Börsipäev 8. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Filmil 'Alice Imedemaal' on olnud erakordselt edukas avanädalavahetus nii tava- kui ka 3-D kinodes. Üheks suureks võitjaks kindlasti Imax Corporation (IMAX), kes on pärast ülimenukat Avatari saanud hulgaliselt uusi kinoelamuse otsijaid. IMAX on LHV Pro investeerimisidee.

Alljärgnev lõik on pärit Bloombergi loost (link siin):

March 7 (Bloomberg) -- “Alice in Wonderland,” the Lewis Carroll tale re-imagined in 3-D by director Tim Burton, made $116.3 million in U.S. and Canadian ticket sales for Walt Disney Co. this weekend, the sixth-biggest opening ever.

The movie also set other records: the biggest debut for March and for a 3-D film, the largest opening weekend for the year, and the best-ever Imax opening, Hollywood.com Box-Office said.

“Alice,” which stars Johnny Depp as the Mad Hatter, opened in 3,728 domestic theaters with 2,063 3-D screens and on an additional 188 in Imax 3-D, according to Hollywood.com. Movie studios are turning to 3-D films to bolster attendance and ticket sales following the record box-office success of “Avatar,” James Cameron’s 3-D epic. Cinemas on average charge about $3 more per ticket for a 3-D film.

“This is a sensational opening weekend,” said Brandon Gray, president of Box Office Mojo, a research company in Sherman Oaks, California.

“It’s not just kids going to see the picture,” he said. “Adults are going as well, and adults without kids.”

“Alice” is the first film ever to cross the $100 million mark in the January-to-March period. Its $11.9 million in Imax receipts is also a record, Hollywood.com said.

-

Naistepäeva puhul hüüame kõik mehed kooris ELAGU NAISED !!!

-

Ilusat naistepäeva kõigile õrnema soo esindajatele ka minu poolt.

Käesolev nädal kujuneb USA-s makrouudiste kohalt võrdlemisi õhukeseks ning suurem tähelepanu koondub alles neljapäevasele töötuabiraha taotluste raportile. Reedene positiivsus on öösel kandunud Aasia turgudele, tuues viimase indeksid kuue nädala tippude juurde. Prantsusmaa presidendi julgustav sõnavõtt Kreeka abistamisest on aga kasvatanud investorite riskiisu euro vastu, mis on tugevnenud dollari suhtes 1.368 tasemel. -

Õige, naxitrall. ELAGU NAISED !!!

Huvitav oleks teada, kui suur osa LHV foorumi igapäevakasutajatest on õrnema soo esindajad? -

iPadi ametliku müügipäeva kinnitamine 3. aprillile vedas Apple'i aktsia reedel uuele rekordtasemele (218.95), mis teeb ettevõtte turukapitalisatsiooniks 198.54 miljardit dollarit. Tänase seisuga on Apple'st saanud neljandaks suurim USA ettevõte, ent päev mida paljud tehnoloogiasõbrad pingsalt ootavad, on hetk, mil möödutakse Microsoftist. Selleks peaks Apple'i turukapitalisatsioon kasvama veel 50 miljardi võrra, mis tähendaks 276 dollarilist aktsiahinda. Vaata videolõiku Apple'i disainist 34a pikkuses ajahorisondis.

-

Kutsume tänase päeva meeleoludes osalema meie neljapäevasel investeerimisalasel seminaril, mille seekord oleme korraldanud just naistele mõeldes. Info ja vajaliku eelregistreerimise leiab siit.

-

AIG teatas, et müüb oma American Life Insurance Co allüksuse (ca 20 miljonit klienti) MetLife'ile (ettevõte, mida juhtis enne praegune AIG tegevjuht R. Benmosche). Tehingu eest saadakse 15.5 miljardit dollarit. Alles eelmisel nädalal teatas AIG, et müüb oma Aasia AIA allüksuse Prudentialile 35.5 miljardi eest. Kokku on AIG suutnud pärast oma bailout ca 60 miljardi eest oma varasid müüa. Mäletatavasti ei suudetud AIG varadele alles 2009. aasta märtsis võileivahinna eest ostjaid leida, kuna ettevõte raporteeris rekordilisest 99.3 miljardi suurusest fiskaalaasta kahjumist.

