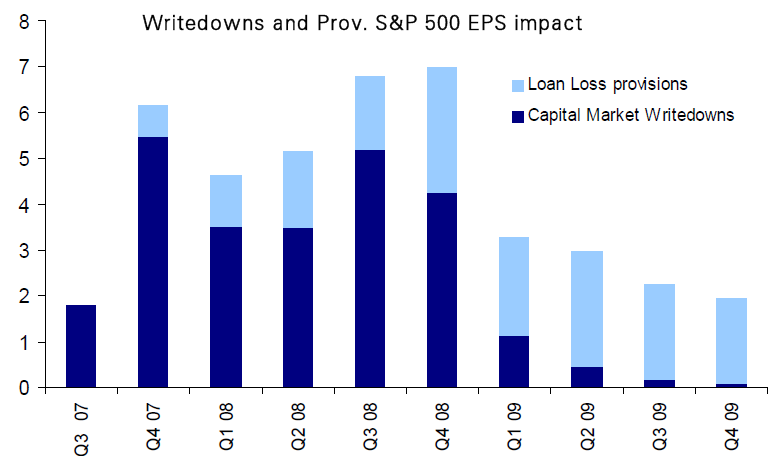

DB-l hea graafik, mis näitab, et mahakirjutamised olid viimases kvartalis peaaegu olematud, kuid laenukahjumid valmistavad pankadele jätkuvalt probleeme:

Allikas: Deutsche Bank

-

DB kinnitab samas analüüsis ka oma S&P500 indeksi 1325 punkti targetit (EPSi ootus $80.8) ja kirjutab:

Strong earnings momentum and a turn in provisioning argue for revising up estimates, but faster than expected dollar appreciation argues against. An imminent increase in enterprise spending, positive guidance, and a turn in provisioning argue for overweighting the Financials, Industrials, Consumer Discretionary and Tech, which is how we are positioned. Negative guidance and a strengthening dollar argue for underweighting Energy and Materials, with underweights for Utilities and Telecom supported by negative guidance and poor earnings momentum, respectively.

-

Klienditoe inimesed on puhkusel või?

-

momentum, klienditoe inimesed ei ole puhkusel.

-

Initial Claims 496K vs 460K consensus, prior revised to 474K from 473K.

January Durable Goods Orders +3.0% vs +1.5% consensus, prior revised to +1.9% from +0.3%.

January Durable Goods ex-trans -0.6% vs +1.0% consensus, prior revised to +2.0% from +0.9%.

Continuing Claims rises to 4.617mln from 4.611 mln. -

Makroandmete poolt nüüd väga korralik külm dušš.

-

Siin on lihtsalt ja lühidalt lahti seletatud, mida uued lühikeseks müügi reeglid USAs endaga kaasa toovad (reeglid kiitis eile heaks SEC).

-

oma osa külmas duššis on selles, et veebruarikuu seasonaly adjusted vs unadjusted andmed on üsna erinevad seoses väiksema päevade arvuga kuus ja puhkepäevaga 15.02.2010 ehk viimasel raporteerimise nädalal :)

UNADJUSTED INITIAL JOBLESS CLAIMS FELL TO 452,468 FEB 20 WEEK FROM 478,235 PRIOR WEEK

UNADJUSTED CONTINUED CLAIMS FELL TO 5,527,142 FEB 13 WEEK FROM 5,597,688 PRIOR WEEK

durable goods numbrid olid aga kokkuvõttes varasemate andmete revideerimisega seoses paremad kui oodati -

USA indeksite futuurid börsipäeva alguseks ca -1.1% kuni -1.4%.

Euroopa turud:

Saksamaa DAX -0.67%

Prantsusmaa CAC 40 -1.07%

Inglismaa FTSE 100 -0.79%

Hispaania IBEX 35 -0.80%

Rootsi OMX 30 -0.54%

Venemaa MICEX -1.95%

Poola WIG -0.30%Aasia turud:

Jaapani Nikkei 225 -0.95%

Hongkongi Hang Seng -0.33%

Hiina Shanghai A (kodumaine) +1.27%

Hiina Shanghai B (välismaine) +1.03%

Lõuna-Korea Kosdaq -1.83%

Tai Set 50 +0.30%

India Sensex 30 -0.01% -

Sitting on the Fence

By Rev Shark

RealMoney.com Contributor

2/25/2010 8:43 AM EST

All men can see these tactics whereby I conquer, but what none can see is the strategy out of which victory is evolved.

-- Sun Tzu

Good trading is all about having an effective strategy. You must be prepared to seize the best opportunities at the best time. There can be a lot of nuance involved, which can be lost when we make broad generalizations about the health of the overall market.

Too many people make the mistake of thinking you have to be either wildly bullish or wildly bearish about the market. To take advantage of opportunities and to effectively manage risk, the proper mindset is usually somewhere in the middle. Even in a very good market there will be bad stocks worth shorting, and in a bad market there will be good longs. If you are too focused on overall market direction, you will miss out on those opportunities.

