Börsipäev 9. juuli

Log in or create an account to leave a comment

-

Ees on ootamas üks suvine reedene kauplemispäev, mis makrouudiste poole pealt on võrdlemisi vaene. Üksnes kell 17.00 teatatakse USA maikuu hulgimüügi varude muutus, kust oodatakse ca +0,4%list kasvu. Hulgimüüjad on kaupade varumisega viimasel ajal väga ettevaatlikud olnud ning varude ja müügi suhtarv on viimase 10 aasta madalaimal tasemel (1.13), mis tähendab, et varutakse täpselt niipalju, kui ostjad jõuavad eest ära osta. Kui hulgimüüjad usuksid majanduse agressiivsemasse taastumisse, hakkaksid nad varusid kiiremini kasvatama.

Kolmapäeval alanud turgude võimas ralli sai jätku ka eile ning see on aidanud ka Euroopa indeksid ca 0,5%lisse plussi kergitada. USA indeksite futuurid on eilsete sulgumistasemete lähistel. -

The Washington Times kirjutas üleeile, et USA avaliku sektori võlg kasvas 30. juunil $166 miljardit - see on USA ajaloos kolmandaks suurim päevane võla kasv. Ühe majapidamise kohta teeb see $1500 ehk 10 korda rohkem kui on majapidamiste päevane mediaansissetulek. Kuigi päevased võla arvutamised võivad tõusta ja langeda, on kolm kõige suuremat päevasisest tõusu olnud Obama administratsiooni ajal. Kuus kõige suuremat päevasisest kasvu on olnud viimase kahe aasta jooksul - see näitab, kuidas võlgu elamine on hoogustunud nii Bushi kui Obama valitsemise ajal. Valge maja ametnike sõnul tegeleb Obama lihtsalt Bushi pärandatud olukorra lahendamisega.

-

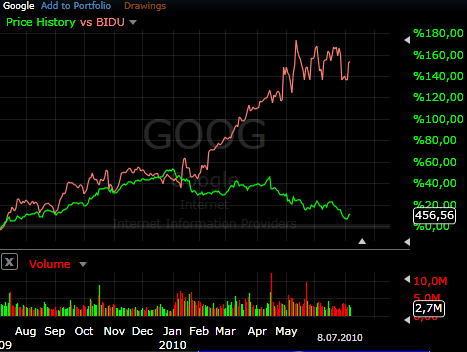

Google tundub täna hea põrkekandidaat ja seda näitab ka eelturg, kus aktsia on +3.9% plussis, kuna ettevõte ei ole ikkagi sunnitud veel Hiinas lahkuma:

Google Inc. said the Chinese government has renewed its Internet license, after the company submitted a revised application to meet regulations in the world’s biggest Internet market by users. (link Bloombergi loolesiin).

Google'i aktsia on hetkel tõusnud +3.9%. Baidu (Google'i peamine konkurent Hiinas) on aga eelturul -5.3% kukkunud. Siin Google'i ja Baidu aktsia viimase aasta tootlus:

-

Kui kedagi huvitab aktsiate volatiilsus tulemuste hooajal, siis Bespoke on välja toonud suurimad liikujad tulemuste järel viimase üheksa aasta keskmise liikumise põhjal. Nagu järgnevast tabelist näha, siis esikohal on LHV Pro klientidele tuttav Fuel Systems Solutions (FSYS):

-

Euroopa turud:

Saksamaa DAX +0,11%

Pantsusmaa CAC 40 +0,10%

Suurbritannia FTSE100 +0,12%

Hispaania IBEX 35 -0,09%

Rootsi OMX 30 +0,93%

Venemaa MICEX -0,88%

Poola WIG -0,33%Aasia turud:

Jaapani Nikkei 225 +0,52%

Hong Kongi Hang Seng +1,64%

Hiina Shanghai A (kodumaine) +2,31%

Hiina Shanghai B (välismaine) +2,66%

Lõuna-Korea Kosdaq +0,65%

Tai Set 50 +0,17%

India Sensex 30 +1,03% -

Stay Alert

By Rev Shark

RealMoney.com Contributor

7/9/2010 8:20 AM EDT

Beware of rashness, but with energy, and sleepless vigilance, go forward and give us victories.

-- Abraham Lincoln

The bulls have done a nice job over the last two days, lifting the S&P 500 better than 4%, but that was the easy part -- now things become much more challenging. After trending lower for two weeks, a bounce of some magnitude was not a big surprise. Everyone was looking for it to happen, and once it started the buyers piled in and helped to propel us to some good-sized gains.

Now things become more difficult, and we must become more vigilant as we run into increasingly tougher overhead resistance as the S&P 500 moves over 1070. The big hurdle is the 1100 mark, but even at this point lots of market players who bought at the beginning of June are just about back to even and the pressure to escape positions that caused them some stress will be building.

In addition, shorts who have been doing well since the end of April are going to start looking harder for entries now that the oversold conditions are relieved and technical resistance builds. The bears have enjoyed three failed bounces in the last two months, and they will be looking for another one to occur very soon.

