Börsipäev 14. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Laiapõhjaline tõus eile USA turgudel tõstis indekseid neljandat päeva järjest ning euro tugevnemine öösel dollari suhtes tasemele $1,408 on indeksite futuure praeguseks hetkeks täiendavalt 0,4% plussi vedanud. Ühtlasi oli börsidel tegu viimase kolme kuu kõige aktiivsema päevaga, kui NYSE päevane käive küündis üle 5 miljardi aktsia.

Eilne Wall Streeti sentiment ning dollari nõrkusest ajendatud tõus toorainetes on Aasia turud samuti plussi vedanud. Nikkei 225 +1,9%, Hang Seng +1%, Shanghai +1,1%.

Euroopas täna olulisi makrouudiseid tulemas pole ning hoolsamalt jälgitakse USA eelmisel nädalal esmakordselt töötuabiraha taotlenute arvu (kell 15.30), mis konsensuse arvates peaks näitama kasvu 445K pealt 450K peale. Kestvate taotluste suurusjärguks prognoositakse 4450K vs eelneva nädala 4462K. Kell 15.30 tulevad veel avaldamisele septembrikuu tootjahinnaindeksid ning USA augusti kaubandusbilansi muutus.

Ühtlasi jätkub tulemustehooaeg, kui raporteerijate osas kiputakse pärast viimaste kuude tõusu kasumeid lukku lööma. JPM odavnes eile -1,39%, Intel -2,68%, Apollo järelturul -15%. Viimane eelkõige sellepärast, et langetas 2011.a prognoose. Täna avaldab enne turgude avanemist oma majandustulemused Safeway ja pärast turgu AMD ning Google.

-

Tavaliselt hoiatab enne kvartalitulemusi positiivsest või negatiivsest üllatusest ca 20-25% S&P 500 ettevõtetest. Enne kui kolmanda kvartali ring Alcoa tulemustega käima läks, tegid eelavalduse 112 ettevõtet, kellest 34 teatas positiivsest kasumihoiatusest ja 78 negatiivsest kasumihoiatusest. See tegi suhteks 2,3, mis on oluliselt negatiivsem eelneva kvartali 1-st ja ajaloolisest keskmisest (2,1). Samal ajal aga pole analüütikud EPSi ootuste osas kuigivõrd negatiivsemaks muutunud, mis loob üsna soodsa pinnase korrektsiooniks kui tegelikke numbreid hakatakse avaldama.

-

Morgan Stanley on Apollot pikemaajalise investeeringuna kaitsmas:

We maintain our Overweight rating on APOL and $60 price target. While near-term results will deteriorate as Apollo manages the transition from associate to bachelor degrees, the implementation of quality initiatives, and the impact from negative press and new regulations, we believe the current valuation overly discounts these risks. We recognize there is potential risk to our revised 2011 EPS forecast, given the uncertainties in this transitional year, but we see these issues as a temporary investment in a more predictable business model, and view the stock as attractive given the company’s longer-term prospects.

Given the uncertainty related to new compensation plans and the orientation program, which will drive a major reduction in starts in Q1 (estimated at >40%), APOL withdrew 2011 guidance of high single-digit revenue growth and flat operating profit. We cut our 2011 EPS forecast to $4.95 from $5.41 but maintain our longer-term forecast of low-single digit revenue growth and mid-single digit EPS growth.

-

German institutes revises GDP forecast to +3.5% from 1.5% in 2010.

Viimane prognoos pärineb aprillist. 2011.a majanduskasvu prognoos kergitati 1,4% pealt 2% peale.

-

Kuld on käinud täna uusi tippe vallutamas ($1387). Ühest küljest pakub tuge dollar, teisest küljest eilne Bloombergi uudis, et Hiina kavatseb kolmandas kvartalis 194 miljardi dollari võrra 2,65 triljoni dollarini suurenenud välisvaluuta reserve rohkem kullas hoida. Selle peale haakis kuld eile dollarist lahti ning põrutas üles vaatamata sellele, et USD ise väga tugeva müügisurve alla ei sattunud.

-

Deutsche Bank aitab Morgan Stanley järel Fordi momentumit hoida, tõstes viimase soovituse "hoia" pealt "osta" peale ning hinnasihi 14,5 USD pealt 19,5 USD peale.

