Börsipäev 1. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Märts on alanud optimistlikul noodil. Enamus Aasia aktsiaturge oli üle 1% plusspoolel ning USA indeksite futuurid on hetkel +0.5% kuni +0.6%.

Makroandmetest ootame täna kell 15.30 jaanuarikuu eraisikute sissetulekute muutust (ootus +0.4%) ja kulutuste muutust (ootus +0.4%) Kell 17.00 teatatakse jaanuarikuu ehituskulutuste muutus, kust oodatakse -0.5% ning veebruarikuu ISM indeks, mille ootuseks on 57.8 punkti. -

Nädalavahetusel toimunud maavärin Tšiilis on põhjustanud korraliku hüppe vase hinnas, kuna riik on maailma suurim vasetootja. ANZi toorainesektori analüütiku sõnul on Tšiili vase pakkumise jaoks sama oluline nagu Lähis-Ida nafta jaoks. Hetkel on järgmise kuu vasefutuurid tõusnud +4%. Vasekaevanduste enda sõnul suuri kahjustusi maavärinast siiski ei tekkinud:

"The earthquake hit several medium-sized mines in the centre of the country. Codelco, the state-owned company, halted production at its El Teniente and Andina mines, while Anglo American stopped activity at Los Bronces and El Soldado.

Executives at Codelco on Sunday said they were hoping to re-start production in the short-term after minimal damage, but Anglo American said its two affected mines were “currently without power following the earthquake”. (link FTs)

-

Kreeka CDSid ja võlakirjade yieldid on alates reedest teinud kerge taandumise, kuna riigi peaminister lubas võtta eelarvedefitsiidi vähendamise nimel ette karmimaid meetmeid, mida käesoleval nädalal tutvustada kavatsetakse. Olulist tähelepanu pälvib järgnevatel päevadel kindlasti ka Kreeka 5 miljardi eurone võlakirjapakkumine, mis peaks näitama investorite isu riigi võlakirjade vastu kõigest nädal pärast seda, kui S&P riigireitingu järjekordse kärpe võimalikkusest hoiatas.

Kreeka 10a võlakirja yield

-

Hommikul tulemustest teatanud Euroopa suurim pank HSBC valmistas investoritele pettumuse - 2009. aastal teeniti 5.8 miljardit dollarit kasumit vs Bloombergi konsensuse järgi oodatud $7.8 miljardit. HSBC-le andsid tagasilöögi tohtud laenukahjumite provisjonid. Lisaks kirjutab Nomura, et HSBC Aasia allüksus on raskustes kasvuootuste täitmisega:

The HSBC figures are light; we estimate approximately $1bn (5%) or so in the continuing operations. This shortfall appears to have been concentrated in Asia ex Hong Kong, which is a key part of the growth story and is disappointing, in our view. At the same time, HSBC Finance also reversed some quarters of stabilisation/improvement in Q4 and losses increased and delinquency also rose (allowing for accelerated write-offs). These factors have prompted an initial fall in the shares, which is understandable to us and also represents a potential negative read across to Standard Chartered.

Tuleviku suhtes on HSBC jätkuvalt väga ettevaatlik: Huge challenges and risks remain for all of us,” said Chairman Stephen Green. HSBC aktsia kaupleb Londonis tulemuste peale -4.7% miinuspoolel.

-

Faber taas meedias - ütleb, et üldiselt ta ei usu S&P500 indeksi puhul uue tipu tegemist, kuid kui S&P500 peaks tõusma uutele selle aasta tippudele, siis selle järel ootab ta ca 20%list korrektsiooni. Link intervjuule siin.

-

CNBC Squawk Boxis on täna külas Warren Buffett, kes on jätkuvalt majanduskasvu taastumise suhtes optimistlik:

"We got past Pearl Harbor. We will win the war, and it's going slightly our way."

Aktsiaturgudel eelistab Buffett olla ostupoolel siis, kui hinnad kukuvad:

"Buffett says he likes stocks more when they go down in price, just as he likes to buy hamburgers at McDonald's more when they're sold at a lower price. Stocks are "far less attractive" now than they were a year ago because they've gone up in price over that time. He says bonds are also far less attractive than a year ago." (link)

-

Tarbijad kulutasid jaanuaris oodatust natuke rohkem, kuid sissetulekud kasvasid oodatust vähem:

January Personal Spending +0.5% vs +0.4% consensus, prior revised to +0.3% from +0.2%

January Personal Income +0.1% vs +0.4%, prior revised to +0.3% from +0.4%

-

säästumäär aka savings rate kukkus selle tulemusel 4,1 pealt 3,3 peale

-

tegu madalaima säästumääraga alates 2008. aasta oktoobrist.