-

Euroopa turud liiguvad kitsas vahemikus reedese sulgemistaseme juures. Korraliku tõusu suudab teha Kreeka börs. Nagu Erko hommikul kirjutas, siis vähendas Ateenas pingeid Prantsusmaa president N. Sarkozy, kelle sõenul on euroala riigid valmis Kreekat aitama, kui riik peaks makseraskustesse sattuma. Samuti kirjutavad ajalehed, et Euroopas käivad läbirääkimised "European Monetary Fundi" loomiseks, mis peaks edaspidi abi pakkuma makseraskustes euroala riikidele - link WSJ loole siin.

-

Joeli positusele täienduseks lisan siia Piper Jaffray väga positiivse kommentaari IMAXi kohta.

IMAX results for Alice in Wonderland smashed previous domestic opening weekend records, performing well ahead of Avatar on most metrics. Once again, firm believes Street ests for IMAX box office results were too low and now anticipate consensus 1Q rev ests are 18% too low. Firm thinks Alice results demonstrate why studios and exhibitors are pleased to be IMAX partners and will not likely be haggling for percentage pts anytime soon. Firm sees a very strong upcoming release slate suggesting more outperformance to come in the 2Q. Firm see the bears in a precarious position with the Street needing to raise 1H numbers significantly and approx 14% short interest in the stock.

Imaxi aktsia on pärast reedest 5.4%-list rallit täna eelturul veel 2.5% kõrgemale roninud. Ettevõte avaldab oma kvartalitulemused neljapäeval enne turgu. -

Merriman on IMAXi 4Q09/1Q10 tulemuste suhtes positiivne, kuid natuke murelik FY11 suhtes:

Merriman notes that for the weekend ending March 7, the domestic box office totaled an estimated $194.3 mln, up 66.3% YoY. The top movie of this year's weekend was new release Alice in Wonderland from Disney (DIS), which generated an estimated $116.3 mln -- with the 3D versions accounting for 70% of the domestic total. They note IMAX is reporting Thursday morning. They are projecting 4Q revenues of $42.9 mln and EPS of $0.08 vs. consensus of $45.3 mln and $0.07. They believe strong Q1 results are already reflected in IMAX's valuation. Their Q1 EPS est is currently $0.20 vs consensus of $0.19. However, increasing the Q1 IMAX box office for their ultimate Avatar expectations, they believe Q1 EPS has the potential to reach $0.30-0.35. But, they expect difficult compares entering FY11. They remain concerned over 2H10 and FY11 as studios can be more profitable going through regular 3D screen vs IMAX screens, also exhibitors will migrate away from installing IMAX screens to go for 3D screens (briefing).

-

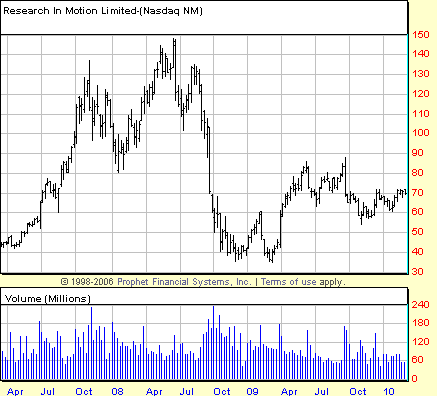

BMO Capital Marketsi Research in Motioni (RIMM) $70 dollari suurune hinnsiht on täitunud ja ettevõte tõstab RIMMi "market perform" soovituse "outperform" peale koos $88 dollari suuruse hinnasihiga. RIMM teatab tulemused 31.03.10.

