Börsipäev 16. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Majandustulemuste poole pealt on USAst täna kell 15.30 oodata märtsikuus väljastatud annualiseeritud ehituslubade arvu (ootus 625 000) ja alustatud ehituste arvu (oouts 610 000). Kell 16.55 tuleb Michigani aprillikuine sentimendi näitaja, kust oodatakse 75.0 punktilist näitajat. Kõigi kolme näitaja puhul oleks aktsiaturgude seisukohast seda parem, mida suuremad nad oleksid.

Google'i tulemused, mis Alari eilsesse börsipäeva foorumisse pani, olid ootustest pisut paremad, kuid aktsia vajus järelturul siiski veidi miinusesse. Täna enne turu avanemist ootame tulemusi Bank of Americalt (BAC), General Electricult (GE) ja Genuine Partsilt (GPC). -

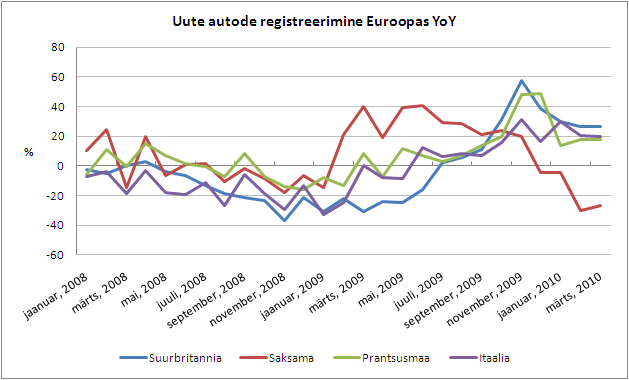

Uute sõidukite registreerimine Euroopas jätkus märtsis tugeva kasvuga, kerkides aastataguse ajaga võrreldes 10.8%. Riikidepõhiselt numbreid vaadates näeme, et kasv tuli sealt, kus raha-romu-eest programmid jätkuvalt veel kehtisid, samas kukkus Saksamaal sõidukite registreerimine märtsis -26.6%, kuna valitsuse finantseerimisprogramm lõppes eelmise aasta lõpus. Aprillis lõpetati subsideerimine nii Suubritannias kui Itaalias, mistõttu peaks nõudlus järgnevatel kuudel ka seal tagasi andma.

-

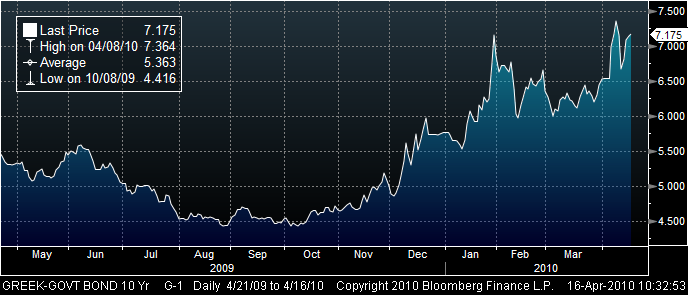

Kreeka peab 20. aprillil investoritele tagasi maksma €8.2 miljardit ja pea sama palju veel 19. mail, mistõttu hindab valdav osa turuosalistest (peale Kreeka enda ministrite) tõenäoliseks, et defaulti vältimiseks tuleb aktiveerida EL-i ja IMF-i abipakett. Bloomberg kirjutab, et laenude väljastamaiseks peavad parlamendid heakskiidu andma, kuid sellega võib minna mitu kuud aega, mistõttu on jätkuv ebamäärasus kergitanud Kreeka 10 võlakirja tulususe põhimõtteliselt tagasi tasemele, kus see oli enne aibipaketi väljakuulutamist möödunud nädalavahetusel.

-

General Electric (GE) tulemused EPSi osas oodatust paremad, kuid tulude ootustele jäädakse alla.

General Electric prelim $0.21 vs $0.16 Thomson Reuters consensus; revs $36.6 bln vs $37.10 bln Thomson Reuters consensus -

Tänasel optsioonireedel võiks olla asjakohane välja tuua optsioonituru sentimen.

ISEE-indeks tegi eilse päevalõpu seisuga uue 52 nädala tipu, milleks on 185 punkti, 52 nädala madalaim tase, 67 punkti jääb 26. jaanuarisse.

