Börsipäev 18. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Sentiment Aasias ja futuuride näol ka USA-s on kergelt negatiivne, kui vähenenud isu riskantsemate varade järele on toetanud dollari tugevnemist olulisemate valuutade suhtes, vedades omakorda langusesse ka toorainete hinnad. EUR/USD hetkel -0,6% @ 1,387 ning USA futuurid eelturul -0,6% punases.

Euroopast täna olulisi makrosõnumeid ei tule. USA-s avaldatakse kell 16.15 septembrikuu tööstustoodangu näitaja ja tootmisvõimsuse rakendamise määr. Ühtlasi on sel nädalal oodata juba oluliselt rohkem majandustulemuste avaldamisi, kui tervelt 113 S&P500 ettevõtet peaks oma kvartalinäitajad raporteerima. Enne turgu on oodata numbreid muuhulgas Citigroupilt ja Halliburtonilt. Pärast turgu on aga suuremateks nimedeks Apple ja IBM.

-

Täna peab kell 17.00 kõne Euroopa keskpanga liige Carlos Costa ja kell 19.55 peab majanduse teemal kõne Föderaalreservi liige Dennis Lockhart. Reedel toimunud Ben Bernanke kõne kohta teen väikese ülevaate valuutaturgude nädala eelvaates (mitte et seal midagi väga uut oleks olnud).

-

Uus-Meremaa tarbijahinnaindeks kukkus III kvartalis 1,5 protsendini (Y/Y), mis on madalaim tase alates 2004. aastast. Uus-Meremaa peaministri John Key sõnul teevad tarbijad säästes õigesti ja et tugev NZD aitab vähendada inflatsioonisurvet. Lisaks ütles Key, et valuutaturgudele sekkumine ei anna tulemusi, kuigi tugev NZD tekitab probleeme ka enamikule Uus-Meremaa eksportijatele. Inflatsiooniraportiga erilist liikumist turgudel ei kaasnenud, kuna turuosalised ei oota Credit Suisse hinnangul keskpangalt intressimäärade tõstmist järgmisel kohtumisel detsembris. Keskpank tõstis intressimäärasid nii juunis kui juulis 3% peale. NZD on USA dollari suhtes kauplemas 0,4% madalamal $0,7532 tasemel.

-

Uus-Meremaalt veel nii palju, et leiboristide partei plaanib piirata välisinvesteeringute ligipääsu Uus-Meremaale:

Labour has made a dramatic turnaround on its foreign investment policy, and now says it will turn down big land sales to overseas buyers except in exceptional circumstances.

Party leader Phil Goff said yesterday a Labour government would welcome foreign investment, but it would have strict controls on it and strings attached.

"Labour will reverse the current approach to overseas sales of land," he said at the party's annual conference in Auckland.

"Instead of the overwhelming majority of farm sales being approved, the overwhelming majority will be declined."

-

Ford Motor (F) ticking lower on reports out over the weekend that the co may sell its stake in Mazda

-

Citigroup prelim $0.07 vs $0.06 Thomson Reuters consensus; revs $20.74 bln vs $21.15 bln Thomson Reuters consensus

-

August Net Long-term TIC FLows $128.7 bln, prior $61.2 bln

-

Gapping up

In reaction to strong earnings/guidance: ZOOM +7.1%, WDFC +4.0%, C +1.5%.M&A news: AGAM +40.4% (AGA Medical to be acquired by STJ for $20.80 per share in a cash and stock transaction valued at ~$1.3 bln; STJ to repurchase $600 mln of its common stock).

