Börsipäev 17. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

USA kinnisvarastatistika, FedExi oodatust madalam kasumiprognoos ja jätkuv hirm Euroopa probleemide pärast tekitasid eile päeva alguses negatiivse sentimenti, mis viis küll indeksid kohe -0,7% punasesse, kuid suuremat kukkumist pärast teisipäevast rallit siiski ei toimunud ning turud lõpetasid nulli lähedal. Euroopa futuurid on hetkel indikeerimas avanemist -0,1% kuni 0,2% madalamal, USA omad kauplevad -0,3% kuni 0,4% allpool eilset sulgumistaset.

Olulist makrot täna Euroopas oodata ei ole, USA-s seevastu on suurima tähelepanu alla eelmise nädala esmaskordse töötuabiraha taotlejate arv (kl 15.30), mille suurusjärguks prognoositakse 450 000 ehk langust 6000 võrra juuni esimese nädala põhjal. Kestva töötuabiraha taotlejate arvuks oodatakse 4,475 mln ehk kasvu 13 000 võrra. Lisaks tuleb kell 15.30 avaldamisele maikuu tarbijahinnaindeks (headline ootus -0,1%) ja kell 17.00 Leading Indicators ning Philadelphia Fedi äritingimusi kajastav indeks.

-

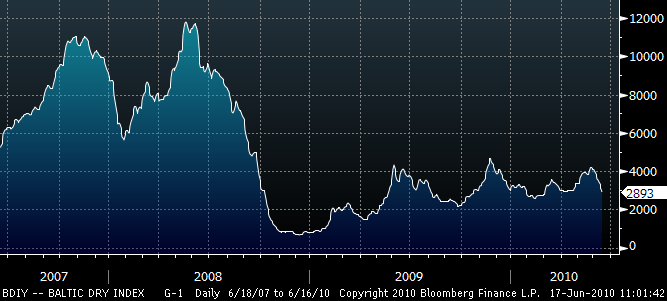

Härrased, kas te siia Baltic Dry indeksi viimase mõne kuu liikumist ei viitsi panna? See on natukene kole, mis mais toimus...

-

http://investmenttools.com/futures/bdi_baltic_dry_index.htm

-

Interco juba viitas graafikule aga et oleks mugavam vaadata....

-

Karum6mm, kas viitad millegile, mida mina siit graafikult ei suuda välja lugeda "hirmus koleda" jaoks?

-

Mitu % on kukkunud mai lõpust? Lisaks, olles esoteerik, vabandust tehnilise analüüsi sõber, siis saaks siit ühe ilusa (koledale tulevikule viitava) kolmnurga.

-

No indeks kukkus ca 1/3 ulatuses. Graafik 2009 algusest näitaks tervamalt langust.

-

Ärge unustage trendijoont, trendijoont!!

:)

-

Et viimase kuu 30%line langus paremini välja tuleks panen siia ka lühema perioodi graafiku

-

Euroopa on päeva alguse miinuse maha raputanud ning 0,5%lisse plussi jõudnud, kergelt rohelises kauplevad ka juba USA futuurid. EUR on samal ajal dollari vastu korraliku hüppe teinud.

-

varsti jagatakse Euroopa kaheks, Põhja-Euroopa (millede majandus on stabiilsem, eesotsas Saksamaa) ja Lõuna-Euroopa (millede laenukoormus on stabiilne)

-

Baltic Dry vs MSCI World - 5 aasta korrelatsioon 0,12, 10 aasta korrelatsioon 0,08 ... kas ikka peaks seda Baltic Dry liikumist nii hoolega jälgima?

-

Henno, võid teadust teha ja aegridasid nihutada, ehk Baltic Dry ja MSCI aegread on väikese ajavaruga tugevas korrelatsioonis?

-

Aitehh, AloV, ma just tahtsin samale veidi tähelepanu juhtida.

-

aga palun, postitage see nihutatud aegreaga data siia - kindluse mõttes soovitan kasutada nihutamisel Tambovi konstanti ehk nihutada vahel rohkem ja vahel vähem - peaasi, et saaks tugeva korrelatsiooni :)

-

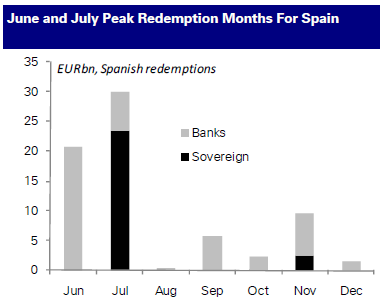

Eurole on tuge pakkumas Hispaania riigivõlakirja edukas oksjon, mille eel kuulujutud ELi ja IMFi võimalikust päästeplaanist veidi ärevust tekitasid. Laenukulud küll kasvavad iga oksjoniga, ent pea kahekordne ülemärkimine näitab, et riigi fiskaalne seis ja pangandussektori probleemid investorites ülemäära palju hirmu ei tekita. Bloombergi vahendusel:

Spain sold 3 billion euros of 10-year debt at an average yield of 4.864 percent, compared with 4.045 percent at a May 20 auction. Demand was 1.89 times the amount on offer. It also sold 479.2 million euros of 30-year debt at 5.908 percent, and the bid-to-cover ratio was 2.45. Spanish bond prices rose after the sale, narrowing the yield difference with German bunds.

