Börsipäev 17. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Täna USAst olulisi majandusraporteid tulemas ei ole ning kogu see nädal on majandusraportite poolest võrdlemisi vaene. Üksnes teisipäeval saame infot aprillikuu ehitusturu arengute kohta ja kolmapäeval inflatsiooni kohta.

Nädalavahetusel toimunud kokkupõrked Bangkokis sõjaväe ja protestijate vahel, Hispaanias vastuvõetud valitsussektori kärped ja pensionide külmutamised ning jutud sellest, et Kreeka kaalub USA pankade vastu juriidilisi samme, on ka tänahommikuse eelturu korralikult punasesse vajutanud. USA indeksite futuurid hetkel ca -0.9%, EUR/USD -0.6% @ €1=$1.229 (madalaim tase alates 2006. aastast) ning nafta -2% (juuni leping $70 ja juuli oma $73.9 barrelist). -

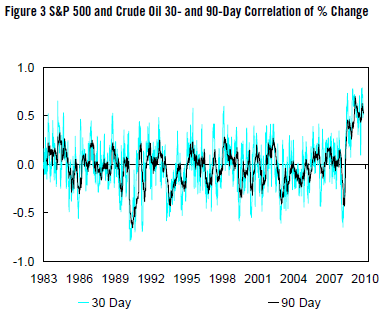

Euroopa turgudel võimsad liikumised - päeva alguse miinusest on üha kõrgemale liigutud. Suuremaid uudiseid ei ole olnud ja pigem näidatakse esmaspäevale omast tugevst. Juuni nafta futuurid, mis käisid korra ka 70 dollarist madalamal, on samuti teinud korraliku põrke. Siin üks hea graafik, kust on näha, et nafta hinna ja aktsiate korrelatsioon on jätkuvalt viimaste kümnendite suurim (sama kehtib ka teiste riskantsemate varaklasside kohta):

Allikas: Citigroup

-

The New York Fed's Empire State Manufacturing Survey recorded a sharp drop in May, with its headline index falling from +31.86 to +19.11, the lowest reading since January. Economists had expected only a slight dip, to +30.00. Expectations for six months out dropped from +55.70 to +42.11.

Almost all the individual indices plunged as well (though the headline reading is not a composite, as it is for the Chicago PMI and ISM surveys). New orders dropped from +29.49 to +14.30, shipments collapsed from +32.10 to +11.29, inventories reverted from +11.39 to +1.32, and the average employee workweek dropped from +13.92 to a flat 0.00.

The bright spot was the number of employees index, which gained slightly from +20.25 to +22.37. Price indices held about steady, with prices paid rising from +41.77 to +44.74, and prices received edging down from +6.33 to +5.26. -

March Long-term TIC Flows +$140.5 bln vs +$40.0 bln consensus, prior +$47.1 bln

Välisinvestorid on US varasid soetamas. -

Suurest eelturu miinusest on börsipäeva avanemise hetkeks USA turud lahti saanud ning indeksid hetkel eilsete sulgumistasemete juures.

Euroopa turud:

Saksamaa DAX +0.94%

Pantsusmaa CAC 40 +0.27%

Suurbritannia FTSE100 +0.83%

Hispaania IBEX 35 +0.42%

Rootsi OMX 30 +1.00%

Venemaa MICEX +0.18%

Poola WIG -0.19%Aasia turud:

Jaapani Nikkei 225 -2.17%

Hong Kongi Hang Seng -2.14%

Hiina Shanghai A (kodumaine) -5.07%

Hiina Shanghai B (välismaine) -5.42%

Lõuna-Korea Kosdaq -2.81%

Tai Set 50 -2.16%

India Sensex 30 -0.94% -

veidi värskemat investorite raha liikumise infot ka

Fund trackers iMoneynet, the Investment Company Institute and EPFR Global all showed money market funds getting net inflows of at least $21 billion in the latest week.

It was the first increase this year, which has been characterised by money flowing out of safe-haven cash funds into higher-yielding bonds and stocks.