We are raising our target price on Ford to $19.50 from $14.50 and raising our recommendation on the stock to Buy from Hold, following a re-assessment of intermediate term risks and opportunities. While we have held a favorable opinion of Ford’s strategy and its outlook for some time, we have maintained a Hold recommendation based on valuation, and based on uncertainty over a number of medium term risks. But recent market and company specific developments suggest that these risks are manageable, or diminishing in intensity.

-

August Trade Balance -$46.3 bln vs -$44.5 bln Briefing.com consensus, prior revised to -$42.6 bln from -$42.8 bln

Initial Claims 462K vs 450K Briefing.com consensus, prior revised to 449K from 445K

Continuing Claims falls to 4.399 mln from 4.511mln

September PPI M/M +0.4% vs +0.2% Briefing.com consensus -

Gapping down

In reaction to disappointing earnings/guidance: UFPI -15.7%, APOL -15.2% (also downgraded to Hold from Buy at Stifel Nicolaus, downgraded to Hold from Buy at Signal Hill, downgraded to Underperform from Market Perform at FBR Capital), STXS -10.2%, BSRR -8.2% (also enters purchase agreements with institutional investors to sell 2.325 mln shares of its common stock at $10 per share; co expects to receive net proceeds of ~$22 mln), LSTR -2.1%.

Select financial related names showing weakness: BCS -2.0%, RBS -1.9%, BAC -1.6%, LYG -1.5%, C -1.2%, IBN -1.0%, NBG -0.8%.

Select education names under pressure following APOL results: COCO -10.3%, ESI -10.1%, CECO -9.3%, DV -9.0%, EDMC -8.5%, WPO -7.1%, APEI -6.9%, BPI -6.0%, STRA -5.1%, DL -5.0%, LOPE -4.6%, LINC -3.6%, EDU -1.2%.

Other news: CHRS -8.0% (announces that James P. Fogarty has stepped down as co's cEO and has resigned from board; Anthony Romano promoted to COO ), PDEX -2.8% (provided updated information regarding its Credit Agreement; Wells Fargo Bank does not intend to renew the revolving credit line), LEN -1.3% (S&P lowers Lennar rating to 'B+' following distressed asset purchase; outlook revised to stable).

Analyst comments: STI -0.7% (downgraded to Mkt Perform at Morgan Keegan).

Gapping up

In reaction to strong earnings/guidance: ZAGG +30.9% (tgt range raised to $7-9 at Merriman), SYT +1.8%, SPTN +1.3% (light volume).

M&A news: YHOO +13.4% (premarket following reports last night that AOL, private equity firms exploring a bid for the co).

Select metals/mining stocks trading higher boosted by RioTinto production results/commentary: RIO +3.0% (formerly traded under RTP; reports 3Q10 operations review: attributable iron ore production set a new quarterly record across its global operations), EXK +3.0%, SLV +2.2%, GRS +2.0%, HL +1.9%, EGO +1.8%, GBG +1.7%, BBL +1.6%, AUY +1.2%, GSS +1.2%, NG +1.2%, PAL +1.1%, VALE +0.6%.

Select oil/gas related names showing strength: CEO +2.8%, TOT +1.9%, REP +1.7%, E +1.6%, STO +1.3%, RIG +1.2%, WFT +1.0%.

Other news: ING +4.5% (trading notably higher; strength attributed to reports that the co is planning to repay bailout funds previously received), EGHT +4.0% (light volume; partners with Polycom to offer IP telephony solutions to virtual office hosted VoIP Subscribers), TSLA +3.7% (Notifies SEC of Agreement with Toyota to Develop Electric Version of RAV4), SI +2.6% (still checking), EXAS +2.5% (Cramer makes positive comments on MadMoney), SDRL +2.4% (to sell the 1984 built jack-up drilling rig West Larissa), SAP +2.0% (hearing early strength attributed to takeover speculation), APKT +1.9% (still checking), CEG +1.1% (Hearing related to EDF potentially buying stake in nuclear plant), .

Analyst comments: VOD +3.7% (upgraded to Buy from Neutral at Nomura), MGM +1.2% (upgraded to Outperform from Market Perform at BMO Capital), F +1.2% (upgraded to Buy from Hold at Deutsche Bank).