As mentioned earlier BMO Capital Markets upgraded RIMM to Outperform from Market Perform and raised their tgt to $88 from $70 saying they expect a meaningful beat and raise when the company reports on March 31. Firm says they are $0.05 above consensus for February and $0.14 above for May. They say strength should be driven by all regions,and the 9700 and 8520 both seemed strong. Competition that they were expecting now seems further away, including a CDMA iPhone, giving RIMM the ability to further grab share in the Smartphone segment. They also expect the solid cash flow performance from the November quarter to continue. (briefing)

-

Euroopa turud:

Saksamaa DAX +0,01%

Prantsusmaa CAC 40 -0,09%

Inglismaa FTSE 100 -0,01%

Hispaania IBEX 35 +0,43%

Rootsi OMX 30 +0,30%

Venemaa MICEX suletud

Poola WIG +0,35%Aasia turud:

Jaapani Nikkei 225 +2,09%

Hongkongi Hang Seng +1,97%

Hiina Shanghai A (kodumaine) +0,73%

Hiina Shanghai B (välismaine) +0,82%

Lõuna-Korea Kosdaq +1,24%

Tai Set 50 -0,29%

India Sensex 30 +0.64%S&P futuur indikeerib avanemist reedese sulgumistaseme juurest

-

Gapping down:

In reaction to disappointing earnings/guidance: YGE -1.7% (also announced 300 MW PANDA mono-crystalline manufacturing capacity expansion project)... European bank stocks showing relative weakness: IRE -4.1%, AIB -2.1%, ING -2.0%, UBS -1.6%, LYG -1.5%... Other news: TTM -6.3% (Daimler selling up to $429 mln Tata Motors stake, sources says - Reuters.com), SSTI -5.7% (shareholders to receive $3.05/share in cash under newly amended merger agreement with MCHP), CIEN -2.8% (announces proposed private sale of $250 mln in convertible senior notes due 2015), NG -2.4% (announces additional $75 million financing)... Analyst comments: AZN -1.8% (cediranib fails in head-to-head with Avastin - Pharma Times), FITB -1.7% ( downgraded to Mkt Perform at FBR Capital), AKS -1.3% (downgraded to Neutral at Goldman).

Gapping up:

In reaction to strong earnings/guidance: XRTX +17.4%, CMM +7.3%, RFMD +5.6%... Other news: OSTE +22.9% (co announces its MagniFuse distributed to 68 U.S. Hospitals as product revenue surpasses $1 mln), GMO +5.3% (seeing continued momentum from Friday's 50%+ move), SEED +10.4% (develops strategic business unit for premium branded pesticide products), AIG +3.5% (confirms sale of American Life Insurance Co to MET), MET +2.6% (co and AIG confirm agreement for the sale of American Life Insurance Co, to MET for approx $15.5 bln; MET expects the American Life Insurance transaction to increase its 2011 operating earnings per share by approximately $0.45-0.55 per share), AMAT +2.6% (announces increased cash dividend to $0.07 from $0.06, and $2 billion share repurchase authorization), MCD +1.1% (reports Feb same store sales up 4.8%)... Analyst comments: RIMM +2.6% (upgraded to Outperform at BMO), X +2.4% (upgraded to Buy from Neutral at Goldman), JCG +1.95% (FBR sees tomorrow's Q4 report as a positive catalyst; expects in-line 4Q09; guidance range with consensus near the midpoint), M +1.7% (upgraded to Buy at Soleil).

-

Rev Shark: Typically Atypical

Remember as far as anyone knows, we're a nice normal family.

-- Homer J. SimpsonOn Friday the market was well set up for a "sell the news" reaction to the jobs news, but expectations were low, we opened strong and didn't look back. According to SentimenTrader.com it is unusual that we didn't have some sort of reversal, but history still favors some profit-taking in the next day or two.

The most typical thing about this market recently has been its tendency to act in atypical fashion. We rally on mediocre volume, cut through resistance without much hesitation and become increasingly overbought even when there is a normal catalyst for some selling.

The easiest thing to do in an environment like this is to overthink. We can come up with lots of good reasons, both technical and fundamental, that the action shouldn't be this strong, but the simple fact of the matter is that we are very strong, and if you battle it you are on the wrong side of action.

When the market acts like this I always end up receiving email from folks who think I'm foolish for expressing any doubts or hesitancy about the action. "Just jump in here and stop looking for reasons not to love this market" is the sentiment.

