Börsipäev 22. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Sel nädalal toimub kauplemine sarnaselt eelmisele nädalale USA turul kell 15.30-22.00. Nädalavahetusel läheb suveajale üle ka Eesti ning uuel nädalal naaseme siis tavapärasele 16.30-23.00 kauplemisperioodile. Makroandmete poole pealt USAst täna midagi olulist tulemas ei ole, kuid reedel allapoole liikumisega hoo sisse saanud indeksid on täna eelturul oma miinust kasvatanud ning futuurid kauplevad -0.6% kuni -0.75% tasemetel.

Kõigile LHV foorumikülastajatele siinkohal aga palve minu poolt. Oma magistritöö raames palun abi ca 10 minutilise aktsiaturgude teemalise küsitluse täitmisel. Tõsi, tavaliselt pooldame selliste küsitluste panemist 'vaba teema' alla, kuid kuna töö teema on seotud otseselt investeerimise ja aktsiaturgudega, kasutan moderaatori õigusi ning levitan oma küsitlust kuni märtsikuu lõpuni ka siinses börsipäeva foorumis. Link küsitlusele on siin. Palun kõigil, kel vähegi võimalik, selle täitmiseks 10 minutit eraldada. Suured tänud kõigile vastajatele!

-

Valuutaturul valitseb euro osas jätkuvalt palju ebakindlust, kuna endiselt pole selgust kas ja kuidas Kreekat abistama minnakse. Neljapäeval ja reedel kohtuvad Euroopa riikide esindajad, kus see teema uuesti päevaplaani võetakse. Kreeka ise tõdes läinud nädalavahetusel, et ilma laenuta suudavad nad vastu pidada aprilli lõpuni, seega tõenäoliselt peaks selleks hetkeks otsus olema tehtud, enne kui Kreeka võlakirju emiteerima hakkab või siis mõnelt organisatsioonilt laenu saab. Sakslaste tugev vastumeelsus Kreeka ja üha rohkem ka eurotsooni vastu peegeldub Merkeli nädalavahetuse kommentaarist:

I don’t see that Greece needs money at the moment and the Greek government has confirmed that. That’s why I’d urge us not tostir up turbulence in the markets by raising false expectations for Thursday’s council meeting. Aid will not be on the agenda at themeeting on Thursday because Greece says itself it doesn’t need help right now.

-

Erko jutule siia järjeks ka nädalane pilt EUR/USD liikumisest - kolmapäeva tasemelt €1=$1.38 on allapoole tuldud 2% ning kaubeldakse tasemel €1=$1.3525.

-

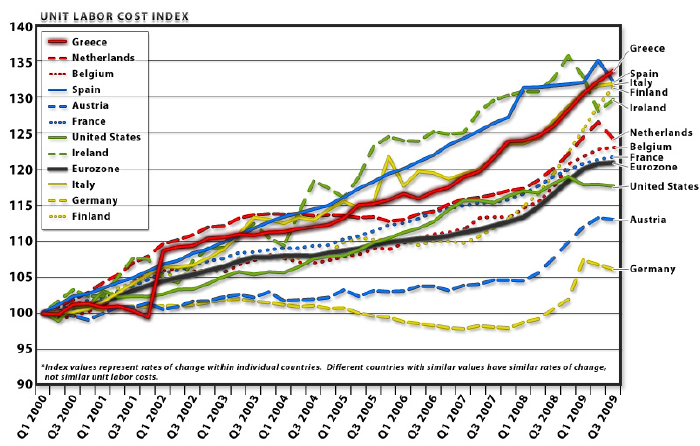

Gartmani newsletteris on väga hea graafik tööjõukulude muutuse kohta eurotsoonis alates aastast 2000.

-

See graafik peaks pigem näitama kui palju on kusagil tööjõud kallimaks läinud. Kui graafikule panna ka Eesti siis teeks me tõenäoliselt Kreekale ära aga ometigi ei ole meie tööjõud tänagi nii kallis kui Saksamaal.

-

http://stats.oecd.org/index.aspx?DatasetCode=ULC_QUA

Cynicul õigus

kui võtta 2005 aasta väärtuseks 100, siis veel 2009. aasta Q2 olid Läti, Eesti ja Leedu teistest tööjõukulude kasvu osas pikalt ees -

Kahjuks on see tõsi, et Eesti on Kreekale Unit Labour Cost Index-i kasvus (konkurentsivõime kadumises) pika puuga ära teinud.

