Börsipäev 25. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Nädala viimane börsipäev sai Euroopas võrdlemisi negatiivse sissejuhatuse. Vaatamata suurimate börsiindeksite miinusele avanes Europe Stoxx 600 indeks ca 0.30% plussis.

USA eelturul olid varastel hommikutundidel indeksfutuurid miinuses – DJIA -0.88%, S&P 500 -0.90% ja Nasdaq 100 -0.63%. Toornafta kallines 0.14% ehk $76.46-le barreli kohta ja maagaas odavnes 1.00% ($4.7630).

Makrouudiste avaldamisega tehakse täna algust Eesti aja järgi kell 15:30, kui turuosalisteni jõuab Q1 SKP viimane ehk kolmas revideeritud number. Briefing.com prognooside kohaselt kasvas majandus esimeses kvartalis 3.0% - ootuste kohaselt kasvu allapoole ei revideerita. Samal ajal jõuab turgudele ka Q1 SKP deflaator. Konsensus ootab deflaatori kasvuks 1.0%.16:55 avaldatakse ka juunikuu University of Michigan/Reuters tarbijate sendimendi indeks. Briefing.com prognooside kohaselt langes indeks maiga võrreldes 0.2 punkti ehk 75.3 punktile. -

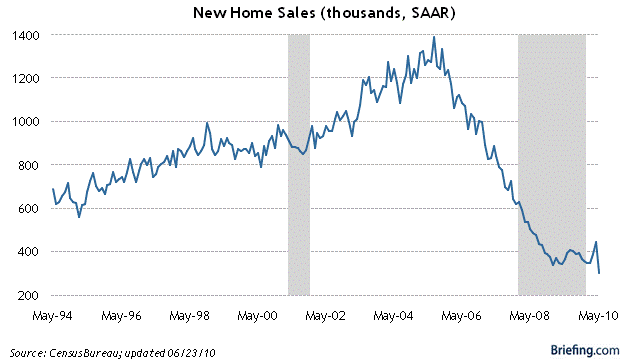

Kuna jaani ajal olid enamusel käed tööd täis šašlõki vardasse ajamisega, siis tahaksin juhtida tähelepanu 23. juunil avaldatud maikuu uute eluasemete annualiseeritud müüginumbritele. Tegu oli esimese kuuga pärast kinnisvaraostu stiimulite lõppemist. Ootused olid minu jaoks raskesti põhjendatavalt kõrged ning reaalsus näitaski, et pärast stiimulite lõppemist oli nõudluse ärakukkumine tugev. Annualiseeritult müüdi maikuus vaid 300 000 eluaset, mis on vaieldamatult mitme kümnendi madalaim näitaja.

Jaanuari nõudluseks oli ca 350K, veebruaris ca 350K, märtsis ca 390K, aprillis ca 450K ja mais siis ca 300K uut eluaset. Seega kes vähegi sai, tõi oma ostukuupäeva riigi toetuste saamiseks aprilli. Tahab veel keegi öelda, et stiimulid ei mõjuta nõudlust? Aprilli ja mai keskmine on ca 375 000 eluaset, mis on sarnane ca viimase aasta jooksul nähtule. Seega aprillis nähtud erakordne nõudlus ei olnud kindlasti veel uue tõusva trendi alustamine kinnisvara nõudluses.

-

Selge see ,et tasuta on parem kui raha eest:))

-

http://www.realtor.org/research/research/ehsdata

uute eluasemete müügist oluliselt laiapõhjalisem näitaja kinnisvaratrendide mõõtmiseks on Existing Homes Sales ja see räägib kinnisvaratrendidest küll veidi teist keelt kui Joeli graafik - lisaks annualiseeritud numbritele tasub vaadata ka keskmise ja mediaanhinna arengut, hooajaliselt kohandamata müüki ja varude muutust -

http://www.realtor.org/research/research/ehsdata

laiapõhjalisem näitaja Existing Home Sales räägib kinnisvaratrendidest siiski veidi teist keelt, uute eluasemete müük on vaid osa kinnisvaraturust - tasub vaadata ka keskmise ja mediaanhinna liikumist, hooajaliselt kohandamata kuist müüki ning varude muutust -

House, Senate lawmakers finalize deal on bank bill

House, Senate negotiators complete massive overhaul of Wall Street rules -

Briefing.com vahendusel:

Q1 GDP- Final Revision +2.7% vs +3.0% Briefing.com consensus, Prior +3.0%

Q1 GDP Deflator- Final Revision +1.1% vs +1.0% Briefing.com consensus, Prior +1.0% -

