Börsipäev 15. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Kuigi USA turud avanesid eile kohe hommikul ca 1% jagu kõrgemalt, siis päeva jooksul anti kogu tõus käest ning õhtuks sulgeti reedeste tasemete juures. Päeva jooksul jõudis S&P500 indeks ära käia ka täpselt 200-päeva keskmise joone all (mis peatas ka esimese põrkekatse juuni alguses), kuid uuele 1 kuu tipule pidamajäämiseks enam jõudu sedapuhku veel ei olnud.

Mingeid väga olulisi makroraporteid täna USAst tulemas ei ole. Indeksite futuurid on hetkel eilsete sulgumistasemete juures. -

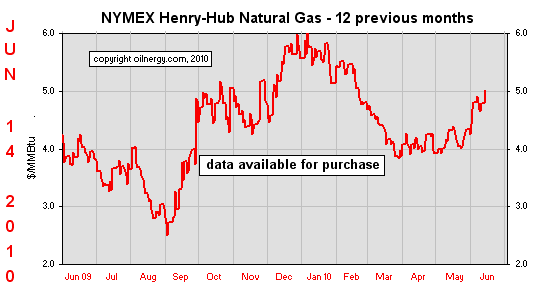

Maagaasile olen siin viimasel ajal palju rõhku pannud. Eile kallines selle maavara hind taas ca 5% jagu ning päev lõpetati $5.006/mcfe peal. Sellega on maagaasihind nüüdseks mai teises pooles nähtud $4lise hinna pealt tõusnud juba üle 25%. Usun, et katalüsaatoreid, mis maagaasihinda ja selle sektori ettevõtete aktsiaid võiksid kõrgemale viia, on praegu enam kui piisavalt. Hiljuti kirjutasin sellest arvamusloo nii e24 portaalis (link) kui ka meie LHV Finantsportaalis (link).

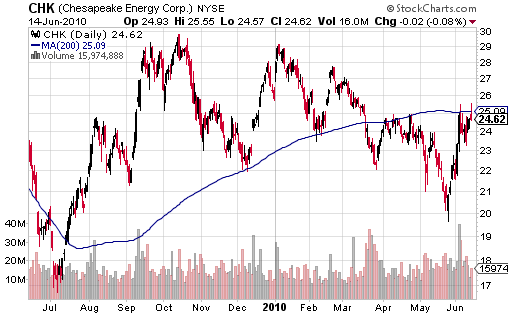

Väga lähedal oli eile ka LHV Maailma Pro idee Chesapeake Energy (CHK) aktsia liikumine olulisest 200-päeva keskmisest ülespoole, kuid õhtupoole nõrgenenud turu taustal jäi see läbimurre eile veel tegemata. Maagaasihinna kallinedes on CHK aktsia ülespoole liikumine minu arvates aga vaid suuresti aja küsimus.

-

Eile kukkus BP (BP) aktsia 9%, kuna USA senaatorid tahavad, et naftagigant eraldaks kohe $20 miljardit naftareostuse puhastamiseks Mehhiko lahes. Samuti selgus, et BP on palganud Blackstone’i, Goldman Sachsi ja Credit Suisse, kes aitavad ettevõttel kohustusi hallata (võimalik, et valmistutakse restruktureerimiseks, mingite varade müügiks vms).

-

Aasias üritab Jaapani keskpank kõigest väest laenuvõtmist stimuleerida. Täna teatati, et pangad saavad uue kolme triljoni jeeni ($33 miljardit) suuruse programmi raames aastaks baasintressimääraga laenu. Laenu saab veel pikendada kolm korda - praeguste tingimuste juures tähendab see, et Jaapani pangad saavad kuni neljaks aastaks laenu 0.1% intressimääraga. (pikemalt loe siit)

Sellise odava laenuraha mõju reaalmajandusele on küsitav. Tihti toetab see lihtsalt mingisuguseid varaklasse, kuna odav laenuraha pargitakse kuhugi kõrgema intressiga varaklassi (nt valitsuse võlakirjadesse).

-

Majandusstatistikat Hispaaniast – Instituto Nacional de Estadistica ehk Hispaania statistikaameti andmetel langesid kinnisvarahinnad aasta esimeses kvartalis y-o-y baasil 2.9%. Möödunud aasta neljandas kvartalis odavnesid hinnad aga 4.3%. Kvartaalselt vaadatuna langesid hinnad 1.2% pärast 0.4%-list langust neljandas kvartalis. S&P teatas eile, et Hispaania kinnivarahinnad võivad langeda veel ca 12%. Alla olen lisanud ka graafiku, mis näitab Hispaania kinnisvara hinnaindeksi muutusi.

