Börsipäev 8. november

Kommentaari jätmiseks loo konto või logi sisse

-

Möödunud nädala lõpus 1,42 dollarini jõudnud euro on täna hommikul jätkamas nõrgenemist ning kurseerimas juba alla 1,40 taset pärast reedel avaldatud oodatust kesisemat Saksamaa tööstustellimuste numbrit ning seoses uuesti kasvanud hirmuga Euroopa perifeeriariikide võlaprobleemide ning eelarvekärbete pärast. Järgneva kahe päeva jooksul saab tähelepanu all olema eelkõige Iirimaa, kuhu Euroopa Komisjoni majandus- ja rahandusvolinik Olli Rehn täna eelarvekava arutama sõidab.

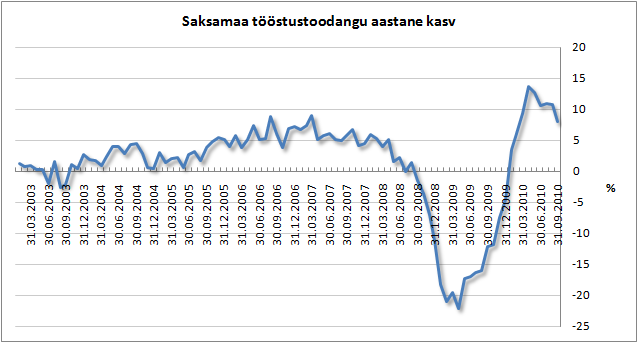

Tänane makrouudiste kalender kujuneb võrdlemisi kesiseks. Ainsana võiks sentimendile suuremat mõju avaldada Saksamaa septembrikuu tööstustoodang kell 13.00.

USA läks eilsest talveajale, mistõttu toimub regulaarne kauplemine käesolevast nädalast jälle 16.30-23.00. USA indeksite futuurid liiguvad hetkel -0,2% punases.

-

Tänane Financial Times`i artikkel annab lootust luksuskaupade müüjatele, sest on mitmeid märke, et ameeriklased on oma rahakoti raudu taas lahkemalt paotamas ja eelseisvaks pühadehooajaks juba hoogsalt valmistumas.

Muutust on täheldatud just keskklassi tarbijate hulgas, kes on hakanud seotama aina julgemalt kallimat kaupa. Näiteks teatas Victoria`s Secret , mis on tuntud luksusliku pesubrändina, et nende vähemalt aasta aega avatud poodides on käive oktoobris võrreldes eelmise aasta sama perioodiga tõusnud 14%.

Sarnast muutust on täheldatud kõigis tavapärasest kõrgema hinnaklassiga kaubasegmentides nagu näiteks aksessuaarid ja orgaanilised toiduained . Just luksuskaupade müüginumbreid räsis majanduslangus aastatel 2008-2009 kõige enam.

-

Nelli postitusele täienduseks võiks vaadata näiteks LVMH graafikut (Kristiina pikemat artiklit võib selle ettevõtte kohta lugeda siit). Kuigi aktsiaturgudel on viimase kahe kuu jooksul praktilselt kõik väärtpaberid raketikütusel liikunud, siis LVMH tõus on küllaltki märkimisväärne võrreldes näiteks CAC40 12%lise ralliga alates septembri algusest.

