Börsipäev 24. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Eile suutsid USA aktsiaturud näidata taas võimsat rallipäeva ning 0.7%lise tõusuga liikusid indeksid ühe uutele viimase 1.5 aasta tippudele. Kui veel veebruari lõpus olid USA suuremad indeksid võrreldes aasta algusega miinuses, siis märtsi esimese 17. börsipäevaga on turud ca 6% tõusnud ning S&P500 indeksi liikumist jälgiva börsilkaubeldava fondi SPY 1. kvartali tootlus ületaks antud hetkel 5% (see oleks neljas järjestikune 5+% kvartal):

Makroandmete poole pealt ootame täna kell 14.30 veebruarikuu kestvuskaupade tellimuste muutust (ootus +0.6% ja ilma autodeta on ootus samuti +0.6%) ja kell 16.00 uute eluasemete müüginumbreid (ootus ca 315 000). Mida suuremad need näidud on, seda parem, kuna indikeeriks tugevamat majanduskasvu.

Kõigile LHV foorumikülastajatele siinkohal aga palve minu poolt. Oma magistritöö raames palun abi ca 10 minutilise aktsiaturgude teemalise küsitluse täitmisel. Tõsi, tavaliselt pooldame selliste küsitluste panemist 'vaba teema' alla, kuid kuna töö teema on seotud otseselt investeerimise ja aktsiaturgudega, kasutan moderaatori õigusi ning levitan oma küsitlust kuni märtsikuu lõpuni ka siinses börsipäeva foorumis. Link küsitlusele on siin. Palun kõigil, kel vähegi võimalik, selle täitmiseks 10 minutit eraldada. Suured tänud kõigile vastajatele!

-

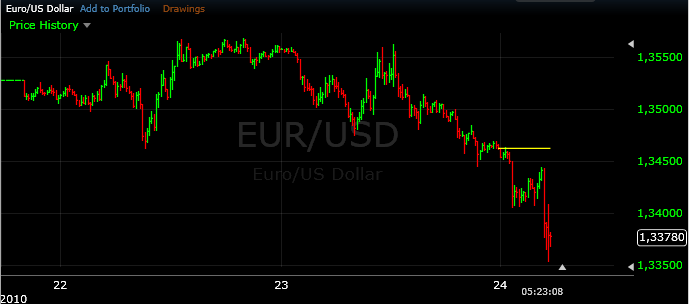

Saksamaa ja Prantsusmaa tõdevad, et ükskõik mis tahes abipaketti Kreeka jaoks välja ei töötata, tuleb ilmselt arvestada IMFi sekkumisega. See tähendaks, et euroalariigid ei suuda iseseisvalt hakkama saada ning investorite pessimism on selle võrra jälle euros suhtes kasvanud. Mäletatavasti käis Goldman Sachs 12. märtsil välja üsna vastuolulise kauplemisidee, pakkudes et euro võinuks toonastelt tasemetelt sooritada kolme kuu jooksul põrke 1.45 juurde. 1.35 juures oli stopp ja seega läks idee seekord vett vedama.

-

Erko kirjutas Fitchi reitingulangetuses Portugalile ka turuülevaates (link), kuid mainin ka siinkohal selle langetamise AA pealt AA- peale ära. See ka üks põhjuseid, miks euro täna dollari vastu terve protsendi kaotanud.

-

Reuters kirjutab täna Bank of America (BAC) laienemisplaanidest Hiinasse.

Väike lõik siia Briefingu vahendusel:

Bank of America looking to expand in China, CEO says - Reuters.com. Reuters.com reports the co is keen to expand in China, Chief Executive Brian Moynihan said. The bank's board recently approved a plan to seek local incorporation in China after months of discussions and delays, according to media reports. -

Venemaa analüüsimaja Otkritie kommentaar Lukoili tulemustele:

LUKOIL [HOLD; TP$70.25] released unimpressive 4Q09 and FY09 US GAAP results, visibly missing against both consensus and our forecasts. While the reported revenues were 1% ahead of consensus, annual EBITDA were 3% below consensus (almost a $0.4bn miss) and full-year earnings were 5% below consensus. LUKOIL reported net income for the full year of only $7.0bn compared to consensus of $7.4bn and our forecast of $7.54bn.

4Q earnings ($1.73bn) were 19% below consensus ($2.12bn), and 4Q EBITDA ($3.31bn) were 13% below consensus ($3.79bn). There were no one-off items which would help explain the poor performance in the reported accounts. Operating expenses exceeded our estimates by more than $260m. Also costs of purchased crude and products, which traditionally includes derivative losses, well exceeded our forecast for the full year.