Other news: CTDC +24.0% (to increase production with capacity expansion plan for crystalline PV modules), ARWR +23.1% (Arrowhead Research portfolio co, Nanotope, enters agreement with Smith & Nephew for the license and development of cartilage regeneration technology), ISTA +22.1% (receives FDA approval for BROMDAY ), PIP +10.7% (continued momentum), PPHM +8.5% (reports promising interim survival data from phase ii cotara brain cancer study), STX +6.3% (continued momentum from Friday's 2+ point jump), AGN +6.0% (BOTOX approved by FDA as prophylactic treatment option for adult chronic migraine sufferers), NVMI +4.9% (adds an additional standalone optical CD customer order valued at ~$4 mln), ISLN +4.6% (ticking higher with strength attributed to article out over the weekend suggesting co as takeover target), UNTD +3.3% (Hearing related to cross imbalance at the close), ISPH +2.8% (Cramer makes positive comments on MadMoney), PRGS +2.7% (still checking), AIG +1.8% (discloses that AIA Group announced details of a global offering and proposed listing of AIA's shares), BP +0.4% (reached agreement to sell its upstream businesses and associated interests in Venezuela and Vietnam to TNK-BP for $1.8 bln).

Analyst comments: HUN +2.4% (upgraded to Buy from Hold at Jefferies).

Gapping down

In reaction to disappointing earnings/guidance: PETS -11.3%, SUPX -6.3% (thinly traded), PHG -5.1%, HAL -3.3%.M&A news: NIHD -4.7% (NII Holdings and Televisa mutually agree to terminate investment agreement).

Select metals/mining stocks trading lower: BBL -3.0%, RIO -2.5% and BHP -1.7% (ended its iron ore JV), EGO -1.5%, GFI -1.4%, PAAS -1.3%, GG -1.2%, NGG -1.2%, GOLD -1.1%, GDX -1.1%, GLD -1.1%, NEM -1.0%, AUY -0.9% (downgraded to Sector Perform from Outperform at Scotia Capital).

Other news: FLR -4.2% (announces $0.90 per share charge due to increased costs of Greater Gabbard Offshore Wind Project; lowers FY10 EPS guidance to $2.20-2.50 vs $3.05 consensus), HEAT -3.5% (files $100 mln mixed securities shelf offering ), LULU -2.2% (trading modestly lower following cautious mention in finance/investor newspaper over the weekend), URI -1.7% (scheduled to report next week), UL -1.4% (still checking), F -0.9% (ticking lower on reports out over the weekend that the co may sell its stake in Mazda).

Analyst comments: ANR -2.1% (downgraded to Neutral from Buy at Goldman), ALTR -1.9% (downgraded to Sector Perform from Outperform at RBC), OAS -1.6% (downgraded to Neutral from Buy at UBS).

-

Rev Shark: Big Day in Earnings

10/18/2010 7:01 AMThere is nothing constant in this world but inconsistency.

-- Jonathan SwiftSome unusual and inconsistent action on Friday sets the stage for the most important day of earnings for the third quarter. Citigroup (C - commentary - Trade Now) reports this morning, and then IBM (IBM - commentary - Trade Now) and Apple (AAPL - commentary - Trade Now) are out this evening. There is probably no stock in the market as beloved as AAPL right now, which creates a very interesting setup for the report tonight -- especially as the dollar begins to strengthen.

The weak dollar and hopes for another round of quantitative easing have been the main driving forces behind this market for the last six weeks. If the dollar continues to weaken, can good earnings from the likes of AAPL and GOOG replace the greenback as a positive market catalyst? The Nasdaq completely ignored the dollar on Friday, but the rest of the market didn't, and that is going to be tough action to repeat for very long.

Friday was a particularly odd day in that we had some broad weakness in financials and commodity-related stocks as the dollar strengthened, bonds fell and some of the excitement about "QE 2" cooled off. Luckily a blowout earnings report from Google (GOOG - commentary - Trade Now) created a strong incentive for money to rotate into the big-cap "glamour" names such as Amazon (AMZN - commentary - Trade Now), Apple and Google. These names are weighted very heavily in the Nasdaq Composite and Nasdaq 100 indices, so we ended up with big gains in those indices while the DJIA and S&P 500 did nothing.

The dollar is up again this morning, creating some downside pressure in the very early going. But can this rotation into the big-cap technology names continue? Of course the AAPL and IBM earnings tonight add a nice complication to the issue. With AAPL at an all-time high and a record of consistently trouncing earnings estimates, the conditions are very ripe for a high level of volatility.

