Börsipäev 9. august

Kommentaari jätmiseks loo konto või logi sisse

-

Puhkuselt tagasi ja täistuuridel nüüd edasi.

Kui reedel avaldatud USA juulikuu tööjõuraport tekitas aktsiaturgudel korraliku USA karusselli laadse alla-üles-alla-üles liikumise, siis tänane päev on teistpoolt ookeani tuleva makro osas üpris tühi. See-eest homme Eesti aja järgi kell 21.15 on oodata Föderaalreservi intressimäära otsust ja olulised on kindlasti sellega kaasas käivad kommentaarid.

Aasia turud on täna olnud pigem positiivsed (välja arvatud Jaapan) ning nädala alguse varajane USA eelturg on samuti hetkel väikeses plussis. -

FT kirjutab täna, et ilmselt langetab Fed homme USA majanduse väljavaadet, kuid ei võta esialgu vastu suuri samme, et kasvu toetada (info allikat ei ole mainitud):

Faced with weak economic data and rising fears of a double-dip recession, the Federal Open Market Committee is likely to ensure its policy is not constraining growth and to use its statement to signal greater concern about the economy. It is, however, unlikely to agree big new steps to boost growth. (link)

Samas kirjutatakse, et ilmselt otsustab Fed aeguvatest MBSidest tuleva raha investeerida nt valitsuse võlakirjadesse või uuesti MBSidesse. Ka turg tundub uut kvantitatiivset lõdvendamist ootavat ja kui seda ei tule, siis oleks see paljudele ilmselt korralik pettumus.

-

Üks potentsiaalne allikas on Danske Bank, kelle arvates on veel liialt vara rääkida täiendavast QE-st:

In the US the FOMC meeting is the main event next week. Recently, speculation of further easing has intensified. However, we believe that it is premature for the Fed to announce new easing measures at the upcoming meeting. That said, it is quite certain that the assessment of the economic situation will be downgraded following a range of disappointing economic data. Hence, the Fed will continue to communicate that yields will remain exceptionally low for an extended period. It will be interesting to see if Plosser votes against the extended period language again. If not, it will be a dovish sign.

A more dovish Fed is likely to fundamentally support the current very low level of US 2-year bond yields, but will probably not be able to push them lower. Following the announcement there might even be a minor risk of disappointment given the recent talk about more QE, which we find premature. It will also be important to see if Hoenig dissents again. If not it would be a dovish sign

-

Panen siia ka USA valitsuse 10a võlakirja tulususe (hetkel 2,82) indeksi graafiku koos S&P500 liikumisega. Nagu näha, siis hetkel käärid aktsiate ja valitsuse võlakirja tulususe vahel suured:

-

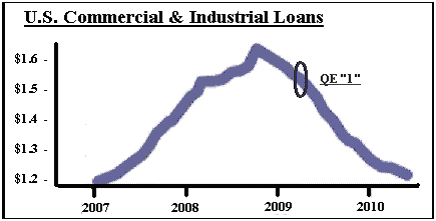

Pragmatic Capitalismis on üks päris huvitav artikkel kvantitatiivse lõdvendamise kohta. Artiklis mainitakse ära, et vastupidiselt üldlevinud arvamusele ei ole QE puhul tegemist raha printimisega vaid varaklasside vahetamisega. FEDi üleööreservid konverteeritakse ümber võlakirjadesse, mis toob võlakirjade tulususe alla ning sunnib omakorda erasektori võlakirju müüma.

In QE, aside from its usual record keeping activities, the Fed converts overnight reserves into treasuries, forcing the private sector out of its savings and into cash. This is just a large-scale version of the coupon-passes it needed to do all along. Again, they force people out of treasuries and into cash and reserves. It is merely an asset swap.

Samuti analüüsitakse artiklis Jaapani QE tagajärgi ning leitakse, et tegemist on läbikukkumisega, sest niigi võlgades tarbijad ei soovi enam laenata, ükskõik, mis hinnaga kapitali neile pakutakse.

The most glaring example of failed QE is in Japan in 2001. Richard Koo refers to this event as the “greatest monetary non-event”. In his book, The Holy Grail of Macroeconomics, Koo confirms what the BIS states above:“In reality, however, borrowers – not lenders, as argued by academic economists – were the primary bottleneck in Japan’s Great Recession. If there were many willing borrowers and few able lenders, the Bank of Japan, as the ultimate supplier of funds, would indeed have to do something. But when there are no borrowers the bank is powerless.”

