Börsipäev 5. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Eilne päev oli väärtpaberiturgudel väga punane. USA suuremad indeksid kukkusid üle 2%, Russell2000 indeks kogunisti ca 3% ning nafta ca 4%. Tähelepanu on selgelt keskendunud hetkel ainult Euroopa võlaprobleemidele ning eile hakkasid väga närvilistes oludes taas kerkima Kreeka, Portugali, Hispaania jt riigivõlakirjade tulususmäärad. Dollar jätkas samal ajal väga kiiret tugevnemist euro vastu ning nüüdseks on jõutud juba tasemele €1=$1.295.

Eesti aja järgi kell 15.15 teatatakse ADP hinnang aprillikuus toimunud muutustele USA tööjõuturul - ootusnumbriks ca +30 000. Kell 17.00 tuleb ISM teenindusindeksi suurus ja 17.30 naftavarude raport.

Pisut ebaleva algusega Euroopa aktsiaturg on täna hommikul kukkumist jätkanud ning USA eelturul indeksid ca 0.3% kuni 0.4% punases. -

Bloomberg on intervjuu teinud Meredith Whitneyga, mida huvilised saavad kuulata siit. Muuhulgas ütleb Whitney, et ootab USA kinnisvaraturul teist nõudluse ärakukkumist - link siin.

-

LOL @ Whitney Houston :D

-

Meredith Whitney ikka

:) -

http://en.wikipedia.org/wiki/Meredith_Whitney

-

:D

-

LHV võiks teha intervjuu Eda-Ines Ettiga ja uurida, mida arvab too CDS-ide hinnaliikumistest.

-

;D Hommikukohv jäi vahele.

-

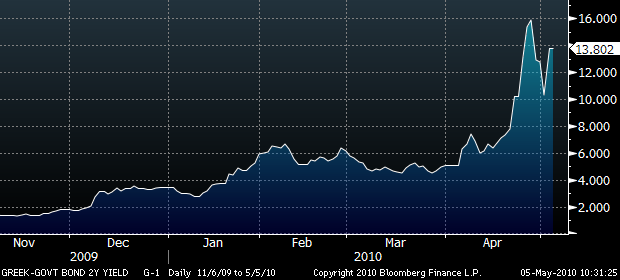

Kuigi Kreekale antavast laenust peaks riigi võlakohustuste katmiseks ametlikult piisama kolmeks aastaks (järjest rohkem jookseb poliitikute ja analüütikute arvamustest läbi 2a), ei näi turud sellest erlist lohutust leidvat, sest pikaajaline maksevõime on jätkuvalt küsimärgi all. Lisaks hirmutavad Hispaania, Portugali, Itaalia ja Iiri võimalikud likviidsusprobleemid.

Kreeka 2a võlakirja yield

-

Kreekas täna järjekordne üleüldine streik, mis võib senistest olla suurim - õhuruum suletakse, koolid ja haiglad kinni, ühistransport töötab vaid selleks, et protestijaid valitsuse hoone ette viia. Pikemalt Bloombergi vahendusel.

-

Kreekas hakati nüüd pommidega panku ja poode ründama!

Seltsimehed elagu revulutsioon! :))

Kui nüüd asi hapuks läheb siis peaks ikka korralik sell off tulema. -

Moody's announces Portugal's Aa2 ratings on review for possible downgrade; P-1 affirmed

-

ADP vastavalt ootustele:

ADP Employment Change 32K vs 30K consensus -

Kreeka börs taas rohkem kui 2 protsenti miinuses ja vaikselt hakatakse lähenema märtsi põhjadele. Tasub rahutustel silma peal hoida. Aga finantsturgudel põhjustaks ilmselt paanilise sell offi Kreeka valitsuse võla restruktureerimine (praegu veel poliitikud eitavad igasuguseid spekulatsioone võla restruktureerimisest).

-

kui ostu koht tuleb siis äratage mind üles

-

ostukohast on asi vist päris kaugel ADP tiba paremgi aga turg selle peale alla,turg läheb hapuks ära

-

USAst ostmiseks tasub radaril hoida väga riskantne National Bank of Greece (NBG) ja madalama riskiga telekomiettevõte Hellenic Telecommunciation Org. (OTE) (kui lisaks mässule võlagade restruktureerimine laiemalt pilti peaks tulema, siis ilmselt näha suuremat müüki ja soodsamaid ostuvõimalusi...)

-

Lõhuvad juba nii kõvasti seal Ateenas, et peaks äkki kohalikke ehitajaid hoopis ostma?!

Keegi peab ju selle linna ka ükskord uuesti üles ehitama :-) -

Mikk Taras, palju on praegu LHV meelest OTE dividend yield?