Võrreldes juulis eesseisva lunastamiskohustusega on summa muidugi tagasihoidlik:

-

Erko, zerohedge kindlasti kirjutab varsti, et selle võla ostis ära European Plunge Protection Team! :-D

-

Karum6mm, järelturul on mingi osa kahtlemata liigub nende bilanssi

-

Futuurid tulnud oodatust suurema töötuabiraha taotlejate arvu peale järsult madalamale, kuid hetkel jätkuvalt veel 0,3% plussis.

Initial Claims 472K vs 450K Briefing.com consensus, prior revised to 460K from 452K

Continuing Claims rises to 4.571 mln from 4.483 mln

May CPI M/M -0.2% vs -0.1% Briefing.com consensus, prior -0.1%

May Core CPI M/M +0.1% vs +0.1% Briefing.com consensus, prior 0.0%

-

Gapping down

In reaction to disappointing earnings/guidance: STLD -3.6%.Select drug related names showing modest weakness: GSK -1.0%, AZN -0.7%.

Other news: DSCO -11.4% (announces that it intends to offer shares of common stock and common stock purchase warrants ), SCEI -10.9% (announces proposed public offering of common stock), CPSI -4.3% (to investigate issues related to suspected misappropriation of assets by VP of Finance and CFO), DRE -3.9% (to offer 23 million shares of common stock; announces acquisition of joint venture partner's interest in industrial portfolio), ICE -2.5% (still checking), XCO -2.5% (announces agreement to acquire Haynesville/Bossier shale properties from SWN for ~$355 mln), BKCC -1.9% (priced its public offering of 7.5 mln shares of its common stock at an offering price of $10.25 per share, raising $76.9 mln of gross proceeds), FCH -1.6% (prices 27.5 mln share common stock offering at $5.50 per share).

Analyst comments: DTV -1.9% (downgraded to Market Perform from Outperform at Wells Fargo).

Gapping up

In reaction to strong earnings/guidance: PIR +8.2%, SJM +3.4%, CFI +2.0%.Select financial related names showing strength: RBS +4.2%, UBS +3.1%, LYG +3.0%, BCS +2.8%, STD +2.5%, BBVA +2.3%, CS +1.9%, DB +1.6%, SNV +1.4%, AIG +1.4%, HBC +1.2%.

Select oil/gas related names showing strength: RIG +4.2%, SUN +3.2% (Hearing stock also getting boost from analyst upgrade), ATPG +2.9%, APC +1.5%, BP +1.4%, TOT +1.1%.

Select solar names ticking higher boosted by FSLR upgrade and reports that Germany may pull back on subsidy cuts: FSLR +4.4% (upgraded to Outperform from Neutral at Credit Suisse), TSL +3.0%, JASO +2.1%, SOLF +2.0%.

Other news: NBIX +8.2% (announces it has established a worldwide collaboration with Boehringer Ingelheim to research and develop small molecule GPR119 agonists for the treatment of Type II diabetes and other indications ), NVDA +3.7% (Cramer makes positive comments on MadMoney), CRUS +3.6% (Cramer makes positive comments on MadMoney), CLH +2.5% (checking for anything specific), TXT +1.9% (Bell Helicopter Textron awarded $546,001,600 contract - DoD ), SAP +1.8% (still checking for anything specific), AIXG +1.5% (still checking), HGSI +1.4% (Human Genome and GlaxoSmithKline announce presentation at EULAR of BLISS-52 Phase 3 SLE study results for BENLYSTA).

Analyst comments: ANAD +5.0% (light volume; upgraded to Buy at Stifel Nicolaus), AAPL +0.8% (initiated with Buy at Janney).

-

USA futuurid on suutnud 0,3%list plussi hoida

Euroopa turud:

Saksamaa DAX +0,42%

Pantsusmaa CAC 40 +0,58%

Suurbritannia FTSE100 +0,68%

Hispaania IBEX 35 +1,04%

Rootsi OMX 30 +0,12%

Venemaa MICEX +0,23%

Poola WIG -0,51%Aasia turud:

Jaapani Nikkei 225 -0,67%

Hong Kongi Hang Seng +0,38%

Hiina Shanghai A (kodumaine) -0,38%

Hiina Shanghai B (välismaine) N/A -0,21%

Lõuna-Korea Kosdaq -0,16%

Tai Set 50 +0,25%

India Sensex 30 +0,88% -

Rev Shark: Giving the Bulls Some Room

06/17/2010 7:29AM

Man stands for long time with mouth open before roast duck flies in. -- Chinese saying

Overseas markets are strong this morning, and that's giving us a positive start. The Spanish bond auction went well, there is a little more clarity about the Gulf spill situation after the escrow deal, retail sales in the U.K. were good due to demand for televisions for World Cup viewing and the euro continues its rally.

With the S&P 500 holding its breakout of the 200-day simple moving average, the bulls are ready for some more upside. After a wobbly close last night. is it really any surprise that we have a strong start this morning? Trapping the unsuspecting overnight crowd has been the pattern lately, and it's playing out again this morning.

