Börsipäev 3. juuni

Log in or create an account to leave a comment

-

Eilse börsipäeva tugeva lõpuga loodi vundament täna tõusu jätkamiseks. Eelturul ongi USA indeksite futuurid juba ca 0.5% plusspoolel.

Makrouudiste poole pealt saab täna olema tihe päev. Eesti aja järgi kell 15.15 tuleb ADP hinnang erasektori töökohtade maikuu muutusele (eelmäng reedesele NFP numbrile), kust oodatakse ca +60 000 uut töökohta. Kell 15.30 teatatakse 1. kvartali korrigeeritud produktiivsuse kasvu näit (ootus +3.3%), möödunund nädala esmaste töötu abiraha taotlejate tempo (ootus ca 455 000), kestvate töötu abiraha taotlejate tempo (ootus ca 4.6 mln). Kell 17.00 teatatakse aprillikuu tehaste tellimuste muutus, kust oodatakse +1.7%list kasvu ning samuti tuleb kell 17.00 ISM teenindusindeks, mille näiduks oodatakse 55.6 punkti. Seega tõeline makronumbrite sadu täna, millest suurimat tähelepanu tasuks pöörata ADP tööjõu numbrile. -

Aasias tegid võimsa ralli autotootjad, kuna eile õhtul avaldatud statistika näitas, et võrreldes eelmise aastaga on automüük USAs järsult kasvanud (eelmise aasta baas on ka väga madal).

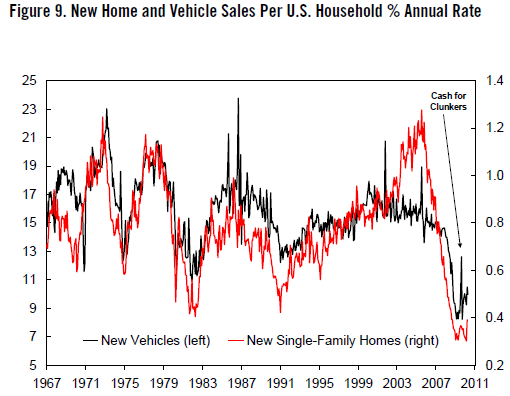

Siin üks Citigroupi graafik, kust näha, et kuna autode ja kinnisvaramüügi tase on väga madal, siis võib oodata ilusaid kasvunumbreid ka edaspidi. Citile jääb arusaamatuks, miks viimasel ajal räägivad kõik uuest majanduslangusest, kui tsüklilised sektorid on nõnda vähe taastunud:

"...from the perspective of the real economy, the U.S. is not positioned for a new downturn when key cyclical activity measures have recovered so little."

-

ADR report +55 000

-

Initial Claims 453K vs 455K Briefing.com consensus, prior revised to 463K from 460K

Continuing Claims rises to 4.666 mln from 4.635 mln

Q1 Nonfarm Productivity-final +2.8% vs +3.3% Briefing.com consensus, prelim +3.6%

Q1 Unit Labor Costs -1.3% vs -1.6% Briefing.com consensus, prelim -1.6%

-

Töötu abiraha taotluste puhul tasub mainida, et kuigi esmased töötu abiraha taotlused kukkusid, siis vähem volatiilne nelja nädala keskmine näit tõusis kolmandat korda järjest.

-

Aasias ja Euroopas on olnud võrdlemisi positiivne kauplemispäev ning USA futuurid indikeerivad päeva avanemist samuti kerges plussis. Nasdaq100 futuur hetkel +0,1% ja S&P500 indeksi futuur +0,4%.

Euroopa turud:

Saksamaa DAX +1,60%

Pantsusmaa CAC 40 +1,92%

Suurbritannia FTSE100 +1,64%

Hispaania IBEX 35 +1,88%

Rootsi OMX 30 +1,83%

Venemaa MICEX +0,95%

Poola WIG N/A (börs suletud)Aasia turud:

Jaapani Nikkei 225 +3,24%

Hong Kongi Hang Seng +1,62%

Hiina Shanghai A (kodumaine) -0,73%

Hiina Shanghai B (välismaine) +0,07%

Lõuna-Korea Kosdaq +1,42%

Tai Set 50 +2,25%

India Sensex 30 +1,68% -

Pump Up the Volume

By Rev Shark

RealMoney.com Contributor

6/3/2010 8:44 AM EDT

"Greatness of soul consists not so much in soaring high and in pressing forward, as in knowing how to adapt and limit oneself."

