Börsipäev 16. august

Kommentaari jätmiseks loo konto või logi sisse

-

Möödunud nädal möödus maailma aktsiaturgudel tormiliselt. Põhjuseid oli selleks mitmeid, kuid üheks suurimaks sentimendi kujundajaks oli vaieldamatult Föderaalreservi otsus jätkata nii-öelda kvantitatiivse lõdvendamisega. Võttes arvesse aga hiljuti avaldatud makrouudiseid, siis tundub, et ka BEA USA SKP Q2 prognoosid olid liialt optimistlikud. Näiteks Deutsche Banka hinnangul olid ehituskulutused teises kvartalis BEA prognoosidest $4.4 miljardi võrra väiksemad, jooksevkonto defitsiit tegelikust suurem ning varude kasv ca $24.5 miljardi võrra madalam. DB ootab suuremahulist revideerimist – 2.4%lise majanduskasvu asemel oodatakse hoopis 1.0%list kasvu. BEA avaldab uue raporti 27. augustil.

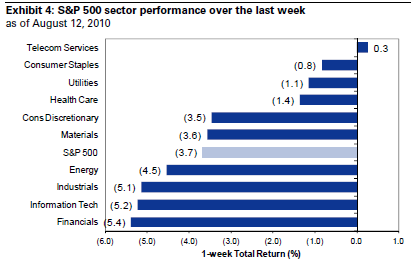

S&P 500 indeks langes nädalaga 3.7% ning plussi jäi vaid telekomiteenuste sektor (+0.3%). Suurim langus tabas finantssektorit, mis kukkus 5.4%. Goldman Sachs on oma 13. augustil avaldatud raportis siiski endiselt positiivselt meelestatud. S&P 500 3 kuu hinnasiht on neil 1160p ja aasta lõpuks peaks nende sõnul S&P 500 tõusma 1200 punktile.

Allikas: Goldman Sachs

Täna kell 15:30 avaldatakse New Yorki osariigi tootmisindeks (konsensus 8.0 punkti), kell 16:00 jõuab turuosalisteni USA rahandusministeeriumi TIC ehk finantsinstrumentide sisse- ja väljavoolu raport ning 17:00 avaldatakse National Association of Home Builders kinnisvaraturu indeks.

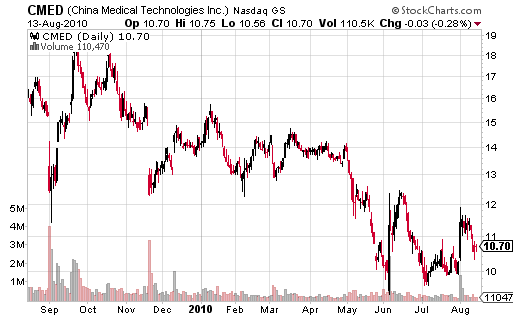

Allikas: stockcharts.com

-

USA indekfutuurid on hommikul viitamas turu nõrkusele. S&P 500 -2.50p (-0.23%), DJIA -13.00p (-0.13%), Nasdaq 100 -3.25p (-0.18%) ja Russell 2000 -1.40p (-0.23%).

-

FEDi otsus jätkata QE-ga, õigemini mitte lasta paberitel aeguda ja osta aeguvate paberite mahus uusi pabereid, ehk säilitada QE maht, väga laias plaanis ei muutnud olukorda.

To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal Reserve's holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities.1 The Committee will continue to roll over the Federal Reserve's holdings of Treasury securities as they mature.

Oluline oli majandust puudutav lõik.

Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

Eriti koht kus tuuakse välja järeldus, et majandus taastub aeglasemalt kui FED eelnevalt ootas.

Laiemas plaanis on käteväristamine ja suhkruvee joomine siiski tarbetu. Varaklassid lihtsalt ei saa kaua kukkuda. FED topib öökimiseni stiimuleid turule niikuinii.

FOMC statement: http://www.federalreserve.gov/newsevents/press/monetary/20100810a.htm -

China Medical Tech reports Q1 EPS of $0.32, ex-items; revs +11% YoY to $27.5 mln; co sees Q2 EPS of not less than $29.5 mln, with EPS of not less than $0.37, ex-items (no quarertly ests)

Sai kunagi CMEDi isegi vaadatud, aga tollal oli ettevõttel raamatupidamise probleeme. Nüüd ollakse aga kasumis tagasi ning Q1 EPS $0.32 ning prognoositav Q2 EPS vähemalt $0.37 lubaks justkui loota, et analüütikute poolt fiskaalaasta peale antud prognoos $1.46 ei pruugigi olla utoopia. Sel juhul kaupleks ettevõte ca 7-8x oodatavat kasumit. Peaks sel ettevõttel rohkem silma peal hoidma.

-

August Empire Manufacturing Index +7.10 vs. +7.5 Briefing.com consensus; prior 5.08

-

Üks video (link siin), kus Doug Kass sõna võtab. Ca 2.35 minuti peal ütleb Kass väga hea pointi: "Miks peaks keegi andma McDonald'sile laenu 3.5%ga (näiteks võlakirjainvestor), kui MCD aktsia maksab täna samal ajal ca 3.1% aastast dividendi ning väljamakstav dividend on iga-aasta ca 8%-10% suurenemas". Tegu on hea näitega sellest, kuidas 0%line intressimäära keskkond ja väga madalad võlakirjade tulususmäärad sunnivad üha rohkem investoreid aktsiaturgude poole pöörduma.

-

Turud Aasias ja Euroopas valdavalt miinuspoolel ning ka USA indeksite futuurid on indikeerimas miinuses avanemist. Turg hakkab tasapisi jõudma ülemüüduse tasemele, kust võib hakata nägema lühiajalisi rallisid.