-

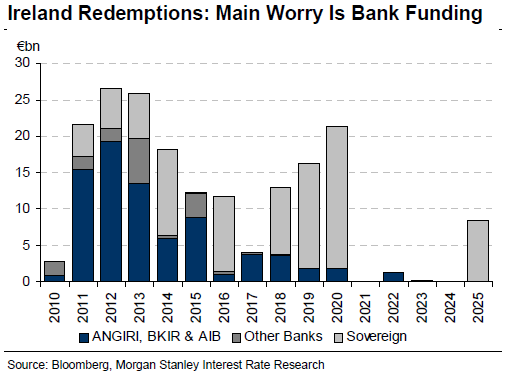

Morgan Stanley arvates on Iirimaa nelja-aastane kava vähendada eelarve puudujääki 15 miljardi euro võrra (sellest 6mld eurot ehk 3,8% SKT-st 2011. aastal) väga ambitsioonikas plaan ning võib-olla suudetaks sellega ka hakkama saada kui poleks paralleelselt pangandussüsteemi probleeme. Eelkõige just viimase pärast võib pöördumine Euroopa finantsstabiilse fondi poole kujuneda vältimatuks. Hetkel on valitsusel 20mld eurot vaba raha, millega suudab riik end järgmise aasta suveni vabalt finantseerida, kasutades seni aega, et turu usaldust taastada. Juhul kui Iirimaa peakski teiste Euroopa riikide abi vajama, saab MS-i hinnangul üheks suurimaks takistuseks olema ettevõtete soodne maksukeskkond, mis on seni soodustanud riiki tehtavaid välisinvesteeringuid. Laenuandjad nõuavad tõenäoliselt selles osas põhjalikku ülevaatamist.

-

Tänane Wall Street Journal kirjutab, et dumb money on aktsiates tagasi. Küsitledes USA erainvestoreid (The American Association of Individual Investors) selgus, et 48% investoritest on aktsiate suhtes positiivsed, mis on kõrgeim tase alates 2007. veebruarist ja ainult 27% negatiivsed, mis on madalaim tase alates 2006. jaanuarist.

Owen Lamont ( kes on põhjalikult dumb money fenomeni uurinud) Harvardi ülikoolist ütleb, et erainvestorid on üldjuhul hilinenud indikaator ehk teisisõnu ei näita erainvestorite raha sissevool aktsiatesse tulevikutrendi. See võib küll lühiajaliselt rallile hoogu anda, aga üldjuhul ei kesta kauem kui mõned kuud.

Kas see võiks olla märk lähenevast korrektsioonist?

-

(GE) GERMANY SEPT INDUSTRIAL PRODUCTION M/M: -0.8% V +0.4%E; Y/Y: 7.9% V 9.5%E

- Prior MoM revised lower from 1.7% to 1.5%

euro on tulnud data peale taas madalamale ning jõudnud juba alla $1,390 piiri. USA futuurid on hetkel kauplemas -0,3% kuni -0,4% punases.

-

LHV, mis asi see siin keset päeva nüüd toimus?

-

Alates kella poole viiest ärge enam nii tehke:))

-

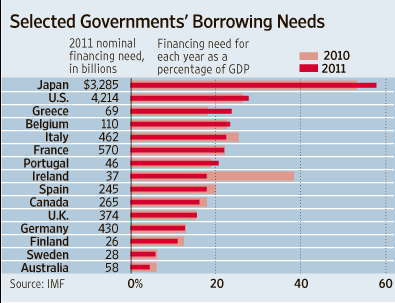

WSJ-s ilmus laupäeval üks lookene sellest, et arenenud riikide valitsustel on 2011. aastal vaja laenata 10,2 triljonit dollarit.

Next year, fifteen major developed-country governments, including the U.S., Japan, the U.K., Spain and Greece, will have to raise some $10.2 trillion to repay maturing bonds and finance their budget deficits, according to estimates from the International Monetary Fund. That’s up 7% from this year, and equals 27% of their combined annual economic output.

Aside from Japan, which has a huge debt hangover from decades of anemic growth, the U.S. is the most extreme case. Next year, the U.S. government will have to find $4.2 trillion. That’s 27.8% of its annual economic output, up from 26.5% this year. By comparison, crisis-addled Greece needs $69 billion, or 23.8% of its annual GDP.