There has been a lot written recently about how this market is nuts, and how there's no rhyme or reason for the way it trades. The market is always irrational to some degree, but there the theme lately has been that it has become so dysfunctional that it's untradeable. There is plenty of evidence to back up that assertion, and the high level of frustration of many market players helps to confirm it.

Unfortunately, complaining about the character of the market action isn't going to make us any money. We either have to find a way to deal with it or just stand aside and ignore it.

There is nothing wrong with sitting on the sidelines when you feel out of sync with the market. It happens to all market players from time to time. No matter how hard you try, you just can't make any progress, and you start to wonder if you just don't have the old mojo anymore. When that happens, getting away from the market for a little while can be a very good idea.

The great thing about the market is that conditions always change if you wait long enough. There will be times when it feels like stocks will never go up again, times when nothing seems to go down, and times when it feels completely random and confused. Eventually things always shift and the character of the market is suddenly quite different. All you have to do is wait long enough and you'll have a different sort of market to deal with.

Don't give up. You have to keep at it day after day so that you have a feel for the action and are mentally and emotionally prepared as things do change. There may be a long period when you don't make any progress and you feel frustrated and confused, but you just have to work through it and wait for greater clarity to emerge.

The market wouldn't be so potentially lucrative if it were easy. Like most good things in life, it requires some hard work if you expect to reap the rewards.

The bulls have some good news flow and are back on track this morning. There have a fair amount of room to run on the upside before they smack into the next level of technical resistance, and I'm giving them room to do so. Yes, volume has been poor and the upside momentum is not very impressive, but this market has been able to run on that sort of action -- and it's doing it again.

-

BDI kohta veel niipalju, et kui viimase viie aasta jooksul lisandus merele umbes 300 uut kaubalaeva aastas, siis sellel aastal peaks see jääma 1400 laeva juurde (07-08 buumi ajal tellitud laevad saavad valmis). Kuna BDI aitab kiiresti jälgida muutust toorainete nõudluse järele, siis on selge, et uute laevade suure arvu tõttu ei ole indeks hetkel väga hea proxy nõudluse hindamiseks toorainesektoris.

Kui aga uute laevade arv stabiliseerub, tasub indeksil ikkagi silma peal hoida (annab üsna kiirelt märku toorainesektori nõudlusest, mis on omakorda sisend erinevates sektorites). Baltic Exchange ise arvab umbes sama (link):

"There are two elements to the BDI: demand and supply. When the supply of shipping is fairly stable, demand represents a good pointer to activity in primary industry,"

"[The BDI] is a good indicator of dry bulk rates in the market—we have never made great claims for it to be more than that."

-

Philadelphia Fedi äritingimusi kajastav indeks oodatust märgatavalt kehvem:

June Philadelphia Fed 8.0 vs 20.0 Briefing.com consensus, May 21.4

May Leading Indicators +0.4% vs +0.5% Briefing.com consensus, prior revised to 0.0% from -0.1%

-

See ongi siis põhjuseks miks põhi alt läks.

-

Panen siia BDI kohta väikse ülevaate:

Dry Bulk Index indicates further weakness possible

With the global economic recovery teetering, a good indication of worldwide demand is the Baltic Dry Index, which tracks worldwide international shipping prices of various dry bulk cargos. The index takes into account 26 shipping routes measured on a timecharter and voyage basis, providing "an assessment of the price of moving major raw materials by sea."

The way the Dry Bulk Index is calculated is a lot like LIBOR in that each day the Baltic calls brokers around the world asking how much it would cost to book different cargos of raw materials on various routes. The Baltic Dry Index is broken down into three categories: Capesize, Panamax, and Supramax/Handymax.

Capesize ships are those that are too big to navigate the Suez, and must travel around the Cape of Good Hope or Cape Horn to reach their destinations. Many vessels of this capacity include oil tankers and bulk carriers transporting raw materials. These ships make up 62% of Dry Bulk traffic.

Panamax ships are those which are able to travel through the Panama Canal. These ships must have the dimensions that enable them to fit in the canal's lock chambers. Panamax ships make up 20% of Dry Bulk traffic.

Supramax/Handymax is the third ship classification in the Dry Bulk Index. These ships are the smallest classification and make up 18% of the index.

Looking technically at the Baltic Dry Index, there are several worrisome signs. After retracing 38.2% of its move from its June 2008 peak to its December 2008 trough (an important Fibonacci retracement), the Baltic Dry Index has struggled to push higher. The index recently dropped below the trendline extending off the April 2009 bottom. By doing so it also caused a breakdown of the RSI, another bearish indicator. The divergence of the MACD fuels the bearish case as further weakness appears on the horizon for the Baltic Dry Index.

While there is no direct way for the average investor to trade the Baltic Dry Index, it can be used as an indicator of future economic expansion/weakness. For those looking for a play on the weakness in the index, Claymore Shipping ETF (SEA), Diana Shipping (DSX), Genco Shipping and Trading (GNK), and Dry Ships (DRYS) are viable options.