Given the strength in the Nasdaq on Friday, I was disappointed that I couldn't find better technical setups in individual stocks. We either had super-hot momentum and parabolic moves in mostly technology names, or toppy action and breakdowns in financials and commodities. There isn't much in the middle, which is understandable given that we have gone almost straight up since the beginning of September.

Probably the biggest positive the market has right now is that the big-cap glamour names make for good leadership. If they hold up, that strength usually will broaden out as market players look for some new names.

Technically, even with the flat action in the senior indices on Friday, we are still in very good shape. There is good underlying support and we can pull back a ways without doing any real damage. The Nasdaq and Nasdaq 100 are extended but the momentum is so strong it is going to be very tough for the bears to put up a fight.

I never like to underestimate the power of momentum, especially in the big-cap technology names that so many market players love, but the dollar and the Fed are forces that can change the mood of this market quickly.

Futures are still indicating a negative open, but we are off the early lows. I expect that optimism about AAPL and IBM tonight are going to keep a bid under this market, but there will be plenty of tricky crosscurrents to navigate.

-

September Industrial Production -0.2% vs +0.2% Briefing.com consensus, prior +0.2%; Capacity Utilization 74.7%, prior 74.8%

-

USA tööstustoodang langes septembris 0,2%, kuigi oodati 0,2% kasvu. Net long-term TIC flows augustis $128,7 miljardit (eelmisel kuul $61,2 miljardit). EUR/USD on kergelt taastunud, kaubeldes $1,3920 juures, kuid avanemistaseme suhtes 0,4% madalamal.

-

USA NAHB kinnisvaraturu indeks tuli 16 punkti vs oodatud 13 punkti. Septembris oli indeks 13 peal.

-

Euroopa keskpanga president Jean-Claude Trichet toetas nädalavahetusel keskpangapoolset nõrgemate eurotsooni riikide võlakirjade soetamist, mis vastandub Saksamaa keskpanga juhi eelmisel nädalal avaldatud arvamusega, mille kohaselt peaks ECB hakkama võlakirjade ostmisprogrammi otsi kokku tõmbama. Trichet lisas, et ECB nõukogu enamus toetab programmi jätkamist.

Keskpanga andmete kohaselt osteti üleeelmisel nädalal kõigest €9 miljoni eest võlakirjasid ja eelmisel nädalal peatus võlakirjade ostmine täielikult. Selle aasta mais alanud programmi käigus on kokku ostetud €63,5 miljardi eest võlakirjasid.

-

kuna AAPL tulemused võiks tulla ?

-

AAPL Next earnings release: Oct 18 after market, confirmed. Thomson Reuters estimate: 4.08

-

10-yr yield falls below 2.50%

-

Bloombergis kirjutatakse, et S&P 500 indeksisse kuuluvate ettevõtete „insider selling“ ja „insider buying“ suhtarv tõusis möödunud nädalal 2018 : 1 peale. 2 nädalat tagasi kirjutasin uudisest ka börsipäeva foorumis, kuid siis oli suhtarv 1169 : 1. Enim müüdi Oracle, GameStop, Google, CSX ja General Mills aktsiaid.

-

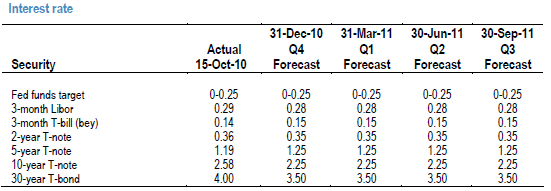

J.P. Morgani analüütikud tegi nädalavahetusel korrektsioone USA riiklike võlakirjade tulususe määrade prognoosides. Analüüsimaja ootused on kajastatud allolevas tabelis.

-

Google'i tulemuste valguses ei maksaks seda insiderite asja eriti tõsiselt vist võtta.

-

AlariÜ, tänud.