Frankly I agree with that idea to a great degree. We might not find the market very logical or understandable at times, but our job isn't to be a psychologist but to do what we need to in order to make money.

Simple discipline keeps me from being more bullish. I have a trading methodology that has served me well over the years, and I'm going to stick with it regardless of what the market is doing. That trading methodology has me taking profits into strong moves and prevents me from chasing technical stocks. I still end up buying things and I don't put on shorts, but I find it increasingly difficult to put capital to work when the trading environment exhibits what I consider to be unusual action.

One thing I need to do a better job of conveying is how I still am doing some buying even though I don't like the technical pattern of the broad indices very much. Those are not mutually exclusive activities: Even in an extended market there will be good stocks that are poised for more upside. There is increased danger of being caught in a reversal, but if you keep time frames shorter and stops tight, you can diminish that risk to some degree.

In premarket trading we have indications for fairly flat action and there's not much news on the wires. Keep in mind that Mondays have been the best-performing day of the week by far since the lows a year ago. However we are very extended after going up every day last week, and the risks of at least some mild profit-taking are high. Nonetheless, we'll be looking for some action to play.

Buckle up and strap on your trading helmets. It should be an interesting week.

-

Siin head graafikud ameeriklaste võlakoormusest. USA suure võlakoormuse taustal on üsna tabav Paul Volckeri antud kommentaar nädalavahetusel:

“Maybe fortunately it’s tested with a country as small as Greece, which doesn’t present an insuperable financing problem...”

Igal juhul on ameeriklastele ülioluline, et nende kasvav võlakoormus liiga suurt paanikat investorite seas ei tekita. See on kindlasti ka üks makroteema, mille suhtes võivad aktsiaturud tundlikuks muutuda, kui tähelepanu Kreekast ja Lõuna-Euroopast USA peale läheb.

-

Kuld, nafta ja EUR langusesse vajunud, kuid aktsiad hoiavad reedestel sulgemistasemetel.

Reedene RUT short idee läbi opti veel hetkel lahti aga kui turg täna nõrgenemismärke ei näita, siis õhtuks positsioon kinni.

S&P 500 põhi jäi 666 peale, RUT reedene sulgumistase 666.02, kas võiks paralleele tõmmata? -

ZANE tõusnud 3 päevaga $0.25 pealt $3.20 peale:

Zanett (ZANE): contracts signed in Jan & Feb Over $12 mln

Co announced that between the two months of Jan & Feb, over $12 mln in new business has been closed. This amount of revenue is comprised of 42 different customers, with the largest customer being responsible for a $4 mln mandate. -

ES 15-20 minutiga 3 punkti spikenud, samuti SPY korralikult üles liigutatud. Aktsiates ja teistes futuurides tõusukäive tagasihoidlikum.

-

Tööstus täna raske, DOW kergelt negatiivne:

The industrials are trading -0.33% vs. the S&P 500, which is trading at +0.07%. In the sector, 44 of the 60 industrial stocks in the sector are trading in negative territory as the group is primarily moving today on broad market weakness.

Nasdaq väga tugev, kus liidriteks RIMM ja CSCO.

CSCO käive täna muljetavaldav ja ühtlasi kauplemas 20 nädala tippudel. -

Turul käive täiesti ära vajunud, kas jõud hakkab raugema?

Viimane kord kui käive nii ära vajus ja VIX põhju tegi oli turg eelmiseid tippe tegemas, millele järgnes ~8% kasumivõttu.

See ei tähenda, et turg nüüd kukkuma peaks hakkama vaid positsioonide soetamisel peaks olema ettevaatlik.

VIX täna isegi 1.5% tõusus, mis indikeerib kaitse soetamist. -

Cisco Systems to unveil new tools for build out of high speed networks - CNBC

See uudis siis tõusu taga:) -

Nysel 22:30 käivet 640 mln aktsiat, mis on ikka väga lahja.

Tänan tähelepanu juhtimise eest:) -

kuidagi ulmeliselt väärakas tundub eesti keelses tekstis mio-lühendi kasutamine

in other news,

head naistepäeva :-)