OECD andmetel kasvas Kreeka ULC 2005-Q2/2009 14,5% Eestis samal perioodil 57,8%, Lätis 65,1%. Jutt on majandusest tervikuna, mitte tööstusest või eksportivast sektorist.

http://stats.oecd.org/Index.aspx?QueryName=427&QueryType=View&Lang=en -

jah, Cynicul on õigus, graafik kajastab muutust mitte tööjõu üldist kallidust nagu mina välja tõin. Parandasin oma kommentaari

-

Euro on vajunud alla 1.35 taseme ja saamas tugevat müüki. .

-

USAs tuleb täna korralikult punane päeva algus. S&P500 indeksi futuurid on hetkel -0.7%, nafta kogunisti -2.3%.

Euroopa turud:

Saksamaa DAX -0.89%

Prantsusmaa CAC 40 -1.14%

Inglismaa FTSE 100 -0.96%

Hispaania IBEX 35 -2.25%

Rootsi OMX 30 -0.68%

Venemaa MICEX -1.14%

Poola WIG -0.74%Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hong Kongi Hang Seng -2.05%

Hiina Shanghai A (kodumaine) +0.22%

Hiina Shanghai B (välismaine) +0.10%

Lõuna-Korea Kosdaq -0.10%

Tai Set 50 -0.31%

India Sensex 30 -0.95% -

A Confederation of Influences

By Rev Shark

RealMoney.com Contributor

3/22/2010 8:38 AM EDT

Capital is reckless of the health or length of life of the laborer, unless under compulsion from society.

-- Karl Marx

On Friday, the major indices suffered the first significant selling in some time. The point loss wasn't particularly large, but breadth was poor and volume heavy. Given how technically extended the market had become, it was only a matter of time before we saw some sort of pullback.

The question now is whether the action Friday is the beginning of a significant turning point, or just a healthy pause that refreshes and sets the stage for more upside. Typically, the indices don't make a new high and suddenly collapse. There are usually strong bulls and buyers who have been left out, who provide underlying support for at least a little while. It is only after the market fails to advance more and they grow frustrated and worried that we see a reversal pick up steam.

What is interesting about the present situation is that this toppy technical action is occurring at the same time as the passage of the very significant health-care legislation. It is a very convenient excuse for selling and profit taking, right at a point where the market is badly in need of a correction or consolidation.

There will continue to be great debate over how good this bill is for the Unites States overall, but I don't think there is any real question that it is bad news for the investment class. The bill will be paid for in large part by the extension of the Medicaid tax to capital gains, interest, dividends and rent, and many businesses are already forecasting that their health-care costs will rise significantly. Even the New York Times in an editorial today states that the legislation will raise, not lower, federal deficits by $562 billion.

The debate over health care is going to continue for quite some time, but what we need to consider is whether the passing of the bill is going to be the catalyst for a market turn. The timing for the bears is almost too convenient. To become extended as we are and then completely reverse on the health-care legislation is a little too cute. It isn't as if the negatives of the health-care bill and its likely passing weren't already known.

The market has seemed very unconcerned about this bill, but that may be because the negatives really don't kick in for a while. In the early stages of implementation, the bill is mostly positive, eliminating discrimination against those with pre-existing conditions, for example.

Overall, the extended technical conditions and the health-care legislation are an interesting confluence of events that are supportive of more profit taking and pullbacks, but we shouldn't be too quick to jump to the conclusion that we are seeing a major market top. It may develop into one, but it will take some time and is likely to occur in fits and starts.

I've been staying very short term and defensive lately as the market has become more extended and provided little good upside opportunity. This has left me positioned now with quite a bit of cash and a lot of flexibility. I intend to stay defensive and will look harder at the short side, but hopefully, a pullback will give us some interesting long opportunities as well.