-

Intel (INTC) Director bought 15K shares at avg price of $19.25 on 10/15

-

Goldman Sachs tõstis täna S&P 500 indeksi järgmise 12 kuu prognoosi 1275 punktile ehk analüüsimaja ootab ca 8.4%list tõusu. Analüütikud kirjutavad, et investorid hakkavad paigutama raha enam riskantsematesse varaklassidesse ning turgude trendi toetab 2012 majanduskasvu prognoosid. 2010. aasta lõpuks kaupleb GS sõnul S&P 500 ca 1200 punkti tasemel. Samuti teatas analüüsimaja, et Q1 2011 tootlus on aktsiaturgudel ilma dividendideta ca 0%.

-

Brazil Bovespa indeks on esimest korda viimase 6 kauplemissessiooni jooksul kergelt miinuses. Nimelt levivad spekulatsioonid, et Brasiilia valitsus on tõstmas tagatisnõudeid futuurikauplejatele.

-

Genzyme (GENZ) lifting on increased volume; Hearing related to speculation related to takeover

-

Bank of America will resubmit 102K foreclosure agreements on 10/25, will resume foreclosures in 23 states on 10/25 - CNBC

-

Apple sees Q1 EPS $4.80 vs $5.06 Thomson Reuters consensus; sees revs ~$23 bln vs $22.34 bln Thomson Reuters consensus

Apple prelim $4.64 vs $4.08 Thomson Reuters consensus; revs $20.34 bln vs $18.90 bln Thomson Reuters consensus

Apple prelim $4.64 vs $4.08 Thomson Reuters consensus; revs $20.34 mln vs $18.90 bln Thomson Reuters consensus -

IBM sees FY10 EPS of 'at least $11.40' vs $11.30 Thomson Reuters consensus, previous guidance was 'at least $11.25'

IBM IBM prelim $2.82 vs $2.75 Thomson Reuters consensus; revs $24.3 bln vs $24.13 bln Thomson Reuters consensus -

Zions Bancorp prelim ($0.47) vs ($0.50) Thomson Reuters consensus

Coldwater Creek sees Q3 EPS of ($0.14)-(0.19) vs $0.03 Thomson Reuters consensus, from $0.01-0.04 previosly; revs $225-230 mln vs $278.48 mln Thomson Reuters consensus -

Microsoft says Ray Ozzie to step down as Chief Software Architect - CNBC

-

Järelturul oli flash crash, SPY oli 10% miinuses.

http://www.zerohedge.com/article/spy-flash-crashes-nyse-cancels-500-million-worth-trades -

Mõnus :) ma just müüsin 15 minti enne turu sulgemist :)

-

Mis siin mõnusat on? Mõtle kaugemale, kui ainult ninaotsa. Mingid surra murra BOT-id teevad su lagedaks, et silm ka ei pilgu. OK, praegu pääsesid, aga järgmine kord?

-

stocker, mingid tyybid kaveati kohtusse kuna nad tegid mingi karja botte lagedaks.

stocker, siiamaani on siiski suudetud teha VÄGA vähe bote mis on mentaalselt võimekamad kui inimesed ja sedagi niivõrd väikese kombinatsioonide arvuga mängus nagu male. -

Mingid tüübid, keda huvitab. Ma ütlen, et mõnusat ei ole siin midagi, kui oma possu järsku mudas leiad.

-

stocker, noo a kas seal on vahet kes su portveli tühjaks teeb, on see inimene või robot ?

-

Teemaks on flash crash, kas seda suudab inimene?

-

stocker, miks mitte ? mingi sheik ütlkeb järsku All out ja ongi sul flash crash.

-

Tin, mis sa jaurad, 6. mai oli eelmine kord, loe siit mis juhtus:

http://online.wsj.com/article/SB10001424052748704029304575526390131916792.html -

opex, ma ise nägin seda mis juhtus, ning siin foorumis inimesed kurtsid, et otsid nii et näpud sinised.

-

lol

Tin, mine maga välja oma Abu-Dhabiga, see all out jookseb maaklerile sülle ja see toimetab peidetud kogusega. Kui sa turu käitumisest muhvigi ei jaga, ära pauguta ( oleks poleks smoleks ). -

Ja ROLEX ka :-)

-

stocker, hmm ok :)