Börsipäev 26. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Reede avaldatud uute majade müügi statistika USAs ning tugevnenud dollar on täna hommikul toetamas laiapõhjalist tõusu Aasias. Sellele lisaks lubasid Hiina ametnikud nädalavahetusel jätkata proaktiivse rahapoliitikaga ning kohaliku ajalehe sõnul kavatsetakse augustis avalikustada koguni järjekordne stiimulpakett.

Käesoleval nädalal hoogustub tulemustehooaeg, kui oma kvartaliaruande peaks esitama ligikaudu kolmandik S&P500 ettevõtetest. Makro osas saab nädal olema põnev just teises pooles, kui kohtub FOMC ning avalikustatakse USA esimese kvartali majanduskasv. Tänane päev jääb aga makro kohalt vaikseks. -

Faber on jätkuvalt ülimatl negatiivne kriisi lõpliku väljundi suhtes, kuid jätab endale hingamisruumi, tõdedes, et turud võivad tänu üleliigsele likviidsusele uute tippude suunas liikumist jätkata (link CNBC intervjuule). Sarnaste mõtetega oli nädavahetusel väljas ka Grantham.

-

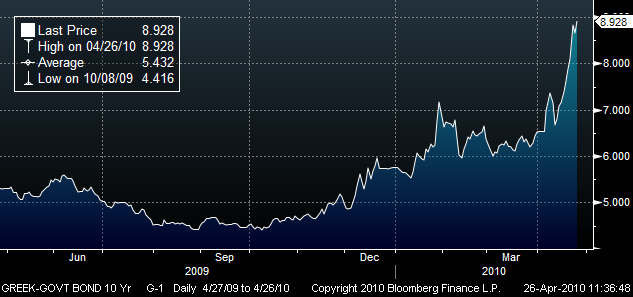

Ei ole siin päikese all midagi kindlat, enne kui paber pole allkirjastatud. Vaatamata sellele, et Euroopa Liidult ja IMFlt on laenu saamiseks nõusolek olemas, trotsib Kreeka jätkuvalt rekordkõrgeid laenukulusid (10a intress 8.93% ja 2a oma 11.1%). Kreeka jääb raha saamisel üsna enesekindlaks, ent investoreid muudab pelglikuks sakslaste tugev oppositsioon ja legislatiivse protsessi võimalik venimine. Sakslaste peamiseks tingimuseks on saanud kredibiilsete reformide väljatöötamine. Wolfgang Münchau via FT:

Greece will need to present a transition programme that explains how a large primary deficit can be turned into an equally large primary surplus without causing a slump in economic growth. What I have heard so far from Greek economists is deeply discouraging. Most of the suggestions are old-fashioned accounting tricks, such as trying to add estimates of the black economy into the official number for gross domestic product. What we should be looking for is a three-year programme that lays out detailed expenditure cuts and structural reforms.

Kreeka 10a võlakirja tulusus:

-

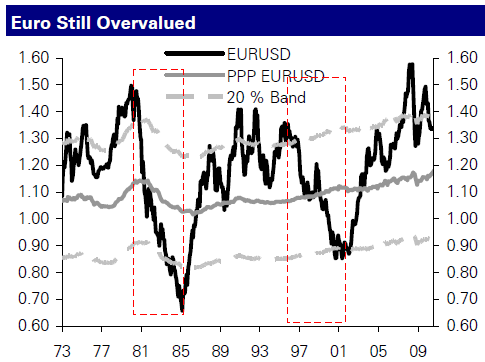

EUR/USD võitleb samuti Kreeka probleemide tõttu 1.3000 tasemega. Kuigi fundamentaalselt on valuutat väga raske hinnata, siis Deutsche Bank kasutab näiteks tuntud ostujõupariteedi meetodit (PPP), mis näitab, et euro on jätkuvalt liiga kallis:

PPP puhul on muidugi palju agasid... Näiteks kui USAs on tulevikus inflatsioon euroalast kõrgem, siis võib EUR/USDi tänane tase PPPst kõrgemal õigustatud olla (hetkel just see tõenäoline tundubki).