-

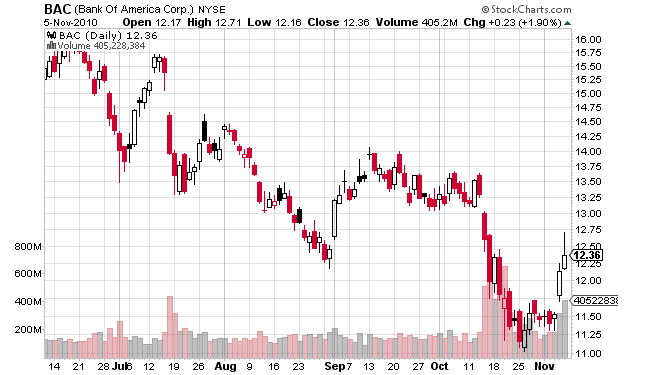

Täna lisasid Morgan Stanley analüütikud oma RTI (Research Tactical Idea) nimekirja Bank of America (BAC) aktsia. Analüütikud usuvad, et 70%-80% tõenäosusega liigub aktsia järgmise 60 päeva jooksul kõrgemale.

Catalysts are 1) Maine State lawsuit dismissed on Nov 4 (highlighting difficulty of private investors to submit reps/warranties cases), which we do not believe is yet reflected in the stock price; and 2) improving credit in master trust (next released on November 15th), with NCOs down 174 bp in Sept and total delinquency rates down 230 bp from peak and continuing to improve.

Üheks peamiseks katalüsaatoriks on kindlasti BAC-i reedene võit kohtus erainvestorite üle. Investorid süüdistasid panga Countrywide ( oli 2005-2007 USA suurim laenuandja) üksust nende eksitamises ning eluasemelaenudel põhinevate väärtpaberite tegelike riskide moonutamises. Otsuse kohta saab täpsemalt lugeda siit. Analüütikud on veendunud, et kohtuotsus ei peegeldu veel BAC-i aktsiahinnas. Teiseks usuvad analüütikud, et master trust krediidikvaliteet on paranenud.

BAC aktsia kaupleb hetkel $12,60 tasemel ja on 1,94 % oma reedesest sulgumishinnast kõrgemal.

BAC on ka LHV Pro idee.

-

Rev Shark: Stand Ready to React

11/08/2010 8:09 AMRational behavior requires theory. Reactive behavior requires only reflex action.

--W. Edwards DemingAlthough many market players were looking for a "sell-the-news" reaction to last week's much anticipated news events, the market powered steadily higher. The major worry was being left behind, which helped to keep very strong momentum going and created a large group of dip buyers who are now looking for an opportunity to buy on weakness.

After the run we've seen since the end of August, the natural inclination has been to look for some profit-taking and consolidation of gains. Many thought the news events last week would be the catalyst for that action, but it was over-anticipated -- and, as a result, the market ended up with a squeeze and even stronger momentum.

One of the most costly things you can do in a market environment such as this is to look for a sudden collapse. Fear of the one-day crash has probably cost investors far more money over the long run than any actual subsequent crash would have done, but it can be very tough to fight the inclination to look for a reversal when there are so many bears talking about why stocks are destined for some major pain.

In addition to being a bit technically extended, the biggest problem the market faces is that there aren't a lot of potential catalysts on the horizon. Earnings season has concluded, the Federal Reserve's second round of quantitative easing is under way and the election is over. Furthermore, there is very little economic news on the calendar this week.

Without any news on the horizon, the bulls will need to maintain this very positive sentiment in order to keep the uptrend chugging along. The biggest danger is that some selling will kick in and then feed on itself as the dip buyers become more cautious. There are a lot of gains to protect, and if the mood becomes upbeat we could easily see market players head to the sidelines for a rest.

There are basically two ways to deal with the market at this point: You can go to cash and be defensive as you anticipate a pullback, or you can stick with positions but use tight stops and be ready to exit should conditions change. One approach is anticipatory and the other is reactive.

I tend to prefer being reactive, because inaccurate timing can prove so costly with an anticipatory approach. We saw a good example last week when the anticipatory bears were shellacked, having thought we'd see a "sell-the-news" reaction.

The reactive approach is going to result in some losses when the market suddenly reverses one day, but typically you'll end up much further ahead by riding the momentum for as long as possible. Since it is impossible to time the market with great precision, you are likely to suffer some setback one way or another. You can either lose money by jumping out too early or lose it by staying too long. In my experience, you usually do better staying too long, because trends tend to last longer than most people believe is reasonable.