-

S&P 500 futuur hetkel kauplemas nullis

Euroopa turud:

Saksamaa DAX +0,36%

Prantsusmaa CAC 40 -0,07%

Suurbritannia FTSE100 -0,04%

Hispaania IBEX 35 +0,34%

Rootsi OMX 30 -0,35%

Venemaa MICEX -0,42%

Poola WIG -0,32%Aasia turud:

Jaapani Nikkei 225 +1,91%

Hong Kongi Hang Seng +1,68%

Hiina Shanghai A (kodumaine) +0,65%

Hiina Shanghai B (välismaine) -0,84%

Lõuna-Korea Kosdaq +1,1%

Austraalia S&P/ASX 200 +1,71%

Tai Set 50 +0,16%

India Sensex 30 -0,92% -

Hewlett-Packard (HPQ) initiated with a Buy at Capstone

-

Rev Shark: Giddy on QE 2

10/14/2010 7:53 AMTo me faith means not worrying.

-- John Dewey

This is a market that requires some faith if you're staying long, and that isn't easy, as there seem to be a great deal of good reasons for at least a bit of a rest. On Wednesday many market players were caught by surprise when the market continued to power upward. As has been so typical for the past 18 months, the uptrend has had almost no pullbacks. Stocks have just gone straight up without a pause, and that frustrates bulls who are trying to add long exposure -- not to mention the poor bears, who have been perpetually squeezed.

The action yesterday was even more challenging than usual, in some ways, because it didn't feel particularly illogical. We saw key earnings reports from Intel (INTC - commentary - Trade Now) and JPMorgan Chase (JPM - commentary - Trade Now). Both reported slightly better than expected, but they each sold off and closed near the lows the day. As I noted, it seemed much of the strength was probably due more to computerized trading given the mood of market players who didn't seem to be aggressive buyers. That made the upward momentum self-perpetuating.

Obviously, the prospect of a second round of quantitative easing from the Federal Reserve is what seems to be really driving this market lately. The belief in QE 2 is keeping the pressure on the dollar, and that is the real key to the market at the moment. Oddly, we saw a little more weakness in U.S. Treasury bonds yesterday. Some might interpret that as a lower level of confidence in the Fed's ability to keep interest rates low through further quantitative easing. However, the dollar was weak again as well, and that seems to have trumped even the bond action.

Stocks are a bit technically extended, but the market just doesn't care right now, even if earnings haven't been so hot. Either the machines are at hard at work driving issues upward, or market players are so excited about the expected effects of QE 2 that they can't wait to jump in.

Stocks closed a bit weak yesterday, but we saw a good-sized gain on 3-to-1 positive breadth and increased volume. Trying to fight that sort of upward momentum is a very tough way to make a buck. The market will top out sooner or later, but one thing we have to keep in mind is that momentum does not die easily. It always lasts longer and goes further than we think it will do.

We continue to see pockets of very aggressive speculation, and I'm a bit concerned about all of the action I'm seeing in low-priced and "junk" stocks, but it's impossible to pinpoint when this sort of action represents an accurate contrary indicator. We have to watch it closely and be ready to move, but it is easy to act prematurely and miss out on some good gains that often come late in a rally.

It has been challenging lately for traders who haven't fully embraced their inner bull. It isn't often that we can just ignore poor reactions to key earnings reports from the likes of Intel and JPMorgan, but that was the smart move.

Our next big earnings report is due from Google (GOOG - commentary - Trade Now) tonight. Weekly unemployment claims and the producer price index are also set for release in a few minutes. However, at this point it looks as though the only thing that matters to the market is the steadily sinking dollar.

Overseas markets were mostly positive, with decent-sized gains in China once again. We're seeing some positive action in the early going as the euro continues to run up big against the dollar.

-

Eile oli mul juhus kohtuda RealMoney kolumnisti ning Morgan Stanley kunagise juhtiva turustrateegiga Rick Besignor’iga. Mees avaldas kindlat arvamust, et käesolev turgude ralli ei põhine mitte fundamentaalidel, kvartalitulemustel ega millelgi muul, kui Föderaalreservi kvantitatiivse lõdvendamise ootusel. Oma klientidel on Rick Besignor soovitanud turgudele rohkem raha mitte paigutada ning lähitulevikus ootab ta kiiret korrektsiooni.

