Börsipäev 20. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Finance.yahoo.com lehe avalooks on täna lugu sellest, kuidas LHV Maailma Pro investeerimisidee Imax Corporation (IMAX) maailma vallutab ning on sõlminud lepingu Jaapanis Imaxi 3-D kinoekraanide sisseseadmiseks. Viimasel ajal on lepinguid Imaxile tulnud tõesti mitmelt rindelt - Jaapan, Lõuna-Korea, Singapur, Venemaa, Prantsusmaa - ning usume, et see näitab ettevõtte äritegevuse tugevust. Link loole on siin.

-

Tulemuste tabel nüüd uuendatud - link sellele siin. Täna eelturul oodatakse eelkõige Goldman Sachsi (GS) tulemusi ning järelturult Apple'i (AAPL) numbreid.

-

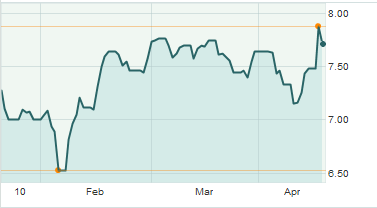

Täna on küll üle hulga aja üks päev, kus osa lennuliiklust on Euroopas taastumas, kuid lennureisijate piletite sasipundart annab veel tükk aega lahti arutada ning oluliselt on kasvanud alternatiivtranspordi kasutamine - bussid, rongid, laevad. Suurbritannia ja Prantsusmaa vahel kiiret rongiühendust võimaldav Eurotunnel on saanud samuti Islandi vulkaani tõttu endale reisijaid tugevalt juurde ning liiklust on nõudluse tõttu kahekordistatud - rong väljub iga 15 minuti tagant. Eurotunneli aktsia on vulkaani purskamise algusest tõusnud hetkel vaid 8% ning kui vulkaanituhk peaks taevaid varjutama oodatust kauem või kui Islandil peaks purskama ka naabervulkaan Katla, võiks seni pidevalt kahjumit tootnud ja Prantsusmaa börsil sümboli GET all kauplev Eurotunneli (GET) aktsia olla investorite/spekulantide jaoks päris huvitav võimalus.

Eurotunneli (GET) aktsia viimase kolme kuu aktsiagraafik marketwatchi vahendusel:

-

Euroopa lennufirmadest sai eilses börsipäevas mainitud Easyjet, mis võib lennuliikluse taastumise korral ostuhuvi näha. Täna tõstis JPMorgan Easyjeti (kaupleb Londonis sümboli all EZJ) "neutraalse" soovituse "overweight" peale:

U.K. no-frills carrier Easyjet was upgraded to overweight from neutral on Tuesday at J.P. Morgan, which cited a positive trading statement from the company released the prior day. J.P. Morgan is lifting current year earnings per share by 8% and fiscal year 2011 EPS by 7%. The investment bank said they've not yet adjusted their forecasts to take into account the volcano impact "partly because we do not know when it will end and partly because the airline industry may be compensated, as was with the case with the U.S. airlines" after the September 11 terrorist attacks. Management has, however, indicated that the cost of the disruption to date is 40 million pounds. and the future daily cost is 5 million pounsd. Using these figures and assumming seven days of disruption we estimate our 2010 EPS forecasts would drop by 27% to 23.3 pence, all else being equal." Reopening of European airspace will be a near-term catalyst for the group, said J.P. Morgan. (allikas: marketwatch)

-

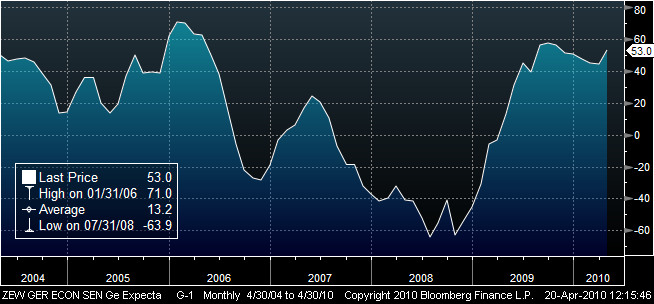

Saksamaa investorite sentiment riigi majandusarengute suhtes paranes esimest korda viimase seitsme kuu jooksul ning seda arvatust märkimisväärselt rohkem. Ootusi kajastav ZEW indeks kerkis aprillis 53 punktini (märtsis 44.5 punkti), ületades ootust 7.9 punktiga. Jooksvate olude hinnangut kajastav indeks kerkis märtsi -51.9 punktilt -39.2 punktile. Oodatust parem statistika on pakkunud eurole veidi toetust ning tõstnud kursi dollari suhtes tagasi 1.35 peale.

ZEW ootuste indeks:

-

Goldman Sachsi (GS) tulemused on oodatust paremad, kuid kas piisavalt head, et SECi süüdistused tagaplaanile jätta?