-- Michel de Montaigne

For the second time in the past week, we had a big bounce but on low volume. The first bounce last Thursday failed at the 200-day simple moving average and fizzled out over the next two days. So, the big question this morning is whether we can build on yesterday's strength.

The biggest negative about the bounce yesterday was the lack of volume. To put in a solid bottom, the market needs upside action on increased volume to indicate that institutional money is being put to work. When volume is light, like it was yesterday, it is more likely caused primarily by short-covering and by flippers looking for very quick gains. It is much more difficult for upside action to be sustained when volume is not growing as we bounce.

Many market players still have fresh in their minds how quickly and easily we recovered from every pullback between March 2009 and April 2010. The recovery this past February was a particularly impressive V-shaped bounce after a pullback, but the reasons for this tendency to bounce straight back up has never been clear. Some market players attribute it to the flood of liquidity caused by bailouts and stimulus. Others claim that the unusual action is a function of the computer dominance of trading.

Whatever the reasons were for those V-shaped bounces in the past, conditions have changed recently and make it more difficult for that type of action to continue. First and foremost is that the huge stimulus no longer exists, as the focus of the federal government turns to raising revenue to pay for all the spending that has already occurred.

We have other macro considerations at work as well. The most notable is the sovereign debt issue in Europe, which is still far from a final resolution. The oil leak in the Gulf of Mexico and the tightening in China also have had a substantial impact.

Another big difference is the technical picture. The pullback in May was much deeper and more severe than anything since the rally began in March. Deeper and bigger pullbacks mean that more people are sitting on losing positions and there is greater overhead.

After the move yesterday, the S&P 500 is close to regaining its 200-day simple moving average, which would be a good first step in a resumption of the uptrend, but we are still far from repairing the damage that was done in May. We could easily bounce more, and with optimism about Friday's jobs report, we could see more buying today. Until we are back up over 1,150-1,175, though, the market is still down-trending.

One other thing in the bears' favor at this point is that seasonality is turning down. We have often heard the line "sell in May and go away" because historically summer has been a tougher time for stocks, especially technology.

So, to sum things up, we had a bounce going, but it was on very light volume and we can't be too trusting. The bigger picture remains negative and won't change until we put together a longer string of positive action. It is a market that requires caution and shorter time frames. The biggest rallies always come during downtrends. Last Thursday and yesterday are good examples. It is only when we have higher-volume follow-throughs that we can be more trusting that upside momentum will continue.

We have a positive start, but retail sales numbers were tepid, and that is keeping things contained.

-----------------------------------

Briefing.com vahendusel:

Ülespoole avanevad:

In reaction to strong earnings/guidance/SSS: XIDE +18.3% (also announced Edward O'Leary, President and COO, submitted his resignation effective as of June 16), JOYG +10.1%, AN +9.8%, CYBX +5.5%, CWTR +4.7%, STP +4.3%, PIR +3.6%, GEF +1.9%, CPRT +1.7%.

M&A news: SNWL +24.8% (SonicWALL to be acquired by investor group led by Thoma Bravo, LLC for $11.50/share in cash ),.

Select financial related names seeing modest strength: CS +1.8%, AIB +1.6%, AIG +1.5%, CS +1.5%, BCS +1.5%, .

Select metals/mining stocks trading higher: RTP +1.9%, BHP +1.1%, MT +1.1%, .

Select oil/gas related names showing strength: HERO +9.1%, FTO +5.9%, BP +4.0%, RIG +3.8%, APC +3.7% (provides Gulf of Mexico update; reaffirms 2010 sales volumes guidance and capital program ), ATPG +3.7%, MEE +3.6% (issues statement on Upper Big Branc reentry ), LINE +2.7% (light volume; announces results of first operated horizontal Granite Wash well, with an initial production rate of 19.4 MMcfe per day ), TOT +1.9%, DO +1.4%, WFT +1.2%, HAL +0.3%, .

Select solar names ticking higher following STP results: CSIQ +2.3%, JASO +1.7%, FSLR +1.0%.

Select European drug names trading higher: SHPGY +1.3%, AZN +1.2% (FDA Advisory Committee reviews MedImmune's Motavizumab), SNY +1.0% (light volume).