We're seeing minor weakness to kick off the week. The dollar is a bit stronger and overseas markets are mixed, but Mondays tend to be positive days, so we'll see if those dip buyers are looking to do to work after the market opens.

Be ready to react as conditions develop, and try not to be too anticipatory.

-

USA indeksite futuurid indikeerimas avanemist -0,2% kuni -0,3% madalamal. EUR/USD kaupleb -0,73% @1,3928, kuld -0,56% @1390,0 USD ja nafta -0,45% @ 86,45 USD.

Euroopa turud:

Saksamaa DAX -0,15%

Prantsusmaa CAC 40 -0,14%

Suurbritannia FTSE100 -0,39%

Hispaania IBEX 35 -1,55%

Rootsi OMX 30 +0,63%

Venemaa MICEX +1,83%

Poola WIG -0,19%Aasia turud:

Jaapani Nikkei 225 +1,11%

Hong Kongi Hang Seng +0,35%

Hiina Shanghai A (kodumaine) +0,96%

Hiina Shanghai B (välismaine) +1,72%

Lõuna-Korea Kosdaq -0,04%

Austraalia S&P/ASX 200 -0,46%

Tai Set 50 +0,98%

India Sensex 30 -0,73% -

Gapping down

In reaction to disappointing earnings/guidance: GSI -8.8%, WCRX -7.1%, RJET -6.3%, CYTR -5.8%, ANSW -1.7%, KWK -0.8%, FTR -0.6%Select energy and materials showing weakness: BHP -1.9%, FRO -1.7%, ABB -1.7%, BP -1.6%, PBR -1.2%

Other news: INVE -22.7% (still checking), SIGA -18.6% (unfavorable ruling from SBA), IRE -14.7% (continued selling overseas), PIP -12.8% (still checking), CADX -4.8% (offering to sell $85 million worth of shares of its common stock), NOK -2.3% (hearing European downgrade), BUD -1.9% (still checking), RDS.A -1.7% (reduces its interest in Woodside), EXM -1.4% (COO to leave)

Analyst comments: SWKS -6.2% (downgraded to Outperform at Raymond James), ALU -4.3% (downgraded to Underperform at Bernstein), CLWR -3.3% (downgraded to Hold at Kaufman Bros ), DISH -3.3% (downgraded to Neutral at UBS), SWY -1.7% (downgraded to Sell at UBS), TI -1.7% (downgraded to Neutral at Credit Suisse), SCCO -1.4% (downgraded to Sell at UBS), AMRS -1.2% (initiated with Neutral at Goldman), RFMD -1.1% (downgraded to Outperform at Raymond James), LOW -0.9% (downgraded to Market Perform at Raymond James), HD -0.8% (downgraded to Market Perform at Raymond James), AA -0.7% (downgraded to Neutal at Davenport)

Gapping up

In reaction to strong earnings/guidance: HIHO +25.7%, SOLR +11.7%, ASTM +5.7%, ATPG +3.8%, MDVN +2.4%, FTR +1.4%, KH +1.3%, XNPT +1.1%, (also Co and GSK respond to FDA on Horizant for RLS), BPL +0.8%Select solar names moving with SOLR: STP +1.6%, LDK +1.1%, JKS +0.9%

Other news: IDT +18.7% (announces strategic initiatives), SBAY +16.2% (still checking), ATHX +12.3% (FDA authorization of Phase II clinical trial for inflammatory bowel disease with PFE), SYKE +7.6% (still checking), CTV +6.6% (CNBC reported that TPG is considering whether to submit offer for co to top Carlyle bid), XNPT +6.1% (Co and GSK respond to FDA on Horizant for RLS), MGM +2.8% Cramer comments RES +2.6% (ex-dividend), EGHT +2.3% (still checking), DELL +2.3% (rumor going private), MRVL +0.9% (unveil its quad-core processing ARMADA XP)

Analyst comments: DLM +4.0% (initiated with Neutral at Suntrust ), DEG +1.8% (upgraded to Overweight at HSBC), SVNT +1.4% (upgraded to Buy at Soleil, light volume), INTC +1.0% (upgraded to Buy at UBS)

-

Dynavax Technologies (DVAX): Initiation details

As mentioned earlier Jefferies initiated DVAX with a Buy and price target of $4 saying they believe Heplisav offers efficacy and convenience benefits that will make it a preferred choice for high-risk adult patients who are poor responders to current HBV vaccines. They see diabetics as a new major market opportunity for Heplisav that has not been fully captured in the valuation.