Goldman Sachs prelim $5.59 vs $4.01 Thomson Reuters consensus; revs $12.78 bln vs $11.07 bln Thomson Reuters consensus

-

JPMorgan tunnistab turgudel suurenenud korrektsiooniohtu, ent on valmis seda üle elama, kuna rallit toetavad tegurid on piisavalt tugevad ulatuslikuma kahju vältimiseks. Üleostetus ja Goldmanile esitatud süüdistused võivad JPM-i arvates S&P 500 lühiajaliselt vedada 1175 punktile, väga väikese tõenäosuse juures isegi alla 1150.

“However, we believe that any correction should be short-lived. The fundamental picture is strong for equities and the news from the 1Q reporting season has been very supportive so far. The 81% of the S&P 500 companies that have reported so far outperformed on revenues and 79% on EPS. Investors are not fully appreciating how strong and broad this earnings cycle is proving to be. 30% of the companies in the S&P 500 are forecast to exceed their prior peak EPS and the top quartile of S&P 500 companies should see EPS collectively 28% above their prior peak.”

-

Sigma Designs (SIGM) oli kunagi ka LHV Pro investeerimisidee, kuid nüüdseks on selle ettevõtte katmisest päris palju aega möödas. Täna on igaljuhul BWS Financial ettevõttele antavat hinnasihti kergitamas $19 peale. Väike väljavõte Briefingust:

Sigma Designs upgraded to Buy at BWS Financial; tgt $19 (11.74). BWS Financial upgrades SIGM to Buy from Hold and sets target price at $19 saying SIGM has continued to benefit from an increase in IPTV subscribers. The growth in the IPTV market is sustainable and leads them to the expectation of SIGM posting better than expected fiscal first quarter results. -

USA indeksite futuurid on eelturul ca +0.4% kõrgemal kauplemas.

Euroopa turud:

Saksamaa DAX +1.43%

Prantsusmaa CAC 40 +1.27%

Inglismaa FTSE 100 +0.88%

Hispaania IBEX 35 +0.87%

Rootsi OMX 30 +1.27%

Venemaa MICEX +1.23%

Poola WIG +1.14%Aasia turud:

Jaapani Nikkei 225 -0.07%

Hong Kongi Hang Seng +1.02%

Hiina Shanghai A (kodumaine) -0.03%

Hiina Shanghai B (välismaine) +0.68%

Lõuna-Korea Kosdaq +1.55%

Tai Set 50 +5.96%

India Sensex 30 +0.34% -

Earnings Had Better Start to Matter

By Rev Shark

RealMoney.com Contributor

4/20/2010 8:34 AM EDT

To be tested is good. The challenged life may be the best therapist.

-- Gail Sheehy

We are looking at a positive open as market players shift their focus away from the Goldman Sachs (GS) fraud charges, but there isn't much reaction to earnings reports so far. IBM (IBM) is trading down following its report, Goldman is up a few cents on blowout numbers, Coke (KO) and Johnson & Johnson (JNJ) are down and Brinker (EAT) and Northern Trust (NTRS) came in below expectations.

Despite the mediocre response to earnings, we are spiking up as oil and commodities are bouncing and financials are a bit less worried that they will suffer the same fate as Goldman. Part of the strength may also be due to optimism about the Apple (AAPL) report due out after the close this afternoon.

Apple is probably the most important stock in the market, and it is going to go a long way in determining market direction. Everyone knows that the company tends to lowball its guidance, so the market will not be a surprised when Apple beats estimates. The question will be whether it beats them by enough to keep this market chugging. AAPL is up more than 20% since this rally started back in early February, so plenty of good news has already be priced in.

The reaction to AAPL is going to set the tone in the near term, and with expectations sky-high, there is a fair amount of risk.

I'm a bit puzzled by the strength this morning. None of the major earnings reports are seeing strong reactions, so it seems to be mostly the weaker dollar that is boosting oil, gold and commodities -- that action is responsible for the strength. We really need earnings to be the main driving force if this market is going to continue its steady move higher.

The thing that troubles me most about this market is that the action under the surface was much weaker yesterday than reflected in the Dow Jones Industrial Average and S&P 500. Breadth was soundly negative and most of the small-caps I followed did not bounce back much at all when the indices strengthened late in the day on Monday.

China stocks, which are one of my key measures of speculative momentum, have been acting very poorly for about a week now and continue to see pressure as China makes moves to cool off its real estate market. When we start losing the hot-money sectors like China, and when small-caps underperform as they did yesterday, I grow much more concerned about the potential for sustained momentum.

Despite the selling of the last two days, the indices still have barely corrected at all, but the Goldman news did result in a few cracks in our uptrend. The issue now is whether the dip-buyers can continue their aggressive buying of any minor pullback. They certainly are looking frisky in the early going today, but the real test will not come until AAPL earnings are issued this evening.

