Börsipäev 12. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

USAst täna olulisi makroandmeid tulemas ei ole. Küll on aga tänasega alguse saamas 2010. aasta 1. kvartali tulemuste hooaeg, kuna Alcoa (AA) teatab oma numbrid täna pärast turu sulgemist. Alcoalt oodatakse vähemalt $0.10list EPSi ja $5.24 miljardilist müügitulu. Turgudel pea kaks kuud kestnud ralli on kvartalitulemuste eel enamuse aktsiate puhul ootused väga kõrgele toonud ning võib eeldada, et suurem osa investoreid ootab väga häid ootusi ületavaid kvartalitulemusi ja positiivseid tulevikuprognoose.

-

Nädalavahetusel on euroala riigid jõudnud kokkuleppele anda Kreekale kolmeks aastaks 30 miljardit eurot laenu intressiga 5%, mis on madalam kui Kreeka praegune kolme aasta pikkuse võlakirja 7%line intress. IMF on omaltpoolt pakkumas täiendavad 15 miljardit eurot. Euro on selle peale gappinud 1.2% üles ning kaupleb nüüd kolme nädala kõrgeimal tasemel @1.364 USD.

-

Kuigi summa tundub üüratuna (ca 19% Kreeka SKTst), siis tegelikkuses ei pruugi sellest kolmeks aastaks jätkuda. Reuters kirjutab, et ühe Kreeka ametniku sõnul peaks bailout olema kaks korda suurem.

-

Samas... alati on ju võimalik, et hiljem antakse laenu juurde. Või siis langeb selle tulemusena aja jooksul Kreeka võlakirja intress 5% juurde ja saadakse puudujääv raha siis juba teistelt investoritelt.

-

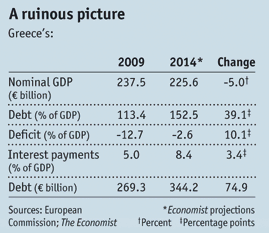

Economisti hinnangul läheb Kreekal samuti vaja umbes kaks korda suuremat summat:

Our projections imply that Greece will run-up an extra €75 billion of debt by 2014, by which time its debt will stabilise at 153% of GDP. This figure is a rough guide to how much financial aid Greece may require (link).

-

Lühiajaliselt rahustatakse investorid ilmselt maha ja Kreeka väljavaated turult laenata muutuvad soodsamaks aga edaspidi saab olema huvitav jälgida just pikemaajaliste võlakirjade reaktsiooni.....kas fundamentaalselt ka midagi paraneb, mis default hirmu lõplikult laualt eemaldaks. Täna on 10a yield igatahes kukkunud 6.72% peale, mis on 0.64 protsendipunkti madalamal 8 aprillil tehtud tipust (7.36%).

-

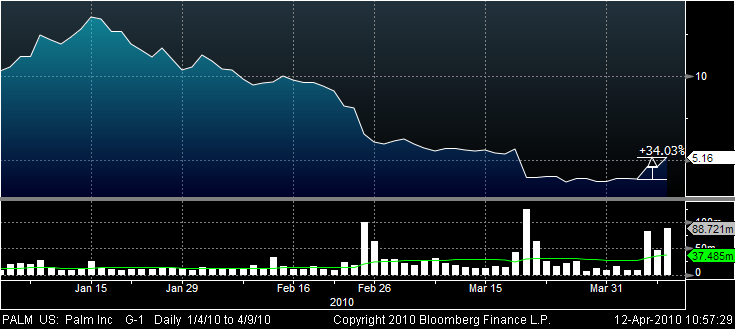

Pärast seda, kui Palmi kehvad kvartalitulemused aktsia viie kuu põhjadele viisid, on väärtpaber kosunud kolmandiku võrra tänu ülevõtmise kuulujuttudele. Tänaseks on selge, et ettevõte ei suuda iseseisvalt jätkata ning juhtkond on asunud Goldmani abiga endale ostjaid otsima. Bloombergi kohaselt võidakse müügitehinguni jõuda juba sellel nädalal. Eelkõige arvatakse, et pakkumise võiks teha mõni arvutitootja, kuna käsiseadmed kipuvad üha edukamalt pakkuma asendust PC-le ja seega oleks loogiline, et viimased ihkaksid mobiiltelefonide turust samuti osa saada