LUKOIL’s visible miss on the 4Q results in combination with ConocoPhillips’ official plan to sell down 10% of LUKOIL shares to the secondary market over the next two years supports our overall not very optimistic short-term view on LUKOIL. We maintain that LUKOIL is highly likely to under-deliver on its 1% annual volume growth target for liquids in 2010, and we project negative volume growth for the next two years. We re-iterate our HOLD rating on the stock. -

Bloomberg on teinud intervjuu Paul Donovaniga UBSist, kus ta arvab, et ühel hetkel Kreeka ei suuda oma laenukohustusi de facto ise kanda - ehk siis 'defaults at some point'. Link intervjuule siin.

-

Kestvuskaupade tellimuste muutus kokkuvõttes oodatust pisut parem.

February Durable Goods Orders +0.5% vs +0.6% consensus, prior revised to +3.9% from +3.0%

February Durable Orders ex-trans +0.9% vs +0.6% consensus, prior -0.6% -

Arvestades seda, et dollar on täna euro vastu üle 1.1% tugevnenud, on USA tähtsamate indeksite futuurid isegi päris hästi vastu pidanud. Hetkel S&P500 futuur -0.4%, Nasdaq100 futuur -0.3% ning nafta -1.6%.

Euroopa turud:

Saksamaa DAX +0.15%

Prantsusmaa CAC 40 -0.35%

Inglismaa FTSE 100 -0.10%

Hispaania IBEX 35 -1.23%

Rootsi OMX 30 -0.67%

Venemaa MICEX +0.04%

Poola WIG -0.20%Aasia turud:

Jaapani Nikkei 225 +0.38%

Hong Kongi Hang Seng +0.10%

Hiina Shanghai A (kodumaine) +0.12%

Hiina Shanghai B (välismaine) +0.39%

Lõuna-Korea Kosdaq -1.26%

Tai Set 50 +0.37%

India Sensex 30 N/A (börs suletud) -

Embrace the Insanity

By Rev Shark

RealMoney.com Contributor

3/24/2010 8:38 AM EDT

"I would be willing, yes glad, to see a battle every day during my life."

-- George Armstrong Custer

The market has been in rally mode for about six weeks now. It hit a low on Feb. 5 and has gone straight up since then. It is almost impossible to come up with new adjectives to describe how remarkable this run has been.

It isn't the point gain that is so unusual; it's the consistency of the action. According to Sentimentrader.com, the longest period of selling pressure during this six-week run is just four hours. In other words, the total market correction over a month and a half of trading is half of a day. I don't know if that is a record, but it must be pretty close.

What makes trading both so fascinating and frustrating is the irrationality of the market beast. The best traders in the world are going to be surprised quite often at the action, and trying to apply logic is a recipe for disaster more often than not.

If you want to be successful in the market, you have to able to embrace the craziness of the market beast. The action may make no sense to us at all, but we can't make money by trying to overpower what may feel irrational to us.

The primary job of the market beast is to make things difficult for us. He'll give us some lay-ups in a while, just to make sure we stay in the game, but ultimately, what he wants to do is drive us nuts and take our cash.

Fortunately, we can still do quite well in the battle with the beast if we stay persistent and disciplined. The great advantage is that we can do battle every day, and we are given an endless number of opportunities to score points. As long as we have capital left, we can keep playing the game, and if you are disciplined in using stops and taking profits, you can play forever.

I'm not going to go into how overbought and how badly we need a rest again this morning. Anyone paying the slightest bit of attention to the market already knows it. We are still walking the high-wire, and so far, there has hardly been a wobble in the ascent. Don't fight this beast, but stay vigilant and disciplined. The one thing we know for sure about the market is that conditions will eventually change.