Allikas: Instituto Nacional de Estadistica

Indice general = üldindeks, vivienda nueva = uute majade hinnaindeks, vivienda de segunda mano = kasutatud majade hinnaindeks.

-

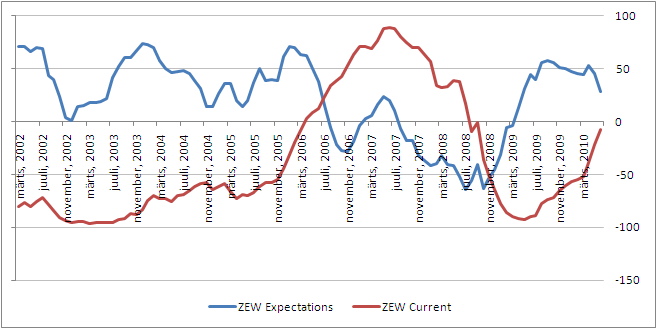

Viimase kuu arengud Euroopas on sakslasi järgmise poole aasta majandusväljavaadete osas tõsiselt ära hirmutanud. ZEW ootuste indeks (sinine), mis veel mais oli 45,8 punkti, kukkus juunis 28,7 punktile. Bloombergi küsitletud analüütikud olid oodanud kõigest 3,8 punktilist taandumist. Seevastu näib Saksamaa alanev töötusemäär ning tugevad tööstusnumbrid pakkuvad lohutust jooksva hinnangu andmisel (punane), mille indeks paranes juunis -21,6 pealt -7,9 peale.

-

EUR on ZEW numbreid tõlgendamas pigem positiivselt ning teinud päeva esimese poole 80 pips kaotuse tagasi

-

Niiii... ja tänase päeva olulisim küsimus tuleb siit:

a) Mis seisuga lõppeb Brasiilia vs Põhja-Korea tänaõhtune mäng?

b) Kas ja milline tulemus võiks mõjutada turge? :D -

Põhja Korea võidab 2:1

-

Siis kuulutaks Lõuna Korea sõja vist kui Põhi võidaks Brasiiliat

-

Peaasi, et Põhja-Korea oma lõunanaabriga kokku ei lähe - siis võib mäng tuliseks minna. Pakuks Brasiiliale vähemalt viit väravat.

-

Ajupesu mõju ei ulatugi spordialaste sümpaatiateni? NKorean fans cheer SKorea's World Cup win

-

Best Buy pakub kerget maitset eelseisvast tulemustehooajast, mille headline jääb paraku kibedapoolseks(aktsia eelturul -6%). Parema pildi globaalsest majandusest peaksid andma homsed FedExi tulemused.

Best Buy misses by $0.14, misses on revs; reaffirms FY11 EPS guidance, revs guidance (41.05)

Reports Q1 (May) earnings of $0.36 per share, $0.14 worse than the Thomson Reuters consensus of $0.50; revenues rose 6.9% year/year to $10.79 bln vs the $10.93 bln consensus. Co reaffirms guidance for FY11, sees EPS of $3.45-3.60 vs. $3.52 Thomson Reuters consensus; sees FY11 revs of $52-53 bln vs. $52.63 bln Thomson Reuters consensus. Comps +2.8% YoY; +1.9% in the domestic segment. Domestic market share was +100 bps YoY. -

4:0 Brasiilia kasuks

-

3:0 brasiilia, kas järgmine pakub "vaid" kahte väravat:)

-

6:1 :-)

-

2:1

-

2:1

-

4-1 brasiilia kasuks. Kuidagi kobistati auvärav. Jaja kordusest paistab üldsegi omavärav!

-

Penaltist võidab P-Korea 1:0

-

Kui P-Korea peaks 6:0 sisse saama, läheb küll üks L- Korea alus teadmata põhjustel põhja.

-

Reaalselt pakun 3:1 Brasiilia.

Aga kuna oddsid olid liiga head, siis panustasin väikselt viigile. -

Börsipäev algab igaljuhul optimistlikul noodil. Indeksite futuurid ca 0,6% plussis, nafta on tõusnud 1% ning maagaas 1,9%.

Euroopa turud:

Saksamaa DAX +0,63%

Pantsusmaa CAC 40 +0,81%

Suurbritannia FTSE100 +0,53%

Hispaania IBEX 35 +0,79%

Rootsi OMX 30 +0,74%

Venemaa MICEX +1,74%

Poola WIG +0,21%Aasia turud:

Jaapani Nikkei 225 +0,08%

Hong Kongi Hang Seng +0,05%

Hiina Shanghai A (kodumaine) N/A (börs suletud)

Hiina Shanghai B (välismaine) N/A (börs suletud)

Lõuna-Korea Kosdaq +0,48%

Tai Set 50 -0,10%

India Sensex 30 +0,43% -

A Murky Market

By Rev Shark

RealMoney.com Contributor

6/15/2010 8:31 AM EDT

Flow with whatever may happen and let your mind be free. Stay centered by accepting whatever you are doing. This is the ultimate.