-

isegi kui see Palmi üleost tehakse on vägagi küsitav millist hinda selle eest makstakse ? aga huvitav jälgimine selleks nädalaks

-

LHV Pro investeerimisidee Imax Corp (IMAX) on viimastel päevadel läbi teinud korraliku korrektsiooni. Samas võiks sellel aktsial ikka silma peal hoida, sest äris ja aktsiahinna liikumises valitsev momentum on veel ülevoolavalt positiivne. Barrington Research kasutas reedest langust ära ja lisas selle aktsia oma parimate ideede nimekirja.

-

USA futuurid alustavad tänast kauplemispäeva reedeste sulgumistasemete juures.

Euroopa turud:

Saksamaa DAX -0.35%

Prantsusmaa CAC 40 -0.41%

Inglismaa FTSE 100 -0.22%

Hispaania IBEX 35 +0.27%

Rootsi OMX 30 +0.20%

Venemaa MICEX -0.05%

Poola WIG +0.24%Aasia turud:

Jaapani Nikkei 225 +0.42%

Hong Kongi Hang Seng -0.32%

Hiina Shanghai A (kodumaine) -0.51%

Hiina Shanghai B (välismaine) -0.98%

Lõuna-Korea Kosdaq -0.87%

Tai Set 50 -4.12%

India Sensex 30 -0.45% -

Waiting for the Shift in Trend

By Rev Shark

RealMoney.com Contributor

4/12/2010 8:30 AM EDT

Reconsider (v.) -- To seek a justification for a decision already made.

-- Ambrose Bierce

This one-way market, which has refused to rest, has been tricky to navigate, but with the start of earnings season, it is likely to become even more challenging. The big question is whether earnings will be a catalyst for taking profits, or whether they will further reinforce the idea that the recession is ending and attract more buyers.

Earnings provide an ideal excuse for market players to make some moves. In the four quarters since the bottom last March, the reaction has generally been positive. The second quarter of 2009 was particularly strong and we blasted straight up, much like we have recently.

This past January, as the fourth-quarter reports from 2009 rolled out, we had our worst reaction to earnings. The reports weren't bad, but the selling hit at the end of January, right after most of the big reports were out. It looked like the market was going to gain some downside momentum, but the bulls found their footing and pulled off another very impressive V-ish move back to the highs.

With the big run we have had for two months now, we have to be watching very closely for a sell-the-news reaction to earnings. Earnings are just too convenient an excuse for some profit taking when the market is as technically extended as this one. Intel (INTC) and Google (GOOG) , which report this week, will provide some insight into the market mood. Intel, in particular, is a good bellwether. It led us up last August on a good report and led us down in January also on a good report.

The good thing about earnings season is that no matter what the reaction is to the reports, it is likely to give us better volatility. This market has been driving many traders crazy, as we slowly float higher without any pullbacks to allow for entry. Volume has declined as we've gone up, which is usually a negative sign, but it just hasn't mattered yet. We have actually had a fair amount of technical distribution as we've rallied, which is a sign that institutional investors have not been big buyers on the way up.

My approach to this market has been to stay short-term bullish until there is some clear sign the trend is going to shift. There are lots of good reasons to look for a pullback, but we keep on chugging along and the dip buyers under the surface are providing excellent support. Perhaps earnings will be the catalyst for some selling, and we'll have to watch for that, but until it happens, the trend remains our friend.

News of a bailout of Greece seems to have been anticipated and is resulting in some flat action in Europe. I see quite a few upgrades on the wires this morning, but we only have a slightly positive open so far. Don't forget that Mondays have had a stellar record of performance for a while and traders are likely inclined to make that a self-fulfilling prophecy to some degree.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: UBS +4.5%.

M&A news: DCP +49.5% (Dyncorp Intl to be acquired By Cerberus Capital Management for $17.55 per Share in Cash), WEL +26.0% (Halliburton to acquire Boots & Coots for $3.00/share in cash and stock), MIR +13.1% and RRI +11.4% (Mirant and RRI Energy to merge; MIR shareholders to receive 2.835 RRI common shares for each Mirant share owned; also both upgraded to Neutral at MAcquarie), SHS +1.7% (Danfoss A/S and Danfoss Acquisition Inc. announce increase in tender offer price for SHS to $14.00 per share and extension of offer).