EPFR estimates that outflows from money market funds have totalled more than $388 billion year-to-date. -

Alari poolt pandud statistika kohta tasub lisada, et eriti suur oli märtsis nõudlus USA valitsuse võlakirjade vastu:

International demand for Treasurys increased $108.4 billion in March, compared with a gain of $48.1 billion in February.

International purchases of U.S. stocks rose by a net $11.2 billion compared with net purchases of $13 billion in February.

-

Poor Technical Pattern

By Rev Shark

RealMoney.com Contributor

5/17/2010 8:32 AM EDT

"Once in motion, a pattern tends to stay in motion."

-- J. G. Gallimore

Over the past two weeks, the market has undergone a textbook breakdown, bounce and failure. Typically, the pattern of his market has been to run straight back up on light volume after a pullback or breakdown, but this time, 1,175, which is the 50-day simple moving average of the S&P 500, proved to be a solid resistance level. After failing to breach that level on Wednesday and Thursday, we rolled over, broke support around 1,150 and racked up some good-sized losses.

Technically, that leaves the major indices with some very poor looking charts. We may be oversold enough to bounce, but if you are bullish about this market, it has to be for a reason other than the technical conditions. There is nothing in the charts to suggest that we are about to find support and turn back up.

Of course, good old-fashioned technical analysis has not mattered much in this market for quite some time. Often the best time to buy has been when the charts looked their worst. Back in early February, for example, we had a similar breakdown and bounce failure, but we quickly found support, churned for a while and then had a spectacular series of positive days on mediocre volume. If that pattern repeats, then we should be very close to a buying point once again.

We have had numerous V-shaped reversals throughout this rally that began in March 2009, so it is natural to not be very trusting of the charts even when they do look as bearish as they look now. It just hasn't paid to look for sustained downside even when the charts seem to clearly suggest further weakness.

What we have to keep in mind is that the market is a perverse beast. Just when we start to think that a pattern of action is going to continue, the market changes its behavior and traps those who were becoming too comfortable and trusting. So many market players have become so confident of V-shaped bounces in this market that they fail to play any defense. After all, this market keeps on bailing out the bulls and punishing the bears, so why should it change now?

Prudent market players really have no choice but to be more defensive when the market breaks down like it did last week, no matter how often we have been saved by the pattern of V-shaped moves. We just can't put our capital at risk regardless of how often the market has made fools out of those who turn bearish as we pullback.

We may pay a price for honoring the charts and being defensive if the market makes another quick recovery, but we can change our stance and start buying should we feel conditions warrant it. In the meanwhile, there is no question at all that the technical pattern of the indices is very poor. We could easily see an oversold bounce, but the technical overhead is formidable and the dip-buying bulls have certainly weakened.

Late last night, the futures looked quite poor, and it looked like we might break this pattern of positive Monday opens, but European markets acted much better than Asia and that brought in some bids.

The weak euro and continued tightening in China are the big headwinds we face right now, but we all know that Mondays have been the best day of the week by far, so it may not pay to be too bearish today. Make no mistake about it, though, the charts of the indices are signaling that great caution is warranted, and that can't be ignored.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: DEER +10.4% (light volume), SIRI +5.6%, CEL +2.2%.

M&A news: GLG +52.9% (GLG Partners agrees to be acquired by Man Group plc for $4.50/share ), DBTK +20.7% (Double-Take Software to be acquired for $10.55 per share by Vision Solutions), PTV +18.9% (Multiple reports circulating this morning indicate private equity firm Apollo is in talks to acquire PTV), UHS +5.7% and PSYS +0.4% (Universal Health Services to acquire Psychiatric Solutions for $33.75/share in cash).

Select financial related names showing strength: CS +2.2%, C +1.3%, LYG +1.2%, COF +1.2%, DB +1.1%, AIG +1.0%.

Other news: VHC +30.5% (VirnetX Holding and Microsoft settle patent infringement case ), IFLG +24.2% (the co and Samsung Telecommunications America announced their plans to collaborate on delivering mobile managed services to customers throughout North America), NLST +9.5% (Netlist settles lawsuit with Texas Instruments), SCLN +8.7% (SciClone Pharma provides clinical program update for SCV-07 for prevention of oral mucositis in patients with advanced head and neck cancer).