We have a good amount of selling in the early going and overseas markets have been mostly in red. However, it is Monday morning, and it wouldn't be surprising to see the dip buyers show up and give it a try once they had a cup or two of coffee.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ALV +6.7%, WSM +2.1%... M&A news: CXG +23.4% (CONSOL Energy to commence a tender offer to acquire all of the shares of CNX Gas common stock that it does not currently own at a price of $38.25)... Other news: SONS +9.4% (Cramer makes positive comments on MadMoney), NOVL +6.4% (rejects Elliott Associates' unsolicited, conditional proposal as inadequate), THC +5.4% (still checking), BDSI +5.0% (announces positive Pre-IND meeting on BEMA Granisetron development program), SD +3.5% (Cramer makes positive comments on MadMoney), GME +1.0% (mentioned positively in Barron's)... Analyst comments: HALO +10.3% (light volume; upgraded to Buy from Hold at Brean Murray), GPC +1.2% (upgraded to Buy from Neutral at Goldman).

Allapoole avanevad:

IRE -7.6%, VRNM -4.4%, AIB -3.4%, MT -3.1%, CS -2.8%, SNY -2.7%, AIG -2.3%, RDS.A -2.2%, BP -2.1%, BT -1.6%, NOK -1.3%. -

Teemaväline küsimus. Kas USA turu tehingutasude maksustamise kohta on mingeid uudiseid (eriti huvitab futuuride tehingutasude maksustamine)?

-

Geithner says failure to pass financial reform would mean U.S. would lose opportunity to set global financial regulatory agenda - Reuters

-

ZWEN, minu teada pole praegu tehingutasude (kaasa arvatud futuuride) maksustamise ideega kuhugi jõutud.

-

BIDu-ga käib ikka väga julm rapsimine, üle 10 punkti sirgelt alla tulnud.

-

Google.cn url is redirected to Google.HK with a message saying it is the "new home" for Google search China

-

GOOG/BIDU seisavad paigal, lõhnab vahva hat tricki järele GOOG poolt

-

A new approach to China: an update

Published: 2010-03-22T12:03:19.036-07:00

On January 12, we announced on this blog that Google and more than twenty other U.S. companies had been the victims of a sophisticated cyber attack originating from China, and that during our investigation into these attacks we had uncovered evidence to suggest that the Gmail accounts of dozens of human rights activists connected with China were being routinely accessed by third parties, most likely via phishing scams or malware placed on their computers. We also made clear that these attacks and the surveillance they uncovered—combined with attempts over the last year to further limit free speech on the web in China including the persistent blocking of websites such as Facebook, Twitter, YouTube, Google Docs and Blogger—had led us to conclude that we could no longer continue censoring our results on Google.cn.

So earlier today we stopped censoring our search services—Google Search, Google News, and Google Images—on Google.cn. Users visiting Google.cn are now being redirected to Google.com.hk, where we are offering uncensored search in simplified Chinese, specifically designed for users in mainland China and delivered via our servers in Hong Kong. Users in Hong Kong will continue to receive their existing uncensored, traditional Chinese service, also from Google.com.hk. Due to the increased load on our Hong Kong servers and the complicated nature of these changes, users may see some slowdown in service or find some products temporarily inaccessible as we switch everything over.

Figuring out how to make good on our promise to stop censoring search on Google.cn has been hard. We want as many people in the world as possible to have access to our services, including users in mainland China, yet the Chinese government has been crystal clear throughout our discussions that self-censorship is a non-negotiable legal requirement. We believe this new approach of providing uncensored search in simplified Chinese from Google.com.hk is a sensible solution to the challenges we've faced—it's entirely legal and will meaningfully increase access to information for people in China. We very much hope that the Chinese government respects our decision, though we are well aware that it could at any time block access to our services. We will therefore be carefully monitoring access issues, and have created this new web page, which we will update regularly each day, so that everyone can see which Google services are available in China.

In terms of Google's wider business operations, we intend to continue R&D work in China and also to maintain a sales presence there, though the size of the sales team will obviously be partially dependent on the ability of mainland Chinese users to access Google.com.hk. Finally, we would like to make clear that all these decisions have been driven and implemented by our executives in the United States, and that none of our employees in China can, or should, be held responsible for them. Despite all the uncertainty and difficulties they have faced since we made our announcement in January, they have continued to focus on serving our Chinese users and customers. We are immensely proud of them.

Posted by David Drummond, SVP, Corporate Development and Chief Legal Officer -

White House says Obama expects to sign financial regulatory reform by the end of 2010 - Reuters

-

küll see Hiina valuutakursi muutus ka nüüd tuleb, üsna pea