Select financial related names showing strength: AIB +3.4%, MBI +3.1%, CS +2.8%, NBG +2.5% (Europe bankrolls Greece - WSJ), STD +2.2%, C +1.8%, DB +1.6%, IRE +1.6%, ING +1.5%, BCS +1.4%, AIG +1.3% (AIG, Goldman unwind soured trades - WSJ), HBC +0.6%. Other news: GNVC +11.3% (announced clinical and preclinical malaria vaccine data were presented at the Keystone Symposium), PALM +8.9% (Palm is seeking a buyer: Report - Reuters), RNN +4.9% (still checking), BRKR +3.9% (Bruker mentioned positively in Barron's), CPKI +2.2% (confirms plan to review financial and strategic alternatives; also issued Q1 guidance), NOK +2.1% (still checking), JACK +1.5% and BJRI +1.4% (Cramer makes positive comments on MadMoney), PRGO +0.9% (Cramer makes positive comments on MadMoney).

Analyst comments: GSIT +11.6% (upgraded to Outperform from Neutral at Baird), TXN +3.4% (upgraded to Outperform from Neutral at Credit Suisse), PH +2.2% (upgraded to Outperform from Neutral at Baird), JOYG +1.9% (upgraded to Outperform from Neutral at Baird), ATHX +1.8% (initiated with a Buy at Brean Murray), INFN +1.4% (upgraded to Neutral from Sell at Goldman), CAT +1.4% (upgraded to Outperform from Neutral at Baird), EMC +1.1% (upgraded to Outperform from Sector Perform at RBC Capital), CCL +0.8% (upgraded to Outperform from Market Perform at Bernstein), BBY +0.6% (upgraded to Mkt Perform at FBR Capital).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: VCLK -6.4%.

Other news: CLNE -3.3% (Clean Energy Fuels mentioned negatively in Barron's), ONNN -2.8% (amended its Zero Coupon Convertible Senior Subordinated Notes due 2024), NOG -2.4% (Northern Oil & Gas issue downside Q1 guidance; provides operations and increased drilling update), STRI -2.0% (commences secondary public 7 mln share offering on behalf of selling stockholders), KG -1.3% (Oppenheimer discusses lifting of temporary restraining order, allows NVS to sell generic skelaxin).

Analyst comments: LPX -2.6% (downgraded to Sell from Neutral at UBS), ARMH -2.4% (downgraded to Sell from Hold at Citigroup), CDCS -1.6% (downgraded to Market Perform from Outperform at Morgan Keegan), NTAP -1.0% (downgraded to Sector Perform from Outperform at RBC Capital), FCX -0.7% (downgraded to Hold from Buy at Deutsche Bank). -

varsti tõstetakse abk sihti ma pakun

-

Teh analüüsi põhjal on Bank of America võimsalt ülehinnatud ...ja juba pikemat aega, aga näed, ka täna alustas rohelises.

-

Mis Bank of Americasse puutub, siis eelmise nädala lõpus üllitas Rochdale'i analüütik Richard Bove analüüsi, kus leidis, et kui Bank of America erinevad pangandussegmendid laiali lüüa, võiks aktsia hind olla isegi ulmelised $53. Seda hinnasihti ei saa kindlasti väga tõsiselt võtta, kuid pikaajalist aktsias peituvat väärtust mingis osas peaks siiski indikeerima. Link ka siia.

-

March Treasury Budget -$65.4 bln vs -$62.0 bln consensus, prior -$191.6 bln

-

Alcoa prelim $0.10 vs $0.10 Thomson Reuters consensus; revs $4.89 bln vs $5.24 bln Thomson Reuters consensus

-

sisenesin Türi peatusest Ambac Financial Group, Inc. Com, ja BAC likvideerisin)))

-

after hours 2.41.mmmmm,mönna rong, siin mugavad istmed puha ja köik joogid tasuta)))

-

angelike,

mitu % teenisid? Millest seal säärane meeletu tõus?