Võib osutuda huvitavaks. -

DVAX käitub nõrgalt.

-

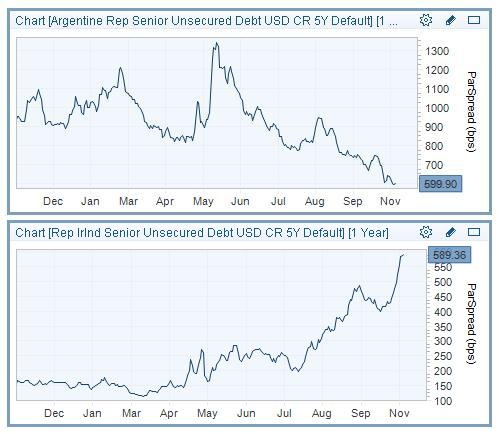

Iirimaad kummitav võlakriis on uuesti pead tõstmas. Iirimaa 5-aastase võlakirja credit-default swap tulusus tõusis täna hommikul 605 baaspunktini. alphaville'i vahendusel võrdlus Argentiina CDS'i tulususega (reedese seisuga):

The Irish Times internetisaidil ilmus täna Morgan Kelly väga kriitiline ning põnev artikkel, milles autor toob välja, et Iirimaa on "sisuliselt maksejõuetu" ja järgmine kriis saab olema "massiline kodulaenude hapuks minemine". Kelly sõnul pole Iirimaal muud valikut kui EL/IMF abipaketi saamine, mis toimub tema hinnangul järgmise aasta sees, kui valitsuse pankade päästepaketi maksumus saab lõplikult selgeks. Kelly sõnul ulatub pankade päästmiseks kuluv summa €70 miljardini, samas kui valitsus on pankde päästmise hinnanguliseks maksumuseks ligi kaks korda vähem.

Mõned tsitaadid Kelly artiklist:

It is a testament to the cool and resolute handling of the crisis over the last six months by the Government and Central Bank that markets now put Irish sovereign debt in the same risk group as Ukraine and Pakistan, two notches above the junk level of Argentina, Greece and Venezuela.

September marked Ireland’s point of no return in the banking crisis. During that month, €55 billion of bank bonds (held mainly by UK, German, and French banks) matured and were repaid, mostly by borrowing from the European Central Bank.

......

The Government has admitted that Anglo is going to cost the taxpayer €29 to €34 billion. It has also invested €16 billion in the other banks, but expects to get some or all of that investment back eventually.

So, the taxpayer cost of the bailout is about €30 billion for Anglo and some fraction of €16 billion for the rest. Unfortunately, these numbers are not consistent with each other, and it only takes a second to see why.

Between them, AIB and Bank of Ireland had the same exposure to developers as Anglo and, to the extent that they were scrambling to catch up with Anglo, probably lent to even worse turkeys than it did. AIB and Bank of Ireland did start with more capital to absorb losses than Anglo, but also face substantial mortgage losses, which it does not. It follows that AIB and Bank of Ireland together will cost the taxpayer at least as much as Anglo.

Once we accept, as the Government does, that Anglo will cost the taxpayer about €30 billion, we must accept that AIB and Bank of Ireland will cost at least €30 billion extra.

......

This €70 billion bill for the banks dwarfs the €15 billion in spending cuts now agonised over, and reduces the necessary cuts in Government spending to an exercise in futility. What is the point of rearranging the spending deckchairs, when the iceberg of bank losses is going to sink us anyway?