-

& olukord Kreeka võlakirjades muutub aina närvilisemaks:

RTRS-GREEK 2-YEAR GOVERNMENT BOND YIELD RISES ABOVE 13 PERCENT FROM NEAR 11 PCT AT FRIDAY’S CLOSE – TRADEWEB

-

1Q10 tulemuste hooaeg on alanud väga hästi ja sarnaselt eelmistele kordadele on analüütikud alahinnanud kasumite taastumist ja tõstavad nüüd oma ootusi. UBSi hinnangul on S&P500 indeksi ettevõtete ärikasum aktsia kohta sellel aastal $90 ja järgmisel $100. Uute kasumiprognooside järgi peaks S&P500 indeks UBSi hinnangul tõusma 1350 punktini (kui järgmine aasta tuleb EPS $100, siis ettevaatav 2011 P/E = 13,5).

-

Caterpillar lööb kasumi osas kuid käive juba seitsmendat kvartalit alla ootuste ning -10% yoy:

Caterpillar prelim $0.50, ex-healthcare costs, vs $0.39 Thomson Reuters consensus; revs $8.24 bln vs $8.84 bln Thomson Reuters consensus. Caterpillar sees FY10 $2.50-3.25 vs $2.69 Thomson Reuters consensus; sees revs $38-42 bln vs $37.00 bln Thomson Reuters consensus.

-

CATi 2010. a prognooside tõstmise taga on jätkuvalt Aasia ja Ladina-Ameerika:

"The main driver behind our improved outlook is robust growth in Asia/Pacific and Latin America and continued improvement in mining and energy globally..."

-

Reedel siis uudistefookuses Dendreon (DNDN) oma Provenge'i ravimi heakskiidu ootuses. Väike väljavõte Realmoney.com alt Adam Feuersteini poolt:

SEATTLE (TheStreet) -- Waiting for U.S. drug regulators to make their approval decision on Dendreon's (DNDN) prostate cancer "vaccine" Provenge this week will be like watching for white smoke to emerge from the Sistine Chapel.

The FDA isn't in conclave choosing the next pope. To biotech investors, the FDA is doing something even more important -- deciding the fate of the first drug that harnesses a patient's own immune system to fight cancer. If approved, Provenge will be the first-ever cancer immunotherapy to reach the market, succeeding where many other similar drugs have failed.

FDA is expected to announce its Provenge approval decision on May 1. Since that's a Saturday, Dendreon might get the news Friday. [The speculation that FDA would convene an advisory panel to review Provenge has faded away.] -

Boiler Roomid keevad juba ilmselt DnDn ootustes, kui hästi läheb saab mega käivet ja kui halvasti peab kontorit kolima taas.

-

USA futuurid indikeerimas avanemist 0-0.2% kõrgemal

Euroopa turud:

Saksamaa DAX +0.99%

Prantsusmaa CAC 40 +1.20%

Inglismaa FTSE 100 +0.73%

Hispaania IBEX 35 +0.37%

Rootsi OMX 30 +0.69%

Venemaa MICEX +0.81%

Poola WIG +1.75%Aasia turud:

Jaapani Nikkei 225 +2.30%

Hong Kongi Hang Seng +1.61%

Hiina Shanghai A (kodumaine) -0.47%

Hiina Shanghai B (välismaine) -0.43%

Lõuna-Korea Kosdaq +0.23%

Tai Set 50 +1.39%

India Sensex 30 +0.29% -

Rev Shark: Frustration Keeps Things Going

04/26/2010 7:39 AM"If you don't like something, change it. If you can't change it, change your attitude. Don't complain."

-- Maya Angelou

I don't recall a market as strong as this one that has been as unloved as this one. Sure, there are folks who have celebrated the action, but I don't think that there have ever been so many bitter complaints about a bull market.

A big part of the reason for the persistent pessimism it is that many people who suffered badly during the meltdown in 2008 and early 2009 never have been able to shake off their fear and embrace this market. They have stayed negative and have only become more so as we run straight up. Many are convinced that this is nothing more than massive manipulation that is sure to come to an ugly end.