Ning siia juurde ka üks huvitav graafik USA kvantitatiivse lõdevendamise ja selle mõju kohta:

-

Kvantitatiivne lõdvendamine - peale kõva söömist lasevad mehed pika laua taga püksirihmad lõdvemaks.

-

nextphase'i poolt pakutud inglise keelne termin on tegelikult spot on. Just sellist relaxation efekti Fed saavutada soovikski : )

-

Central bänkers to people: Relax guys..

Kui seda lõdvendamist google translatoriga edasi-tagasi piisavalt kaua lasta, siis on päris naljakas.. -

Näide:

Stocks climbed to a 12-week high and U.S. futures gained on speculation weaker jobs growth will prompt the Federal Reserve to extend efforts to shore up the economy. The euro weakened and copper rose.

=>

Varud tõusis 12-nädalase kõrge ja USA futuurid saanud spekulatsioone nõrgem töökohtade kasv kiire Föderaalreservi laiendada jõupingutusi Pönkittää majandust. Euro nõrgenenud ja vase roosi. -

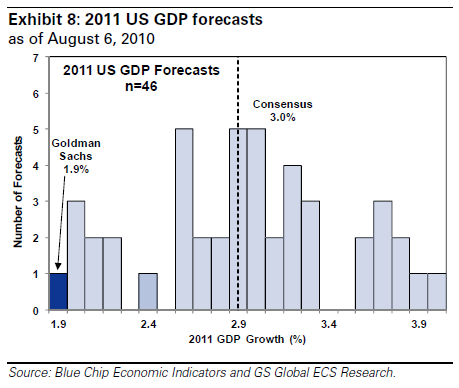

Goldman Sachs langetab täna 2010.a lõpu s&P500 indeksi prognoosi 1250 punkti pealt 1200 punkti peale. Kuigi GS tõstab heade 2Q10 tulemuste järel selle aasta EPSi prognoosi, siis langetatakse järgmise aasta EPSi prognoose, kuna juunis ja juulis ilmus majanduses uusi nõrkuse märke.

Strong 2Q corporate results but a weak US economic forecastlead us to raise 2010 EPS estimate for the S&P 500 to $81(from $78) but lower our 2011 estimate to $89 (from $93). Wereduce our year-end 2010 index forecast to 1200 (from 1250),reflecting 7% return. Firms with low operating leverage andstocks with high dividend growth should outperform.

USA 2011a SKP prognoosid:

-

Skype Files For IPO

-

http://www.businessinsider.com/skype-files-for-ipo-2010-8

-

Expect More Randomness

By Rev Shark

RealMoney.com Contributor

8/9/2010 8:26 AM EDT

"Increased government spending can provide a temporary stimulus to demand and output, but in the longer run, higher levels of government spending crowd out private investment or require higher taxes that weaken growth by reducing incentives to save, invest, innovate and work."

-- Martin Feldstein

After the poor jobs report on Friday, the market had good reason to sell off, but we bounced back sharply in the last 90 minutes of trading and closed with just minor losses. There is no question that the jobs news was weak, but some market players view that as a positive because it increases the chances that the Fed may implement additional monetary stimulus at its meeting this week.

The Federal Open Market Committee will make its interest rate decision on Tuesday at 2:15 p.m. EDT. With the recent spate of weaker-than-expected economic reports, speculation is increasing that it may announce some sort of quantitative easing or at least hint that something is under serious contemplation. The market is very aware of how the cheap money policies drove the action off the March 2009 low, and the bulls would love to see a rerun.

That optimism is what has helped to hold the market steady for the last week and has kept the S&P 500 above key technical support at 1,115, which is the 200-day simple moving average. We have been unable to push through the June high of 1,131, but we have held up very well and are building a good base for an attack on the upside. With anticipation about something positive from the Fed tomorrow afternoon, it is going to be tough for the bears to make much process until that event is out of the way.

The problem we face from a trading standpoint today is that there just isn't assurance that the Fed is going to do anything. If it doesn't, the trading is going to become very difficult as we enter the slowest trading period of the year over the next few weeks. Earnings season is over this week, and now is the time when Wall Street tends to take vacations. Volume is going to be even lighter than its already low recent levels, and that means more random action.

What it all boils down to right now is to what degree we want to bet on the FOMC doing something market-friendly tomorrow afternoon. The technical setup is positive for a good reaction, but you have to wonder how much the market is going to like the fact that unemployment and the economy in general remain so poor that the Fed is being forced to act. While the market loves cheap cash and it usually doesn't pay to fight the Fed, it is running out of ammunition. Rates are practically at zero already, so we are moving to the point where the Fed will have few choices left but to actually drop cash out of a helicopter like Ben Bernanke so famously wrote about.