U.S. revised Q1 corporate profits after tax +5.0% vs forecast +2.4%

-

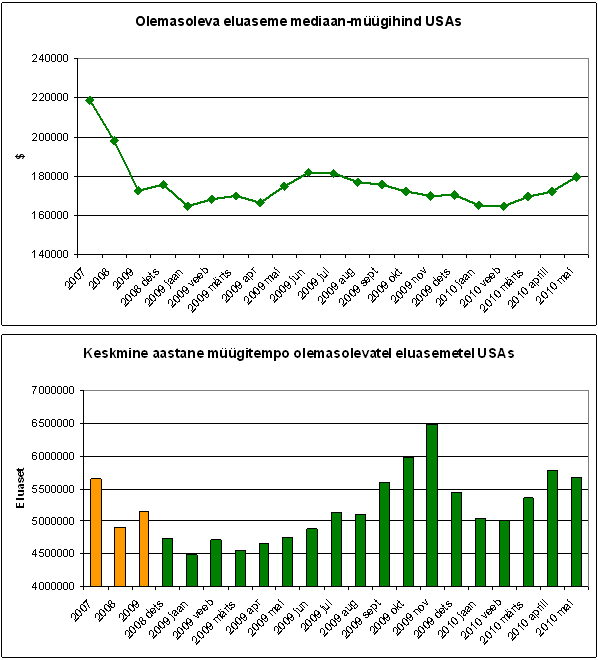

Jah Henno, loomulikult on mul ka need graafikud olemas. Mediaanhind (kohandamata) on sarnaselt eelmisele aastale kevadel/suvel tõusmas ning nagu allolevalt graafikult näha, on see ca viimased 1,5 aastat püsinud võrdlemisi muutumatuna vahemikus $160,000 kuni $180,000.

-

Euroopa turud:

Saksamaa DAX -0,71%

Pantsusmaa CAC 40 -0,81%

Suurbritannia FTSE100 -0,46%

Hispaania IBEX 35 -0,43%

Rootsi OMX 30 N/A (börs suletud)

Venemaa MICEX -0,92%

Poola WIG +0,16%Aasia turud:

Jaapani Nikkei 225 -1,92%

Hong Kongi Hang Seng -0,21%

Hiina Shanghai A (kodumaine) -0,54%

Hiina Shanghai B (välismaine) -0,25%

Lõuna-Korea Kosdaq -0,20%

Tai Set 50 -0,02%

India Sensex 30 -0,88% -

Computers Could Cause a Chaotic Close

By Rev Shark

RealMoney.com Contributor

6/25/2010 8:28 AM EDT

"Action is at bottom a swinging and flailing of the arms to regain one's balance and keep afloat."

-- Eric Hoffer

It is a summer Friday, and many folks will be looking for some sleepy action, but the Nasdaq is very likely to see its highest volume of the year. Over 3,000 stocks will be impacted by the rebalancing of the Russell indices, which occurs at the close today. Last year, volume jumped from 2.2 billion to over 3.5 billion shares on the Nasdaq on the day of the rebalancing, and we should see a similar jump again this year.

Unfortunately it isn't easy to trade this major reshuffling. There are giant computer programs at work and lots of hedging taking place as brokers accumulate the shares that the index funds need to own at the close. At the close today, we will have a bunch of huge prints as the brokers transfer the shares they have accumulated to the index fund.

The brokers may have already completed all the buying that is necessary of some stocks or they might even short shares to the index funds at the close, so we can't just anticipate that there will be massive buying in the index plays all day. However, in some of the thinnest stocks, there can be some very wild spikes near the close if brokers are still trying to buy the necessary shares.

So don't be at all surprised if the close today is especially chaotic. This rebalancing doesn't just impact the stocks that are being added and deleted from the indices, but every stock that remains in the Russell indices will likely have its weighting changed at least a little.

The vast majority of this trading is handled by computers that are buying and selling big baskets of the stocks that are impacted. They may also be hedging, shorting and employing other strategies that they feel will give them an edge. It is likely we will have very abrupt movement today as the computers kick in.

That is the micro view for the day, and it is not going to be easy. The macro view is equally complex. Overseas markets were quite weak overnight, but there is some optimism that banks will bottom out as the Finreg bill is hammered out in Congress. Gold is spiking to all-time highs this morning, and futures are ticking up and reflecting a positive open.

Technically, the market is oversold after four days of steady selling. We have a little technical support around 1,075 and when you combine that with the upside pressure that tends to occur at the end of a quarter, some sort of bounce looks like a good bet here.

Right now, the big picture looks very poor. The news flow and economic data have been very negative lately, and technically, we are in the grips of a downtrend that began back at the end of April. We have had three failed bounces along the way and are threatening to retest the recent lows. I'm looking for some sort of oversold bounce in the near term, but I'm not anticipating that it will lead to a change in trend at this time. Earnings season is what is going to determine the intermediate trend of this market.