Another reason this rally has been cursed by many is that the action is so unusually lopsided. There have been very few easy entry points along the way. We have hardly had more than a half day of selling since the current uptrend began back in early February.

The very fact that so many folks have been frustrated with this market is part of the reason it continues to act in such a resilient manner. It is standard "Wall of Worry" action. People don't trust the market so they have cash on the sidelines, but as it keeps going higher, they become increasingly frustrated with being left behind so they put to cash work. That cash caused the market to move even higher, which creates more frustration and more cash from the sidelines to come in. Pessimism keeps cash on the sidelines, but the fear of being left out of the party keeps drawing it in and helps to things keep on going.

Frankly, I'm a bit tired of writing about this sort of action. The only logical way to play it is to embrace the momentum and stay vigilant so that you don't suffer too much damage when we eventually do see a reversal. The higher we go and the more extended we become, the greater is the temptation to call a top, but that has been happening for weeks now and anything other than complete bullishness has been costly.

We have hundreds of earnings reports this week which will add a little spice to the mix, but even though we have seen a few "sell the news" reactions to some reports, the market has been quick to shake it off. On both Thursday and Friday last week, we started off slowly after a few key reports were met with selling, but we shook it off and ended up with strong closes.

That brings us to Monday, which by far has been the best performing day of the week for quite some time. We have barely had a negative Monday in months. Market players know that, and they help to keep it going.

So, as we kick off the week, nothing much has changed. We are still trending upward, we are still technically extended, and we still have no signs of selling pressure. Fighting this simply has not worked. We need to have an attitude that allows us to embrace the strength, even if we don't believe it. Holding your nose and buying has worked for the skeptics.

Overseas markets were strong overnight as they caught up with our late action on Friday, and we have a slight positive open on the way. The dollar is strong especially against the yen, and Caterpillar (CAT - commentary - Trade Now) is up following a good report, which is giving us a slightly positive open.

-

Gapping down

In reaction to disappointing earnings/guidance: PMI -12.5% (also announces $600 mln offering of common stock and convertible senior notes), FRBK -12.0%, PVTB -10.1%, TUES -4.7%, BLK -1.4% (light volume).M&A news: CRL -9.2% (Charles River Laboratories to acquire WuXi PharmaTech for $21.25/share in cash and stock), CKR -3.9% (CKE Restaurants announces agreement to be acquired by affiliates of Apollo Management VII, LP and termination of merger agreement with affiliates of Thomas H. Lee Partners, LP), SF -2.6% (Stifel Financial to acquire Thomas Weisel for ~7.60/share).

Other news: GMO -13.0% (receives $10 million under Hanlong bridge loan agreement), CPD -8.3% (still checking), IRE -5.8% (proposes to raise euro 3.421 billion equity tier 1 capital), RDN -3.4% (down in sympathy with PMI), ERIC -2.9% (still checking), NBG -2.3% (continued concerns surrounding bailout, C -1.9% (issues filing for Treasury sale of securities), LEN -1.6% (Lennar proposes to sell senior notes and convertible senior notes), FMBI -0.9% (acquires Peotone Bank and Trust Company; downgraded to Perform from Outperform at Oppenheimer). Analyst comments: AIV -6.8% (downgraded to Underperform from Market Perform at BMO Capital ), ESI -3.4% (downgraded to Neutral from Outperform at Credit Suisse), BSY -2.5% (downgraded to Hold at Jefferies), NOK -2.5% (downgraded to Market Perform from Outperform at Bernstein), DV -2.1% (downgraded to Neutral from Outperform at Credit Suisse), BANR -1.1% (downgraded to Underperform from Mkt Perform at Keefe Bruyette), DELL -1.0% (light volume; downgraded to Hold from Buy at Standpoint Research).

Gapping up

In reaction to strong earnings/guidance: MGIC +9.6%, TZOO +6.1% (light volume), SOHU +3.7%, HUM +3.2%, WHR +3.2%, CAT +3.1%.M&A news: WX +20.1% (Charles River Laboratories to acquire WuXi PharmaTech for $21.25/share in cash and stock), SDXC +6.7% and EQIX +2.0% (United States Department of Justice closes its investigation of Switch and Data's merger with Equinix), DTG +6.4% (Hertz to acquire Dollar Thrifty for $41.00/share in cash and stock).