Be ready for some choppy action as we await the Fed decision tomorrow afternoon. Europe was generally upbeat overnight, with strength in banks and commodities. Generally, it looked like it was catching up with the late-day rally in the U.S., as market players grow more optimistic about some market-friendly action by the Fed.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: OTIV +12.1% (thinly traded, light volume), JADE +5.8%, CELM +4.9%, SOL +1.6%, MCD +1.1%.

M&A news: SWSI +20.8% (Nabors commences a tender offer for SWSI at $22.12 per share in cash, ~$900 mln deal).

Select metals/mining stocks trading higher: AA +1.3% (announces preliminary results of tender offer for 6.00% notes due 2012, 5.375% notes due 2013 and extension of early tender date), NGG +1.3%, AUY +1.2%, GOLD +1.1%, BHP +1.1%, BBL +0.8%.

Select oil/gas related names showing modest strength: TOT +1.4%, RIG +1.4%, SD +1.3%.

Select solar names ticking higher in early trade: CSIQ +2.2%, SOLF +2.0%, LDK +1.9%, JASO +1.7%.

Other news: DGI +9.6% (entered into a $3.55 billion agreement with NGA effective September 1, 2010 upon expiration of its NextView Agreement), GEOY +1.9% (awarded program under the NGA's EnhancedView), DELL +1.4% (trading higher following HPQ news).

Analyst comments: SFD +3.0% (light volume; initiated with a Buy at Goldman).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: HPQ -7.1% (also announces CEO Mark Hurd resigns; CFO Cathie Lesjak appointed interim CEO), DISH -6.3%, BWEN -6.0%, KERX -4.6%, IDSA -4.1%, CAAS -3.0%.

Other news: CRIS -8.0% (provides update on Genentech's Phase II clinical trial of GDC-0449 in advanced ovarian cancer patients), LSCC -5.5% (announces resignation of CEO effective September 4; appoints Christopher Fanning as Interim CEO), KOG -2.9% (announces proposed public offering of 25 mln shares of common stock), RBS -2.8% and LYG -2.7% (still checking for anything specific), TE (ticking lower; hearing attributed to tier 1 firm downgrade).

Analyst comments: MDT -2.7% (downgraded to Neutral from Overweight at JPMorgan), VECO -1.2% (downgraded to Hold from Buy at Canaccord Genuity), TSN -0.8% (added to Conviction Sell List at Goldman), PCS -0.4% (downgraded to Mkt Perform from Outperform at Bernstein). -

Euroopa turud:

Saksamaa DAX +1,36%

Pantsusmaa CAC 40 +1,56%

Suurbritannia FTSE100 +1,50%

Hispaania IBEX 35 +1,48%

Rootsi OMX 30 +0,64%

Venemaa MICEX +1,40%

Poola WIG -0,33%Aasia turud:

Jaapani Nikkei 225 -0,72%

Hong Kongi Hang Seng +0,57%

Hiina Shanghai A (kodumaine) +0,53%

Hiina Shanghai B (välismaine) +1,25%

Lõuna-Korea Kosdaq +1,13%

Tai Set 50 -0,12%

India Sensex 30 +0,79% -

Apple tgt raised to $375 from $280 at Needham

-

Skype'i IPO taga peamiselt GS, JPM ja MS:

Goldman, Sachs & Co., J.P. Morgan Securities Inc. and Morgan Stanley & Co. Incorporated will be the joint global coordinators as well as joint book-running managers for the offering. BofA Merrill Lynch, Barclays Capital Inc., Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC and Deutsche Bank Securities Inc. will also be acting as joint book-running managers. Lazard Capital Markets LLC, RBC Capital Markets Corporation and UBS Securities LLC will be acting as joint lead co-managers; Allen & Company LLC and Evercore Group LLC will be acting as co-managers for the offering (link).

-

Financial Select Sector SPDR (XLF) Aug 15 puts are seeing interest with 15.7K contracts trading vs. open int of 63.3K, pushing implied vol up around 7 points to ~28%

-

Unises augusti kuumuses SPY-l käive täiesti kadunud, kui nii edasi liigutakse siis tuleb alla 100 mln käibega päev. Sellise käibega päevi tehti viimati juuli alguses ja enne seda aprilli alguses. Mõlemad korrad on indikeerinud turgudele lähenevat tugevat liikumist ja ka lühiajaliselt muutnud trendi.