-

USA tähtsamad indeksid alustavad päeva ca 0.3% kuni 0.4%lise tõusuga ning nafta on kerkinud 0.8% $80.3 peale.

Euroopa turud:

Saksamaa DAX +1.25%

Prantsusmaa CAC 40 +0.86%

Inglismaa FTSE 100 +0.46%

Hispaania IBEX 35 -0.08%

Rootsi OMX 30 +1.11%

Venemaa MICEX +0.68%

Poola WIG +0.16%Aasia turud:

Jaapani Nikkei 225 +0.45%

Hongkongi Hang Seng +2.17%

Hiina Shanghai A (kodumaine) +1.18%

Hiina Shanghai B (välismaine) +0.14%

Lõuna-Korea Kosdaq N/A (börsid suletud)

Tai Set 50 N/A (börs suletud)

India Sensex 30 N/A (börs suletud) -

An Indecisive Market

By Rev Shark

RealMoney.com Contributor

3/1/2010 8:38 AM EST

Indecision and delays are the parents of failure.

-- George Canning

For three weeks now the market has been struggling to recover from a technical breakdown. The action hasn't been bad, but it has not been easy either. The bulls are holding up well but have not been able to move back over 1109, the 50-day simple moving average of the S&P 500.

Last year the market seldom hesitated as it bounced back from a pullback. Once we started to turn back up, we'd just keep on running and cut through technical overhead as if it were meaningless.

This time the action is much more mixed. We have had quite a few positive days and there seems to be a pretty consistent bid under the market, but we have yet to see an accumulation day -- an up day on higher volume -- since this bounce began. Volume has been quite light and leadership is a mess. Despite poor consumer confidence news, higher-than-expected weekly unemployment claims and other negative economic news, retail stocks have been leading the market. The news flow has not been very positive yet it doesn't seem to matter too much.

The action has a bullish bias, but it's indecisive and slow. We can't be overly negative because we are holding up well and appear to have a supply of buyers providing support. On the other hand, if we don't make better progress soon there is risk that the bulls will give up or tire out. The bulls need to press their advantage while they still have it.

In an indecisive market, we have to stay flexible and be ready to adapt should a stronger trend emerge. We have this low-energy bounce in play right now, but there is so little momentum that we can't be very trusting that it will continue. On the other hand, the bears are struggling even more and have not been able to make any progress at all.

Today is a Monday morning and the first day of the month, both of which tend to have a positive bias. The market has done very well on Mondays for quite some time and we are off to a positive start once again.

I'm going to be keeping time frames short and stops tights. I don't want to be bearish here, but I don't want to be very trusting of the bulls either. It's indecisive out there, and we have to keep an open eye until we see what the market wants to do.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: BID +6.2%, USU +6.2%, ROSE +2.5% (light volume), ISIS +1.0%... M&A news: OSIP +47.2% (Astellas Pharma offers to acquire OSI Pharmaceuticals for $52.00/share in cash), RISK +12.7% (MSCI to acquire RiskMetrics for $21.75/share in cash and stock), MIL +11.4% (Merck KGaA acquires Millipore for $107/share in cash)... Other news: CIIC +19.0% (still checking), ARIA +13.8% (receives Orphan Drug Designations for its investigational pan BCR-ABL inhibitor, AP24534, in chronic myeloid leukemia), AIG +8.6% (AIG to sell AIA to Prudential for approx $35.5 bln; upgraded to Buy at Societe Generale), BIOD +5.3% (announces FDA Accepts VIAject NDA for Review), PLL +5.1% (up in sympathy with MIL), ELN +5.0% (announces that findings from a Phase II study which suggested bapineuzumab reduced amyloid-beta deposits), VVUS +3.6% (announces FDA acceptance of Qnexa new drug application for treatment of obesity), NUVA +2.5% (announces additional insurance provider XLIF policy reversal; upgraded to Strong Buy at Needham, target raised to $53 at JP Morgan following XLIF removal from experimental procedures), MRH +1.5% (purchases 6.9 mln of its common shares in a private transaction), SPWRA +1.4% (signs 32-megawatt solar power supply agreement with Toshiba), FCX +1.1% (Chile quake impact on copper's limited, Goldman says - DJ), ... Analyst comments: ASIA +4.5% (upgraded to Buy from Neutral at Goldman), ESV +3.2% (added to Conviction Buy List at Goldman), DNR +3.0% (upgraded to Buy at KeyBanc Capital Mkts), CVH +2.7% (upgraded to Overweight from Equal Weight at Morgan Stanley), PALM +1.5% (Buy PALM in the aftermath - MKM Partners), BRY +1.3% (upgraded to Outperform from Market Perform at Raymond James ),