Analyst comments: JAKK +4.6% (upgraded to Buy at KeyBanc Capital Mkts), WCRX +3.4% (upgraded to Buy from Hold at Jefferies), BUCY +3.3% (upgraded to Outperform from Neutral at Baird), BEE +3.0% (upgraded to Neutral from Underperform at Baird), CAAS +2.5% (initiated with a Outperform at Oppenheimer), AMGN +1.7% (upgraded to Buy from Hold at Citigroup ), V +1.3% (upgraded to Buy from Neutral at SunTrust), HPQ +0.6% (initiated with a Buy at Brean Murray;).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: PWRD -10.4%, HAUP -7.9%, BSPM -6.3%, AMCF -2.7%, LOW -2.4%, PUK -2.0%.

M&A news: TSFG -52.2% (South Fincl Group to be acquired by TD Bank for either $0.28 in cash or 0.004 shares of TD common stock for each outstanding South Financial share), OSIP -4.1% (Astellas Pharma to acquire OSI Pharma for $57.50/share in cash).

Select metals/mining stocks trading lower: RTP -2.1%, BHP -2.1%, VALE -2.0%, IAG -1.2%, GFI -1.2%, BBL -1.0%, MT -1.0%.

Select oil/gas related names showing weakness: RDS.A -1.1%, TOT -1.1%, CVX -0.9%.

Select casino related names under early pressure: LVS -1.8%, MGM -1.8%, WYNN -1.0%.

Other news: SNY -5.3% (trading ex dividend).

Analyst comments: BRCM -2.1% (downgraded to Hold at Roth), PPO -1.6% (downgraded to Neutral from Overweight at JP Morgan), SY -0.7% (downgraded to Neutral from Overweight at JP Morgan, -

Euroopa börsid lõpetasid päeva müügisurvega ja päeval tehtud tõus müüdi ära. USA börsid on samuti korralikult punasesse vajunud (käive siiski üsna tagasihoidlik). Ning nafta juuni futuurid on tagasi 70 dollarist madalamale liikunud. Nafta on lühiajaliselt kallima dollari ja Euroopa ning Hiina makroriskide pärast päris võimast müük saanud ja siit koridori alumisest äärest võib tekkida huvitav põrke võimalus (sõltub kindlasti suuresti dollari käekäigust).

-

Müügisurve on tõesti väga tugevad tuurid üles võtnud ning indeksite miinuseks juba ca 2% kogunenud. Ehk on tegu lühiajalise paanikamüügist tingitud põhjaga?

-

Joel,kas juba ülemüümisega pole tegemist?

-

Pole küll finantsturgudega seotud uudis, kuid spordisõpradele sellegipoolest huvitav infokild. ESPN vahendab, et New York Red Bulls on sõlminud lepingu legendaarse Prantsuse koondise ründaja Thierry Henryga. Seega vähemalt teoreetiliselt võimalik, et Red Bullsi edurivi näeb edaspidi välja: Thierry Henry - Joel Lindpere.

-

O'Neill Goldman Sachsist kirjutab, et paljuräägitud jutud nagu võiks eurotsoon järgmise 12 kuu jooskul ära laguneda, on alusetud. O'Neill pakub isegi, et euro langus teiste valuutade vastu võib olla juba otsakorral. Link Bloombergi artiklile siin.

Minu lemmiklõik sellest artiklist:

"O’Neill said the overwhelming consensus is that euro will weaken further. Of 600 people he addressed recently, only three predicted the currency would strengthen, he said.

“In my experience of being in the foreign exchange market for 29 years, that makes it virtually guaranteed that the euro isn’t going to go down much further,” he said. O’Neill predicts the euro may fall as low as $1.20."

-

On olnud äärmiselt volatiilne kauplemispäev. Ja -2% pealt on indeksid liikunud tagasi reedeste sulgumistasemete juurde.