It can also cost you greatly if you are too inflexible about your market views. The bulls have dominated even when technical patterns appear to be quite negative. If you have been too aggressively bearish when the market has been extended on light volume at technical overhead, you have almost certainly suffered some pain. On the other hand, if you believe in your reading of the charts then you are acting irrationally if you don't listen to what they tell you.

The only solution to this dilemma is to straddle the fence, being distrustful of market direction but not betting against it. That has been my position recently. I believe that the market is going to deliver another leg down in the near future, but the bulls have shown some very good resilience and I'm not going to fight them until they weaken. In fact, I'm going to join them if I can find some charts that I like.

Usually the best way to implement this sort of hedged view of the market is to focus on the charts of individual stocks. Even if you have an overall bearish view of the market, go ahead and buy some good-looking long setups -- but keep time frames short and stops tight. Be ready to move out of the way if your overall market thesis proves to be correct.

Lately I've been distrustful of the market, yet I still have some long positions and have not been aggressive with shorts because they aren't working yet. Since I can't find many longs that I like, I end up with high cash levels by default. If my bearish thesis starts to play out, I'll close out the longs that I have and focus more on the developing shorts. My goal is to react quickly as my market thesis plays out.

It isn't a black-and-white approach, which can be confusing when we talk too much about being "bearish" or "bullish." Overall market direction is the main driving force behind the majority of stocks, but it can be muddled and uncertain quite often. We need to look at those charts that are at the extremes, either very good or very bad.

We have a weak start on the way this morning, which gives us a very tricky market pattern of up, down, up, down over the last four days. The dollar appears to be the main driving force lately, and strength there seems to be producing the pressure this morning. Given the technical condition of the market, the upside looks challenging to me and I'll be ready to be more aggressively bearish, but let's see what the bulls can do with this open.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: VG +13.4%, PPO +13.2%, ESRX +9.3%, IPXL +7.7%, EXM +7.5%, SHOO +7.2% (light volume), SMSI +6.7%, DPS +6.5%, RBS +6.0%, PCS +5.8%, CYD +5.6%, CBEH +5.1% (light volume), ES +4.7% (also upgraded to Mkt Perform at FBR Capital), BX +4.3%, LTD +3.8%, TRLG +3.7%, TQNT +3.7%, GSS +3.6%, GNK +3.3% (light volume), DCI +2.9%, SENO +2.0% (light volume), CRM +1.2% ... M&A news: CCE +31.0% (Coca-Cola Ent North American bottling business to be acquired by KO; CCE will provide its shareowners with a special one-time cash payment of $10 per share )... Other news: SNSS +10.1% (completes formal End-of-Phase 2 meetings with the U.S. Food and Drug Administration), SOLR +4.6% (Announces Multiple New DSS Orders Totaling ~$200 mln), BMY +4.0% (still checking)... Analyst comments: CLDX +4.6% (initiated with Buy at Roth), BIG +3.8% (upgraded to Overweight from Neutral at JP Morgan), KERX +3.0% (initiated with Buy at Roth), NKE +1.5% (added to Conviction Buy list at Goldman), YGE +1.1% (upgraded to Buy at Deutsche), SOL +1.0% (upgraded to Buy at Deutsche), CME +0.6% (upgraded to Buy from Hold at Deutsche Bank),

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ANDS -20.8% (also says ANA598 demonstrates 73% cEVR in combination with interferon and ribavirin; downgraded to Perform at Oppenheimer), MALL -14.9%, MGA -8.8%, BBI -8.3% (also downgraded to Sell from Neutral at Janney Montgomery), ISNS -7.3%, GDP -6.5%, DVR -6.3% (light volume), REV -5.9%, DGI -5.3%, HLX -5.0%, CSE -4.4%, CBOU -4.2%, RRI -3.5%, BTI -2.5%, CCJ -2.1%... M&A news: KO -3.0% (-Cola Ent North American bottling business to be acquired by KO; CCE will provide its shareowners with a special one-time cash payment of $10 per share ) ... Select financial names showing weakness: IRE -3.3%, BBVA -2.5%, KEY -2.5%, AIB -2.5%, ING -1.7%, WFC -1.3%, BAC -1.2%... Select oil/gas related names trading lower: REP -2.6%, RDS.A -2.5%, STO -2.4%, TOT -2.3%, E -2.1%, EOG -2.1%, BP -2.0%, PBR -1.8%, HAL -1.6%, COP -1.3%... Select metals/mining names showing weakness: RTP -3.3%, NG -2.9%, BBL -2.9%, BHP -2.8%, GOLD -1.9%,... Other news: GPRE -8.2% (proposes offering of 5 mln shares of its common stock), KNDI -4.4% (filed for a ~6.89 mln share common stock offering by selling shareholders), TI -4.1% (Telecom Italia to delay results as probe shock spreads - Reuters.com), TS -4.1% (still checking), GME -3.9% (CFO Resigns; accepts a position with WMT; Piper Jaffray downgrades GameStop (GME 18.86) to Neutral from Overweight), NBG -3.7% (Greece to issue bond next week, after austerity package, sources say - DJ), LIHR -3.7% (trading ex dividend), COIN -3.1% (Notifies the SEC of Voluntary Removal from Listing of Units), RF -2.7% (filed for a mixed shelf offering for an indeterminate amount), OC -2.0% (Owens Corning/Fibreboard Asbestos Personal Injury Trust prices secondary offering of ~12.3 mln shares of Owens Corning common stock at $23.75), UL -1.8% (still checking), PCX -1.1% (files mixed securities shelf offering), GE -1.1% (General Electric to sell $3.3 billion stake in Garanti, GE sources say - Reuters.com), X -1.0% (files for a mixed shelf offering for an indeterminate amount)... Analyst comments: TS -8.7% (downgraded to Neutral at Goldman), HPT -4.7% (Baird downgrades Hospitality Properties Trust (HPT 23.14) to Neutral from Outperform), FITB -2.8% ( downgraded to Hold from Buy at Citigroup), FSLR -2.5% (Phaseout of Farmland Tariff Dampens Profitability Further - FBR Research), PSYS -2.1% (downgraded to Neutral at Piper), FMS -1.8% (downgraded to Neutral from Overweight at Piper Jaffray), TSL -1.1% (downgraded to Neutral from Outperform at Credit Suisse). -

