Börsipäev 14. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Kuigi sel nädalal on USAs avaldatavaid makroraporteid omajagu, pole tänase peale neist ühtegi planeeritud. Aasia turud on täna hommikuse seisuga olnud rohelised, euro on jätkanud tugevnemist dollari vastu (hetkel +0.6% ja kaubeldakse tasemel €1=$1.218), nafta on jätkanud kallinemist (hetkel +1.3% @ $74.7) ning USA indeksite futuurid on ca 0.4% plussis, millega S&P500 indeks jõuab üha lähemale olulisele 1100 punkti piirile.

-

Eurostati andmetel tõusis eurotsooni tööstustoodang aprillikuus m-o-m baasil 0.8%. Märtis registreeriti tööstustoodangu kasvuks 1.5%. Tulemus ühtis Moody’s prognoosidega, kuid ületas konsensusprognoosi +0.5%. Y-o-y baasil vaadatuna tõusis euroala tööstustoodang aga aprillis 9.5%.

-

Eurotsooni tööstustoodangu kasv on eurotsooni ajaloos rekordiline

Eestis on EU27 riikidest YoY suurim tööstustoodangu tõus

täpsemalt - http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/4-14062010-AP/EN/4-14062010-AP-EN.PDF -

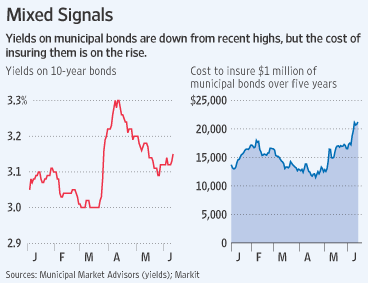

WSJ kirjutab, kuidas investorid ei pööra tähelepanu ohumärkidele USA munitsipaalvõlakirjade turul, mis on ca $2.8 triljoni suurune:

Numerous municipalities are struggling financially. A Rhode Island city recently said it faces insolvency. Harrisburg, the capital of Pennsylvania, is considering a municipal-bankruptcy filing. And famed investor Warren Buffett recently warned of a "terrible problem" ahead for municipal bonds. (link)

Munitsipaalvõlakirjade olukorra jälgimiseks tasuks kindlasti radaril hoida antud võlakirjade tulusus (mida saab teha nt Bloombergi lehel siin). Seoses korrektsiooniga on nt 10.a munitsipaalvõlakirjade tulusus 3.3% pealt aprillis kukkunud 3.1% juurde. See viitab justkui madalamale riskile.

Negatiivsem signaal on aga credit-default swapides (CDS), mis võimaldavad panustada maksevõimetusele ka neil, kes munitsipaalvõlakirju ei oma. Viimaste nädalatega on antud CDSid teinud järsu tõusu:

A basket of 50 of these contracts trade through an index called Markit MCDX. The cost of insuring $1 million of five-year bonds rose 16% in the past week, to $20,000 a year.

-

USA indeksid on oma plussi eelturul hoidnud ning kauplevad praegu ca +0,9% peal. Euro on dollari vastu täna tugevnenud ca +1,2% ning see on aidanud ka energiahindade ca 2,5%lisele tõusule kaasa.

Euroopa turud:

Saksamaa DAX +1,32%

Pantsusmaa CAC 40 +1,78%

Suurbritannia FTSE100 +0,61%

Hispaania IBEX 35 +0,07%

Rootsi OMX 30 +1,43%

Venemaa MICEX N/A (börs suletud)

Poola WIG +1,13%Aasia turud:

Jaapani Nikkei 225 +1,80%

Hong Kongi Hang Seng +0,90%

Hiina Shanghai A (kodumaine) N/A (börs suletud)

Hiina Shanghai B (välismaine) N/A (börs suletud)

Lõuna-Korea Kosdaq +0,30%

Tai Set 50 +1,38%

India Sensex 30 +1,60% -

Monday Morning = Gap Up

By Rev Shark

RealMoney.com Contributor

6/14/2010 8:27 AM EDT

There is nothing as mysterious as something clearly seen.

-- Robert Frost

As we kick off a new week, the hunt for greater clarity is at the forefront. The major indices sit at an important juncture, and this week will help determine if a bear market develops, or if we shrug off a nasty correction.

After struggling throughout the month of May, we have some support around 1,050 on the S&P500 and are now working to hold the low and build a little upside momentum. Unfortunately, we have some substantial overhead resistance around 1,100-1,107, and the recent buying has not been very vigorous. The bulls will have their jobs cut out for them if they are going to manage to turn us back up.

