Börsipäev 1. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

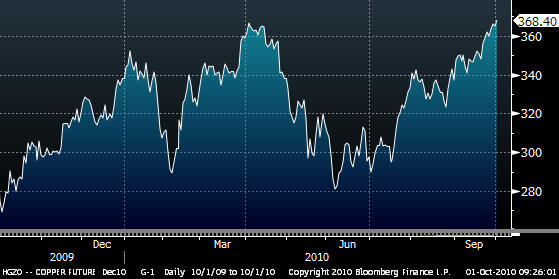

Kuigi Hiina turud on täna suletud, toetab viimase oodatust parem tööstustoodangu data regiooni muid aktsiaturgusid. Septembrikuu ostujuhtide indeks paranes augustiga võrreldes 2,1 punkti 53,8 punktini, ületades ka kõige optimistlikumaid prognoose. Uudist tervitavad eriti tooraineturud, kui nafta kaupleb taas üle 80 dollari barreli eest ning vask jõudnud kõrgeimale tasemele alates 2008. aastast. Euroopa futuurid indikeerimas avanemist 0,3-0,4% kõrgemal, USA olulisemate indeksite futuurid on hetkel kauplemas 0,2% plussis.

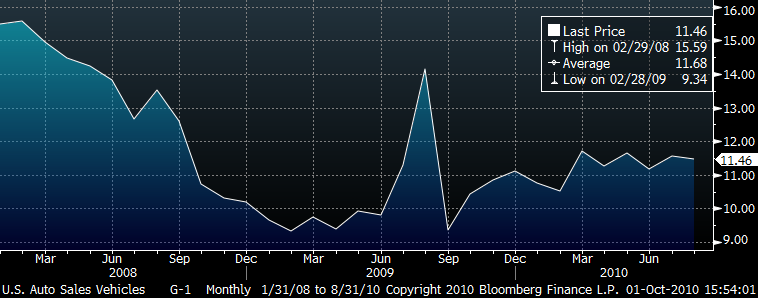

Vase detsembrikuu futuur

Euroopas tuleb kell 11.00 avaldamisele eurotsooni septembrikuu lõplik PMI ning septembri töötusemäär. USA-s on aga fookuses kell 15.30 augustikuu isiklike sissetulekute ja kulutuste näidud, Michigani tarbijasentimendi indeks kl 16.55, septembri ISM indeks kell 17.00. Ühtlasi raporteerivad autotootjad päeva jooksul eelmise kuu müüginumbreid.

-

Šveitsi jaemüük kasvas augustis 0,5% (YoY), eelmise kuu näit redigeeriti 0,1 protsendipunkti võrra alla 4,7% peale. Septembrikuu SVME-PMI indeks tuli oodatud 60,7 asemel 59,7 punkti. Augusti näit oli 61,4. Dollari vastu on frank ära andnud öise tugevnemise, kaubeldes 0,9823 juures. Euro vastu kaupleb frank 0,22% madalamal 1,3428 juures.

-

Euro on septembris dollari suhtes tugevnenud 1,27 pealt 1,367 peale ning Morgan Stanley arvates võib euro osutuda tugevaimaks globaalseks valuutaks ka järgneva kolme kuu jooksul. Kuigi palju sõltub sellest, kui nõrgaks või tugevaks USA majandus osutub, arvestatakse turgudel üsna realistliku võimalusega, et FED üritab inflatsiooni kõrgemale pressida.

"Although peripheral concerns remain, we don't expect these to weigh on the euro, as policymakers now have a Maastricht 2 framework and many of the fiscal offenders are trying hard to curb their budget shortfalls. The European Financial Stability Facility (EFSF) also offers a framework for bailouts, while after some doubts the ECB has not gone down the path of further quantitative easing. The ECB is starting to sound more like the Bundesbank again, with some press articles suggesting that the ECB is moving towards exiting its extraordinarily easy policy and would like to shrink its balance sheet. The ECB has recently raised its growth and inflation forecasts and seems to be focused on dampening inflation expectations, while the latest Belgian business survey suggests activity is holding up well."