jim, su eilne pealkiri "sarjast 'huvitavaid DCF mudeleid' " oli ütlemata hästi sõnastatud : )

-

Treasury says likely to exit its investment in GMAC through sales of shares following public offering; says supplier support program will wind down in April - Reuters

-

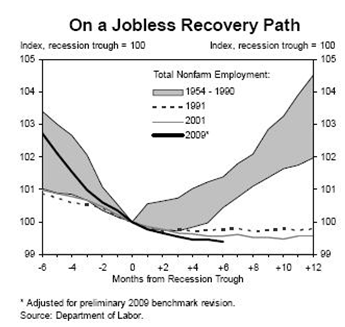

Selle aasta tööturustatistikat kinnitab igal juhul üha rohkem jobless recovery'i teekonda, kus majandus küll kasvab, kuid töökohti ei looda. Siin on üks Goldman Sachsi graafik (eelmise aasta seisuga), mis näitab hästi, et selline olukord on just viimaste majanduslanguste eripära. Graafikul on ka näha, et paranemismärke ei tasu niipea oodata.

Allikas: Goldman Sachs

-

Ma arvan, et neid loomata töökohti USA-s tuleb pigem Hiina SKP-st otsida.

-

pakun lambist, et varasemate peale II maailmasõda toimunud majanduslanguste eel ei olnud ameeriklaste säästumäär veel negatiivne (negatiivne alates ca 2005 vist ja nüüd taas positiivne juba) ja võlakoormus nii kõrge, mistõttu töötu abiraha taotlemine ei olnud nii populaarne kui täna

-

Siin võib kindlasti mitu faktorit olla. Nt:

-USA majanduses toimub mingi strukturaalne muutus (odavat tööjõud on palju, kuid seda pole vaja? Hiina roll?)

-äkki vanasti said ettevõtted kiiremini palgad alla lasta, mis tekitas omakorda kiiremini huvi palkamise vastu, kui ilmusid esimesed rohelised võrsed. -

Natural gas inventory showed a draw of 172 bcf, analysts were expecting a draw of 169 bcf, with ests ranging from a draw of 175 bcf to a draw of 165 bcf.

-

$32 bln 7-year Note Auction Results- Yield 3.078% (expected 3.103%); Bid/Cover 2.98x (4-auction avg 2.745x, Prior 2.85x); Indirect Bidders 40.3% (4-auction Avg 54.4%, Prior 51.1%)

-

Fed's Bullard says Fed should have more, not less, regulatory power - Reuters

-

Fed's Duke says financial market conditions continue to improve, but credit market access remains difficult for many small businesses - Reuters

-

Fed's Duke says anecdotal information suggests consumer deliquencies may be close to peaking - Reuters

-

Fed's Bullard says if inflation expectations become unhinged, would trump all other considerations, Fed would raise rates - Reuters

Ja turg rallin mii mis kole! -

Apple: CNBC notes there is a rumor making the rounds that the co will do a 4-for-1 split

Fed-i Bullardi kommentaarid ja AAPL kuulujutud turu tunduvalt kõrgemale viinud. -

Apple: One shareholder asked CEO Steve Jobs whether the company would dip into its $25 billion cash pile to pay a dividend. Jobs didn't seem keen on the idea, saying that by holding its cash the company maintains "tremendous security and flexibility."

-

Turu kosumise taga kindlasti ka EUR tugevnemine USD vastu ja ostuhuvi kullas.

-

White House says it still committed to Volcker Rule, banks should not use federal safety net to support risky activity - Reuters

-

Fed's Fisher says rates likely to stay low for extended period - DJ