The technical condition of the indices is reflecting a slew of macroeconomic concerns. The European sovereign debt issue, attempts to cool the Chinese economy, recent poor retail and jobs reports in the US and the Gulf of Mexico oil spill are all creating a high level of uncertainty. There is more talk now about a potential double-dip recession than there has been in a long time.

The good news for the bulls is that the market has become oversold to the downside, and there are some subtle signs of underlying support. The key is that we continue to hold above recent lows and that the dip buyers show some interest if we soften. The lack of volume is a concern, and slower summer trading can be an issue.

Also, we haven't had much leadership lately. There is a small group of momentum stocks that Jim Cramer has been discussing, which includes names like Netflix (NFLX) , Chipotle (CMG) and Deckers (DECK) , but at lot of the upside recently has come from dead-cat-bounce action in oils, which have been pounded. Gold probably has the best relative strength lately, and that usually isn't a very healthy sign.

At this point, the best approach is to stay very open minded and flexible. The bear case here looks more convincing, but the bulls have been attempting to make a stand and they have an opportunity to pull it together and generate some upside. If we can make it through the 200-day simple moving average around 1,107, there is a pretty good shot at the 50-day moving average and resistance at 1,150.

I certainly don't plan to be very trusting of this market and am keeping time frames and stops tight. The bears can easily be squeezed a bit, especially if we gain any clarity into the major macroeconomic concerns that are out there.

Right now, we are looking at a pretty typical Monday-morning gap to the upside. Banks and miners are bouncing overseas, but oil is seeing some pressure again, as little progress was made with the Gulf spill this weekend.

The airline group saw an upgrade today and has been performing well recently. The charts look pretty good, and I'll be watching that group. I don't see much other news at the moment, so we'll watch to see how well the buyers hold on to the opening bounce. Stay flexible and be ready to move quickly. It is a muddled market, and we want to go with the flow as things develop.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: BNHNA +8.1%.

Select financial related names showing strength: NBG +5.5%, MBI +3.2%, ING +3.1%, HIG +2.9%, BCS +2.8%, DB +2.4%, IRE +2.2%, BAC +1.9%.

Select metals/mining stocks trading higher: PAL +4.5%, MT +4.1% (upgraded to Buy from Hold at Collins Stewart), BBL +2.7%, RTP +2.8%, GOLD +2.3%, AU +1.8%, AA +1.8%, FCX +1.6%, VALE +1.1%, GFI +1.0%.

Select oil/gas related names showing strength: SDRL +4.1%, ACGY +5.2%, TOT +2.5%, RIG +2.1%, WFT +2.1%, CHK +1.8%, BEXP +1.2%, RDS.A +1.0%, CVX +0.9%.

Other news: NLST +15.9% (made certain stock option grants to new employees), CTIC +7.8% (Italian Medicines Agency has approved the facility at NerPharMa DS for the production of CTIC's drug candidate pixantrone), ASML +4.3% (still checking), SI +3.5% (traded higher overseas), TM +2.4% (still checking), HLX +2.0% (Floating Production Unit joins GoM spill response), MRVL +1.8% (Cramer makes positive comments on MadMoney).

Analyst comments: CRNT +7.4% (upgraded to Buy from Neutral at Merriman), JBLU +4.6% (initiated with a Buy at Deutsche Bank).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: THQI -8.1% (light volume).

Other news: QCOR -10.7% (Receives Notification of PDUFA Date Extension to September 11, 2010 ), ONXX -5.8% (Ph. 3 trial of Nexavar in first-line advanced non-small cell lung cancer does not meet primary endpoint of overall survival), HGSI -4.9% (FDA issues Discipline Review Letter expressing concerns regarding the risk benefit assessment of ZALBIN dosed every two weeks ), CVC -3.6% (announces acquisition of Bresnan Communications), BP -3.2% (provides update on GoM oil spill response; updated its cost of response to the oil spill in the Gulf of Mexico to $1.6 billion), ULTA -1.3% (announces pricing of secondary common stock offering by selling stockholders of 8,976,112 shares of common stock at $22.25). -

Moody's downgrades Greece debt to BA1 from A3; stable outlook

-

Toornafta viimase 10 minutiga teinud läbi terava kukkumise. Hetkel järgi antud juba üle $1.

-

AMBAC Fincl climbing on huge volume with reports that the Chairman said at shareholder meeting that the co has alternatives to bankruptcy +30% $0.90 tasemel.