-

Norra keskpank liigutas oma intressimäärasid 2009. aasta neljandas kvartalis ülespoole kahel korral. Täna jätkati seda seeriat ning intressimäärad tõsteti 1.75% pealt 2.0% peale.

-

TaivoS, LHV meeskonnaga OTE'd põhjalikumalt uurinud ei ole. Hetkel ei ole veel lubatud mingisuguseid dividende, aga eelmisel aastal makstud dividendide põhjal oleks yield ca 10% ja Bloombergi prognooside järgi võiks dividenditootlus sellel aastal jääda 6% juurde.

-

OK, siis on see korrektne. Yahoo! räägib mingist 8-9% yieldist ja mujal olen sama näinud, kuid kui hakkasin ise kontrollima, oli pilt teine. 0,5 EUR dividend eelmise aasta eest ning Ateena börsil aktsia hind 8,2 EUR.

Makrot arvestades ei paista küll eriliselt huvitav ost. Räägiks paar punkti kõrgemast, oleks juba huvitav. -

PS, minu arust oli auditeeritud 2009. aasta aruandes juba sees, et makstakse 0,5 EUR aktsia kohta eelmise aasta eest. Paranda kui eksin.

-

Euro on dollari vastu vabalanguses ning ainuüksi tänasega on euro dollari vastu kaotanud 1.3%. Tugevneva dollari taustal on veel mõned päevad tagasi $86 juures kaubelnud naftahind kukkunud juba allapoole $80 piiri. Hetkel musta kulla hinnaks $79.5 ja päevaseks miinuseks -4%.

-

Euroopa turud:

Saksamaa DAX -1.02%

Pantsusmaa CAC 40 -1.32%

Suurbritannia FTSE100 -1.16%

Hispaania IBEX 35 -2.45%

Rootsi OMX 30 -1.67%

Venemaa MICEX -1.09%

Poola WIG -1.15%Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hong Kongi Hang Seng -2.10%

Hiina Shanghai A (kodumaine) +0.79%

Hiina Shanghai B (välismaine) -2.47%

Lõuna-Korea Kosdaq N/A (börs suletud)

Tai Set 50 N/A (börs suletud)

India Sensex 30 -0.29% -

Burden of Proof Shifts to the Bulls

By Rev Shark

RealMoney.com Contributor

5/5/2010 8:57 AM EDT

The genius of investing is recognizing the direction of a trend -- not catching highs and lows.

-- James Koford

Nothing is more important to market success than trading in the same direction of the overall market trend. Roughly 70%-80% of stocks will move in the same direction of the overall market. If you are fighting the trend, your chances of making money decrease dramatically.

That sounds pretty easy, but the hard part is determining which way the market is trending and then sticking with it. Within any good trend there will be countertrend moves and pullbacks that will appear to be a shift in market direction. The market will constantly try to shake us out, but there will also come a time when the trend does actually change, and if we don't react quickly the losses can grow very fast.

Which brings us to the million-dollar question this morning: Is the market now undergoing a major change in trend? After the big breakdown yesterday, Investor's Business Daily deems the market to be "undergoing a correction." If you follow that publication's methodology, that means selling positions and heading for the sidelines.

It isn't particularly difficult to see why IBD has concluded that we are now in a correction. As I discussed yesterday, we have had quite a few "distribution" days in the last few weeks where volume was higher on down days than on the prior positive days. We have also broken below the lows of April and given back all the gains for that month. We still have some technical support for the S&P 500, most notably at the 50-day moving average at 1168 and at the January high around 1150, but this market went almost straight up on light volume for nearly three months, so there is very little significant support

With the trend shifting downward and the market in correction, it's pretty obvious that the proper course of action is to be more defensive. Good trading discipline demands that we take steps to protect our capital before losses can grow.

That is pretty easy to say, but for over a year the market has punished disciplined traders who become defensive as the market starts to break down. We have had at least half a dozen situations where we have broken down and then immediately reversed and went straight up and made new highs. It is not the sort of action you expect to see when the market breaks down, but it's happened with such regularity that it is hard to bet against it.

Should we look for this market to bounce back sharply and go to new highs just like it did over the last few months and back in July, August, September and October of last year? It would seem to be the way to bet given the pattern, but for the disciplined trader it's the wrong play. Betting on "V"-shaped recoveries is very dangerous -- if they don't occur, the losses can be quite high. The risk just doesn't justify the reward for most people.

Although this market may indeed be undergoing a correction, that doesn't mean we won't see a good bounce back up or have some positive action. In fact, it would be unusual if we didn't see some kind of snapback move. But we need to watch how this market acts on a bounce. Do the sellers use strength to dump positions and put on shorts, or do the dip-buyers jump in and keep the trend moving higher?