I'm looking for this hot open to cool off fairly quickly and expect choppy action as we wait for tonight's earnings. The tepid response to key earnings looks like a worrisome sign, but so far the market seems focused on other issues. If we don't see better reaction to earnings pretty quickly, I'll be much more concerned about the health of our uptrend.

-----------------------------

Briefing.com

Ülespoole avanevad:

In reaction to strong earnings/guidance: ATHR +5.7% (also tgt raised to $46 at Brigantine, target raised to $48 from $42 at Jefferies following above consensus Q1 results and Q2 guidance ), UNH +3.7%, ESLR +3.4%, STLD +3.0%, AVGO +2.6%, ZION +1.8%, NVS +1.0% (Novartis to reorganize U.S. staff; reports 1Q10 results - WSJ), COH +0.9%.

M&A news: CKR +6.3% CKE Restaurants declares takeover proposal superior; gives notice that it is prepared to terminate the merger agreement with affiliates of Thomas H. Lee Partners, LP.

Select European financial related names showing strength: DB +2.6%, AIB +2.6%, IRE +2.6%, ING +1.7%.

Select metals/mining stocks trading higher: MT +2.2%, BHP +1.8%, BBL +1.2%, RTP +0.4%.

Other news: ARRY +39.1% (has entered into an agreement with Novartis for the worldwide development of the small-molecule MEK inhibitors ARRY-162 and ARRY-300 and other MEK inhibators), JSDA +27.1% (Target Stores offer Jones Soda Co.'s New GABA infused beverage nationwide), ABK +10.3% (still checking), UNIS +6.9% (Cramer makes positive comments on MadMoney), XOMA +5.6% (XOMA 052 shows potent in vitro inhibition of interleukin-6 production in human myeloma cells), THC +3.6% (still checking), RIG +3.1% (will begin trading on SIX Swiss Exchange), ATPG +3.0% (received approval for the commingling of two zones at the Atwater Valley 63 #4 well), SSN +2.4% (advises that it expects to be drilling the Gary #1-24H well in mid to late May 2010), WYNN +2.2% (Cramer makes positive comments on MadMoney), FRO +1.8% (still checking).

Analyst comments: MWW +4.1% (upgraded to Outperform at Credit Suisse; tgt raised to $22 ), MGM +3.3% (added to Conviction Buy List at Goldman; Cramer makes positive comments on MadMoney), HK +2.7% (upgraded to Outperform from Market Perform at FBR Capital), IPI +1.9% (upgraded to Hold from Sell at Soleil; maintains $25 tgt), TOT +1.6% (upgraded to Buy from Hold at Citigroup), POT +0.8% (upgraded to Hold from Sell at Soleil).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: MTG -12.1% (also filed for a mixed shelf offering for an indeterminate amount), FALC -7.4%, EAT -5.6%, SVU -4.9%, NTRS -4.5%, WERN -2.2%, FRX -1.8%, IBM -1.8%, KO -1.4%, USB -1.1%, LNCR -0.4% (light volume).

Select mortgage insurer related names pulling back following MTG results: RDN -3.5%, PMI -3.4%, MBI -1.1%.

Other news: NIV -7.7% (prices ~7.3 mln shares at $3.29), HGSI -5.5% (Human Genome and GlaxoSmithKline announce topline 76-week results of Phase 3 trial of Benlysta in Systemic Lupus Erythematosus), CIGX -4.3% (files for 18,050,847 Share Common Stock offering selling stockholders), GILD -1.2% (terminates Ph. II clinical trial of GS 9450 in patients with chronic hepatitis C).

Analyst comments: GCA -1.7% (downgraded to Hold from Buy at Lazard), CSTR -1.6% (downgraded to Market Weight from Overweight at Thomas Weisel). -

Tulemuste tabelisse nüüd kõikide olulisemate hommikuste raporteerijate numbrid sisse kantud. Link siin.

-

Yahoo! prelim $0.22, icluding $0.07 in benefits vs $0.09 Thomson Reuters consensus; revs $1.6 bln vs $1.17 bln Thomson Reuters consensus

Yahoo! sees Q2 revs of $1.600-1.68 bln, including TAC, may not compare to the $1.18 bln Thomson Reuters consensus -

Apple tulemustega väljas. Tulemused traditsiooniliselt väga tugevad ning prognoosid konservatiivsed.

Apple prelim $3.33 vs $2.45 Thomson Reuters consensus; revs $13.5 bln vs $12.04 bln Thomson Reuters consensus.

Apple sees Q3 $2.28-2.39 vs $2.70 Thomson Reuters consensus; sees revs $13.0-13.4 bln vs $12.97 bln Thomson Reuters consensus