We have a little weakness on a downgrade of Portugal debt, which is hitting the euro and causing the dollar to rise. Economic reports should give us a jiggle, but it is going to take something pretty severe to scare away the dip-buyers, who haven't had a dip that has lasted longer than four hours in the past six weeks.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: MF +12.0% (also appoints Jon Corzine Chairman and Chief Executive Officer), LEN +6.7%, AIS +5.3% (light volume), ADBE +4.1% ... Other news: GENT +20.9% (announces Defibrotide results at EBMT Annual Meeting; 40% reduction in the incidence of VOD within 30 days after SCT ), OCNF +12.0% (announces an order for three VLOCs), XFN +8.0% (issues letter to shareholders indicating it has been awarded $63.6 mln in stimulus grants and long term loans from USDA), NVAX +6.8% (announces "Positive" clinical results from first stage of pivotal study of 2009 A/H1N1 VLP Pandemic Influenza Vaccine in Mexico), USU +4.9% (USEC and DOE Fund continued American Centrifuge activities), S +4.4% (Sprint Nextel and HTC Corporation announced summer availability of the world's first 3G/4G Android handset, HTC EVO 4G), NTDOY +3.6% (light volume; Nintendo plans 3-D hand-held - WSJ), PHM +2.4% (up in sympathy with LEN), SOMX +1.9% (still checking), COP +1.3% (takes steps to increase shareholder value; announces plan to increase dividends, reduce LUKOIL ownership, and resume share repurchases)... Analyst comments: FCH +13.0% (upgraded to Outperform at FBR), JEC +1.8% (upgraded to Overweight at JPMorgan), CNX +1.2% (upgraded to Overweight at JPMorgan), HNZ +0.7% (upgraded to Neutral from Underperform at BofA/Merrill).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: LIME -15.2%, PUDA -15.0%, JBL -5.2%, SONC -4.9% (also downgraded to Sell at Stifel Nicolaus), CHU -4.4%, CMC -1.8%... Select financial related names trading lower: CS -3.4%, UBS -2.9%, HBC -2.6%, DB -1.4%, .... Select metals/mining names showing weakness: BBL -3.2%, BHP -2.9%, MT -2.5%, SLW -2.4%, AU -2.3%, ALV -2.2%, NEM -2.1%, GDX -1.9%, GOLD -1.8%, KGC -1.8%, GG -1.8%, ABX -1.7%, RTP -1.1%, GLD -0.9%... Select Portugal/Spain related names trading lower following Fitch downgrade of Portugal: STD -4.8%, PT -3.9% (Fitch Downgrades Portugal to 'AA-'; Outlook Negative), TEF -1.7%... Select oil/gas related names showing weakness: E -2.4%, TOT -2.1%, RDS.A -1.9%, STO -1.8%, BP -1.3%, PBR -1.3%... Other news: PARD -20.5% (suspends efforts to obtain regulatory approval for picoplatin in SCLC; has engaged Leerink Swann to conduct a review of strategic alternatives), MDTH -9.4% (still checking), BOCH -9.1% (priced a 7.2 mln share common stock offering at $4.25/share), ORRF -6.6% (prices 1,481,481 common shares at $27.00/share), GENZ -5.4% (announces FDA enforcement action regarding Allston plant; expects shipments of Cerezyme, Fabrazyme and Myozyme to continue uninterrupted ), TKC -4.9% (still checking), CX -4.5% (announced a $500 mln convertible notes offering), NETL -4.4% (filed for a ~5.89 mln share common stock offering; 3.2 mln shares will be offering by the co and the remainder will be offered by selling shareholders), ERIC -3.9% (traded lower overseas; China Unicom is ERIC customer and reported earnings), PAY -3.1% (still checking), DT -2.5% (T-Mobile to boost U.S. network - WSJ), GFA -2.0% (Hearing weakness attributed to pricing of offering), LSI -1.5% (Integrated Device receives favorable ruling in patent action versus LSI Logic), LINE -1.0% (prices 15.0 mln units of its limited liability company interests at $25.00/unit), MEE -0.8% (announces pricing of 8.5 mln share offering at $49.75), ... Analyst comments: TWTC -4.2% (downgraded to Hold from Buy at Collins Stewart), SRCL -2.8% (downgraded to Neutral at JPMorgan), DT -2.5% (downgraded to Neutral at Credit Suisse), NRG -1.1% (removed from Conviction Buy List at Goldman). -

Greece will default on its bonds “at some point” as the euro region fails to deal with its first major economic crisis, said Paul Donovan, deputy head of global economics at UBS Investment Bank.

“I think it’s in an impossible situation,” said Donovan, who is based in London, in an interview with Bloomberg Radio today. “Europe has failed to clear its first serious hurdle. If Europe can’t solve a small problem like this, how on earth is it going to solve the larger problem, which is the euro doesn’t work. It’s a bad idea.” -

Kuigi uute eluasemete müüginumbrist midagi ilusat näha ei olnud, on turg oma miinust vähendanud.

February New Home Sales 308K vs 315K consensus; m/m change -2.2% -

vix on päris närviline