-

Täienduseks Erko postitusele toon välja ka EUR/USD graafiku. Täna läbis euro $1,37 taseme, saavutades uue kuue kuu tipu. Septembri tõus on üle 8%.

-

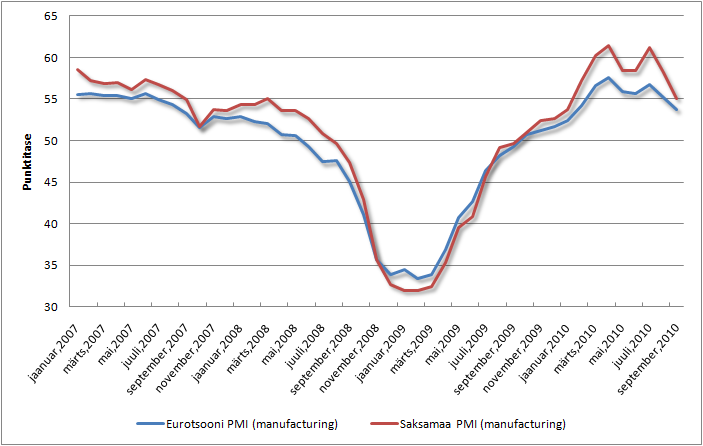

Eurotsooni töötleva tööstuse lõplik PMI näit (sept) korrigeeriti 53,6 pealt 53,7 peale, mis sellele vaatamata kinnitab majandusaktiivsuse aeglustumist (augustis 55,1). Sama peegeldub Saksamaa PMI indeksist, mis alanes septembris 58,2 pealt 55,1 peale (esialgne näit oli 55,3).

-

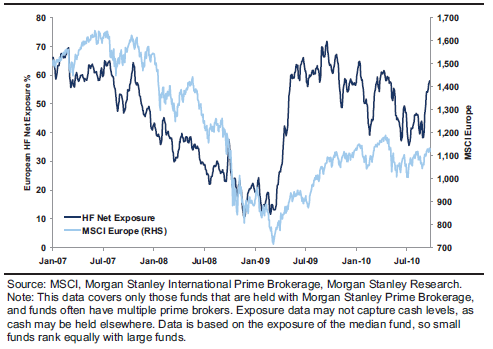

Morgan Stanley'lt üks hea graafik, mis näitab, kuidas septembrikuu võimsa ralliga kaasnenud short covering on tõstnud Euroopa hedge-fondide pikkade ja lühikeste positsioonide suhte hüppeliselt kõrgemale. Midagi sarnast võib ilmselt näha ka ülejäänud regioonides. Kui nüüd turg peaks jõudma risk-off faasi, siis ilmselt näha järske liikumisi teises suunas:

-

Suurbritanniast makroandmeid: Housing equity withdrawal (HEW) - investeeringuteks ja tarbimiseks mõeldud laenud - vähenesid II kvartalis £6,2 miljardit. PMI tootmisindeks tuli oodatud 53,8 asemel 53,4 punkti. Naelsterling kaupleb dollari suhtes 0,53% kõrgemal $1,5804 juures.

-

Eurotsooni töötusmäär tõusis marginaalselt eelmise kuu 10% pealt 10,1 protsendini. Euro tipuks on praeguse seisuga $1,3730.

-

Wells Fargo is reducing ests for BAC, GS, JPM, and MS saying lower trading volumes and subdued investment banking activity levels will drive Q3 UCMB results generally lower than Q2

-

August Personal Income +0.5% vs +0.3% Briefing.com consensus

August Personal Spending +0.4% vs +0.3% Briefing.com consensus -

Fed's Dudley says that more Fed action warranted unless outlook changes at SABEW Conference

-

Gapping down

In reaction to disappointing guidance: DVOX -24.8% (withdrawing 2011 guidance due to softness in Q1; downgraded to Market Perform from Outperform at William Blair; downgraded to Neutral from Overweight at Piper Jaffray).