At this point, caution is required and the burden of proof shifts to the bulls. Maybe they will pull off yet another "V"-shaped bounce to new highs, but first they need to step up and stop this downtrend that is developing.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: TORM +36.3%, AMMD +11.7%, CBMX +8.6%, ACAS +4.6%, WMGI +4.4%, PLT +4.0% (light volume), WBC +3.9%, IPI +2.7% (also plans to proceed with Langbeinite recovery improvement project), DVN +2.5%, INT +2.2%, SVR +1.1%, CNO +1.0%.

Select metals/mining stocks trading higher: RTP +1.6%, BHP +1.2%.

Other news: OSIR +19.2% (receives FDA orphan drug designation for stem cell treatment for Type 1 diabetes), SPIR +11.4% (awarded U.S. GSA contract), ARIA +6.8% (announces restructuring of its Ridaforolimus collaboration with Merck), NBG +3.5% (still checking), BZH +3.3% (prices 12.5 mln common shares at $5.81/share), SVA +1.5% (submits clinical trial application for mumps vaccine).

Analyst comments: S +2.9% (upgraded to Buy from Hold at Deutsche Bank).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: MYGN -23.8% (also announced plan to repurchase $100 mln of common stock; downgraded to Market Perform from Outperform at JMP Securities, downgraded to Neutral from Buy at Piper Jaffray), UWBK -15.0%, GRMN -13.1%, CETV -9.2% (light volume), TNDM -8.8%, CRAY -8.7%, USU -7.7% (also updated status of its centrifuge project and announced that lead cascade testing program is successfully underway), TRLG -5.3%, RJET -4.8%, FRPT -4.3%, PAR -3.9%, STO -3.5%, FEIC -3.1% (light volume), NWSA -2.6% (also downgraded to Neutral from Overweight at JP Morgan), DBTK -2.4% (also downgraded to Hold from Buy at Lazard Capital, downgraded to Neutral from Buy at MKM Partners), SONS -2.4% (light volume), WBMD -2.4% (downgraded to Hold from Buy at Canaccord), PAR -2.1% (also downgraded to Market Perform from Outperform at Morgan Keegan).

Select financial related names showing weakness: BBVA -5.0%, IRE -3.8%, DB -3.1%, BCS -2.8%, CS -2.6%, GNW -2.7%, UBS -2.6%, FITB -2.5%, HIG -2.4%, MS -2.2%, LYG -2.1%, ING -2.0%, C -1.6%, USB -1.5%, STD -1.3%, AIG -1.2%.

Select oil/gas related names trading lower: REP -4.6%, RDS.A -3.9% (trading ex dividend), PBR -2.5%, TOT -2.0%, E -1.5%, SLB -1.5%.

Select large cap pharma/drug related names seeing early weakness: GSK -2.0% (trading ex dividend), NVS -1.7%, AZN -1.6%, SNY -1.4%.

Other news: ITMN -77.0% (receives FDA complete response letter on Esbriet (Pirfenidone) NDA; downgraded to Perform from Outperform at Oppenheimer, downgraded to Neutral from Overweight at JP Morgan, downgraded to Hold from Buy at Canaccord, downgraded to Market Perform from Outperform at JMP Securities, downgraded to Market Perform from Outperform at Wells Fargo), ALXA -8.2% (files $75 mixed securities shelf offering), KERX -6.0% (still checking), ISRG -5.6% (still checking), BPOP -3.2% (Popular to convert depositary shares into common stock), WLP -1.5% (still checking).

Analyst comments: MPEL -5.0% (downgraded to Sell from Neutral at Goldman), ONXX -4.8% (downgraded to Neutral from Outperform at Baird), INTC -1.1% (downgraded to Hold from Buy at ThinkEquity). -

Tundub et saame selle sell offi juba täna. (kui vaske või naftat vaadata)

Pole siin mingit võlagade restruktureerimist vaja! -

jimi viidatud intervjuu tundub olevat lavastatud, kunstilise taotlusega teos, mitte reaalne intervjuu. Kasvõi seetõttu, et seal kasutati Nokia telefoni, mille puhul on ju selge, et päriselus seda ei juhtu.

-

jim & suffiks - tänase päeva parima naerupahvaku esilekutsuja auhind läheb minu poolt just teile :D

Aga taas tõsisemale lainele minnes, siis tulemustetabeli jõudsin nüüd õhtuste numbritega ära uuendada ja link sellele on siin. Tõsi, praegused teatajad on turu jaoks juba marginaalse tähendusega ning pommid ja rahutused Kreekas, võlakirjade spreadide suurused Euroopas ja dollari-euro kurss on hoopis need tegurid, mis turgu praegu rohkem oma tahte järgi hüpitavad.