Adding quite a bit of complexity to the current situation is that earnings season kicks off next week. The first big report is from Intel (INTC) on Tuesday night, and that's going to tell us a lot about the market mood. Intel has been trading straight down for months after what looked like a solid first-quarter report. Expectations appear to be low not only for Intel but for most stocks, and that could be a major positive for the bulls if the tone of the reports is upbeat.

The biggest negative continues to be weak economic data and the issues in Europe. Yesterday retail sales were mixed at best and weekly unemployment claims were worrisome, as many workers are now running out of unemployment benefits. A few months ago no one seemed to think a double-dip recession was possible, but now it is being debated daily.

It is very likely that we will continue to have a slew of economic issues to worry about. What is of greater concern is that we no longer seem to have the liquidity that helped the market overcome all these issues last year. Last year folks struggled to reconcile the buoyant action on Wall Street with the dour mood on Main Street. The disconnect was caused by the flood of cheap dollars from stimulus and bailouts that had no place to go but into stocks.

The best evidence that this liquidity is no longer in play is the market action since April. We have had almost textbook technical action with resistance levels mattering and a number of bounce failures. No longer are we seeing these "V"-shaped bounces that felt so artificial. I'm sure many bulls aren't so happy about that, but it does make navigation a bit easier for active traders.

While I'm giving the bulls more room to go higher here, I'm playing things very tight and will be very quick to lock in gains and cut positions on weakness. We are still drawing in some buyers who are anxious to believe that we have seen a meaningful low, but I'll be very surprised if we can make it back through 1100 without a major battle first.

With earnings reports on the horizon, we have to be ready to shift our focus quickly in the next few days. The bulls are looking OK at the moment, but if they start to stall out here, the profit-taking can kick in very fast. Watch to see how aggressive the selling is into any further strength -- if we take out yesterday's lows, there is likely to be a rush for the exits.

-----------------------------------

Briefing.com vahendusel:

Ülespoole avanevad:

In reaction to strong earnings/guidance: NUHC +9.6%, SCSC +8.5%, NANO +6.4%.

M&A news: ARG +0.8% (Air Products confirms it increases all-cash offer for Airgas to $63.50 Per Share).

Select oil/gas related names ticking higher following reports that US federal appeals court rejected moratorium on deepwater drilling: EVEP +2.3%, EXXI +2.1%, ATPG +1.9%, HERO +0.5%.

Other news: SKH +10.7% (continuing to rebound from this week's 60% drop), TIVO +6.1% (still checking), ACE +4.8% (will replace Millipore in the S&P 500), GOOG +4.5% (confident will renew China web license - CNBC), ATX +3.3% (has repurchased 1.25 mln shares of Class A common stock for ~$5 mln from Galal Doss, a member of the Board of Directors), QGEN +2.7% (Hearing attributed to analyst upgrade), NRF +1.8% (NorthStar Realty Finance announces acquisition of $1.1 bln CDO), UAUA +1.6% (reports June 2010 operational performance), CISG +0.8% (prices 4.6 mln share follow-on public offering at $25.00 per share).

Analyst comments: V +2.0% (added to Conviction Buy List at Goldman), HGSI +1.9% (added to Top Picks Live list at Citigroup).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CPTS -22.4% (also downgraded to Hold from Buy at Lazard), LWSN -6.4%, BGFV -2.9%.

Select financial related names showing weakness: AIB -4.9%, IRE -4.0%, BCS -3.0%, DB -2.0%, ING -2.1%, RBS -2.1%, STD -1.4%, UBS -1.1%, MTB -1.0%, CS -1.0%, NBG -0.8%.

Select drug related stocks trading lower: GSK -1.7% (under pressure as European Medicines Agency starts review of rosiglitazone-containing (Avandia) medicines), NVS -1.2%, JNJ -1.1%. Select oil/gas related names showing strength: .

Other news: BIDU -4.7% (lower on reports that GOOG renewed its China license), MSG -4.0% (trading lower after news that LeBron will play for Miami), BP -2.6%.

Analyst comments: PT -4.8% (downgraded to Underperform from Market Perform at Bernstein), NGG -3.3% (downgraded to Hold from Buy at Citigroup), EXPE -2.5% (removed from Conviction Buy List at Goldman), MRVL -1.9% (downgraded to Perform from Outperform at Oppenheimer), MYGN -1.9% (downgraded to Neutral from Overweight at JP Morgan), AMD -1.9% (downgraded to Underperform from Perform at Oppenheimer), BBY -1.7% (downgraded to Hold from Buy at Jefferies). -

Briefing,com vahendusel:

May Wholesale Inventories +0.5% vs +0.4% Briefing.com consensus, prior revised to +0.2% from +0.4% -

According to CNBC, the SEC and Exchanges will tighten rules for market makers, eliminate stub quotes; they will also expand circuit breaker programs to all stocks and ETFs