ISEE indeks näitab ostetud put ja call optsioonide suhet ehk mitu call optsiooni on ostetud 100 put optsiooni kohta. Kui neutraalne tase on 100 siis praegust 185 punkti taset võib pidada üsna ekstreemselt positiivseks. Ajaloost on teada, et ISEE indeks tegi oma kõigi aegade madalaima taseme 56 punkti 10. märtsil 2009 ehk päev pärast aktsiaturu põhja.

CBOE statistika näita järgmisi suhtarvusid:

Total Put/Call Ratio 0.72

Index Put/Call Ratio 1.39

Equity Put/Call Ratio 0.37 -

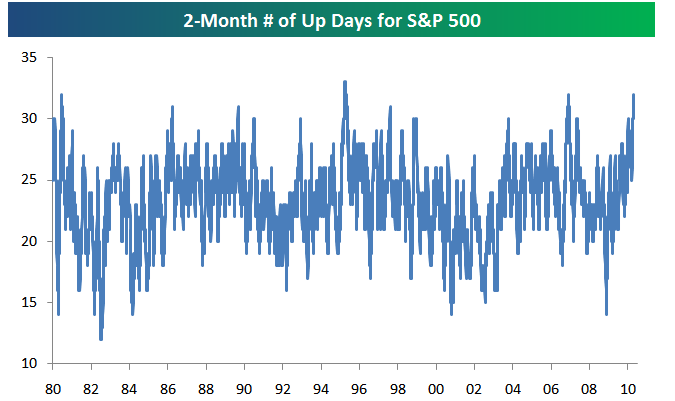

Bespoke toob samuti välja, et positiivsus väga erakordne:

Over the last two months, 73% of the trading days have been up days. Since 1980, there have only been 3 other periods where this high of a reading was reached -- 6/1980, 4/1995, and 11/2006. Be sure to remember this trading period, because this kind of action does not happen often (link).

-

BACi tulemused esmapilgul tugevad:

Bank of America prelim $0.28 vs $0.09 Thomson Reuters consensus; revs $31.97 bln vs $27.97 bln Thomson Reuters consensus

-

Kui eile võidi Euroopas tühistada hinnanguliselt 8000 lendu siis halvemal juhul võib see number täna olla 15 000 ehk ligikaudu pool tavapärasest lennuliiklusest. Finnair ja SAS on öelnud, et õhuruumi sulgemise tõttu ulatub saamata jäänud tulu miljonitesse eurodesse päevas (Dagens Industri andmetel on SASi päevane käive keskmiselt 10 miljonit eurot), mistõttu on lennusektor aktsiaturgudel täna ka kõige punasem. Finnair -3.9%, SAS -2.4%, Lufthansa -2%, Ryanair -2.5%, Air France -1.7%, BA -1.07%.

-

Phase Forward to be acquired by Oracle through a cash merger for $17.00 per share (13.08). Aktsiaga kauplemine hetkel peatatud

-

Phase Forwardi osas ammu kardetud uudis. Oracle osas väga loogiline ja hästi ajastatud samm. Hinnaga küll PFWD aktsionärina rahule ei jää.

-

Exxon Mobil (XOM) saab Raymond Jamesilt upgrade'i 'overweight' pealt ja hinnasihi $80.

-

RBC'lt üsna julge call - Palm: See takeout value around $10-14/sh. Pikemalt Notable Calls vahendusel

-

Kuigi Google’i (GOOG) tulemused investorite ootusi ei rahuldanud, on analüütikud tulemustega rahul ja siiani keegi GOOGi soovitust muutnud ei ole (ettevõttel jätkuvalt 33 ostu-, 8 hoia- ja 0 müügisoovitust). Siin näiteks FBR Capitali arvamus:

Spending growth, China, regulatory scrutiny, and growing competition on multiple fronts remain risks, but with the stock at 17x FY11 PF EPS vs a growth rate of >20%, GOOG remains their FBR Top Pick in the sector

-

USAs väljastatud ja alustatud ehituslubade arv tõusis märtsis kolmandat kuud järjest, mis on positiivne märk kinnisvarasektori jaoks. Alustatud ehituslubade arv on nüüd kõrgeim alates 2008. aasta novembrist:

March Building Permits 685K vs 625K consensus. M/M change +7.5%

March Housing Starts 626K vs 610K consensus, M/M change +1.6%

-

USA indeksite futuurid on eelturul ca 0.4% kuni 0.5% jagu miinusesse vajunud, nafta -1.8% @ $84.0.