What is driving our bond yields to record levels is not the Government deficit, but the bank bailout. Without the banks, our national debt could be stabilised in four years at a level not much worse than where France, with its triple A rating in the bond markets, is now.

As a taxpayer, what does a bailout bill of €70 billion mean? It means that every cent of income tax that you pay for the next two to three years will go to repay Anglo’s losses, every cent for the following two years will go on AIB, and every cent for the next year and a half on the others. In other words, the Irish State is insolvent: its liabilities far exceed any realistic means of repaying them.

Kogu artikkel on väärt lugemine.

-

HIHO oli parem variant.

-

Bloomberg kirjutab sellest, kuidas järjest rohkem USA ettevõtteid tõstab oma kasumiprognoose. Eelmisel kuul tõstsid 198 ettevõtet oma kasumiprognoose üle analüütikute ootuste, samal ajal prognoosis oodatust kehvemaid tulemusi 130 ettevõtet. See tähistab suurimat vahet alates 1999. aastast. Viimati kui ettevõtete juhid sama optimistlikud olid tõusid aktsiad järgneva kolme ja poole aasta jooksul 39%. Seega iga ettevõtte kohta, kes prognoosisid oodatust halvemaid tulemusi, oli ca 1.5 ettevõtet, kes prognoosid oodatust paremaid tulemusi. Viimasel kümnel aastal on see suhe keskmiselt olnud 0.59 ning madalaim suhe oli 0.1 2008. aasta detsembris.

-

Kulla detsembri futuur tegi hetk tagasi kõikide aegade tipuks $1402.

-

USA turgudel on uusi päevasiseseid tippe tegemas riiklike võlakirjade tulususe määrad. Alloleval graafikul on kujutatud 10-aastase võlakirja tulususe määr viimase 3 kauplemispäeva jooksul. Kuld kaupleb taas päeva tipu lähedal ehk ca $1406 tasemel.

-

PCLN tulemused väga tugevad ja prognoosid samuti üle analüütikute ootuste, järelturul kauplemas ~6% kõrgemal $411 juures. Aktsia korralikult rallinud viimased 6 kuud ja siit investorina rongi peale ei jookseks.

Ise ootaks järgmise kvartali jooksul isegi ~20% juukselõikust, kuna ei usu, et see edulugu nii hoogsalt jätku saab.

Priceline.com travel services provider said third-quarter net income of $223 million, or $4.41 a share, compared with $319 million, or $6.42 a share. Revenue was $1 billion, up from $730.7 million. Adjusted income was $5.33 a share. Analysts had expected earnings of $4.97 a share, on revenue of $974.4 million.

For Q4, Priceline sees revenue up 31%-36% from a year ago, which implies $710 million to $747 million, ahead of the Street at $689.4 million. The company sees non-GAAP profits for the quarter of $2.91 to $3.06 a share, ahead of the Street at $2.68.

Põhja-Ameerika oli suht nõrk~12%, kuid muu maailma käibe kasv 67.6% ja sealt ka enamus kasumist. Numbritoad ja autorent näitasid korralikku kasvu, kuid lennupiletite vahendus jäi ~5% madalamaks. Mis on üllatav, siis q4 prognoositakse ettevõtte enda poolt numbitubade tuntavalt kõrgemat müüki, kui analüütikud ootaksid:

Q4 guidance of 36%-41% y/y growth in gross bookings, vs. estimates around 28% -

Ambac Financial Group Inc. (ABK) filed for Chapter 11 bankruptcy on Monday after failing to raise additional capital, the bond insurer said. Ambac will continue to operate as "debtor-in-possession" under the jurisdiction of the Bankruptcy Court. The company also failed to reach an agreement on restructuring its debt with creditors but has agreed to a non-binding term sheet that will allow it to further negotiate with the creditors and emerge from bankruptcy more quickly, it said. As of June 30, the company had outstanding debt of $1.62 billion.

ABK järelturul kauplemas ~63% madalamal $0.18 tasemel.