Kui Rick Besignori turutunnetusest rääkida, siis 2008. aasta septembris teatas ta, et S&P 500 indeks moodustab põhja 2009. aasta märtsis ca 667 punkti tasemel. Teatavasti osutus põhjaks 676.53 punkti.

-

Moody's revises U.S. newspaper industry outlook to Negative from Stable reflecting waning of recent moderation in advertising revenue declines

-

goodbye heaven

-

$13 bln 13-yr Bond Auction Results: 3.852% (expected 3.831%); Bid/Cover 2.49x (Prior 2.73x, 12-auction avg 2.63x); Indirect Bidders 32.4% (Prior 36.1%, 12-auction Avg 36.4%)

-

Treasuries selling off hard following 30-yr reopening

-

Finants juba täitsa ribadeks, kuid turg veel hoiab. Siit finantsi vaadates, peaks tulema õhtuks korralik sell off.

C,BAC,WFC,STI üle 5% languses, JPM, GS, MS, BK üle 2% languses -> XLF 2.56% madalamal.

Viimasel ajal muidugi turg kõik uudised üles ostnud! -

Hämmastavalt tugev on see turg, kuid kui siit nüüd müüma hakatakse, siis kukkumine saab olema väga terav!

-

miks siit müüma peaks hakkama?

-

Kui ikka kogu finantssektor nii tugevalt pihta saab, siis peaks see vallandama kasumivõtu. Kuna kasumit pole lukku pandud ikka väga kaua, siis tõenäoliselt akumuleerub müük väga kiirelt ja selleks ei pea eraldi põhjust otsima.

-

Kui võlamull hakkab siin lõhki minema, siis võib hoopis aktsiarallit oodata.

-

To:SideKick

Võlamull pikem teema, ma pidasin silma tänast päeva ja turu üleostetust. -

Panen siia ühe lingi turuvaibale. Hetkel see päris punane - link siin.

-

turu üleostetus pole kah 2 tunni teema. või ootad uut flash crashi?

Kui bondlandil mingi probleem tuleb, siis ma usun, et see jõuab suht kiiresti (paari päevaga) commodities ja aktsiaturule.

niisama:

DougKass: the 30 year auction was terrible - short bonds, potentially the trade of the decade.. buy tbt -

Kui samas vaimus jätkatakse, siis ma ei julgeks välistada flash crashi.

-

Tänase seisuga S&P 500 liikumine ajavahemikus 31.08-14.10 EUR arvestatuna 0.74% tõusu.

-

Keegi informeeritum võiks vaadata, kas BACi CDS tegi täna selle aasta tipu.

-

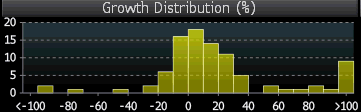

Tänaseks päevaks on Ameerika Ühendriikides Q3 tulemused avadanud 107 ettevõtet 5518st. Allolev graafik kujutab ettevõtete aktsiapõhise kasumi y-o-y kasvu normaaljaotust. Ehk aktsiapõhise kasumi kasvu silmas pidades oli möödunud kvartal ettevõtetele võrdlemisi edukas.

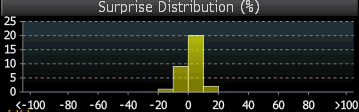

Kui aga vaadata allolevat fraafikut, mis näitab aktsiapõhise kasumi ning konsensuse poolt oodatud kasumi protsentuaalset erinevust, siis vähemalt senini on tulemused vastanud suuresti konsensuse ootustele. Erilist põhjust optimismiks ei ole.

-

klmike, ei teinud. All on BAC 5-aastase võlakirja CDS.

-

BAC 5 aasta CDS veidi spikenud, kuid hetkel veel madalamal, kui augusti lõpus.

-

Google prelim $7.64 vs $6.68 Thomson Reuters consensus; revs $5.48 bln vs $5.27 bln Thomson Reuters consensus

-

Ja GOOG aktsia $565 ning ronib edasi.

-

GOOG +6% @ $575. Koos Google'iga on tuule tiibadesse saanud ka ülejäänud turg. Indeksite futuurid miinusest nulli või isegi plussi tõusnud.

-

AMD

Advanced Micro Devices Inc Reports Q3 $0.15 v $0.06e, R$1.62B v $1.6Be

hind spikenud 7,10-lt 7,58-le