-- Chuang Tzu

The best investment results are obtained when you are intellectually and emotionally in tune with the market action. You will rack up your biggest gains when you understand and embrace the price action that is occurring in front of you.

The trick is that the market action is often not very clear. When there is little edge in the market, you need to understand and embrace that fact as well. That's when you will need to be patient and wait for things to develop before you can be more aggressive with your trading.

Current market conditions are quite murky and strongly suggest that we wait for things to develop more fully. The bulls have been trying for about three weeks now to turn this market back up but have been turned back three times as they tried to move through key resistance at the 200-day simple moving average of the S&P 500, which is around 1108.

While it is a positive that we are holding well above the recent lows at 1050 or so, it is a negative that we have not had better momentum to pop us through key resistance. The late-day failure yesterday after news of a downgrade of Greek debt is that exactly the sort of action you expect to see in a poor market. The bulls were given a good opportunity to push higher but just couldn't muster the buying power to do so.

After the action yesterday, we are back in the three-week-long trading range. We are still at the upper levels of the range and the bulls are showing a little early interest but the path of least resistance is to the lower boundary of the range.

We need to watch for this market to resolve the recent trading range and then to embrace the action as conditions change. In the meantime, we might want to do some short-term trades within the trading range, but until a larger trend emerges it is quite difficult to build longer-term positions.

I'm staying very open-minded about the way in which this trading range will resolve, but the bigger picture is not very positive. We all know that the news flow isn't very good, but it is the technical picture that is of major concern. We broke down badly in May and have been trying to turn up for three weeks now with limited success. The bulls are using up a lot of bullets in their battle to develop an uptrend, and the lack of volume makes it clear that they are lacking firepower.

Should we take out 1108 of the S&P 500, that is likely to trigger some technical buying and short-covering, but we start running into more overhead resistance quite quickly once again. It is going to take some good news and better sentiment to put this market on a solid upward trajectory.

We have a slight gap up to start the morning. Good bond auctions in Europe are helping the tone and the euro and oil are showing some strength. We'll see how well the early strength holds but this market is not going to give us much clarity right away.

-----------------------------

Briefing.com vahendusel

Ülespoole avanevad:

In reaction to strong earnings/guidance: KFY +6.6%, SURG +6.6%, THC +3.2%, LGND +1.9% (authorizes reverse stock split and $10 million share repurchase; issues 2010 and 2011 guidance).

Select European financial related names rebounding: DB +3.9%, UBS +3.5%, RBS +3.0%, ING +2.9%, STD +2.4%, LYG +2.2%, CS +2.0%, BCS +2.0%, BPOP +1.8%, IRE +1.7%, PUK +1.3% ,

Select metals/mining stocks trading higher: MT +4.2%, GOLD +2.3%, RTP +2.3%, HMY +2.1%, AU +1.6%, GFI +1.4%, BHP +1.4%, EGO +1.0%.

Select oil/gas related names showing strength: HERO +3.9%, REP +2.8%, E +2.4%, TOT +2.4%, APC +2.3%, RIG +2.3%, STO +1.7%, BP +1.6% (speculation builds on reports of the hiring of financial advisers), RDS.A +1.3%.

Select European telecom names seeing modest strength: TEF +1.6%, DT +1.6%, VOD +1.5%

Other news: ZANE +30.5% (Significant level of contracts signed for Zanett Q2-to-date; $12.6 mln among 37 customers; year-to-date $29.7 mln contracts signed), ATRC +17.6% (receives FDA 510(k) clearance; initial launch in the United States is anticipated to begin later this month), THQI +5.9% (Valhalla Game Studios and THQ announce ground-breaking partnership), ERIC +3.0% (still checking for anything specific), TMRK +2.4% (Terremark Worldwide Strikes Deal with Verizon Business , MRVL +1.3% (Cramer makes positive comments on MadMoney), LNC +1.2% (Fitch assigns expected rating of 'BBB' to Lincoln National's Sr. Debt Issuance; On Watch Positive ), C +1.0% (sells Canadian MasterCard business; sale not expected to have a material impact on C's net income or capital), CHK +0.8% (says he likes this stock as a play on natural gas), .