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PUK -13.5%, GAME -12.0%, HBC -7.6%, SNDA -6.5%, CEDC -4.8%, PWRD -3.5%, IPI -2.6%... M&A news: MXB -8.3% (MSCI to acquire RiskMetrics for $21.75/share in cash and stock)... Select financial related names showing weakness: LYG -7.7%, AIB -6.4%, IRE -6.1%, BCS -5.6%, CS 1.4%... Select metals/mining names trading lower: GOLD -2.0%, RTP -1.4% (Rio Tinto increases ownership in Ivanhoe Mines to 22.4% with $232 mln purchase of shares), AU -0.8%, ... Other news: AV -7.4% (still checking), SOLR -5.0% (filed for a 25 mln share common stock offering by selling shareholders), OSK -2.3% (mentioned negatively in Barron's), BT -1.3% (still checking), DMND -1.0% (announces it has commenced an offering of 4,500,000 shares of common stock)... Analyst comments: TASR -5.4% (downgraded to Neutral at JP Morgan), SIRI -3.9% (downgraded to Hold at Wunderlich), ITRN -1.0% (downgraded to Underweight from Neutral at JP Morgan), ANF -0.7% (downgraded to Sell from Hold at Brean Murray). -

February ISM Manufacturing 56.5 vs 57.9 consensus, January 58.4.

January Construction Spending M/M -0.6% vs -0.6% consensus. -

Makro seega vastavalt ootustele.

-

Tax increases, spending cuts both needed to balance U.S. budget, according to U.S. House Majority Leader Hoyer - Reuters

-

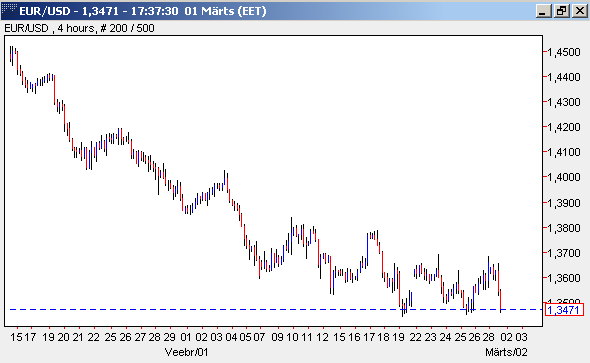

EUR/USD on täna viimaste kuude põhjade juurde vajanud. Aktsiaturge dollari kallinemine (täna eelkõige naela suhtes) hetkel ei hirmuta. Igal juhul tasub jälgida, kas EUR/USDi veebruarikuu põhjadest minnakse läbi või mitte?

-

Kreeka rahandusminister üritab jätkuvalt rahustada inimeste kartusi riigi eelarvepoliitika osas:

Greek Fin Min tells German paper that Greece is ready to take further budget consolidation steps; says will do what is necessary -

Nüüd võiks siia otsa kohe jälle tulla mõni süüdimatu Kreeka parlamendihälvar, kes Reutersile teataks, et Kreekat koheldakse praegu, nagu Tshehhe aastal '38 või et peale Saksa soovidele vastavate eelarvemeetmete vastuvõtmist muutub Ateena Varssavi geto sarnaseks vms. Traditsioone järgides või nii.

-

Kreeklased peavad end vist euroopaliku kultuuriruumi nii kõvadeks esiisadeks, et neile on kõik lubatud. Oleks aeg kärpimisega Lätist lõuna poole edasi suunduda ja kopitanud ühiskonnamudelid ümber vaadata.

Kas kusagil mingeid Kreeka riigivõla graafikuid ka näeb? -

Hinna/tootluse graafikuid siis, mitte mahu.

-

Naftafutuurides toimumas kõva müük (käive väga korralik), hetkel kauplemas juba $78.60 tasemel, olles 1.33% languses. Ei leia mingit uudist müügi põhjenduseks, üsna kummaline.

-

USD/EUR paigal püsinud, kuid nafta liigub magnetina $78 tasemele.

-

FNM ja FRE laenudega toetatavat nn koduplaani pikendati valitsuse poolt 10. juunist 2010 kuni 10. juunini 2011.

Fannie, Freddie Regulator extends home affordable refinance program by a year - Reuters -

IMF says global recovery off to stronger start than expected - DJ

IMF note to G20 Ministers says us dollar still 'somewhat overvalued' - Reuters -

Greek PM calls Cabinet meeting for Wednesday to "take decisions about the economy" - Reuters

-

OCC'S Dugan says banks' sovereign risk exposure is something regulators have been concerned about, watching for a long time, according to Reuters insider - Reuters

-

Qualcomm (QCOM) increases quarterly dividend by 12% and announces new $3 bln stock repurchase program

-

Intel's Sean Maloney to take medical leave.

INTC kauplemine peatatud.