Euroopa turud:

Saksamaa DAX -0.10%

Prantsusmaa CAC 40 -0.20%

Inglismaa FTSE 100 -0.16%

Hispaania IBEX 35 -0.65%

Rootsi OMX 30 +0.73%

Venemaa MICEX -1.33%

Poola WIG -0.19%Aasia turud:

Jaapani Nikkei 225 -1.52%

Hong Kongi Hang Seng -1.32%

Hiina Shanghai A (kodumaine) -1.10%

Hiina Shanghai B (välismaine) -0.30%

Lõuna-Korea Kosdaq -0.04%

Tai Set 50 -3.39%

India Sensex 30 -0.27% -

Dip-Buyers Will Be Tested Today

By Rev Shark

RealMoney.com Contributor

4/16/2010 8:38 AM EDT

Stubbornness does have its helpful features. You always know what you are going to be thinking tomorrow.

-- Glen Beaman

Earnings season continues but the reports this morning are much more mixed as the celebration over Intel (INTC) starts to cool off. GE (GE) and Bank of America (BAC) look solid and are gapping up, but last night Google (GOOG) , AMD (AMD) and Intuitive Surgical (ISRG) sold off even though the numbers were mostly ahead of estimates.

Given our very stubborn uptrend and extended technical conditions, many market players were looking for INTC to sell off on its earnings news. However the numbers were just too strong and the "sell the news" strategy a bit too obvious. As a result, the INTC report, rather than being a turning point, turned into a catalyst for a further move higher as overanxious profit-takers were squeezed.

Yesterday we tacked on a few more gains on good volume, but the momentum cooled off a little and breadth was much more mixed. That brings us to this morning, where we are seeing a slight "sell the news" reaction in the early going.

The big question is whether market players are going to finally feel inclined to protect some of the good-sized gains they have racked up recently. The dilemma here is that there just aren't many signs that momentum is going to cool much, and even if it does there is a good likelihood that the dip-buyers are not going to sit around for very long before they jump back in.

The key to this market for a year now has been the dip-buyers who have consistently kept our pullbacks and dips extremely shallow. Dip-buying has just not failed at all recently, so there is no hesitancy to keep on doing it. That is what prevents this market from suddenly collapsing, although we could very easily see some short-lived spikes to the downside on a little flurry of profit-taking.

The market continues to be at an extremely difficult juncture right now. The uptrend is extremely stubborn and we are overbought, sentiment is downright frothy following Intel earnings and all sorts of technical indicators hint that we are due for a rest. However there just aren't any cracks in the price action and earnings reports have been pretty solid so far. Everyone is expecting dips to be quickly bought in any event, so there just isn't any rush for the exits.

At this point the main thing we have to watch for is a sustained "sell the news" reaction to key reports. GE and BAC are already starting to fade and GOOG is lower this morning than it was last night. If they don't bounce back quickly after the open, I'll be watching for profit-taking to pick up.

We are very ripe for a profit-taking dip, but don't expect it to last for long. Don't go looking for a one-day top. A top will take some time to develop, and there will be some choppy action before there is a chance for a downtrend to build some momentum.

So once again we have very extended technical conditions and conditions are good for a pullback, but the strong momentum is confounding anyone who is the slightest bit bearish.

We have slight weakness this morning as technology and commodity-related stocks offset gains in financials but it is mild action so far. The key to the action today will be the vigor of the dip-buying after we open. If the dip-buyers lose some steam, the bears may finally have some short-lived opportunities.

-----------------------------

Briefingust:

Ülespoole avanevad:

In reaction to strong earnings/guidance: SIMO +5.0%, MAT +4.8%, LBAI +3.8% (light volume), NEP +3.3%, BAC +1.4%, GE +1.4%.

M&A news: PFWD 29.2% (Phase Forward to be acquired by Oracle through a cash merger for $17.00 per share).

Select financial related names showing strength: RBS +7.4% (UK government stake in RBS hits profit level as shares up 9% - Dow Jones), IRE +5.3% (Bank of Ireland forced to sell off assets - Times Online), CS +2.6$, BCS +2.2%, C +1.9%, LYG +1.2%.