M&A news: ELNK -1.0% (ITC DeltaCom to be acquired by EarthLink for $3.00 per share in cash (107% premium); ELNK raises lower end of FY10 adj. EBITDA, net income, FCF guidance).

Other news: SNSS -16.7% (priced a 44.1 mln unit offering, each unit consisting of one share of its common stock and a warrant to purchase 0.5 of a share of its common stock, at a public offering price of $0.35/unit, for gross proceeds of approximately $15.5 mln), TNK -7.8% (announces pricing of public offering of 8.2 mln shares of Class A common stock at $12.15/share), HPQ -2.5% (Leo Apotheker Named CEO and President of HPQ), GMCR -2.2% (Cramer makes negative comments on MadMoney), WCRX -2.0% (Hearing weakness attributed to pricing of offering), ANH -1.0% (declares Q3 common stock dividend of $0.23/share, down from $0.25/share).

Analyst comments: ELX -4.2% (downgraded to Underweight from Neutral at JP Morgan), LTD -2.9% (downgraded to Sell from Neutral at Goldman), XLNX -2.4% (downgraded Sell from Neutral at Goldman), NFLX -1.4% (downgraded to Negative from Neutral at Susquehanna), DE -1.0% (downgraded to Neutral from Overweight at JP Morgan; downgraded to Market Perform from Outperform at Wells Fargo).

Gapping up

In reaction to strong earnings/guidance: TESS +4.8%, ACN +4.5%(also raises semi-annual dividend 20%to $0.45; upgraded to Outperform from Market Perform at Wells Fargo), DMAN +3.6%(light volume).

M&A news: CHIO +37.0%(entered into letter of intent to merge with Dingneng Bio-Technology), GYMB +22.8%(surging on reports that co is exploring a possible sale to private equity firms).

Select financial related names showing strength: IRE +5.6%, KEY +2.4% (initiated with Overweight at JP Morgan), HBC +1.9%(added to Conviction Buy List at Goldman), COF +1.8%, RBS +1.6%, C +1.5%, IBN +1.3%, LYG +1.3%, BCS +1.1%, GS +0.8%.

Select metals/mining stocks trading higher: KGC +3.0%, BBL +2.0%, MT +2.0%, AUY +1.8%, BHP +1.6%, RTP +1.6%, MCP +1.5%, FCX +1.4%, NG +1.3%, PAL +1.2%, EGO +1.1%, VALE +1.1%.

Select oil/gas related names showing strength: REP +4.9%(Repsol SA and Sinopec formed an alliance in Brazil to create a private energy group valued at $17.8 bln), STO +2.1%, TOT +1.9%, RDS.A +1.8%, BP +1.7%, .

Other news: GTSI +6.4%(announces increase in offer price for shares of GTSI Corp. to $7.50 in Cash), NOK +3.0%(announced that more than 200,000 people are currently signing up daily to Ovi), ARMH +2.6%(still checking), PLCE +2.5%(up in sympathy with GYMB), PWER +2.3%(Power-One and Intersil Corporation (ISIL) announced an agreement under which Intersil has licensed Power-One's Digital Power Technologies), SAP +2.2%(still checking; HPQ picked new exec from SAP veteran), COP +1.0%(Cramer makes positive comments on MadMoney), UNFI +0.8%(Utd Nat Foods prices of 3,850,000 shares common stock public offering at $33.00/share).

-

S&P 500 futuur hetkel kauplemas 0,64% kõrgemal

Euroopa turud:

Saksamaa DAX +0,52%

Prantsusmaa CAC 40 +0,15%

Suurbritannia FTSE100 +0,97%

Hispaania IBEX 35 -0,06%

Rootsi OMX 30 -0,16%

Venemaa MICEX +1,4%

Poola WIG +0,02%Aasia turud:

Jaapani Nikkei 225 +0,37%

Hong Kongi Hang Seng suletud

Hiina Shanghai A (kodumaine) suletud

Hiina Shanghai B (välismaine) suletud

Lõuna-Korea Kosdaq +0,47%

Tai Set 50 +0,27%

India Sensex 30 +1,87% -

Rev Shark: Bulls Have the Ball

10/01/2010 7:56 AMAn ounce of performance is worth pounds of promises.