So buckle up and adjust your trading goggles. It is going to be a wild one today.

-----------------------------------

Briefing.com vahendusel:

Ülespoole avanevad:

In reaction to strong earnings/guidance: TIBX +6.3%, ORCL +4.9%, ACN +2.1%.

M&A news: ADG +7.2% (disclosed details related to purchase agreement with Chemring Group; termination fee of $1.2 mln).

Select financial related names rebounding after U.S. lawmakers agreeing on financial reform bill: FITB +9.1%, USB +5.0%, AIB +4.1%, KEY +3.1%, SNV +3.0%, HBAN +2.8%, FITB +2.3%, GS +2.1%, BAC +1.9%, MS +1.8%, JPM +1.7%, CS +1.6%, C +1.6%, WFC +1.5%, RF +1.3%, BPOP +1.1%.

Other news: ALTI +27.5% (signs long-term supply agreement with Proterra Inc. to power Proterra's electric and hybrid transit buses), MNKD +6.7% (American Diabetes Association/The Lancet Symposium will highlight study showing AFREZZA provides comparable glycemic control with less weight gain and hypoglycemia than standard of care), APP +4.5% (Ronald W. Burkle discloses 6.0% stake in 13D filing; may communicate with the Board regarding potential strategic or financing partners), ATPG +3.9% (secures $150 mln senior term loan and option for additional $350 mln Loan), CCJ +2.3% (signs supply agreement with China Nuclear Energy Industry Corporation), CDE +1.4% (begins production at New Kensington gold mine in Alaska), MGA +1.3% (to provide additional disclosure regarding proposed transaction to eliminate the company's dual class share structure), ADBE +0.7% (light volume; enters into stock repurchase agreements for $400 mln).

Analyst comments: JOYG +1.0% (light volume; initiated with a Hold at Jefferies).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: RIMM -5.3% (also downgraded to Neutral from Outperform at Baird), FINL -4.5%, KBH -1.8%, AVAV -1.1% (light volume).

Select metals/mining stocks trading lower: MT -2.9%, RTP -2.0%, BHP -1.6%.

Select oil/gas related names under pressure: BP -3.5% (provides update on GOM oil spill; cost of the response to date amounts to ~$2.35 bln), SDRL -1.8%, REP -1.6%, STO -1.3%, RIG -0.6%.

Other news: FCEL -13.3% (prices 24 mln shares of common stock at $2.25 per share ), CWLZ -5.3% (modestly pulling back from yesterday's 40%+ surge higher), JOE -1.2% (Cramer makes negative comments on MadMoney).

Analyst comments: CXW -2.6% (downgraded to Neutral from Buy at Suntrust). -

Sentimendinumbrid oodatuga võrreldes pisut paremad:

June University of Michigan Confidence- Final Revision 76.0 vs 75.5 Briefing.com consensus, prelim 75.5 -

ITMN miskit teoksil, kiire liikumine üles ja hetkel jub +5%, $9.87 tasemel. Olulist uudist silma ei jäänud.

-

AlariÜ, short covering - ma arvan

Intermune kukkus mais pärast FDA complete response letterit ca 80% tipust alla ja on pärast 9-10 vahel tiksunud. Ilmselt hakkavad shordid vaikselt väljuma, sest et on näha, et allapoole teda enam pressida suurt ei õnnestu.

Muidugi biotehhi puhul ei tea tihti milline trigger parasjagu kiire jõnksu taga on. -

Collins Stewart notes the scope and depth of the reform legislation appear far more negative than they had anticipated following the Senate version passed in May

Collins Stewart notes that the scope and depth of the fin reg legislation appear far more negative than they had anticipated following the Senate version passed in May. The Bill represents the most comprehensive attempt to regulate the financial services industry since the passage of the Securities Exchange Act of 1934. While the legislation stops short of a worst case scenario (i.e. the outright ban of certain capital markets businesses, break-up of systemically important companies, and legislated capital requirements), the financial supermarkets (BAC, C, JPM, WFC) will be the cos most negatively impacted by this legislation. -

Heameel on tõdeda, et Eesti kõrgemate riigiametnike seas on omajagu finantsiliselt intelligentseid inimesi, kelle kätte võib usaldada meid kõiki puudutavate majandusotsuste tegemise.

Ka need, kes on valinud oma vara haldama personaalpanganduse spetsialistid, on käitunud asjatundlikult – iga vend jäägu ikka oma liistude juurde.

NB! Tundub, et kõige teravamad stock picker’id on olnud suursaadikud.

Riigi Teataja: AMETIISIKUTE MAJANDUSLIKE HUVIDE DEKLARATSIOONID -

Täna toimub Russell-i indeksite tasakaalustamine, mis toob turgudele lisavolatiilsust.