Euroopa turud:

Saksamaa DAX -0,23%

Pantsusmaa CAC 40 -0,82%

Suurbritannia FTSE100 -0,41%

Hispaania IBEX 35 -0,75%

Rootsi OMX 30 +0,23%

Venemaa MICEX -0,56%

Poola WIG +0,28%Aasia turud:

Jaapani Nikkei 225 -0,61%

Hong Kongi Hang Seng +0,19%

Hiina Shanghai A (kodumaine) +2,11%

Hiina Shanghai B (välismaine) +1,31%

Lõuna-Korea Kosdaq -0,23%

Tai Set 50 -0,01%

India Sensex 30 -0,64% -

Plenty of Gloom

By Rev Shark

RealMoney.com Contributor

8/16/2010 8:44 AM EDT

"He who wishes to fight must first count the cost. When you engage in actual fighting, if victory is long in coming, then men's weapons will grow dull and their ardor will be dampened. If you lay siege to a town, you will exhaust your strength."

-- Sun Tzu

Instead of the typical Monday morning gap up, the S&P 500 is set to gap down for the fourth day in a row. Not only is the big picture rather gloomy but my review of individual charts this weekend yielded very few positive setups. There is no upside market leadership right now, and there is plenty of gloom in the air. We are becoming oversold, and the chances of at least a temporary bounce back up are increasing, but the summer doldrums and negative seasonality are kicking in. The very low volume illustrates great disinterest and that can be worse than outright negativity.

One of the things I noticed last week was a fairly high level of disgust with the market. Market players didn't want to hear about this Hindenburg Omen nonsense despite a fairly good statistical track record. There were many comments about how things really weren't that bad and the market shouldn't be seeing so much negativity.

Personally, I try to set aside my feelings about what the market should or shouldn't be doing and focus on what it actually is doing. What it is doing right now isn't very positive. What was particularly negative was how few positive chart setups I found, even among those stocks that posted great quarterly earnings. The technology sector and semiconductors in particular have been brutalized, and virtually every stock with a strong report is well off its highs.

We can spend plenty of time discussing why this action may be illogical or wrong, but I'm more interested in making money, and you aren't going to make any if you buy stocks that are breaking down -- no matter how wrong the market may be. My style is to stick with the trend rather than to fight it. More often than not, the trend will persist longer than most think it will.

On the other hand, market players with a contrarian approach will constantly be looking to exploit what they view as market overreactions. When we gap down four days in a row and are technically oversold, they will be looking to catch an upside bounce. Their approach is generally premised on the idea that the market goes too far and will eventually revert. While I agree that the market almost always goes too far in one direction or the other, I have found that most people almost always underestimate how long a trend can persist. A great example is the run off the March low. I don't think anyone anticipated that we would run up as much and as quickly as we did.

At this point, the market is a mess and technically looks quite poor. We are down enough to setup some reflexive bounces, but negative seasonality and a lack of positive catalysts are going to make it tough for the bulls to turn this market back up. If you are playing the long side, make sure that you stay disciplined and don't let losses run. It is going to take some time for the charts to improve, so time frames need to be quite short.

It is ugly out there, so focus on defense and keep that capital safe. Maybe the market is wrong to be so negative, but trying to fight it isn't a good way to make money.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: ONP +10.6%, JKS +1.6%, LOW +1.5%.

M&A news: PAR +85.0% (Dell has signed an agreement to acquire 3PAR for $18 per share in cash), RSCR +23.8% (receives acquisition proposal from Onex Corporation for $12.60 per share).

Select gold/mining stocks trading higher: GG +2.2%, NG +2.0%, KGC +1.9%, AUY +1.6%, EGO +1.5%, NEM +1.3%, AEM +1.3%, GDX +1.3%, GOLD +1.3%, GLD +0.9%.

Other news: SYUT +20.8% (is rebounding sharply following reports that a China clinical investigation found no evidence of abnormalities in the co's products), AAU +7.7% (generates BP Carlin-type project in Nevada), WPI +0.6% (plans Q4 2010 ella (ulipristal acetate) emergency contraceptive launch).

Analyst comments: GNW +0.9% (upgraded to Outperform from Market Perform at Raymond James).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CNAM -13.4%.

Select financial related names showing weakness: IRE -5.8% , LYG -2.0% , RBS -2.0%, AIB -1.8%, DB -0.6%.

Select education stocks under pressure following DOE release regarding Gainful Employment regulation: STRA -15.5% (held a conference call to discuss the data released by the Department of Education), COCO -9.2% (downgraded to Hold from Buy at Deutsche), ESI -6.7% , DV -5.2% (currently analyzing the data released on for its institutions and intends to work collaboratively with ED to gain clarity on its methodology), LINC -4.7% , APEI -2.8%.

Analyst comments: ATML -1.7% (downgraded to Mkt Perform from Outperform at FBR Capital). -

Reedel välja pakutud ALY idee võiks siit nüüd kinni panna. Hind jõudnud ilusti $3.90 peale.

-

Fed releases July Senior Loan Officer Opinion Survey; banks eased standards and terms over the previous three months on loans in some categories

The July 2010 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the supply of, and demand for, bank loans to businesses and households over the past three months. The survey included a set of special questions that asked respondents about lending to European firms and their affiliates and subsidiaries. This summary is based on responses from 57 domestic banks and 23 U.S. branches and agencies of foreign banks... The July survey indicated that, on net, banks had eased standards and terms over the previous three months on loans in some categories, particularly those categories affected by competitive pressures from other banks or from nonbank lenders..While the survey results suggest that lending conditions are beginning to ease, the improvement to date has been concentrated at large domestic banks...ost banks reported that demand for business and consumer loans was about unchanged.