--Mae West

The market put in a good performance for the third quarter, but there was high level of volatility. This September -- the best since 1939 -- has changed the market substantially, yet the S&P 500 is still up only 2.3% for the year. It has been a very choppy year so far, and the fourth quarter is going to be a very interesting battle.

We saw near-breakdowns to new lows in early July and at the end of August, but the market then proceeded to fly straight upward for all of September, hitting a new high before a slight reversal. September is historically one of the weakest months of the year, and yet the market pulled off another impressive V-ish bounce that confounded the bears and frustrated the underinvested bulls.

The fourth quarter is kicking off with some early strength. That's pretty typical of the first day of a new month, when new money is flowing into funds and pension accounts. However, yesterday's failed breakout above 1150 on the S&P 500 was a negative sign, and the bulls will need to put forth some effort to shake it off. Obviously the best way to do that is to recapture that level and then close above it.

Despite this, as well as the fact that the indices are still a bit extended, I'm keeping an open mind and have not become overly bearish. As I mentioned yesterday, the dip buyers have tended to do a very good job of holding the market up when stocks are close to the top of a range, and we've seen only minor weakness so far. Because dip-buying has worked so well for the past month, they've garnered a high level of confidence, so it will likely be very hard for the bears to gain downside traction.

What we have to watch for is failed bounces after some significant technical failure, such as yesterday's reversal. A series of lower highs, simultaneous to lost momentum in bounces, together would constitute the classic sign that a roll-over is kicking in.

What you must keep in mind is that upside momentum does not die easily. That is why momentum trading can work so well if you have the discipline to stick with a trend as others continue to call for market turns. Momentum almost always lasts longer than most people believe it will do.

For the last 18 months, the biggest mistake you could have made in this market would have been underestimating how long stocks could continue trending upward. Given the persistent economic worries, it isn't surprising that so many market players tend to distrust these uptrends and are continually looking for tops.

That, however, is also part of what keeps them going. It is simple, good old-fashioned "climbing-the-wall-of-worry" action -- and when you combine that with another old adage about not fighting the Federal Reserve, the upside drivers become much clearer.

In sum, then, the bears scored some points yesterday but the bulls still have the advantage -- the market is typically quick to shrug off these counter-trend moves. Given, as well, that the first few days of a new quarter tend to favor the bulls, it looks as though they are feeling confident this morning. However, it all comes down to the ability of the dip-buyers in continuing to drive stocks forward. When they start to struggle, the market will turn more bearish quite quickly.

-

September U MichiganConsumer Sentiment- Final 68.2 vs 67.0 Briefing.com consensus, prelim 66.6

-

September ISM Manufacturing Index 54.4 vs 54.8 Briefing.com consensus, August 56.3

-

2-yr hits all-time low yield of 0.4066%

-

Soft commoditi viimasel ajal korralikku müüki saanud:

December corn futures hit limit down; -6.1% at $4.6575 per bushel -

Päeva alguse korralik käive on jällegi asendunud käibeta tiksumisega. Tundub, et siit võidakse sulgemiseks madalamale tulla.

Juhul, kui täna peaks indeksid kergelt punaseks jääma, siis tõenäoliselt vallandub lähipäevil ka kasumivõtt. -

Täna öösel kell 24:00 avaldatakse USAs sõidukite müüginumbrid. Paljud analüütikud on täna maininud, et müüginumbrid ületasid augustikuu 11.46 miljonit (annualiseeritud). General Motors teatas, et septembrikuus kasvas nende müük ca 12 miljonile, Chrysler müüs ca 11.9 miljonit ning Ford Motor ca 12 miljonit sõidukit (numbrid on annualiseeritud). TrueCar.com sõnul müüdi septembris ligikaudu 11.9 miljonit sõidukit vs varem prognoositud 11.6 miljoni asemel. Allolev graafik näitab sõidukite müüki m-o-m baasil.