Other news: BUCY +5.3% (trading higher in sympathy with JOYG), LVS +2.7% (Hearing strength attributed to analyst upgrade), EGP +2.3% (Cramer makes positive comments on MadMoney), ARNA +2.2% (to Receive $35.5 Million from Deerfield Mgmt).

Analyst comments: BCSI +5.0% (upgraded to Outperform from Market Perform at FBR Capital), ACGY + 4.3% (upgraded to Buy from Neutral at Nomura), WPPGY + 2.7% (upgraded to Buy from Neutral at UBS).

Allapoole avanevad:

In reaction to disappointing earnings/guidance/SSS: DDMX -6.3%, BKE -5.8%, PRXL -4.6% (light volume), FDO -4.2%, GPS -1.8% (light volume), COST -1.7%.

Select discount/dollar stores ticking lower in sympathy with FDO: NDN -2.2%, DG -1.6%, DLTR -0.8%.

Other news: MSEX -5.6% (files for 1.7 mln share common stock offering), CEPH -2.2% (provides clinical update on phase II study of NUVIGIL; announced that the primary endpoint was not met in a Phase II clinical trial), DLR -1.7% (prices 6.0 mln common shares at $57.00/share).

Analyst comments: ACAS (downgraded to Sell from Hold at Stifel Nicolaus), GIFI (initiated with Reduce at Madison Williams). -

S&P500 on jõudnud üsna lähedale viimase 200päeva libisevale keskmisele (ca 1105 punkti juures), mida paljud pikaajalised investorid kasutavad trendi jälgmiseks:

-

Teenuste ISM võrreldes aprilliga mais liikumist ei teinud (kuna teenuste ISM kõigub vähem, siis majandustsüklite jälgmiseks on parem tööstussektori ISM):

May ISM Services 55.4 vs 55.6 Briefing.com consensus, April 55.4

-

Tehaste tellimuste kasv oli aprillis oodatust väiksem, samas märtsikuu näitu on ülespoole revideeritud, seega kokkuvõttes tasakaalustavad üksteist ära.

April Factory Orders +1.2% vs +1.7% Briefing.com consensus, prior revised to +1.7% from +1.3% -

Goldman Sachs tõstab homse tööjõuraporti eel maikuu tööjõuturu kasvunumbri +500 000 pealt +600 000 peale. Tõsi, suurem osa neist oleksid siis USA rahvaloendusega seotud isikud, kuid Goldmani poolne tõstmine on üldiselt hea märk, kuna minu mäletamist mööda on nad selle numbri prognoosimisel isegi rahuldavat täpsust üles näidanud.

-

Täna siis suurpäev väikeinvestoritele.

Uskumatu ,et leidus üks keskerakondlane kes seadust toetas. -

Maagaasihind ja maagaasisektori aktsiad on viimase paari nädala jooksul tugevalt tõusnud ja tänagi ollakse korralikus tõusus. Üha enamatele investoritele on saamas selgeks see, millest olen siin viimastel nädalatel rääkinud - nimelt Mehhiko lahe naftareostus on avamas USA poliitikute silmad ja rahva südamed alternatiivsete fossiilkütuste ehk eelkõige maagaasi vastu. Nüüd on kuulda juba ka seda, et madalates vetes praegu uusi naftapuurimislube ei väljastata, mis tähendab, et hakkamegi tasapisi jõudma olukorda, kus vähenev pakkumine hakkab nafta- ja gaasihindu üles suruma ning maagaas ja maagaasisektori aktsiad on siin selged võitjad. Meie LHV Maailma Pro ideele Chesapeake Energy'gle (CHK) sobib see olukord väga hästi. Panen siia väikese väljavõtte Rev Sharki tänaõhtusest postitusest:

"News that oil-drilling permits for shallow waters won't be issued is helping to pop the price of oil, with supply likely to diminish. On the other hand, companies that drill in shallow waters are taking a bit of a hit.

Natural gas appears to be the major beneficiary of this mess. I added U.S. 12 Month Natural Gas (UNL) to the ETF Shark Alert model portfolio yesterday, and I'm looking for more natural-gas plays, such as SandRidge Energy (SD) , which is the one Jim Cramer has favored." -

EPA signs rule to cut smokestack SO2 - see toetas täna maagaasi kui vähemreostavat energiaallikat vs kivisüsi.