Käibed kokku:

NYSE 2:00 pm. ET volume @ 383.5M vs. 515.5M (-25%)

NASDAQ 2:00 p.m. ET volume @ 965M vs. 1.19B (-19%) -

ABK Aug 1.5 calls and Aug 1 calls are seeing interest ahead of earnings today after the close. The Aug 1.5 calls (volume: 5090, open int: 14.8K, implied vol: ~283%, prev day implied vol: 173%) and the ABK Aug 1 calls (volume: 2800, open int: 9750, implied vol: ~224%, prev day implied vol: 172%)

-

Vaikne suvepäev tõepoolest, kuid enne homset Föderaalreservi intressimäära otsust ja viimast turu tõusu arvesse võttes on karud praegu lihtsalt ära hirmutatud ning see ongi aidanud turul väikese käibega kõrgemale loksuda.

-

Vallo poolt kopeeritud link on üsna huvitava nurga alt kirjutatud, samas jääb siiski liiga must-valgeks.

Minu arusaamist mööda on viidatud eelkõige sellele, et kui näiteks keskpank vahetab pankades olevad valitsuse lühiajalised võlakirjad uue raha vastu, siis panga seisukohast on saadud küll võlakirjade vastu raha, kuid sisuliselt on vahetatud üks nulltootlusega vara teise nulltootlusega vara vastu. Teisisõnu ei ole tehingu tulemusena muutunud panga bilansi iseloom, mistõttu ei pruugi toimuda aktiivsuse tõusu ka panga laenutegevuses.

Selle ümberlükkamiseks võiks mõelda aga reaalmäärade, mitte nominaalsete intressimäärade kontekstis. Kui rahapakkumise kasv tõstab oodatavaid pikaajalisi intressimäärasid, võib see viia negatiivsete reaalintressideni. Nominaalsete intressimäärade langust piirab alumine nulltase, kuid reaalsete intressimäärade puhul selline takistus puudub. Kui oodatav inflatsioon on positiivne, on raha tootlus negatiivne ning pangad ei soovi seda oma bilansis hoida. Järelikult ei soovi pangad sellises keskkonnas negatiivset tootlust, mistõttu proovitakse lahti saada nominaalse nulltootlusega varadest. See aga aktiviseerib laenutegevust.

On ka teine ja sama loogiline variant. :D

Keskpangad võivad osta varasid ka muult erasektorilt peale pankade (pigem siiski ebaharilik), nt. kindlustusettevõtted ja pensionifondid. Varade müüjatel on rohkem raha (õigemini tekib müüja pangal vist nõue keskpanga vastu), mis võidakse suunata majandusse (ebatõenäolisem) või osta teisi varasid, nt. aktsiaid või võlakirjasid. Aktsiad tõusevad --> varade hinnad tõusevad. Võlakirjad tõusevad --> madalam tulusus langetab ettevõtete ja majapidamiste laenukoormust.

Kolmas seletus on kõige lihtsam.

Kui keskpank ostab (või "vahetab" - kui see nii oluline on) pankadelt valitsuse võlakirjasid ning need ostavad kasvõi osaliselt asemele uued valitsuse võlakirjad (kui nad laenata ei taha), siis kas tegemist on rahapakkumise kasvuga või mitte, kui valitsus on raha juurde saanud ja ceteris paribus keskpanga bilansimaht on maagilisel kombel kasvanud?

Jaapani osas oli probleemiks see, et majanduse hilisem tõus oli finantseeritud pigem ettevõtete vabadest rahavoogudest, mistõttu ei olnud suurt vajadust pankade laenuraha järele. Lisaks ei olnud Jaapani ettevõtetel suuri likviidsusprobleeme, sest valitsuse kapitalisüstid ja erinevad garantiid tagasid ettevõtete kindlustunde. Intressimäärad olid madalad ning ei hälbinud eriti keskpanga poolt seatud määrast. Kõrge naftahind ja teiste sisendite hinnatõus viisid küll inflatsioonini, kuid ilma toiduainete ja nafta hinnatõusu arvestamata püsis core inflation nulli ümber isegi aastaid hiljem.

Muide, "kvantitatiivse lõdvendamise" mõiste võttis minu meelest kasutusele Pajula, meie portaalis eemaldati lihtsalt jutumärgid. -

Energy Conversion (ENER) jumps to new highs on spike in volume; Hearing won the battery contract for Mercedes electric car

Hetkel kauplemas $5.72 tasemel, +9.16%