Other news: TWO +9.1% (announces cancellation of proposed offering of 14 mln shares of common stock), IMGN +7.8% (Immunogen pops 7.4% to $9.67 after CNBC announced the CEO will appear next on Cramer's show), LGF +7.5% (Mark Cuban discloses 5.4% stake in 13D filing; Reuters reported Carl Icahn announces increase in tender offer price for common shares of Lions Gate to $7/share), BSX +6.4% (to Immediately Resume Distribution of COGNIS CRT-Ds and TELIGEN ICDs in the U.S.), MIPI +6.2% (Receives 30-Day Extension of Waiver Agreement With Bond Holders), PALM +5.2% (hearing RBC saying co could be worth $10-14 in a takeover), ANR +1.8% (amends and extends secured credit facility).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: KNL -16.0%, ISRG -4.4%, GOOG -4.2%, AMD -4.0%, FHN -3.9%, CBST -1.4%.

Other news: AEZS -18.2% (will sell 11.1 mln common shares to institutional investors at $1.35/share), NPSP -7.6% (announces 7.5 mln common stock offering), ATEC -6.2% (prices a 16 mln share common stock offering at $5/share), NBG -4.5% (Europe reviews options to tackle Greek debt crisis - Reuters.com), IMAX -3.6% (announces it crosses $100 mln milestone on Avatar; issued correction that screen average should be ~$1.2 million, not ~$1.6 mln), IVR -1.1% (files to sell $200 mln in common stock), XNPT -0.9% (EPO rules European patent for XP13512 is valid), RTP -0.9% (Rio issues 'extra guidelines' for China - Financial Times).

Analyst comments: JACK -3.6% (downgraded to Perform from Outperform at Oppenheimer), CFNL -3.1% (downgraded to Neutral from Outperform at Robert W Baird), NVDA -2.8% (downgraded to Hold at Needham), RVBD -2.8% (downgraded to Sell from Hold at Auriga), ME -2.6% (downgraded to Hold at Wunderlich), SDRL -2.1% (downgraded to Neutral from Buy at UBS), ACF -1.8% (downgraded to Underperform from Market Perform at Keefe, Bruyette), LEN -1.7% (downgraded to Market Perform from Outperform at Raymond James), CAH -1.1% (downgraded to Neutral from Buy at Goldman), RIG -0.7% (downgraded to Market Perform from Outperform at BMO Capital Markets). -

USA tarbijate sentiment on aprillis üllatavalt nõrk (ilmselt teeb kehv olukord tööturul tarbijatele jätkuvalt muret):

April University of Michigan Sentiment- preliminary 69.5 vs 75.0 consensus, March 73.6

-

Jah, oodatust nõrgem sentiment lõi korraks ka turul jalad nõrgaks, kuid juba üritatakse stabiliseeruda.

Tuleks ka meeles pidada, et täna on aprillikuu optsioonireede. -

Tabav seos jobless recovery kohta:

1. Fortune 500 companies tripled their profits to $391 billion in 2009.

2. They also slashed their payrolls by more than 800,000 jobs.

-

Goldman Sachs drops a few points on surge in volume with Bloomberg reporting that SEC charging GS with fraud

Ja see uudis on nüüd turule suure müügisurve toonud. -

Goldman Sachs: SEC to hold 11am ET conference call on Goldman Sachs - CNBC

10 minuti pärast peaks SECilt tulema ka selleteemaline konverentsikõne. -

Doug Kassi kommentaar Realmoney.com all teemal, kes võiks praegusest SECi uurimusest rohkem võita ja kaotada, mulle meeldib ja panen selle ka siia:

Besides American International Group (AIG) look for the bond insurers, like MBI (MBIA) and Ambac (ABK) to rip higher as they are seen as potential beneficiaries. (This is a new fraud that could allow the insurance companies to rescind claims.)

Conversely, look for weakness in the banks as the SEC is no doubt likely to investigate them as well as Goldman Sachs (GS). -

Ka teised pangad ei pruugi süüst puhtad olla

Deutsche Bank: In response to question whether or not Deutsche Bank will be charged with anything, SEC says investigation continues into structured products and other instruments, but will not say if other banks will be brought into the fray

-

2 GS 170 putti vedelesid portus, 5 usd tükk soetus (koos teenukatega). Kerge raputuse ootuses oli 15 usd tükk väljas, kuid kui selline pomm tuli ei jõudnud reageerida. Päris raju:D

-

All 41 US Senate Republicans sign letter opposing Democratic financial reform bill - Reuters