Analyst comments: HEV +8.6% (initiated with a Buy at Needham; $6 tgt), JAZZ +4.3% (initiated with a Buy at Capstone), FINL +2.6% (upgraded to Buy from Hold at Citigroup), AMKR +1.7% (upgraded to Buy from Hold at Deutsche Bank).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CMM -20.8% (light volume), SMBL -14.6% (also downgraded to Market Perform from Outperform at Northland Securities), ELY -11.2% (also downgraded to Market Perform from Outperform at JMP Securities), CPST -6.1%, BBY -5.0%, LZB -4.4%.

Other news: TRBN -11.2% (thinly trade, light volume; announces Pfizer to continue development of SBI-087 and discontinue development of TRU-015 ), NGG -10.0% (trading ex dividend), FCH -9.8% (plans to make a public offering of 25 million shares of its common stock), GMR -7.2% (files for 25.5 mln share common stock offering), PBTH -4.7% (Hearing early weakness attributed to analyst downgrade), CCNE -3.3% (prices 2.93 mln common stock offering at $10.25/share), RL -2.6% (announces 9 mln secondary offering of common stock on behalf of its principal stockholder, Mr. Ralph Lauren), SDRL -2.1% (trading ex dividend).

Analyst comments: VVUS -3.4% (downgraded to Hold from Buy at Lazard), LNCR -2.0% (downgraded to Neutral from Positive at Susquehanna ), NLY -0.9% (downgraded to Market Perform from Outperform at FBR Capital), APEI -0.5% (downgraded to Mkt Perform from Outperform at Barrington Research). -

Kellel aega ja tahtmist saab lugeda huvitavat tehnilist pilti euro viimaste päevade tugevusest:

Recent euro strength to continue?

Watching the euro has become increasingly important when trading equities because of the market's obsession with every piece of news that comes out of Europe. With yesterday's downgrade of Greece's debt to junk status, and continued worries about other eurozone debt obligations, the euro has rallied in the face of bad news. Yesterday, Moody's downgraded Greece's debt to junk, and although the move wasn't a surprise (S&P previously downgraded to junk), it was a reminder that there is still a long way to go in this leg of the crisis as Greece is just the tip of the European iceberg. While today's bond auction in Spain was viewed as successful, the country was forced to pay an increased risk premium after denying reports it may be the next country to accept a Greek-like bailout. Over the past several sessions the euro has seen a bounce from its low of 1.1877 to its current level near 1.2300.

The recent move higher has squeezed late entrants on the short side, forcing them to cover. As the euro looks to correct its heavily oversold conditions, a move above 1.2400 will result in a retest of the 1.2600 area with the euro possibly seeing the 1.2700 level as the 50-day moving average acts as a magnet. The MACD and RSI both flashed positive signs as they failed to make new lows as the euro moved to its 4-yr low below 1.1900. A failure to recapture 1.2600 will result in continued selling as new shorts may try to enter the market.Stepping back a little bit and looking at a monthly euro chart, the euro broke 1.2500, major support, during the May selloff, before stabilizing below 1.2000. The first level of longer-term resistance comes into play near 1.2500 with 1.3000 acting as the next ceiling should 1.2500 be breached.

A move above the 1.3250 area will negate the multi-year topping pattern that developed with the breach of major support. However, if the euro is unable to top 1.3250, a major fall could materialize with the potential for the euro to eventually reach par versus the dollar. Both the RSI and the MACD are indicating the possibility of more weakness ahead as they continue to make new lows on the weakness in the euro.

Following the euro has become more important as of late because of the correlation between the currency and equities since the European debt problems began to surface. Moving forward, this relationship should continue as the European debt problems are likely to be front and center for the immediate future. For those who do not have access to the Fx or futures market, Currencyshares Euro Trust ETF (FXE) is the best way to participate in the euro.

EURUSDi viimase 2 nädala graafik:

-

Noh uued ennustused:D 0-0,1-0?

-

2:0 bra kasuks

-

Vabandust aga Kaka on totter peenisepea et mitte väga ropuks minna.Mänguga hakkama ei saa siis kukub teesklema.Üldse mitte ei salli selliseid lohhe.

-

jah kui mängupilti vaadata, siis brazad on oma käitumiselt "haledad beibed".

-

Hetkel mu ennustus peab paika. Tundub et nii ka jääb.

-

Teadsid kah, et just BRA vasemal pool tabloos on enne mängu?Vb kuskil mingi mängutabelis olemas pole ise uurind.

-

HEINZ ja Marelarn - võidupunktid sedapuhku teile. Päris üllatav kohe, et lausa kaks õiget pakkumist.

-

Nad on tublid :P