Select financial related names showing strength: RBS +4.0%, AIB +3.7%, BCS +3.1%, LYG +2.6%, ING +1.5%, AIG +1.2%, DB +1.1%, HBC +1.0%.

Select metals/mining stocks trading higher: MT +1.7%, BBL +1.4%, RTP +1.1%, BHP +1.0%.

Select ag machinery related related names showing strength boosted by CAT earnings: DE +1.8%, JOYG +1.1%, BUCY +0.9%.

Other news: DRAD +33.0% (receives FDA Clearance for Ergo Large Field-of-View, Solid-State, General Imaging Nuclear Medicine Camera), BPAX +16.8% (enters option agreement to its 2A/Furin Antibody Expression Technology), LVS +2.5% and MGM +2.3% (still checking for anything specific).

Analyst comments: RRR +7.8% (upgraded to Buy from Hold at Deutsche Bank), MDVN +3.4% (upgraded to Buy from Hold at Roth Capital), CF +1.6% (upgraded to Neutral from Sell at UBS), HOT +1.4% (upgraded to Buy from Hold at Stifel Nicolaus),

-

NYSE-l kaubeldav nii VIP (alates 23.04.10) kui OVIP. OVIP- millega tegu?

-

VIPi all kaupleb VimpelCom Ltd. OVIP on OJSC Vimpel-Communicationist ADSid, mille ettevõte on lubanud mõne nädala pärast delistida.

-

Kas tuleks siis kontol olevad OVIP-d kiirelt võõrandada ja millised on soovitused, nõuanded, ohud?

-

Lennar: Moody's rates Lennar's new notes B3; outlook positive

LEN kogub turult täiendavalt vahendeid, millele investorid on positiivselt reageerinud (LEN kauplemas +1.02% tõusus) ja Moodys annab võlakirjade reitinguks B3.

Viimase nädalaga aktsia hind rallinud ~20%. -

Paistab, et tänane õhtupoolik võib kergelt närvilisemaks minna -> VIX ja VXN mõlemad korralikus tõusus.

KRE ja XHB künnavad samuti päeva põhju. -

To: erik mottus

Kõige parema ülevaate peaks saama VimpelCom Ltd kodulehelt: http://www.vimpelcom.com/investor/index.wbp

Samas tegemist üsna keeruliste tehingutega. -

Paistab, et LEN-ile hakkab gravitatsioon siiski mõjuma. Päeva tõus käest antud ja $20 tase on magnetiks saamas.

-

Sealt ka sai loetud, aga võõrandasin ära, ja soovitan ka teistel mitte OVIP ADR-dega enam mitte tehinguid teha. Kui õieti aru sain, et makstakse 0,00005 rubla 1-ADR eest kui delistimiseks läheb.

-

erik mottus,

kuidas sa ADR-e võõrandad? Kas müüd või on sul veel mingi variant? -

erki, mulle tundus, et mingit olematut rahalist kompensatsiooni pakuti siis, kui tehti pakkumine OVIPi osakud VIPiks vahetada (summa oli väike, sest eelistati, et aktsionärid ikka alles jääks. Samas oli mingit rahasummat vaja pakkuda, sest seadused nägid ette). Kui nüüd OVIPi osakud käes, siis tuleb squeeze out. Ma täpset infot selle kohta ei leidnud, kuid siin pigem oht, et see ei tule meeldiv. Sellega tasub ka arvestada, et kuna kaubeldavate OVIPide arv on väga väike, siis käive aktsias on madal ja spreadid ilmselt suured.

-

The U.S. Offer will expire at 5:00 p.m. New York City time on April 15, 2010, unless we decide to extend the U.S. Offer.

Hetkel võimalus müüa. Ettevõte on öelnud, et detailid squeeze-out'i kohta tulevad hiljemalt 26. mail.

-

To:MSM

Ikka müüsin.